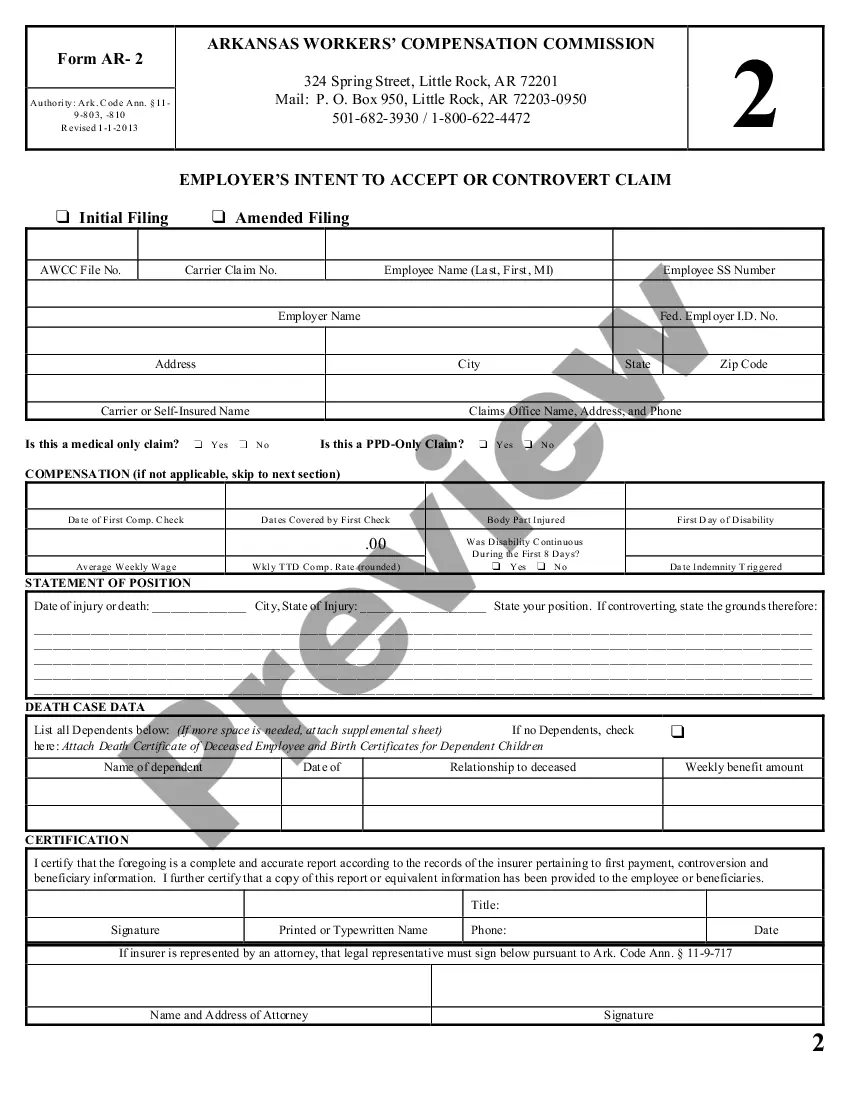

Employers use this form at the time a debt or loss is incurred to memorialize the debt owed to the Company and to obtain authorization for making deductions from an employee’s paycheck.

