California Certificate of Independent Review for Donative Transfers

Description

How to fill out California Certificate Of Independent Review For Donative Transfers?

If you are seeking appropriate California Certificate of Independent Review for Donative Transfers templates, US Legal Forms is what you require; obtain documents crafted and reviewed by state-certified attorneys.

Utilizing US Legal Forms not only alleviates concerns regarding proper forms, but you also save time, effort, and money! Downloading, printing, and submitting a professional document is considerably less expensive than hiring a lawyer to do it on your behalf.

And that’s it. With just a few simple clicks, you possess an editable California Certificate of Independent Review for Donative Transfers. When you register, all future purchases will be processed even more smoothly. If you have a US Legal Forms subscription, simply Log In/">Log In to your account and then click the Download button visible on the form's page. Then, when you need to use this template again, you will always be able to locate it in the My documents section. Don’t waste your time searching through countless forms on various websites. Acquire accurate documents from a single secure platform!

- To get started, complete your registration process by entering your email and setting up a secure password.

- Follow the instructions below to create your account and locate the California Certificate of Independent Review for Donative Transfers template to resolve your concerns.

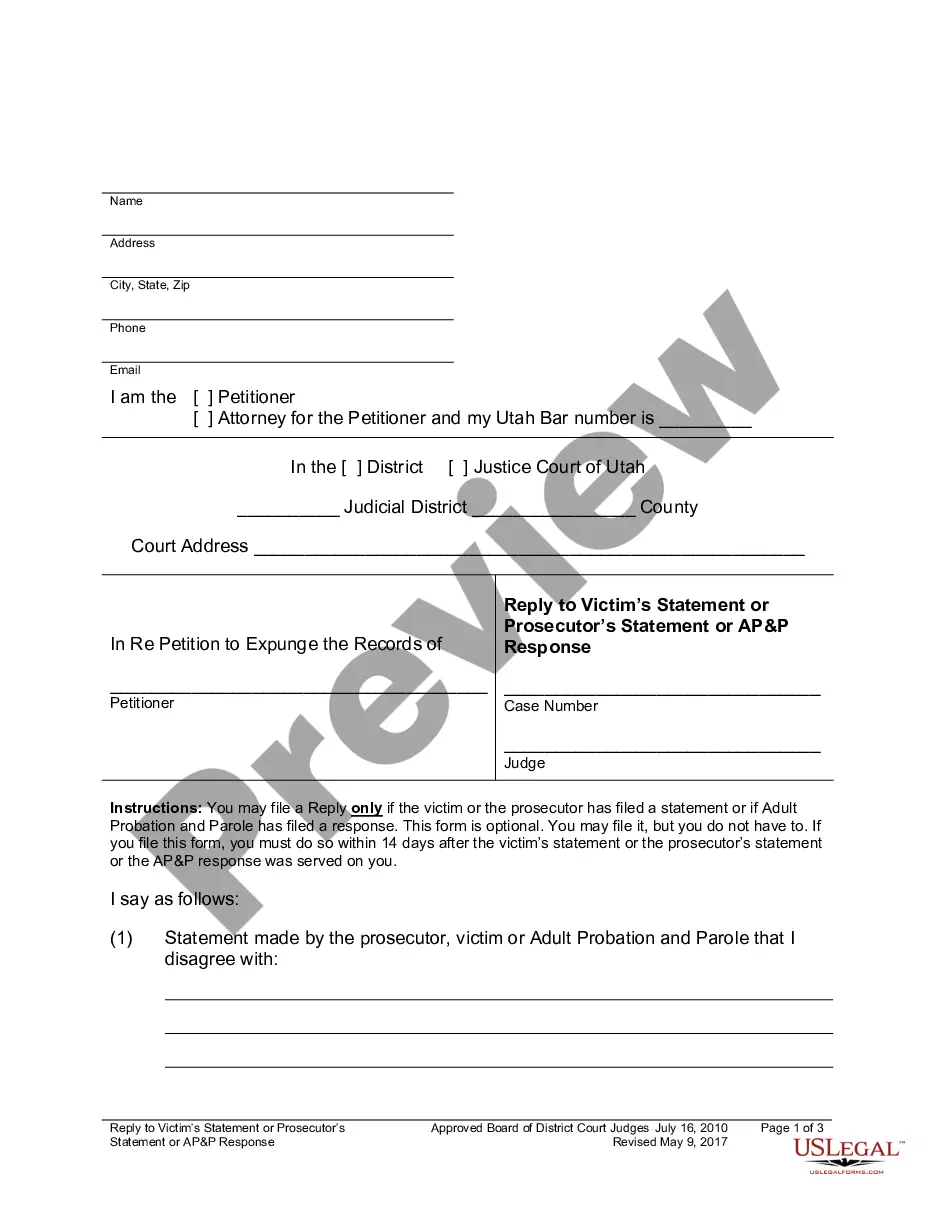

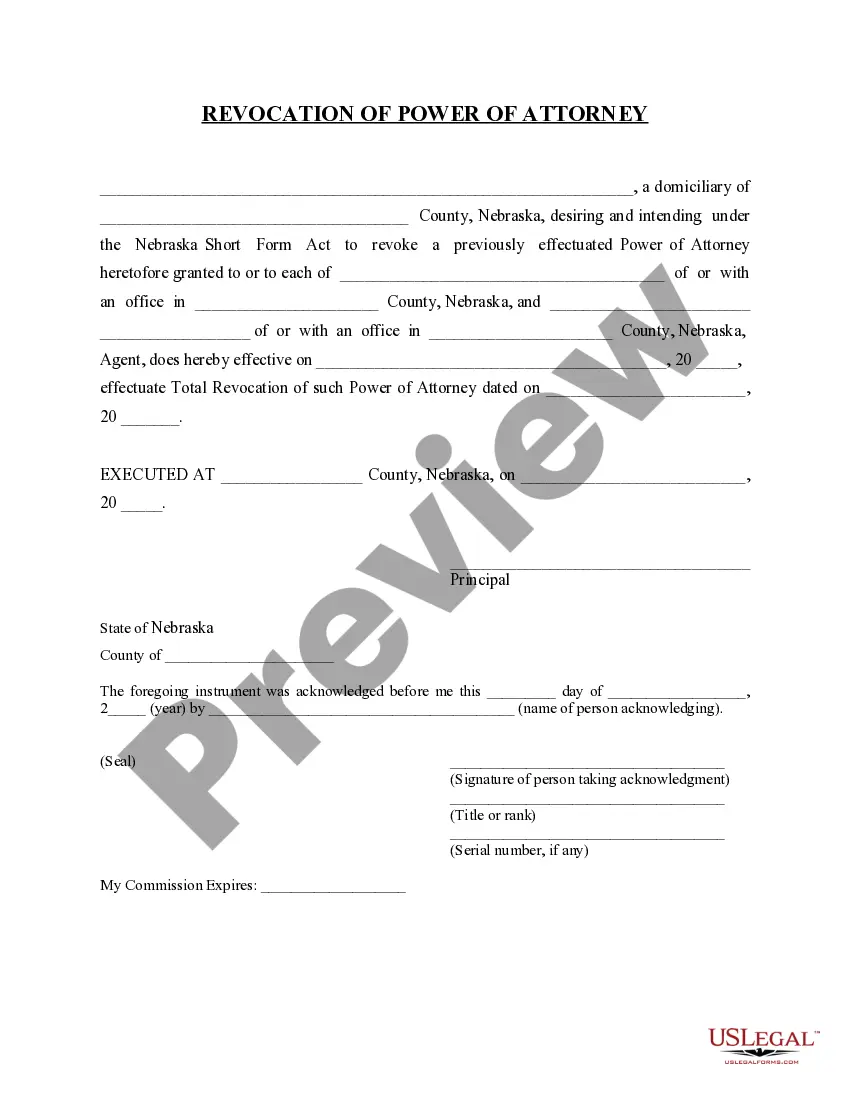

- Utilize the Preview option or examine the document details (if available) to ensure that the form is the one you require.

- Verify its legality in your residing state.

- Click Buy Now to place an order.

- Select a preferred pricing option.

- Create your account and pay using a credit card or PayPal.

Form popularity

FAQ

