Employers use this form to recover the cost of voluntary training if the employee leaves prior to fulfilling an agreed-upon term of service.

California Tuition Payback Agreement

Description

How to fill out California Tuition Payback Agreement?

If you're seeking exact California Tuition Payback Agreement exemplars, US Legal Forms is just the right thing you need; locate files produced and examined by state-licensed legal professionals. Employing US Legal Forms not only saves you from problems concerning lawful paperwork; additionally, you economise time and effort, and cash! Downloading, printing out, and submitting a professional web template is significantly less expensive than asking a solicitor to accomplish it for you.

To get going, complete your enrollment process by providing your email and building a security password. Adhere to the steps listed below to create an account and get the California Tuition Payback Agreement template to deal with your issues:

- Take advantage of the Preview solution or look at the file description (if available) to make certain that the template is the one you want.

- Check out its validness in your state.

- Click Buy Now to make your order.

- Select a preferred pricing program.

- Make your account and pay with the credit card or PayPal.

- Pick a convenient formatting and download the record.

And while, that is it. With a few easy actions you own an editable California Tuition Payback Agreement. After you make your account, all upcoming requests will be worked up even simpler. If you have a US Legal Forms subscription, just log in account and then click the Download button you can find on the for’s webpage. Then, when you need to use this template again, you'll always be able to find it in the My Forms menu. Don't spend your time and energy comparing countless forms on several web sources. Buy precise templates from one trusted service!

Form popularity

FAQ

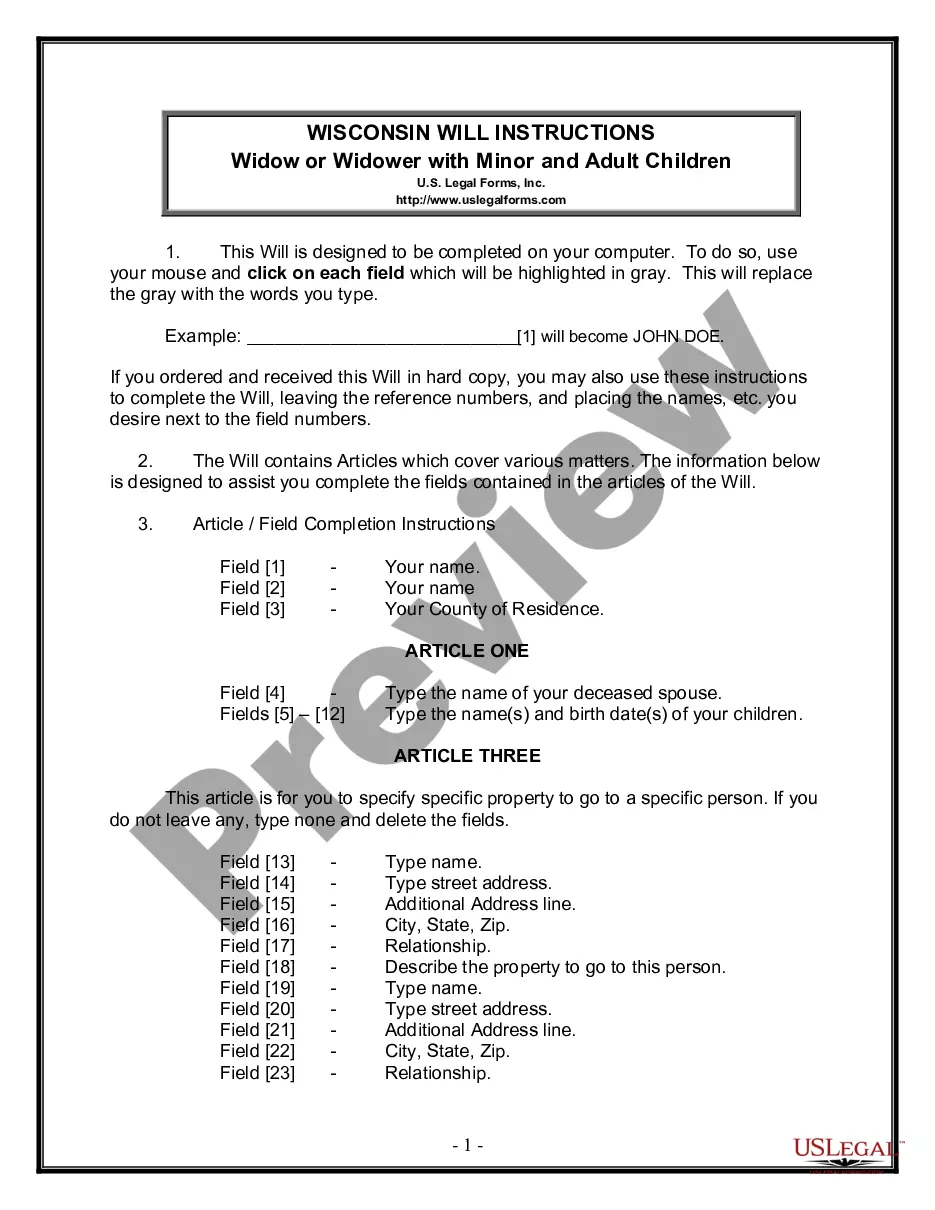

The IRS allows employers to reimburse employees for tuition costs without taxation, up to a specific limit. Under the California Tuition Payback Agreement, employers can provide financial assistance for education and training related to the employee's job. However, reimbursement may be subject to certain conditions, such as the employee's commitment to work for the employer for a specified period post-reimbursement. Understanding these rules is crucial for both employers and employees to maximize their benefits legally.

