California Petition for Withdrawal of Funds from Blocked Account

Definition and Meaning

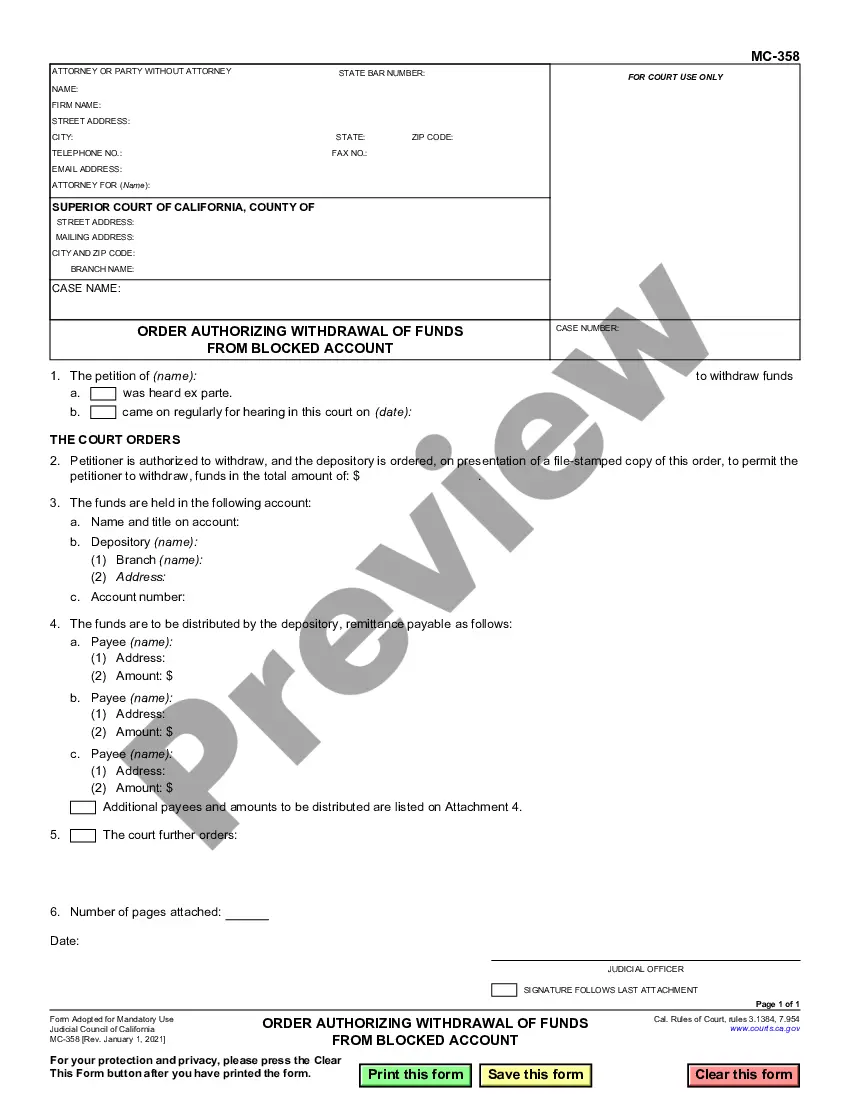

The California Petition for Withdrawal of Funds from Blocked Account is a legal document that allows a petitioner to request permission from the court to withdraw funds from an account that has been previously blocked. This may occur in cases involving minors, conservatees, or beneficiaries who are unable to access their funds due to court orders or restrictions. The petition outlines the necessary details about the individual whose funds are affected and the reasons for the withdrawal.

How to Complete a Form

Completing the California Petition for Withdrawal of Funds from Blocked Account involves several steps:

- Identify the Petitioner: Provide the name and contact details of the person filing the petition.

- Describing the Individual: Fill out information regarding the person whose funds are to be withdrawn, including their name, date of birth, address, and more.

- Specify Parental Information: If the individual is a minor, include the names and contact information of their parents.