California Authorization for Deduction from Pay for a Specific Debt

Description Pay Specific Debt

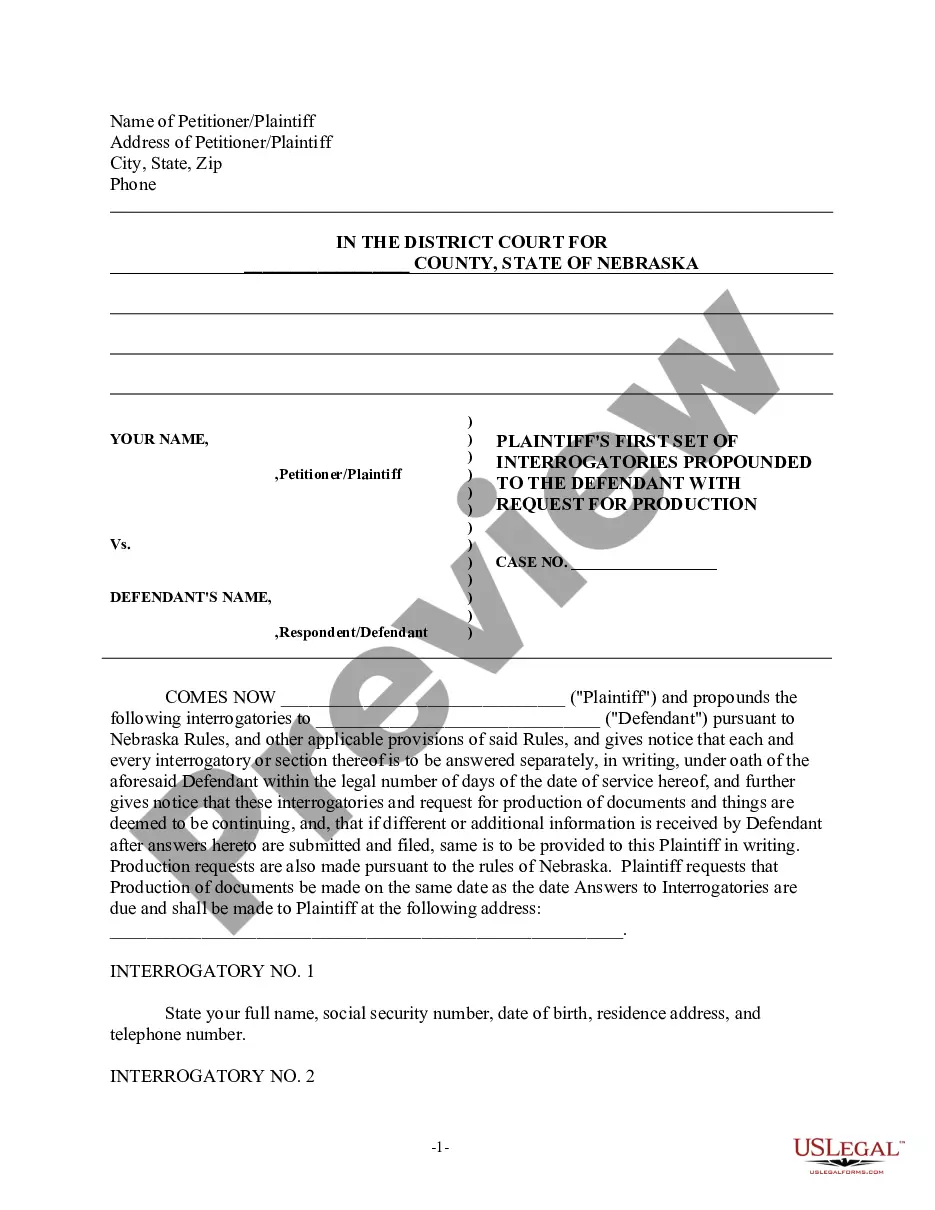

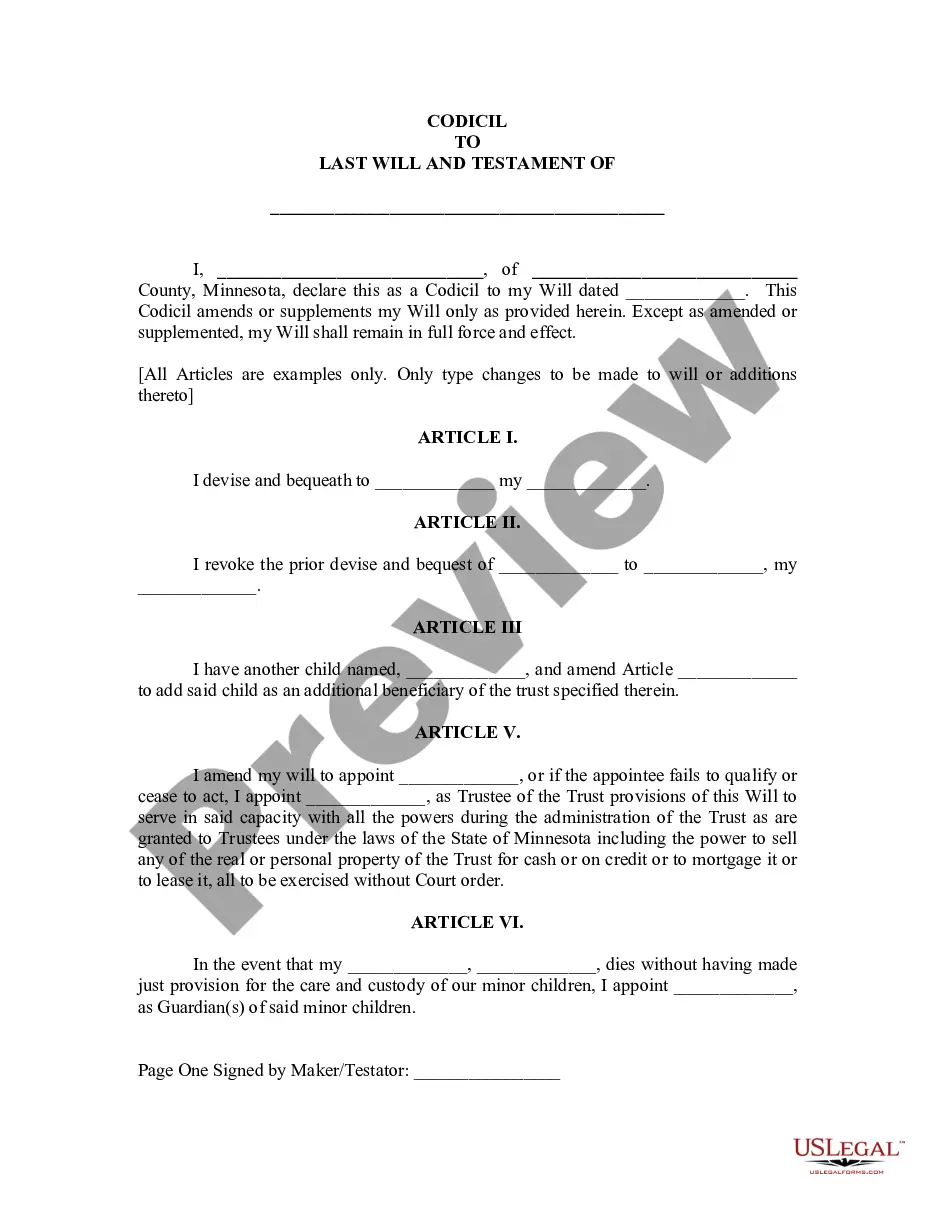

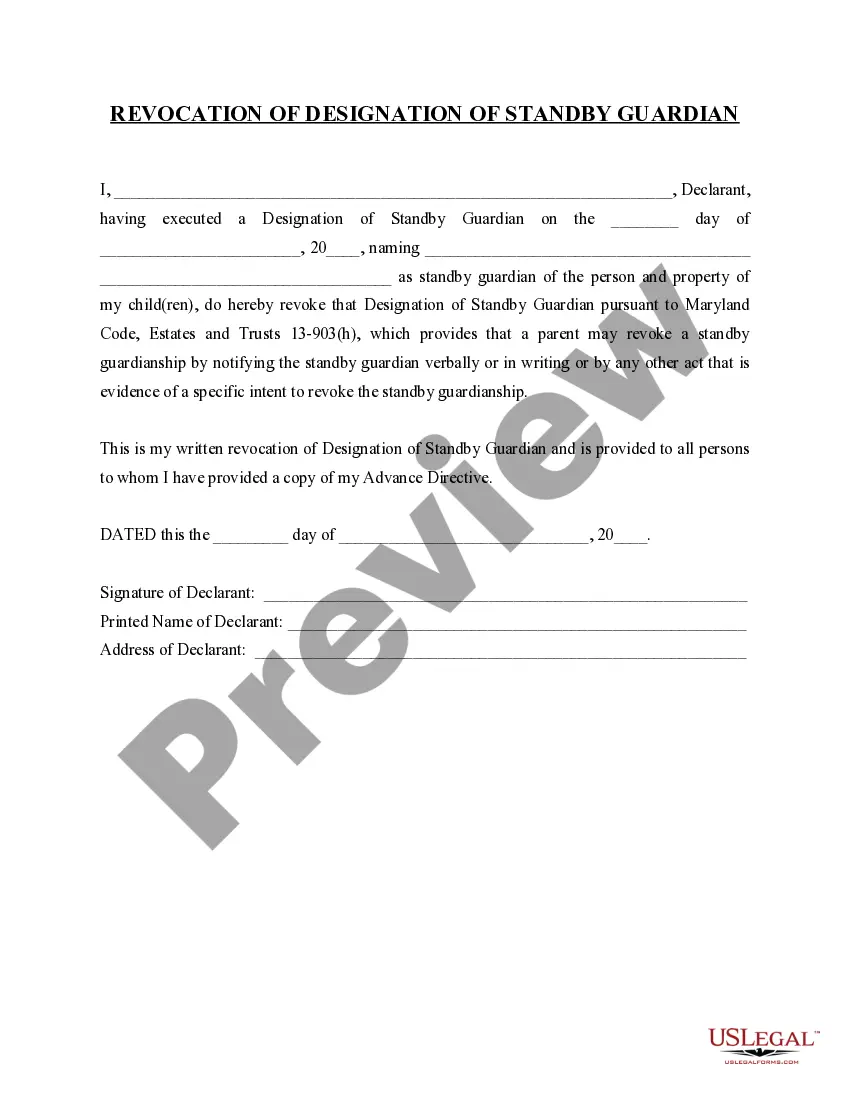

How to fill out Deduction Pay California?

If you're trying to find accurate California Authorization for Deduction from Pay for a Specific Debt web templates, US Legal Forms is the thing you need; find files made and checked out by state-licensed legal representatives. Utilizing US Legal Forms not only saves you from problems concerning legitimate documentation; in addition, you save up time and energy, and funds! Downloading, printing, and submitting a proficient web template is really less expensive than requesting a lawyer to do it for you.

To begin, complete your registration process by adding your e-mail and making a password. Follow the guidance below to create your account and get the California Authorization for Deduction from Pay for a Specific Debt web template to deal with your situation:

