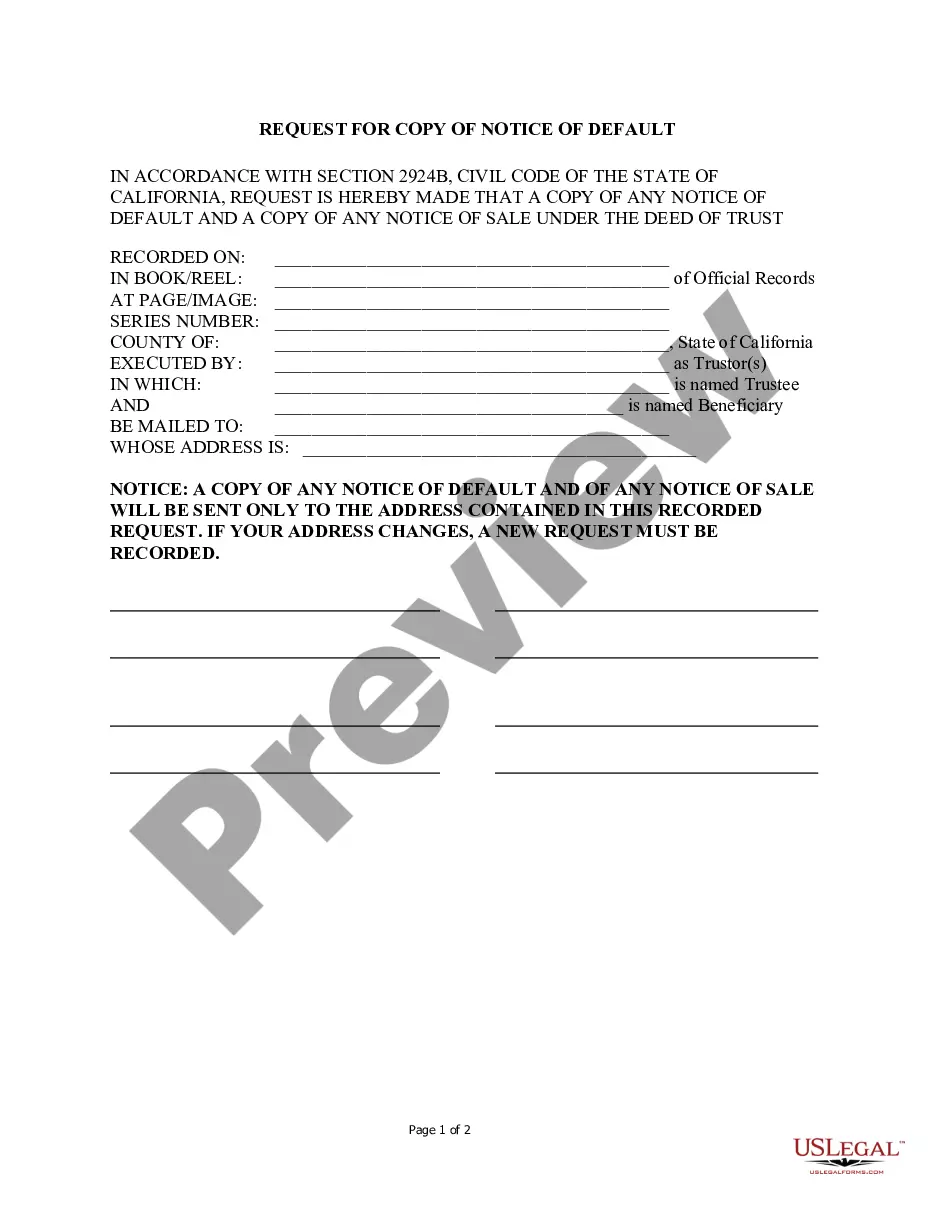

California Request for Copy of Notice of Default

Description

How to fill out California Request For Copy Of Notice Of Default?

Working with legal paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your California Request for Copy of Notice of Default template from our service, you can be certain it complies with federal and state laws.

Working with our service is easy and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your California Request for Copy of Notice of Default within minutes:

- Remember to carefully look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the California Request for Copy of Notice of Default in the format you need. If it’s your first experience with our service, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the California Request for Copy of Notice of Default you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Request for Notice means a written notice given to the City by a Mortgagee specifying the name and address of such Mortgagee and attaching thereto a true and complete copy of the Mortgage held by such Mortgagee.

A notice of default is a public notice that a borrower is behind on their mortgage payments. (Also known as being in default on their loan.) It's typically filed with a court and regarded as the first step in the foreclosure process.

The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees. A declaration must be attached to the notice stating the lender has spoken to you or tried to reach you to discuss your situation.

If you have revived a Notice of Default or Foreclosure Notice you can respond by mailing a Federal Debt Validation Letter demanding that the mortgage lender or servicer validate the debt. This can help you stall their collection efforts, and help you gain the material facts needed to exhibit to your complaint.

When you receive the Notice of Default, you have 180 days to get your loan current or the bank can take the next step in the foreclosure process. The next step, called the Notice of Trustee's Sale, sets a date for a public foreclosure auction of your home.

A notice of default is a public notice that a borrower is behind on their mortgage payments. (Also known as being in default on their loan.) It's typically filed with a court and regarded as the first step in the foreclosure process.

A document where the current lender agrees to makes their encumbrance deed of trust, subject-to (junior) to another loan. 8. Request for Notice of Default. A document whereby the junior lenders require the senior lender to notify them when the borrower defaults on their loan.

After the Notice of Default is filed, the homeowner has 90 days to cure the default, which usually means paying everything that is owed. If the borrower does not pay within the 90-day timeline, the bank can record a Notice of Sale announcing that the property will be sold at auction.