Independent review offers several benefits, including enhanced transparency and reduced risk of legal challenges. By validating the terms of a donative transfer, this process protects both the donor and the recipient. Specifically, in the context of California Certificate of Independent Review for Donative Transfers, it fosters trust and ensures compliance with California's legal framework, ultimately streamlining the transfer process.

To invalidate a trust in California, one must provide strong evidence that the trust was created under undue influence, fraud, or lack of mental capacity. This process typically involves legal proceedings, which can be complex. However, the California Certificate of Independent Review for Donative Transfers can help clarify intentions and strengthen claims, making any potential disputes easier to navigate.

An independent review aims to evaluate the appropriateness of a donative transfer in accordance with legal standards. This ensures that the grantor's intentions align with state laws and safeguards against potential disputes. Engaging in an independent review, especially regarding California Certificate of Independent Review for Donative Transfers, provides peace of mind, as it helps validate the transaction.

A certificate of trust serves to confirm the existence of a trust and details its important terms. This document often helps in establishing the trustee's authority without disclosing the entire trust agreement. When dealing with California Certificate of Independent Review for Donative Transfers, this certificate enhances clarity in asset transfers and simplifies the process for all parties involved.

To obtain a copy of a trust document in California, you'll typically need to request it from the trustee, as they hold the original document. If the trust is irrevocable, beneficiaries have a right to access certain trust information, including its terms. In situations where the trustee is uncooperative, legal action may be necessary to compel the production of the document. For comprehensive guidance on this process, consider turning to US Legal Forms to find the necessary resources and templates.

