California Certificate of Lien for Unsecured Property Taxes

Description

How to fill out California Certificate Of Lien For Unsecured Property Taxes?

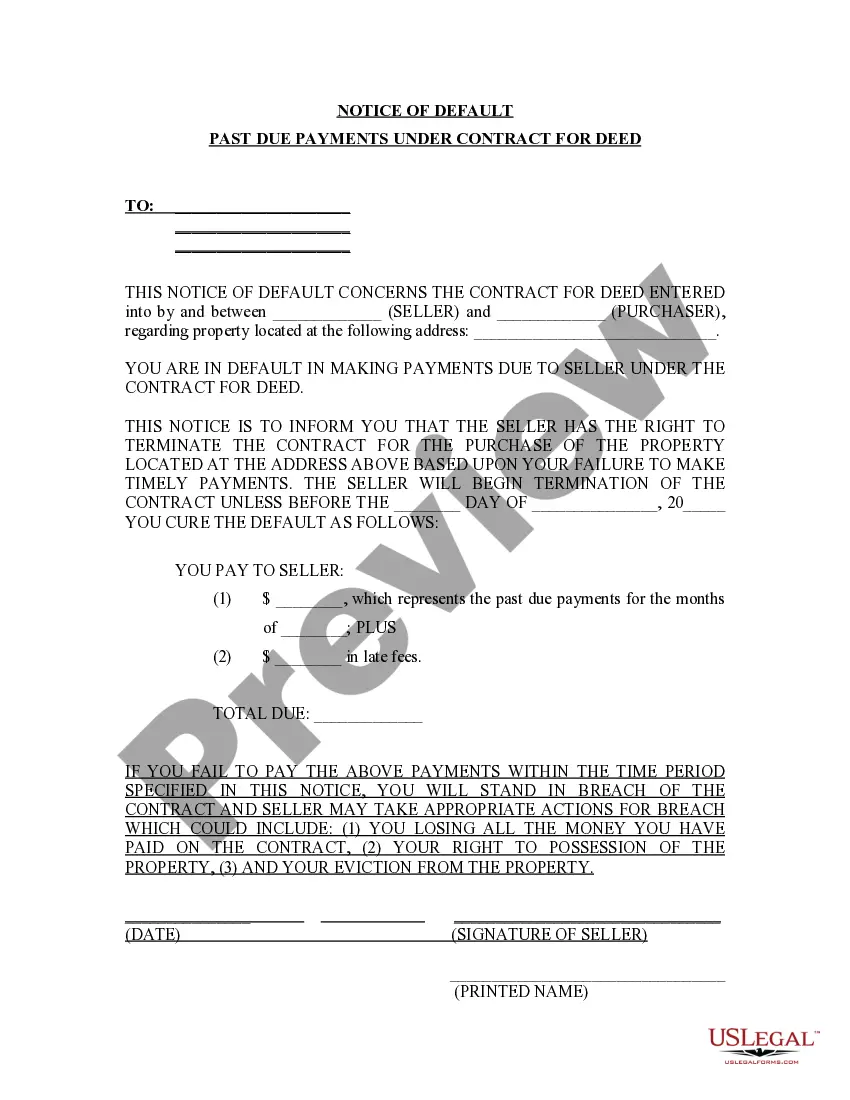

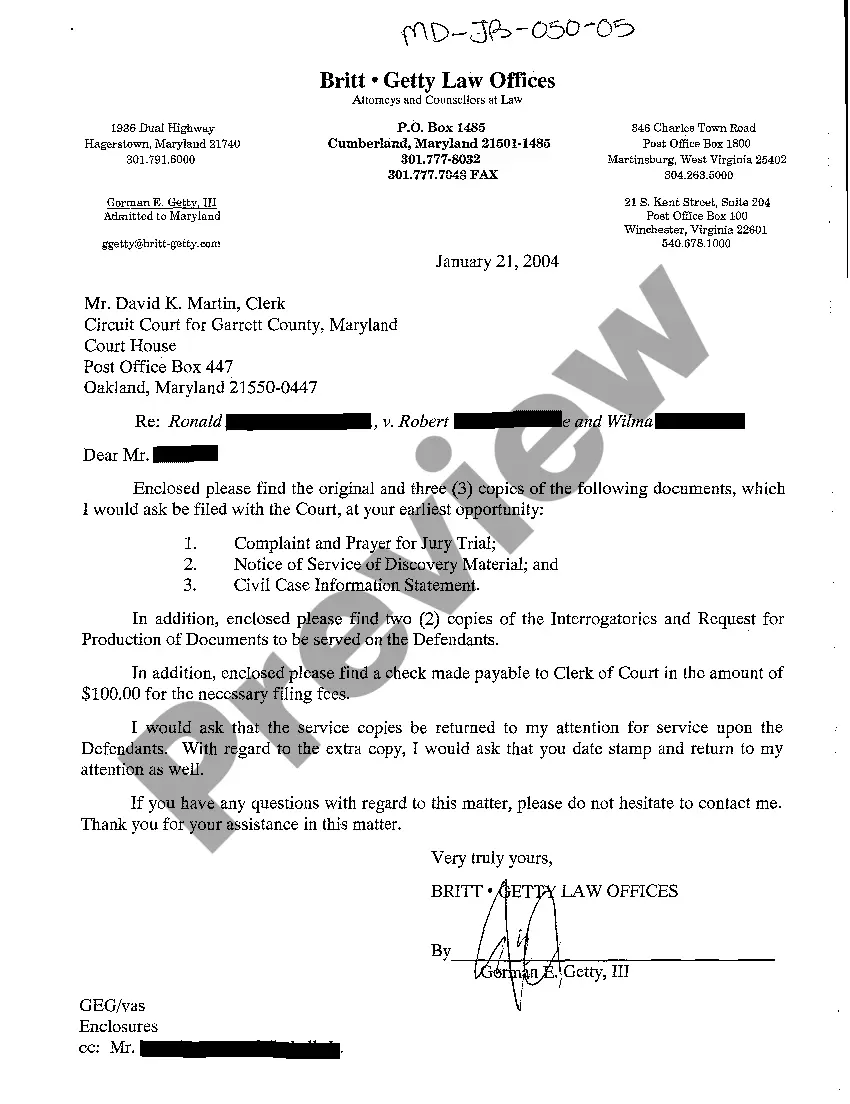

If you're trying to find precise California Certificate of Lien for Unsecured Property Taxes templates, US Legal Forms is what exactly you need; find files provided and verified by state-licensed attorneys. Utilizing US Legal Forms not only will save you from bothers concerning legal forms; in addition, you help save effort and time, and money! Downloading, printing out, and submitting an expert template is really less expensive than inquiring legal counsel to do it for you personally.

To get going, complete your registration process by adding your e-mail and building a security password. Adhere to the instructions below to make an account and get the California Certificate of Lien for Unsecured Property Taxes sample to remedy your needs:

- Utilize the Preview tool or read the document description (if provided) to be certain that the sample is the one you need.

- Check out its validity in your state.

- Just click Buy Now to make an order.

- Go with a recommended rates plan.

- Make an account and pay with your visa or mastercard or PayPal.

- Select an appropriate formatting and store the the form.

And while, that is it. In a few simple actions you own an editable California Certificate of Lien for Unsecured Property Taxes. Once you make your account, all next requests will be processed even easier. Once you have a US Legal Forms subscription, just log in profile and then click the Download option you see on the for’s web page. Then, when you need to use this template once again, you'll constantly manage to find it in the My Forms menu. Don't squander your time and energy comparing hundreds of forms on several web sources. Purchase accurate templates from one trusted platform!

Form popularity

FAQ

Unsecured property tax in California applies to properties that do not have a physical address or are not permanently affixed to land, such as personal property and business inventory. These taxes are levied on movable assets and can be more challenging to collect. A California Certificate of Lien for Unsecured Property Taxes can serve as a strategic investment, giving you rights to recover funds associated with these taxes. Understanding this category of tax can help you make informed financial decisions.

In California, unpaid property taxes start accruing interest after a specified deadline, usually five years. If the taxes remain unpaid, the county can sell a tax lien certificate, leading to potential foreclosure. By acquiring a California Certificate of Lien for Unsecured Property Taxes, you can take action to collect what's owed before it escalates. Timely intervention can help both investors and property owners resolve their tax obligations efficiently.

In California, the property owner is responsible for paying the secured property tax bill. These taxes are levied against the property itself, and if unpaid, may result in a lien against the property. However, as a tax lien investor, you can benefit from this process through a California Certificate of Lien for Unsecured Property Taxes. By understanding this responsibility, you can better navigate the investment landscape.