- Account Details: List the account name, number, current balance, and previous withdrawals.

- Amount for Disbursement: Indicate the total amount being requested for withdrawal.

- Provide Reasons for Withdrawal: Clearly state why the funds are necessary to be disbursed at this time.

- Payee Information: Include the names and addresses of the individuals receiving the funds.

Who Should Use This Form

The California Petition for Withdrawal of Funds from Blocked Account is intended for people who are legal guardians or representatives of individuals whose funds are restricted. This typically includes:

- Parents of Minors: Parents seeking to access funds for their minor children.

- Conservators: Individuals appointed by the court to manage the financial affairs of another person, usually due to incapacity.

- Beneficiaries: Persons entitled to funds from estates or trusts that are currently under restriction.

Key Components of the Form

Several crucial components are included in the California Petition for Withdrawal of Funds from Blocked Account:

- Petitioner Information: Details about the individual filing the petition.

- Subject Details: Comprehensive information related to the person whose funds are being requested for withdrawal.

- Account Information: Specifics of the bank account from which funds are to be withdrawn.

- Reason for Withdrawal: Justification for needing the funds at this time.

- Disbursement Details: Identification of payees and the amounts they will receive.

Common Mistakes to Avoid When Using This Form

When filing the California Petition for Withdrawal of Funds from Blocked Account, it's essential to avoid these common mistakes:

- Incomplete Information: Ensure all requested details are filled out fully to prevent delays.

- Missing Signatures: Verify that all necessary parties have signed the document before submission.

- Incorrect Account Details: Double-check account numbers and balances to ensure accuracy.

- Failure to Attach Additional Documents: Include any required attachments that support the petition.

What Documents You May Need Alongside This One

When submitting the Petition for Withdrawal of Funds from Blocked Account, additional documentation may be required to support your request:

- Birth Certificates: To verify the identity and age of minors.

- Court Orders: Any previous court documents related to the establishment of the blocked account.

- Financial Statements: Recent bank statements showing account balances.

- Identification: A valid form of ID for the petitioner and any payees listed in the petition.