Tuition reimbursement from an employer typically involves the company covering some or all of the educational expenses that an employee incurs. Employees often must submit requests and documentation showing their enrollment and expenses. Agreements may stipulate that employees must remain with the company for a certain period after receiving reimbursement, connecting to the California Tuition Payback Agreement framework. For tailored agreements and forms, check out US Legal Forms.

In California, the Student Tuition Recovery Fund (STRF) provides protection for students who attend non-accredited institutions. Eligibility for STRF is typically determined by whether a student suffered a loss due to the school's failure to fulfill its obligations. As part of understanding your rights and protections, knowing about options like the California Tuition Payback Agreement is essential. To find more resources on STRF, visit US Legal Forms.

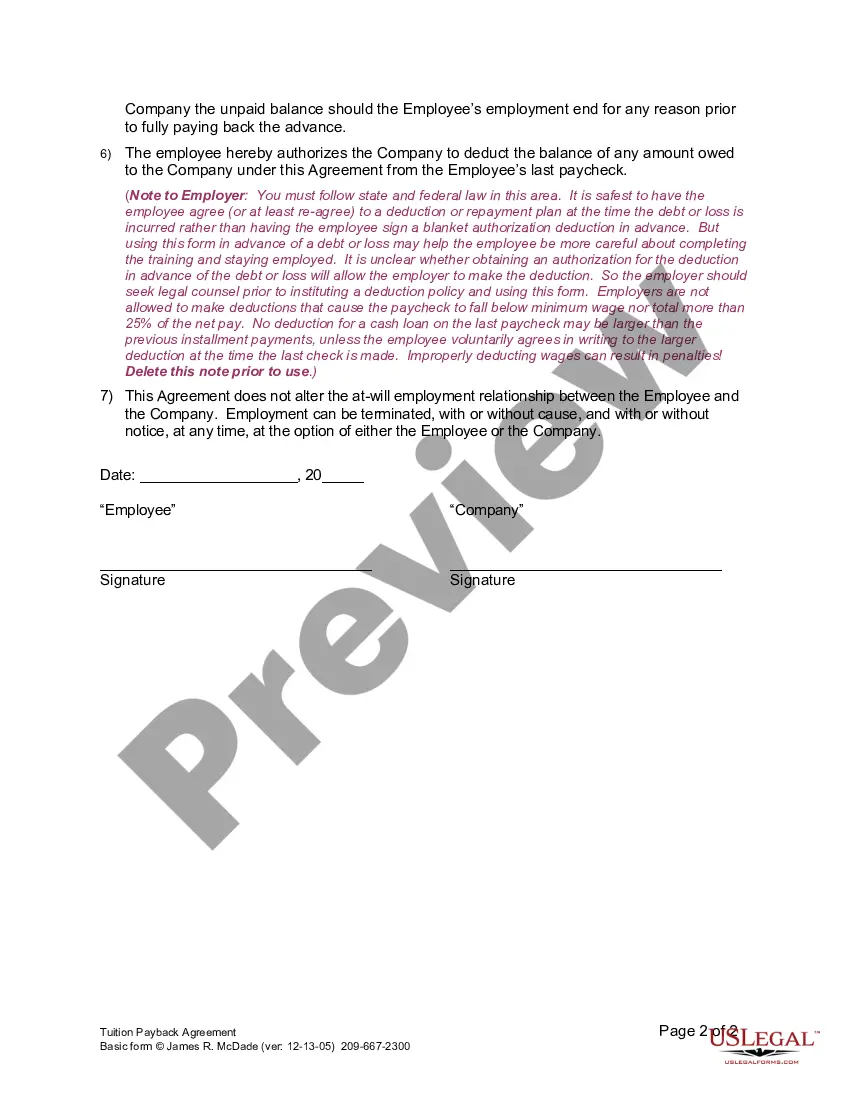

Training repayment agreements can indeed be enforceable in California when they meet specific criteria. The California Tuition Payback Agreement outlines the necessary terms, such as clarity in repayment conditions and mutual consent between parties. To ensure enforceability, it's critical to have a well-drafted agreement that aligns with state laws. Resources available on UsLegalForms can assist you in creating compliant agreements that protect your interests.

Yes, training repayment agreements are legal in California under certain conditions. These agreements fall under the California Tuition Payback Agreement framework, ensuring they comply with state regulations. It's essential for both employers and employees to understand their rights and obligations before entering such an agreement. Utilizing platforms like UsLegalForms can help you navigate these legal requirements effectively.

Tuition Reimbursement as a Fringe Benefit As stated above, any amount of tuition reimbursement that exceeds $5,250 is considered a fringe benefit of the job, and the employee will have to pay taxes on that amount.Otherwise, the money will be considered taxable income.

You can only participate in up to two tuition assistance funded classes at a time. You have to pay back tuition assistance if you don't maintain a satisfactory grade, and you won't get further tuition assistance until it is paid back.

Many companies offer tuition reimbursement as part of their benefits package. Here's how it typically works: an employee pays up front for college, graduate, or continuing education classes. Then, once the class or semester is complete, the employer will refund a portion of the money spentor the full amount.

Is the repayment agreement enforceable? Yes, according to a California Court of Appeal.

Some tuition reimbursement agreements do not penalize the employee if the company terminates the employee's work contract through no fault of the employee's. If you are laid off, an employer will often not require you to repay training and education costs, since you did not breach the contract.