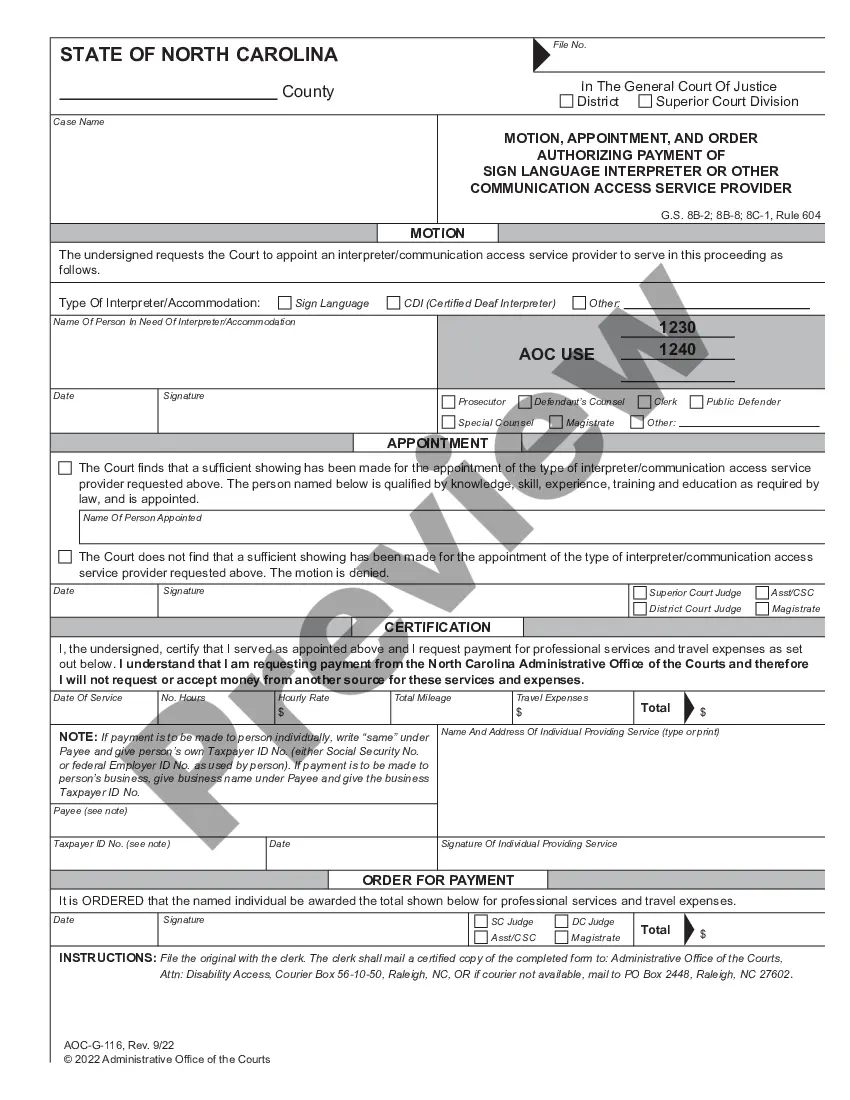

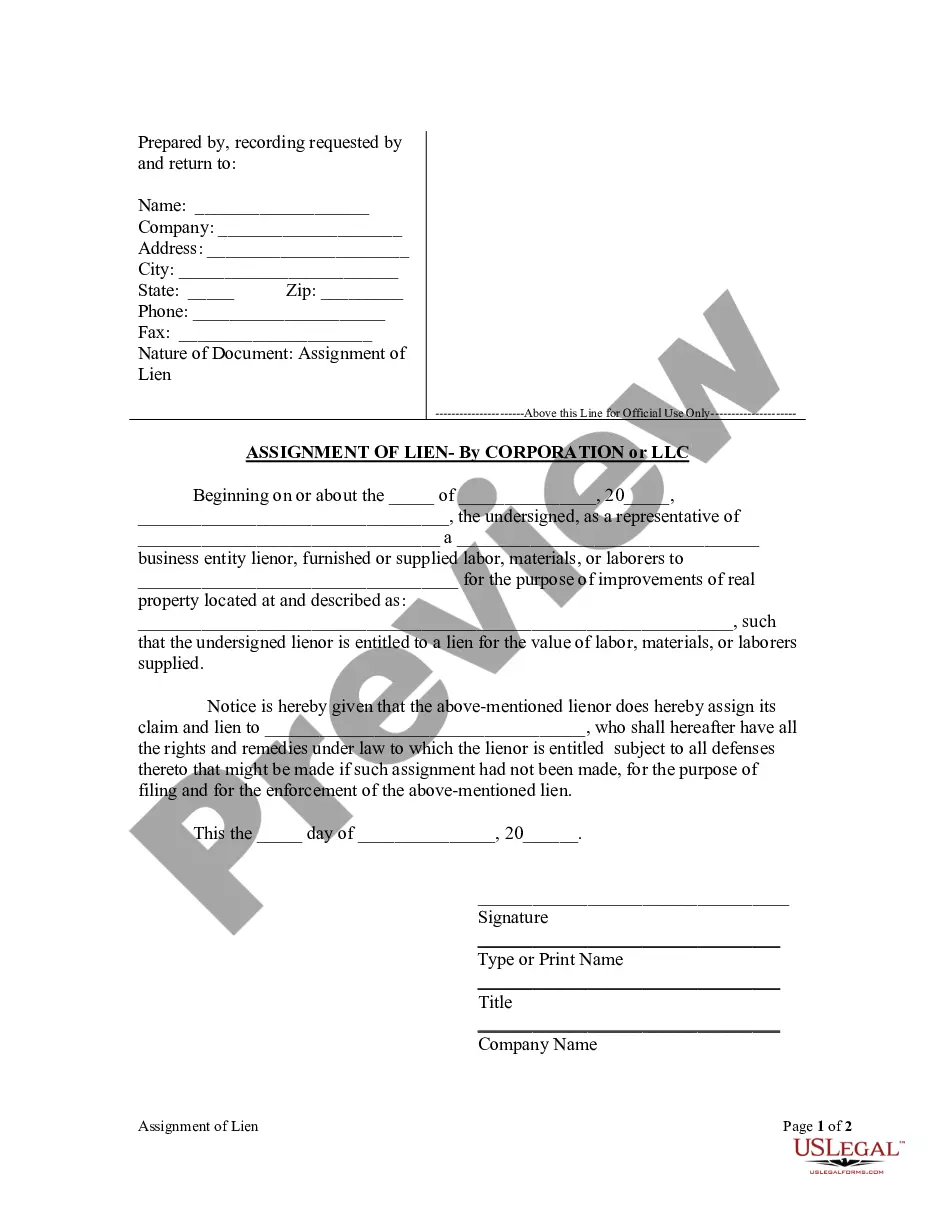

- Make use of the Preview option or look at the document description (if offered) to make certain that the template is the one you need.

- Check out its applicability in the state you live.

- Click on Buy Now to make your order.

- Go with a recommended pricing program.

- Make your account and pay with your visa or mastercard or PayPal.

- Choose a convenient format and store the record.

And while, that is it. In a few easy clicks you have an editable California Authorization for Deduction from Pay for a Specific Debt. When you make your account, all upcoming requests will be worked up even easier. If you have a US Legal Forms subscription, just log in account and then click the Download option you see on the for’s webpage. Then, when you need to use this sample again, you'll constantly manage to find it in the My Forms menu. Don't spend your time and effort checking hundreds of forms on several web sources. Purchase precise documents from one secure platform!

Deduction Debt Editable Form popularity

Employer Advance Paid Other Form Names

Deduction Pay Ca FAQ

Your employer is not allowed to make a deduction from your pay or wages unless: it is required or allowed by law, for example National Insurance, income tax or student loan repayments. you agree in writing to a deduction. your contract of employment says they can.

No, employers cannot charge employees for mistakes, shortages, or damages. Only if you agree (in writing) that your employer can deduct from your pay for the mistake.Deductions must be for your benefit (and agreed to in writing), or done to comply with some aspect of state or federal law.

Under California law, an employer may lawfully deduct the following from an employee's wages: Deductions that are required of the employer by federal or state law, such as income taxes or garnishments.

Some of the types of deductions which are authorized under federal and state law include: meals, housing and transportation, debts owed the employer, debts owed to third parties (through the process of garnishment); debts owed to the government (such as back taxes and federally-subsidized student loans), child support

An employer is allowed to deduct certain items from an employee's paycheck if the employee has voluntarily authorized the deduction in writing. Examples of such deductible items are union dues, charitable contributions, or insurance premiums.

There has been a deduction of 10% for the months of April and May. I am at a loss to understand why my salary is being deducted. I humbly request you to look into the matter and sort out the issue before I receive my next paycheck. I shall be grateful to you for your consideration.

The only deductions your employer can take from your pay are deductions he or she must take and deductions you have agreed to. Your employer must have your agreement in writing. Your employer cannot decide to take other deductions out of your pay for any other reason.

Unlawful Deduction of Wages is when a worker or employee has been unpaid or underpaid wages. There must be an actual deduction of wages, not just a proposal to deduct wages. The Employment Rights Act 1996 (ERA) protects employees and workers from having unauthorised deductions made from their wages.