In California, the property owner is primarily responsible for unsecured property taxes. If there are multiple owners or entities involved, all parties may share this responsibility. Understanding your obligations related to the California Certificate of Lien for Unsecured Property Taxes is crucial for avoiding penalties and maintaining compliance with local tax laws.

Paying property tax does not automatically grant ownership of the property in California. Ownership is determined by the property's title rather than tax payments. However, the California Certificate of Lien for Unsecured Property Taxes may impact a property’s title if taxes remain unpaid, potentially leading to foreclosure and ownership transfer.

The property tax loophole in California often refers to Proposition 13, which limits property tax increases to a maximum of 2% per year based on the assessed value. While this provides tax stability for homeowners, it can create disparities in tax obligations. Investors considering a California Certificate of Lien for Unsecured Property Taxes should be aware of these implications, as they affect the overall assessment and collection of taxes.

To look up a tax lien in California, you can visit your county's tax assessor's website or contact their office directly. Many counties offer online databases where you can search by property address or owner name. This process allows you to easily access information about any California Certificate of Lien for Unsecured Property Taxes associated with a property, which is essential for informed property investment decisions.

Yes, anyone can buy tax lien certificates in California, provided they meet specific requirements set by the local government. These certificates represent unpaid property taxes, which can be purchased through tax lien sales. By obtaining a California Certificate of Lien for Unsecured Property Taxes, you can potentially earn interest on your investment while helping local governments recover lost revenue.

After purchasing a tax deed in California, you gain ownership of the property, but the previous owner has a redemption period to reclaim it. During this time, you should begin managing the property and understand the California Certificate of Lien for Unsecured Property Taxes as it may affect your investment. It's also wise to conduct a thorough title search to identify any additional liens or claims. If the original owner doesn’t redeem the property, you can fully enjoy the benefits of your investment.

The best state to buy tax lien certificates depends on your investment goals and risk tolerance. States like Florida and Arizona are popular for their straightforward processes and lucrative interest rates. However, California also offers opportunities through its California Certificate of Lien for Unsecured Property Taxes. Investigate each state's laws and potential returns to find the right fit for your investment strategy.