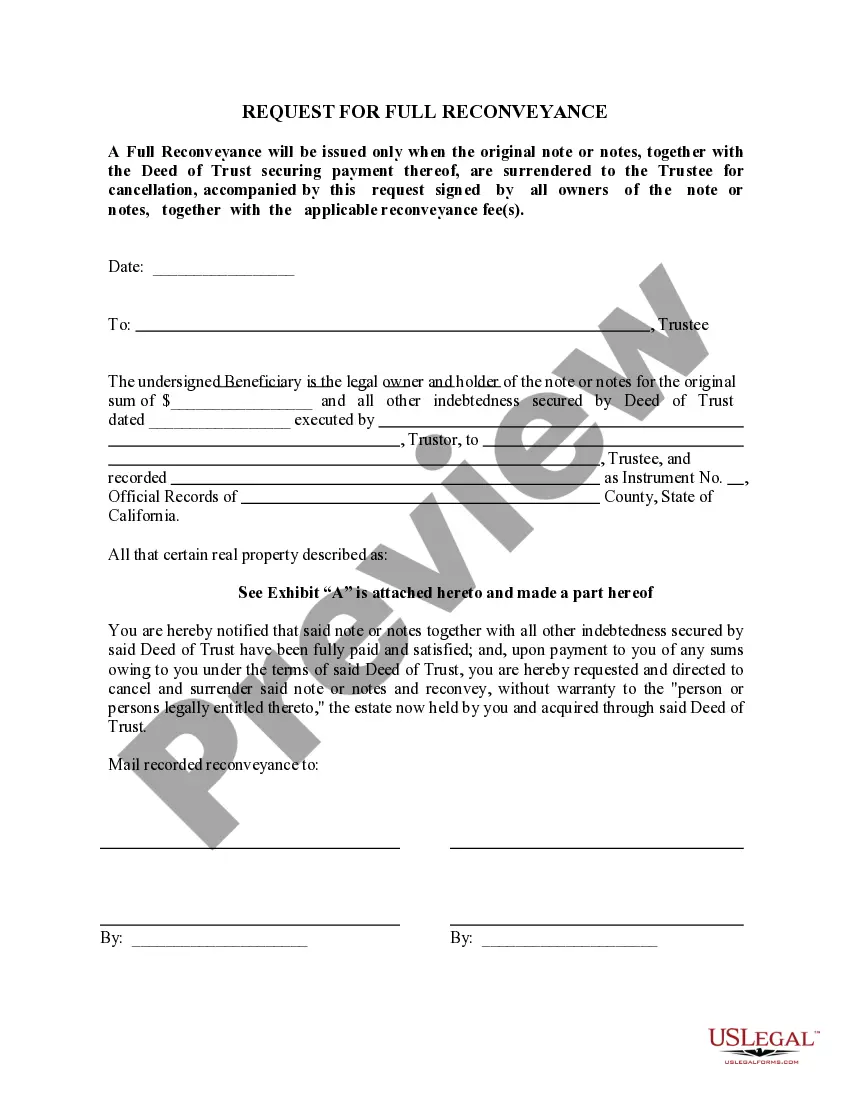

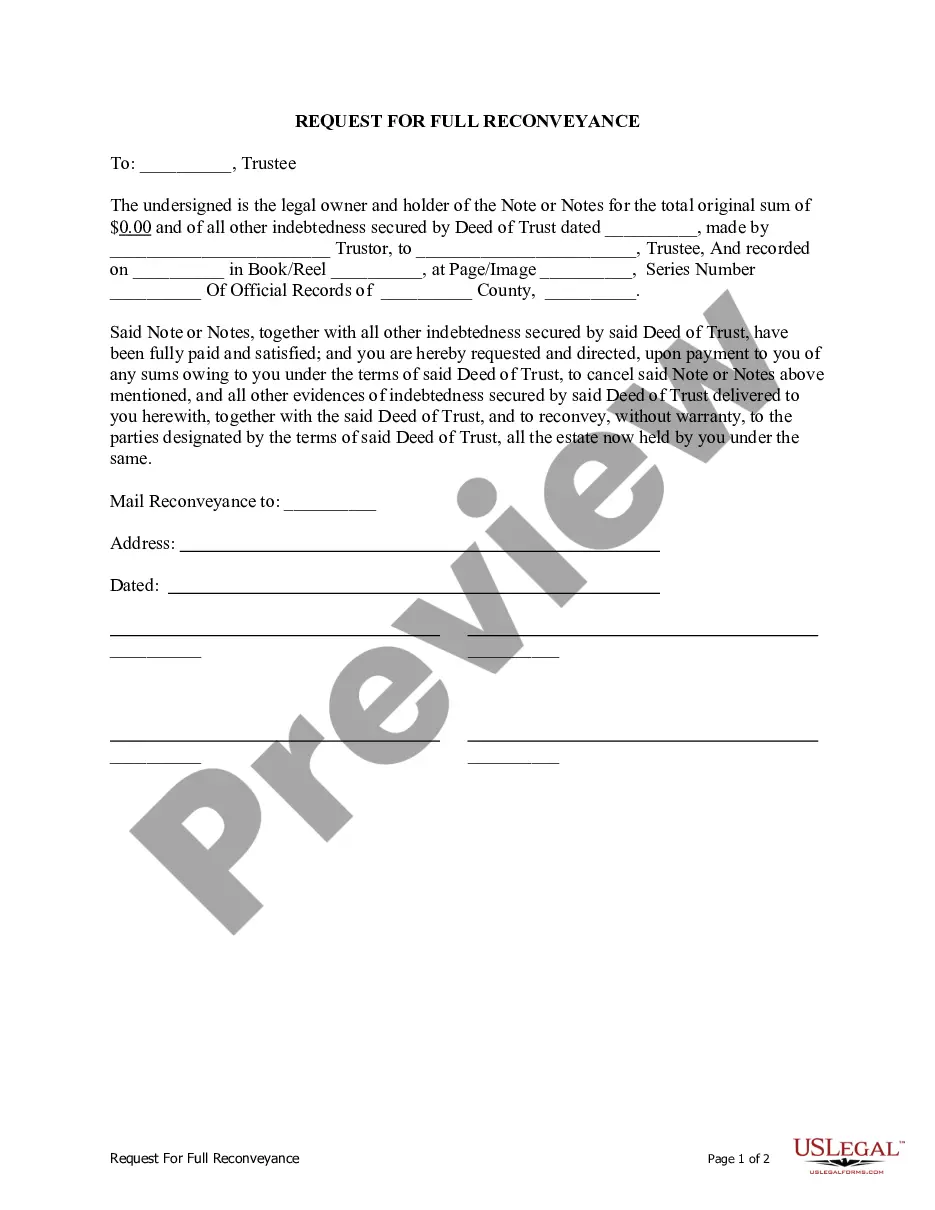

California Partial Re conveyance is a legal process that allows a borrower to pay off a portion of their mortgage balance. This is most commonly used when a borrower has used a home equity line of credit (HELOT) to pay off part of their mortgage. In this case, the lender will file a Partial Re conveyance with the county recorder's office to show that the borrower has satisfied part of the loan obligation. The Partial Re conveyance document will include the amount of the partial payment, the date of the payment, and the loan information. There are two types of California Partial Re conveyance. The first type is a standard Partial Re conveyance, which is typically used when the borrower has used a HELOT or other loan to pay off part of their mortgage. The second type is a Deed of Re conveyance, which is typically used when the borrower has paid off their mortgage in full. The Deed of Re conveyance will include the full amount of the loan, the date of the payment, and the loan information.

California Partial Reconveyance

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Partial Reconveyance?

If you’re searching for a way to properly complete the California Partial Reconveyance without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business scenario. Every piece of documentation you find on our online service is drafted in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Follow these straightforward instructions on how to get the ready-to-use California Partial Reconveyance:

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and choose your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your California Partial Reconveyance and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Practically, lenders and servicers may want to consider including in payoff demand statements an additional $150 in recording fees for a Substitution of Trustee and Full Reconveyance ($75.00 for each document ?title?), necessary for the release of the loan.

To record the reconveyed deed, the property owner must go to the office of the Registrar-Recorder in which the property is located. For example, if the property is located in Los Angeles County, the reconveyed deed must be taken to the Los Angeles County Recorder's Office.

The beneficiary is usually the lender or carry back seller. The beneficiary receives no legal interest in the property through the trust deed. Because of his secured relationship to the property, the beneficiary acquires an equitable interest to the extent permitted under the title rights given to the trustee.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

A partial reconveyance is to reconvey a portion of the land subject to a deed of trust, not the loan amount.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

California Civil Code section 2941 (b)(1) requires the beneficiary, upon payoff, to ?execute and deliver to the trustee the original note, deed of trust, request for a full reconveyance?.? The trustee then executes and records the full reconveyance within 21 days of receipt of the documents from the beneficiary,