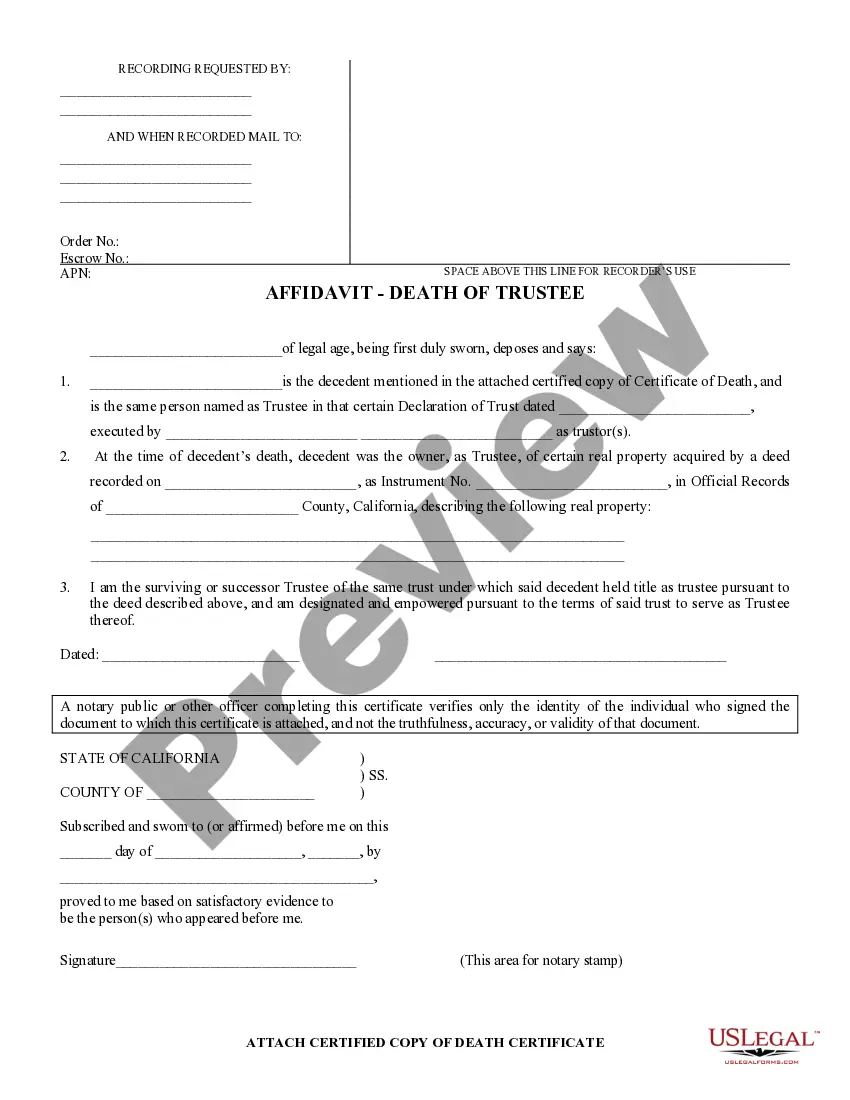

The California Affidavit — Death of Trustee, is a legal document used to prove the death of a trustee and to transfer legal authority over a trust to the successor trustee in the state of California. This document is also used to officially inform the probate court of the death of a trustee. There are two types of California Affidavit — Death of Trustee: the Trustee's Affidavit of Death and the Successor Trustee's Affidavit of Death. The Trustee's Affidavit of Death must be signed by all the trustees of the trust, or by the executor of the deceased trustee's estate. This affidavit must include the name of the deceased trustee, the date of death, and the name of the successor trustee. The Successor Trustee's Affidavit of Death must be signed by the individual appointed to be the successor trustee. This affidavit must include the name of the deceased trustee, the date of death, and the name of the successor trustee. The Successor Trustee's Affidavit of Death also must include a statement that the successor trustee has agreed to serve as the trustee of the trust. Both affidavits must be notarized and filed with the probate court.

California Affidavit - Death of Trustee

Description

Key Concepts & Definitions

Affidavit of Death of Trustee: A legal document filed to declare the death of a trustee, transferring trust administration responsibilities to a successor trustee. This affidavit is crucial for the proper management and transfer of trust assets.

Successor Trustee: An individual or entity assigned to manage and distribute the trust assets following the death of the original trustee.

Trust Assets: These include real estate, investments, and other property held within a trust.

Prepare Affidavit: The process of creating and validating the affidavit required to formally recognize the death of a trustee.

Step-by-Step Guide to Filing an Affidavit of Death of Trustee

- Obtain Death Certificate: Secure a certified copy of the death certificate for the deceased trustee.

- Prepare Affidavit: Draft the affidavit, ensuring all the necessary information about the deceased trustee and successor trustee is included.

- Apply for an EIN: If the trust does not already have an Employer Identification Number, apply for one through the IRS.

- File the Affidavit: Submit the completed affidavit to the relevant local or state offices to officially recognize the change in trusteeship.

- Notify Financial Institutions: Inform banks and other financial institutions of the trustee's death and provide the affidavit, along with the successor trustee's details.

- Transfer Assets: Start the process of transferring trust assets under the supervision of the new trustee.

