Employers use this form to notify an employee that his or her social security number does not match the name on file with the U.S. Social Security Administration and he or she needs to correct the mismatch.

California Social Security Mismatch Notice

Description

How to fill out California Social Security Mismatch Notice?

If you're seeking correct California Social Security Mismatch Notice templates, US Legal Forms is what exactly you need; get files created and checked out by state-accredited lawyers. Making use of US Legal Forms not simply will save you from bothers concerning legitimate documentation; furthermore, you save time and effort, and cash! Downloading, printing, and submitting a proficient document is really more economical than requesting a solicitor to accomplish it for you personally.

To begin, complete your registration procedure by adding your e-mail and creating a password. Adhere to the instructions below to create an account and find the California Social Security Mismatch Notice sample to deal with your circumstances:

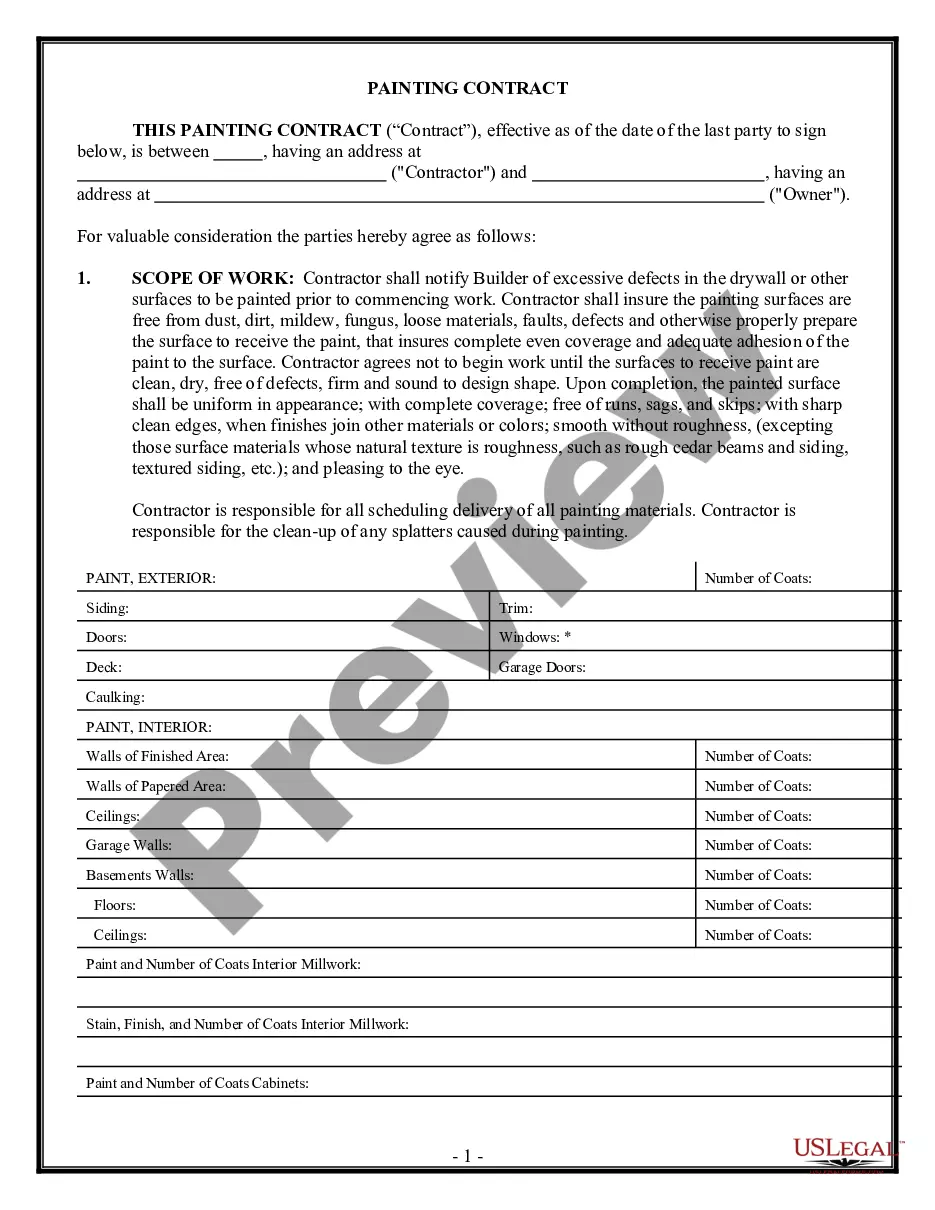

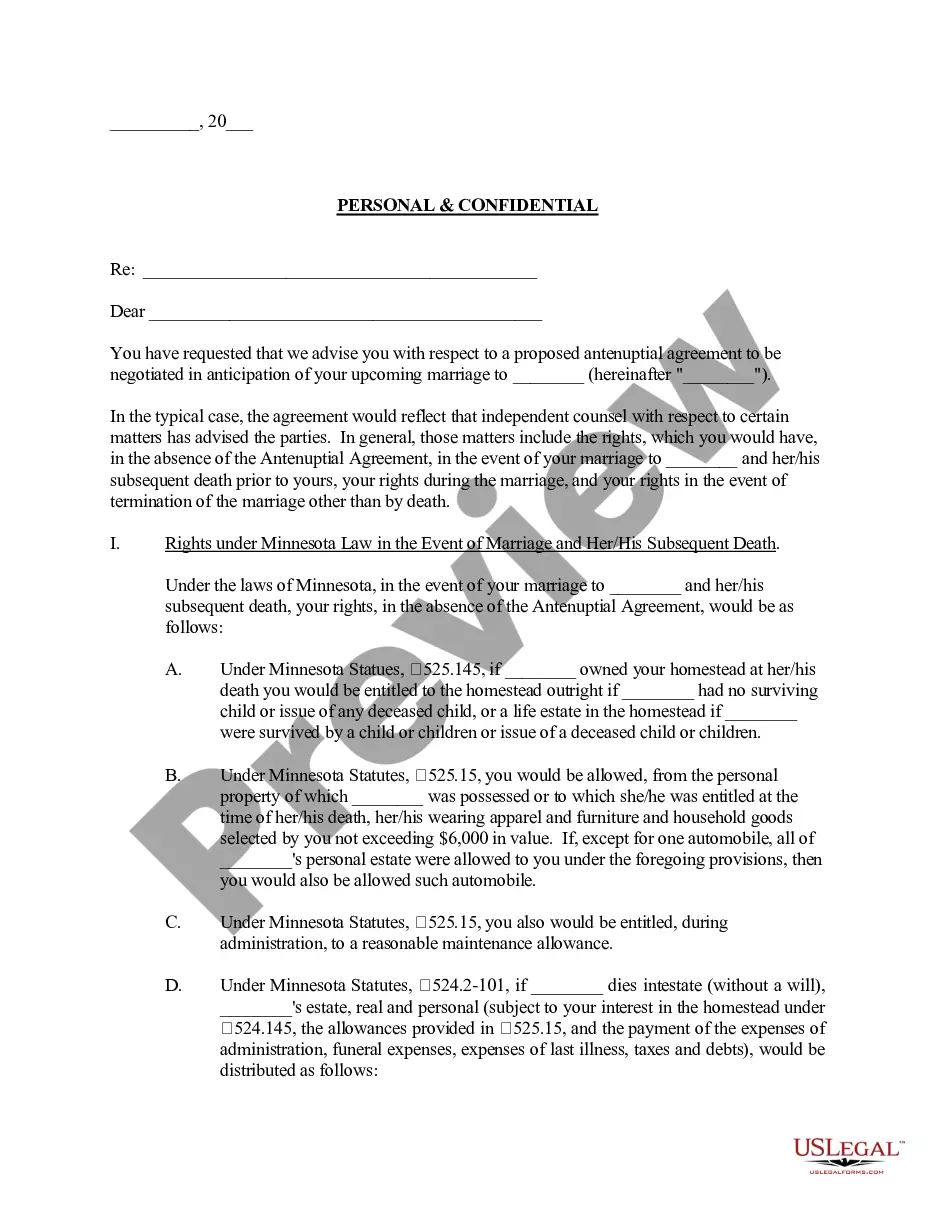

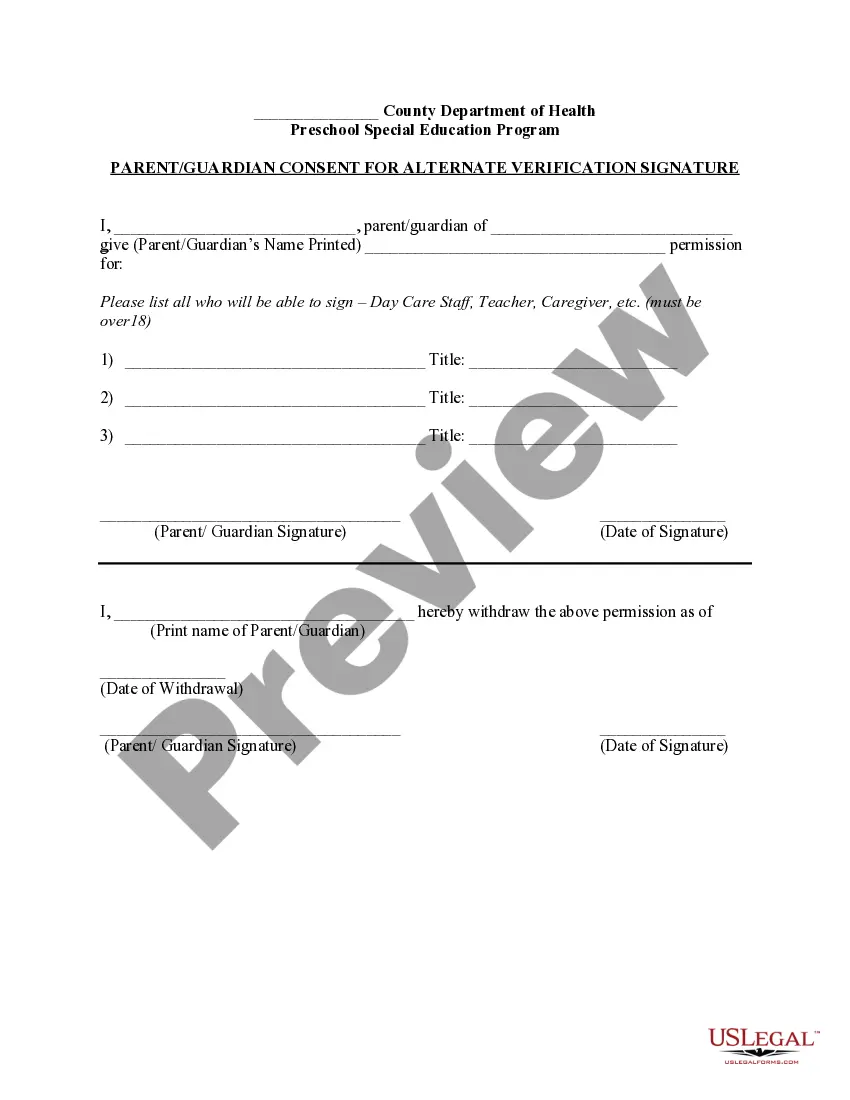

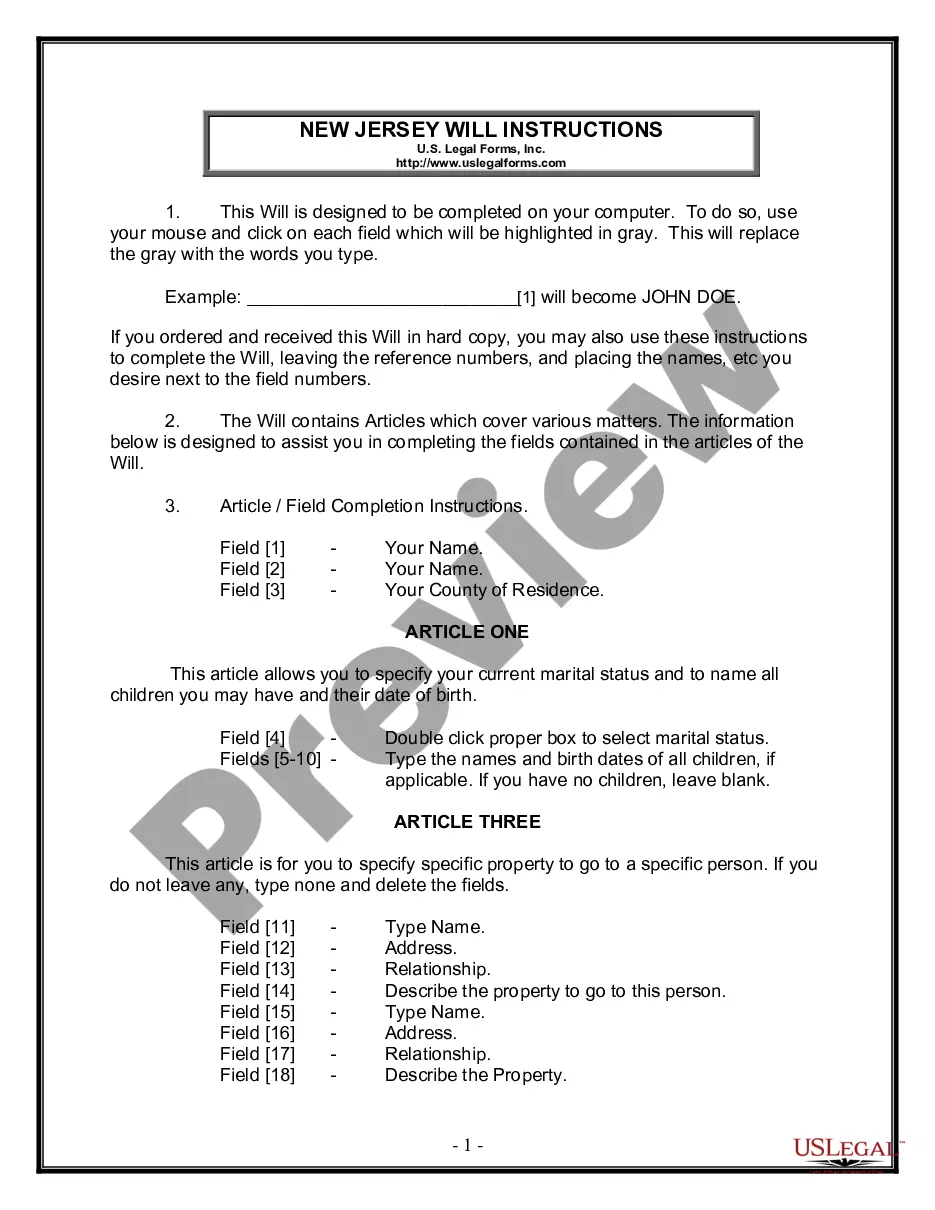

- Make use of the Preview solution or look at the document information (if available) to ensure that the form is the one you need.

- Check out its validity where you live.

- Simply click Buy Now to create an order.

- Choose a recommended rates plan.

- Create your account and pay with your visa or mastercard or PayPal.

- Select a handy formatting and store the papers.

And while, that is it. In a couple of simple clicks you have an editable California Social Security Mismatch Notice. Once you create an account, all next orders will be processed even simpler. If you have a US Legal Forms subscription, just log in account and click the Download button you see on the for’s web page. Then, when you need to use this template once again, you'll constantly manage to find it in the My Forms menu. Don't squander your time and energy checking countless forms on various websites. Order accurate copies from one secure platform!

