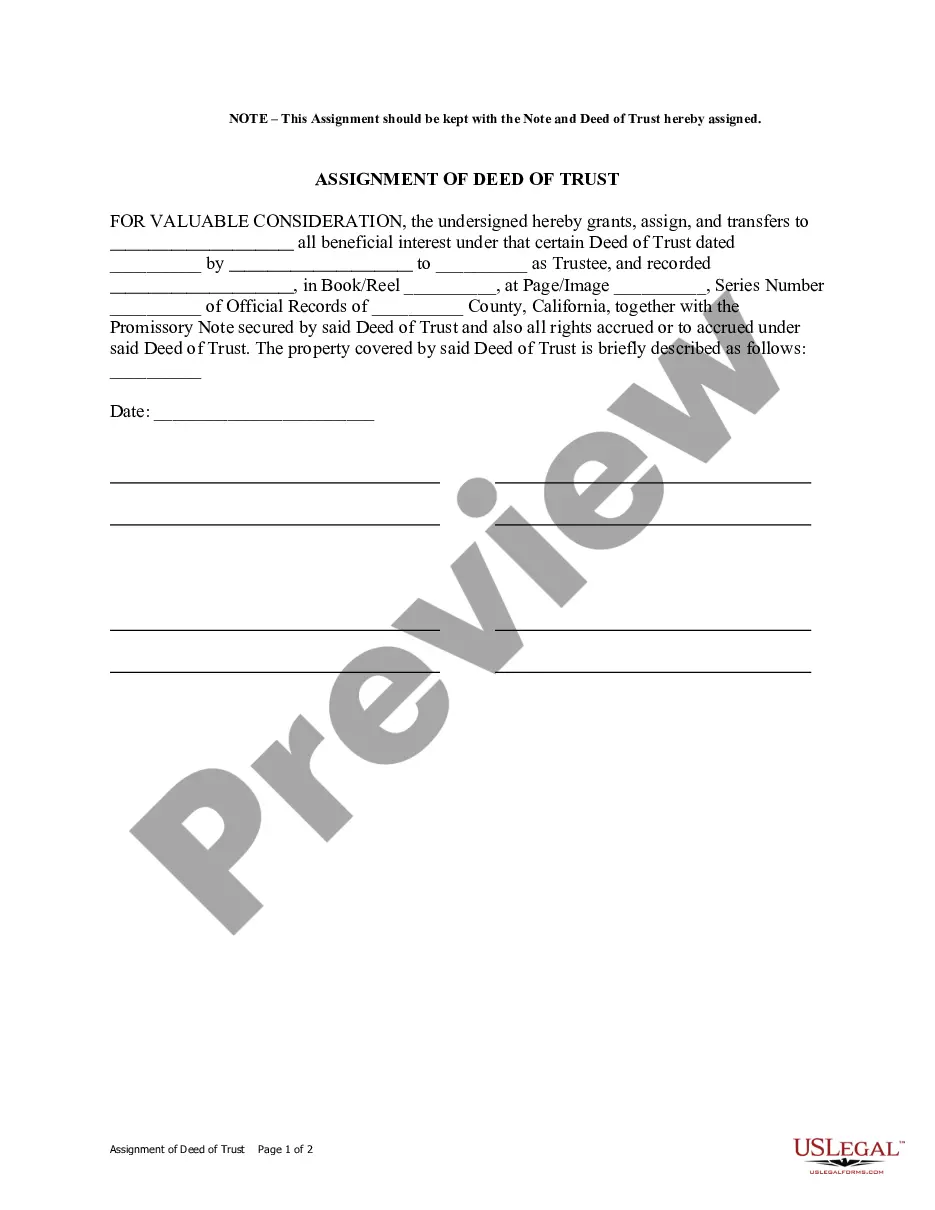

A California Assignment of Deed of Trust is a legal document that transfers the ownership of a mortgage loan from one party to another. It is used in situations where a borrower is refinancing a loan or transferring ownership of a loan. The document assigns the loan from the original lender to a new lender or assignee. This document is recorded with the county recorder’s office and becomes part of the public record. There are two types of California Assignment of Deed of Trust: an absolute assignment and a limited assignment. An absolute assignment transfers the full ownership of the loan to the assignee and the original lender is released from any obligations. A limited assignment transfers only a portion of the ownership of the loan and the original lender still retains some ownership rights.

A California Assignment of Deed of Trust is a legal document that transfers the ownership of a mortgage loan from one party to another. It is used in situations where a borrower is refinancing a loan or transferring ownership of a loan. The document assigns the loan from the original lender to a new lender or assignee. This document is recorded with the county recorder’s office and becomes part of the public record. There are two types of California Assignment of Deed of Trust: an absolute assignment and a limited assignment. An absolute assignment transfers the full ownership of the loan to the assignee and the original lender is released from any obligations. A limited assignment transfers only a portion of the ownership of the loan and the original lender still retains some ownership rights.