Risk Analysis

- Legal Risks: Incorrect or incomplete affidavits can result in legal challenges or delays in asset transfer.

- Financial Risks: Delays in filing the affidavit or mismanagement during the transition can lead to financial losses for the trust.

- Compliance Risks: Failure to properly apply for an EIN or correctly file necessary documents might lead to compliance issues with tax authorities or regulators.

Best Practices

- Ensure Accuracy: Double-check all information in the affidavit to prevent legal complications.

- Seek Professional Help: Consider hiring an attorney or a financial advisor specialized in trust administration for guidance.

- Timely Filing: Promptly file all necessary documents to avoid penalties or delays in the management of trust assets.

Common Mistakes & How to Avoid Them

- Delay in Filing: Avoid delays by preparing the affidavit soon after obtaining the death certificate.

- Inaccurate Information: Double-check details in the affidavit with a legal professional before filing.

- Overlooking Asset Transfer Requirements: Be aware of all legal requirements for transferring different types of assets within the trust.

How to fill out California Affidavit - Death Of Trustee?

Managing legal paperwork necessitates focus, accuracy, and utilizing well-structured templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, ensuring that when you select your California Affidavit - Death of Trustee template from our platform, it complies with federal and state regulations.

Utilizing our service is straightforward and efficient. To obtain the required document, you'll only need an account with an active subscription. Here’s a brief guide to help you acquire your California Affidavit - Death of Trustee in minutes.

All documents are designed for multiple uses, including the California Affidavit - Death of Trustee displayed on this page. If you require them again, you can fill them out without additional payment - simply access the My documents tab in your profile and complete your document whenever needed. Try US Legal Forms and efficiently manage your business and personal documentation while ensuring full legal compliance!

- Ensure to thoroughly review the form content and its alignment with general and legal stipulations by previewing it or examining its description.

- Search for an alternative official blank if the one you opened initially doesn’t match your circumstances or state laws (the tab for that is located in the top page corner).

- Log In to your account and download the California Affidavit - Death of Trustee in your desired format. If this is your first time using our site, click Buy now to continue.

- Create an account, choose your subscription plan, and complete the payment with your credit card or PayPal.

- Select the format in which you wish to save your form and click Download. Print the document or upload it to a professional PDF editor for electronic preparation.

Form popularity

FAQ

Filling out an Affidavit of Heirship form requires specific information about the deceased, their heirs, and the relationship between them. It is essential to provide accurate details to ensure the validity of this document. When completing such forms, especially in the context of a California Affidavit - Death of Trustee, you may consider using platforms like US Legal Forms to access templates and guidance, ensuring your form meets all legal requirements.

An Affidavit of successor trustee in California is a vital document that officially appoints a new trustee following the death or incapacity of the previous one. This affidavit provides necessary details about the new trustee and validates their authority. Utilizing a California Affidavit - Death of Trustee can streamline this transition process, ensuring that the trust is managed effectively and in compliance with California law.

The affidavit of death of trustee is essential for confirming the death of a trustee and initiating the transfer of responsibilities to the successor trustee. This document simplifies the process of proving a trustee's death to banks, courts, and other institutions. Completing a California Affidavit - Death of Trustee ensures a smooth transition and maintains the trust’s operations.

A trustee's affidavit is a legal document used to declare the authority and actions of a trustee. This affidavit often serves as proof that the trustee has the authority to act on behalf of the trust. In the context of the California Affidavit - Death of Trustee, this document outlines the responsibilities and changes in trusteeship after the original trustee's passing.

In California, a trustee typically has several months to settle an estate, although the exact timeline can vary depending on the circumstances. They must complete necessary tasks like notifying beneficiaries and resolving any debts. Utilizing a California Affidavit - Death of Trustee can help clarify timelines and responsibilities. Professional guidance can ease this process and help ensure compliance with state laws.

After the death of a trustee, the successor trustee has several key responsibilities. They must collect the trust's assets, settle any debts, and ensure that the terms of the trust are fulfilled. They should also prepare to distribute assets according to the California Affidavit - Death of Trustee, which can facilitate a smooth transition. Navigating these duties can be complex, so seeking support from a knowledgeable source may be beneficial.

When a trustee dies, the first step is to locate the trust document. You will need to determine who the successor trustee is, as they will take over the management of the trust. It is advisable to file a California Affidavit - Death of Trustee to formalize the transition. Consulting a legal professional can also help clarify the process.

To fill out an affidavit example, start by identifying the required legal information specific to your situation, such as dates and names. Follow the structure of the example, ensuring consistency in language and form. Platforms like uslegalforms provide helpful samples that guide you through the completion of an affidavit, making it easier to avoid errors.

Filling out an affidavit of death of trustee involves providing accurate details about the deceased trustee, including their full name, date of death, and trust identification. Ensure that each section is completed and the affidavit is signed under oath. You might find it helpful to use resources from uslegalforms to simplify this process and ensure compliance with legal requirements.

To fill out an Affidavit of death of trustee in California, first, gather required information such as the trustee's name, date of death, and trust details. Complete the affidavit by clearly stating the facts and signing in front of a notary public for validation. Utilizing platforms like uslegalforms can guide you through the process with templates designed for your needs.