Form popularity

FAQ

The letters at the end of a SSN indicate the claim number for a SSI or Social Security beneficiary."If you are an SSI beneficiary, your claim number is your nine-digit Social Security Number (SSN) (000-00-0000) followed by two letters such as EI, DI, DS, DC.

Inform affected employees of the no-match notice and ask that they confirm the name and Social Security number reflected in their employment records. Advise the workers to contact the SSA to correct their SSA records. Give employees a reasonable period of time to do this.

Any employer that uses the failure of the information to match SSA records to take inappropriate adverse action against a worker may violate State or Federal law. The information you receive from SSNVS does not make any statement regarding a worker's immigration status.

Once you have gathered your documents, contact Social Security at 800-772-1213 to begin the process of correcting your earnings record. What are possible reasons for the error? An employer may have reported your earnings incorrectly or reported your earnings using the wrong name or Social Security number.

If you did look at your earnings record and notice a mistake, the burden is yours to prove it. You might want to start by checking out the SSA's Request For Correction of Earnings Record form. You should be prepared to locate documents that prove the error such as tax forms, W-2 forms or pay stubs.

A no-match letter can expose an employer to liability under IRCA for knowingly continuing to employ an unauthorized individual.Employers cannot simply ignore them, but can potentially face discrimination lawsuits for being too keen in responding to no-match letters.

"No-match letters notify employers of a discrepancy in an employee's information between the SSA's records and the employee's Form W-2," Karcutskie said.

To seek correction of information related to individual records, benefits, or earnings, please call us at 1-800-772-1213 or contact us. The Social Security Administration has received no requests for correction to information under Section 515.