A California Balloon Payment Promissory Note Secured by Deed of Trust is a legal document that serves as a legally binding agreement between a borrower and a lender. This type of loan is used when a borrower needs to borrow a large sum of money for a specific purpose and has agreed to pay back the loan in installments over a set period of time. At the end of the loan period, the full amount of the loan is due in one final, larger payment—known as the balloon payment. The balloon payment is secured by a Deed of Trust, which is a legal document that serves as collateral for the loan. If the borrower defaults on the loan, the lender can foreclose on the Deed of Trust. Types of California Balloon Payment Promissory Note Secured by Deed of Trust include adjustable rate and fixed rate promissory notes. An adjustable rate promissory note is based on an index, such as the London Interbank Offered Rate (LIBOR), and the interest rate may change throughout the life of the loan. A fixed rate promissory note has a single interest rate for the entire term of the loan, and the interest rate will remain the same until the loan is paid off.

California Balloon Payment Promissory Note Secured by Deed of Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

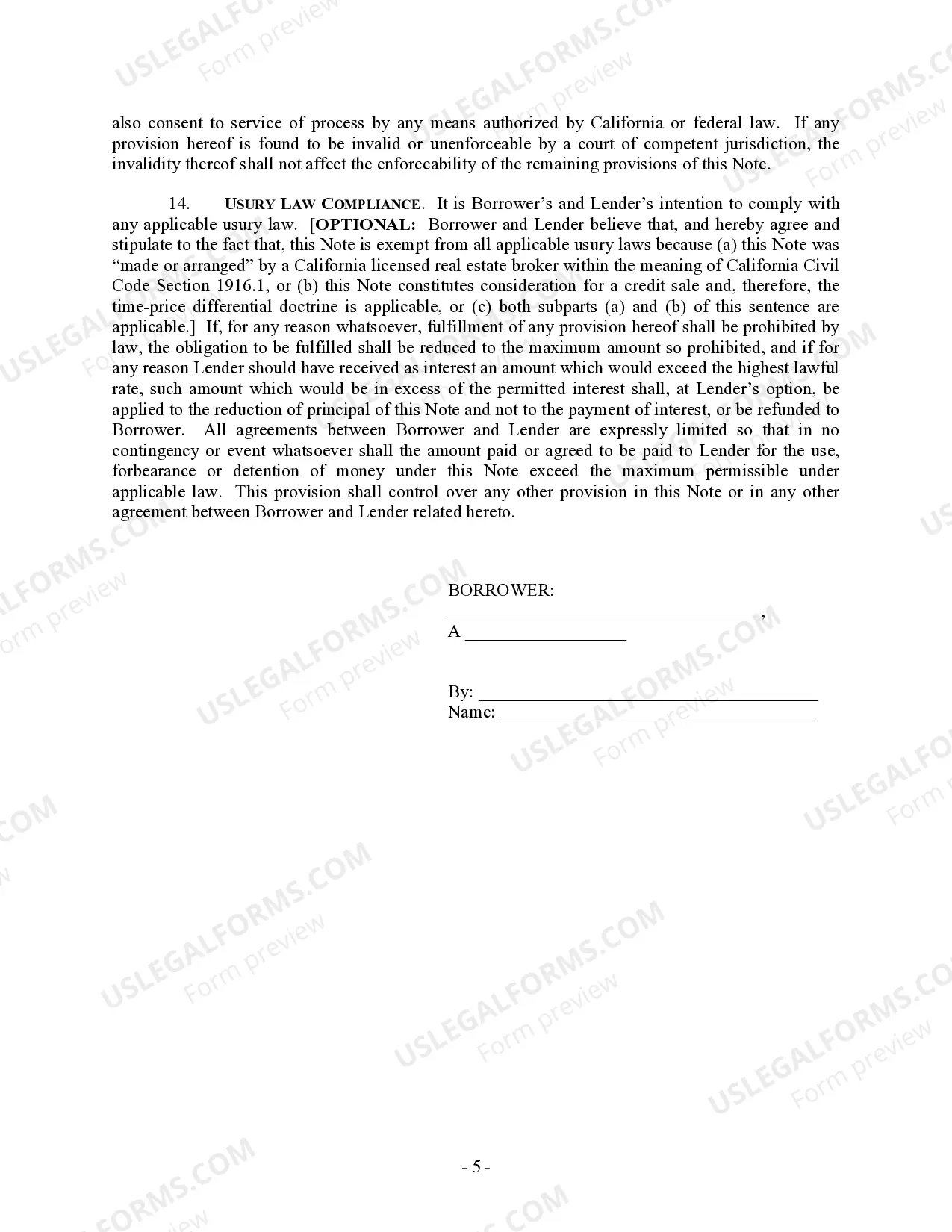

Balloon Payment Promissory Note Secured by Deed of Trust: A type of financial agreement where the borrower agrees to make one large payment (balloon payment) at the end of the term, after a series of smaller regular payments. The note is 'secured' by a deed of trust, which means the property serves as collateral for the loan. This method is often used in real estate transactions in the United States.