Generally, a certificate of trust can be drafted by the trustee, the grantor, or an attorney who specializes in estate planning. It is highly recommended to work with an attorney to ensure that the certificate complies with California law and accurately reflects the trust's terms. A well-drafted certificate aligns with excellent practice, easing interactions with banks, real estate firms, and other institutions. Remember, clarity in this document can prevent misunderstandings later.

A certificate of trust is usually created by the person who establishes the trust, known as the grantor, or the trustee once the trust is active. The preparation of this document often involves careful consideration of the trust's terms and the relevant parties titled in the trust. Once created, it serves as proof of the trust's existence and essential provisions, useful in dealing with financial institutions and other entities. Seeking professional legal assistance can make this process more streamlined.

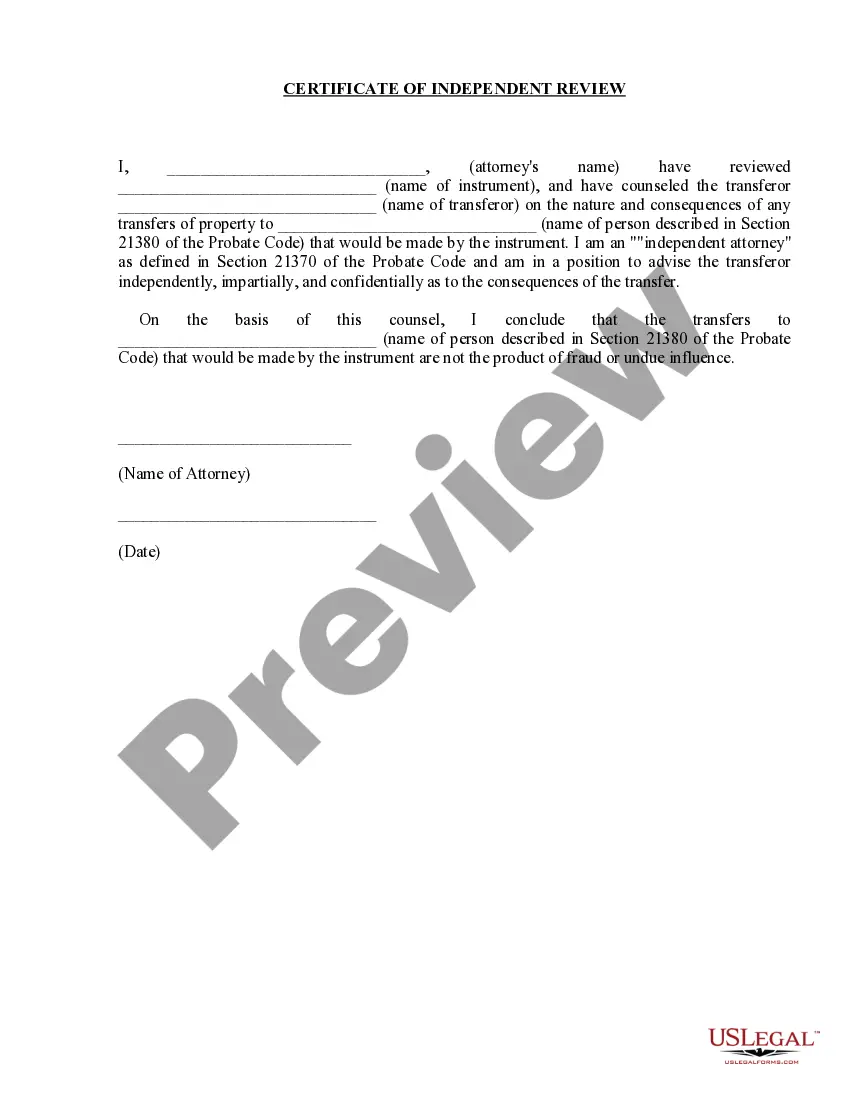

A certificate of independent review is a legal document that confirms a professional review has been conducted regarding a donative transfer, such as gifts or bequests. This certificate aims to ensure that the donor's intent is honored while also providing a level of protection against potential disputes or legal challenges. For individuals considering significant transfers, obtaining a California Certificate of Independent Review for Donative Transfers can be beneficial. It promotes transparency and helps prevent future litigation.

In California, a certificate of trust is typically issued by the trustee of the trust. The trustee must have the authority to manage the trust according to its terms, which is established during the creation of the trust. This certificate serves as a summary of the trust without disclosing all details, making it easier for third parties to verify its existence. It is crucial to have this document issued correctly to facilitate transactions related to the trust.

No, trust documents are generally not considered public records in California. This means that access to these documents is restricted to trustees and beneficiaries. However, the California Certificate of Independent Review for Donative Transfers can provide clarity and assurance in the context of private transfers, reinforcing the need for transparency and legality in these matters.