This package includes essential forms for the promotion and proper operation of a child care service. The forms included are designed to protect the liability of the child care provider and minimize the potential for future litigation. Purchase of this package is a savings of more than 50% over purchasing the forms individually.

This package includes the following forms:

1. Child Care Services Contract

This is an agreement between an individual employer and a child care provider whereby the employer hires the provider to care for employer's children as an independent contractor.

2. Employment Agreement with Director of Child Care Center including Non-Competition Provision

This form is used to establish the terms of employment, including duties, compensation, termination, benefits, and more between a child care provider and the director hired by it. A non-competition clause is included as well. Restrictions to prevent competition by a former employee are held valid when they are reasonable and necessary to protect the interests of the employer.

3. Sample Letter for Promotional Letter - Daycare Services - Professional

This form is a sample letter in Word format designed to be used to promote child care services offered in a professional and inviting manner.

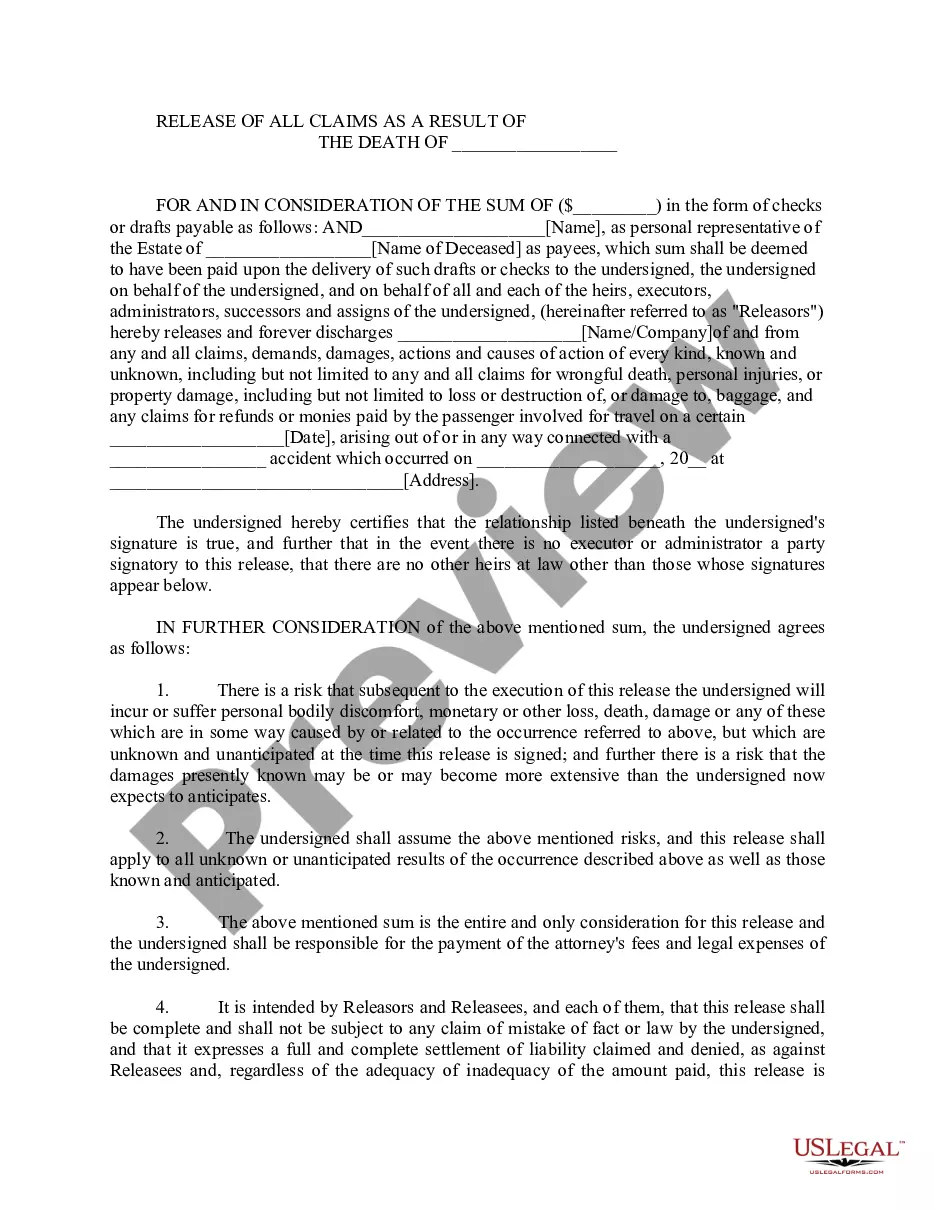

4. Waiver and Release for Childcare Services

This form is a release given to a childcare service for any injuries that are suffered by a child while under the care of the childcare service. This form is a generic example that may be referred to when preparing such a form for your particular state.

5. Business Use of Your Home - Including Use by Daycare Providers

This is a free instructional form with guidance on complying with tax implications involved in running a home daycare business. Specific instruction is provided on the deduction of business expenses in a home daycare situation.