Form popularity

FAQ

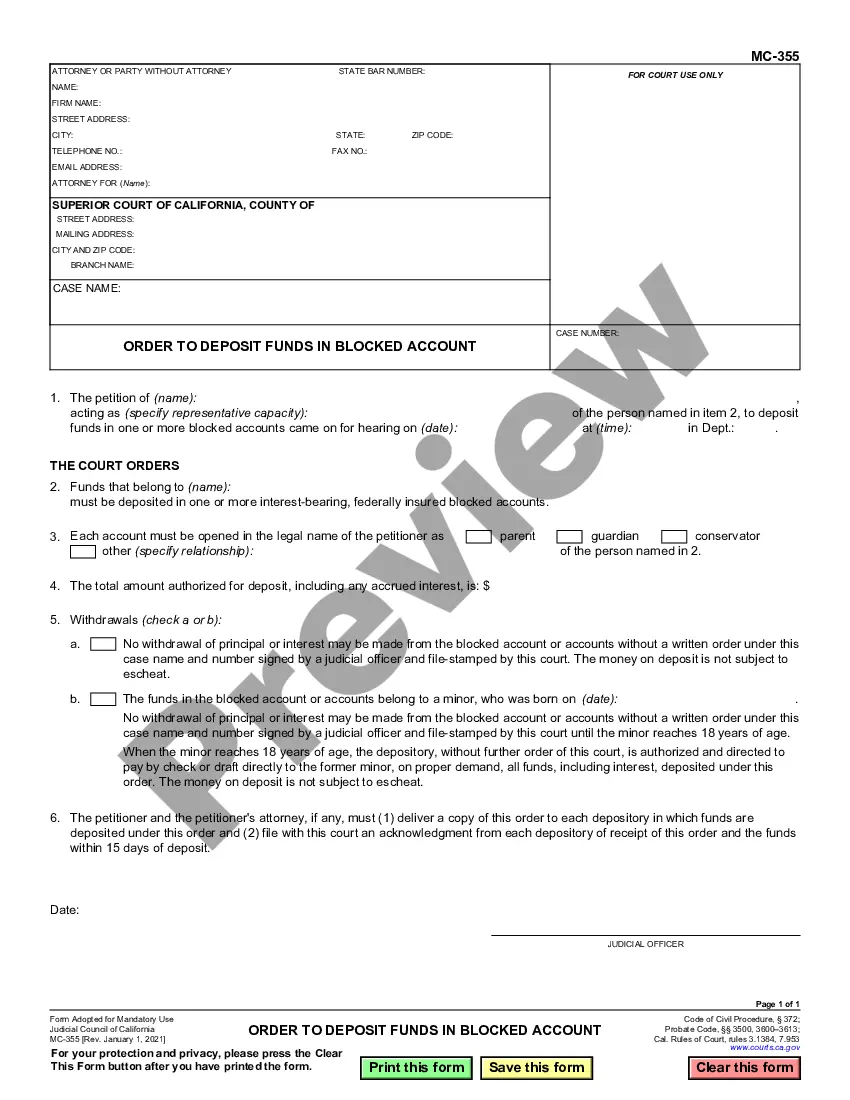

An order authorizing withdrawal of funds from a blocked account is a legal document issued by the court, permitting the release of funds that have been held in a blocked account. This process often requires a California Petition for Withdrawal of Funds from Blocked Account to be filed to obtain the necessary court approval. Understanding this order is vital for those seeking access to their funds, as it outlines the specific conditions and requirements involved. If you need assistance with this process, UsLegalForms provides resources and templates to help you navigate your legal needs effectively.

Yes, a blocked bank account can be unblocked by following specific legal procedures. By filing a California Petition for Withdrawal of Funds from Blocked Account, you can seek permission from the court to release your funds. The process may require you to demonstrate why the account should be unblocked, so having the right information will be crucial. US Legal Forms can assist you in drafting and filing this petition correctly to enhance your chances of success.

To recover your blocked bank account, you may need to submit a California Petition for Withdrawal of Funds from Blocked Account. This petition allows you to request access to your funds by providing relevant information to the court. Gathering necessary documentation and understanding the conditions that led to the blocking can help streamline this process. Additionally, using a service like US Legal Forms can simplify completing the required paperwork efficiently.

A blocked account in probate refers to a bank account that the court restricts from being accessed by the executor or administrator without permission. This limitation usually occurs during the probate process while the estate is being settled. To manage these funds legally, individuals often need to file a California Petition for Withdrawal of Funds from Blocked Account. Utilizing the US Legal Forms platform can simplify the process and provide necessary templates for this petition.

And then, give the details of the savings account to the bank where you've opened a blocked account. Note: You can't withdraw money directly from a blocked bank account, you need a savings account for withdrawal.

A court must approve and order any withdrawal of funds from a blocked account. The most common reason to petition a court to withdraw funds from a blocked account is to access a blocked account because the account was created for a minor who has subsequently turned 18.

Can you still transfer money if your card is locked? No, it is not possible to transfer money via your ATM/debit card if it is locked. However, you can still use your account details to transfer money via NEFT or RTGS.

Very broadly, a blocked account refers to an account that does not allow for unlimited or indiscriminate withdrawal or other access but instead has certain restrictions or limitations on when, how much, and by who, capital can be withdrawn.If an account becomes completely blocked, it is said to be "frozen".

Being signed by a talent agent is not considered a form of employment. Statutory requirements to close a Coogan are an original or certified copy of the former minor's birth certificate. They must also have valid government issued identification that meets the bank's requirements to process a withdrawal.

If an account is blocked then access is denied and you will not be able to access the money until the block is released. You could open another account at a different bank, but you will not be able to transfer any money into from the blocked account.