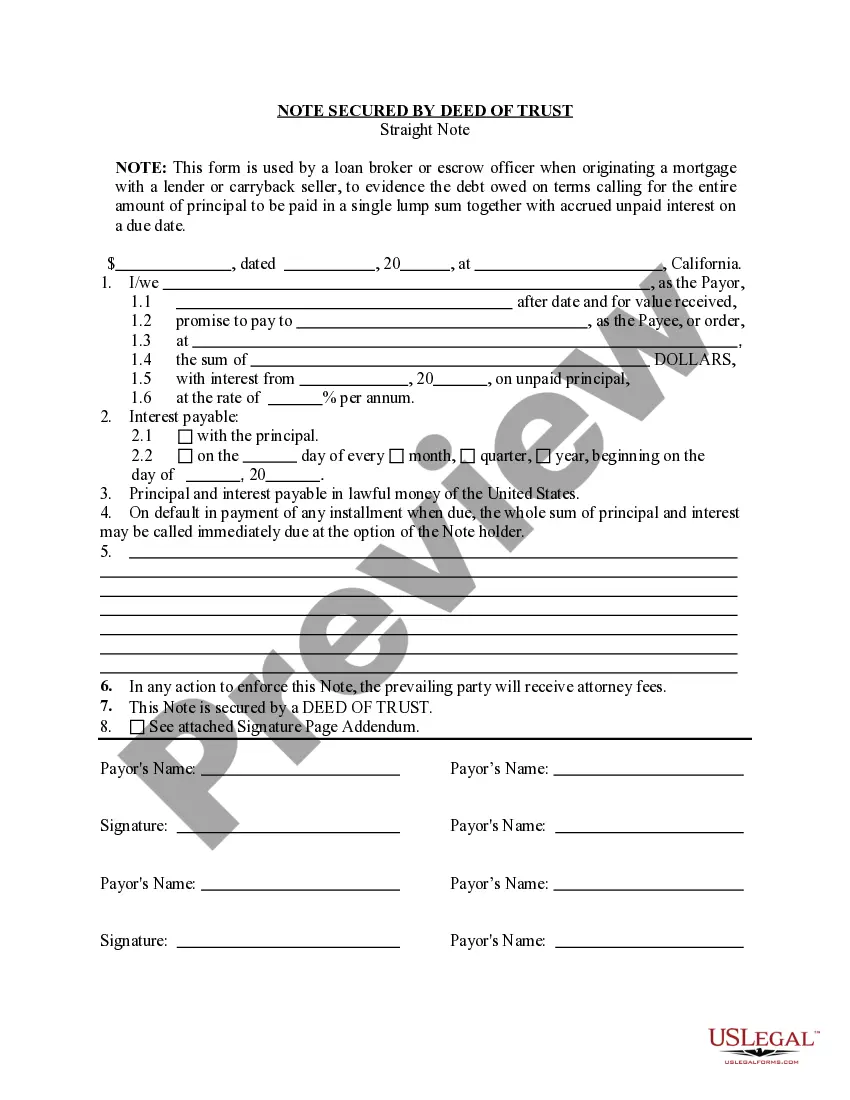

California Note Secured By Deed of Trust

Description

How to fill out California Note Secured By Deed Of Trust?

US Legal Forms is the most simple and affordable way to locate suitable formal templates. It’s the most extensive online library of business and individual legal paperwork drafted and verified by legal professionals. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your California Note Secured By Deed of Trust.

Obtaining your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted California Note Secured By Deed of Trust if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one corresponding to your demands, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you like most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your California Note Secured By Deed of Trust and save it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding formal documentation. Try it out!

Form popularity

FAQ

The deed of trust acts as a promise from the borrower to repay the loan. A promissory note secured by deed of trust allows the lender to foreclose on the borrower's home if the borrower stops making payments.

The deed of trust secures the loan by holding the commercial property as security. The deed of trust outlines the terms of the loan. The borrower accepts the deed of trust by signing the promissory note.

A promissory note secured by deed of trust is a type of loan document that details how and when a borrower will repay money to a lender. A promissory note is a kind of IOU that's secured by property, often property that the borrower owns.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A deed of trust can be used to secure more than one note. In California, the trustee and beneficiary may be the same entity. The lender does not need to be named in a deed of trust. The statute of limitations might bar action on a note with a deed of trust that has power of sale.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note.

A deed of trust often requires a promissory note, but the promissory note is a specific document type. While a deed of trust describes the terms of debt as secured by a property, a promissory note acts as a promise that the borrower will pay the debt. A borrower signs the promissory note in favor of a lender.