Step-by-Step Guide to Drafting a Balloon Payment Promissory Note

- Determine the Principal Amount: Decide on the total amount that will be loaned.

- Agree on Interest Rate: Settle on the interest rate to be applied on the principal amount over the term of the loan.

- Set the Term of the Loan: Define the duration over which the loan is to be repaid before the balloon payment is due.

- Define the Balloon Payment: Specify the amount and conditions under which the balloon payment will be made at the end of the term.

- Security Agreement: Detail the deed of trust that secures the promissory note.

- Signatures: Have all parties sign the note, ensuring it is legally binding.

Risk Analysis

- Risk of Default: If the borrower defaults on a balloon payment, they could lose the collateral property.

- Interest Rate Risk: If the interest rate is variable, it might increase over the term, thereby increasing the balloon payment.

- Refinancing Risk: The borrower may face difficulties in refinancing the balloon payment at the end of the loan term.

Pros & Cons of Using a Balloon Payment Promissory Note

- Pros:

- Lower initial monthly payments.

- Potentially easier to qualify for than traditional loans.

- Cons:

- Large sum due at the end of the loan term.

- Risks associated with the fluctuating interest rates.

How to fill out California Balloon Payment Promissory Note Secured By Deed Of Trust?

Managing official paperwork necessitates focus, accuracy, and utilizing properly prepared templates. US Legal Forms has been assisting individuals nationwide in achieving this for 25 years, so when you select your California Balloon Payment Promissory Note Secured by Deed of Trust sample from our collection, you can be assured it complies with federal and state laws.

Using our service is straightforward and quick. To obtain the required documents, all you will need is an account with an active subscription. Here’s a simple guide for you to acquire your California Balloon Payment Promissory Note Secured by Deed of Trust in just a few minutes.

All documents are created for multiple uses, such as the California Balloon Payment Promissory Note Secured by Deed of Trust showcased on this page. If you require them again, you can complete them without any further payment - simply navigate to the My documents tab in your account and finalize your document whenever you need it. Try US Legal Forms and complete your business and personal documentation swiftly and in full legal accordance!

- Ensure to thoroughly review the contents of the form and its alignment with general and legal standards by previewing it or reading its overview.

- Seek an alternative formal template if the previously accessed one does not fit your circumstances or state laws (the tab for this is located in the upper corner of the page).

- Log in to your account and store the California Balloon Payment Promissory Note Secured by Deed of Trust in your desired format. If it’s your initial visit to our website, click Buy now to continue.

- Establish an account, select your subscription option, and pay using your credit card or PayPal account.

- Choose the format in which you wish to save your document and click Download. Either print the template or incorporate it into a professional PDF editor for electronic submission.

Form popularity

FAQ

If you default on a note secured by a deed of trust, the lender typically has the right to foreclose on the property. This situation arises particularly with a California Balloon Payment Promissory Note Secured by Deed of Trust, where the lender can take legal action to reclaim the debt. It is important to remember that defaulting can have serious consequences, including loss of your property. Therefore, proactive communication and financial planning can be beneficial in avoiding defaults.

A promissory note does not always require a deed of trust, but having one provides added security. In the case of a California Balloon Payment Promissory Note Secured by Deed of Trust, the deed acts as collateral. This arrangement protects the lender and clarifies the rights of both parties if issues arise. Therefore, using a deed of trust can be advantageous for both borrowers and lenders.

When the debt secured with a deed of trust is satisfied, several things occur. First, the lender will release the deed of trust, which effectively removes their lien on the property. Additionally, the borrower receives a satisfaction of the deed, which confirms that the obligation has been fulfilled. This process is essential for ensuring that the borrower's ownership is clear and unencumbered moving forward.

Typically, a promissory note exists separately from the deed, but it is closely tied to it. The deed of trust serves as security for the promissory note, which means that the two documents work hand in hand. In a California Balloon Payment Promissory Note Secured by Deed of Trust, the connection is crucial for ensuring that lenders have recourse should the borrower default.

Under California law, if there is a lump sum payment due on a secured Note (?balloon payment?), the lender is required to provide a specified notice to the borrower ninety days prior to the date the payment is due. But such balloon payment can exist in both consumer and business loans.

A balloon payment loan has lower monthly payments for a set period (generally three to 10 years) and one big "balloon" payment when the loan term ends. Because the balloon payment is significantly more than your regular monthly payment, these loans can be risky.

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.

Balloon payments can be strategically used by a business to finance short-term needs. The business may draw on a balloon loan with no intention of holding the debt to the end of the term. Instead, the company can use the money to repay the loan in full before the end of the loan term.

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

Promissory notes with balloon payments are a financing option you may be considering for your business. These types of loans may be secured by collateral or not, but they always end their repayment schedule with a big payment, known as the balloon payment.