This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

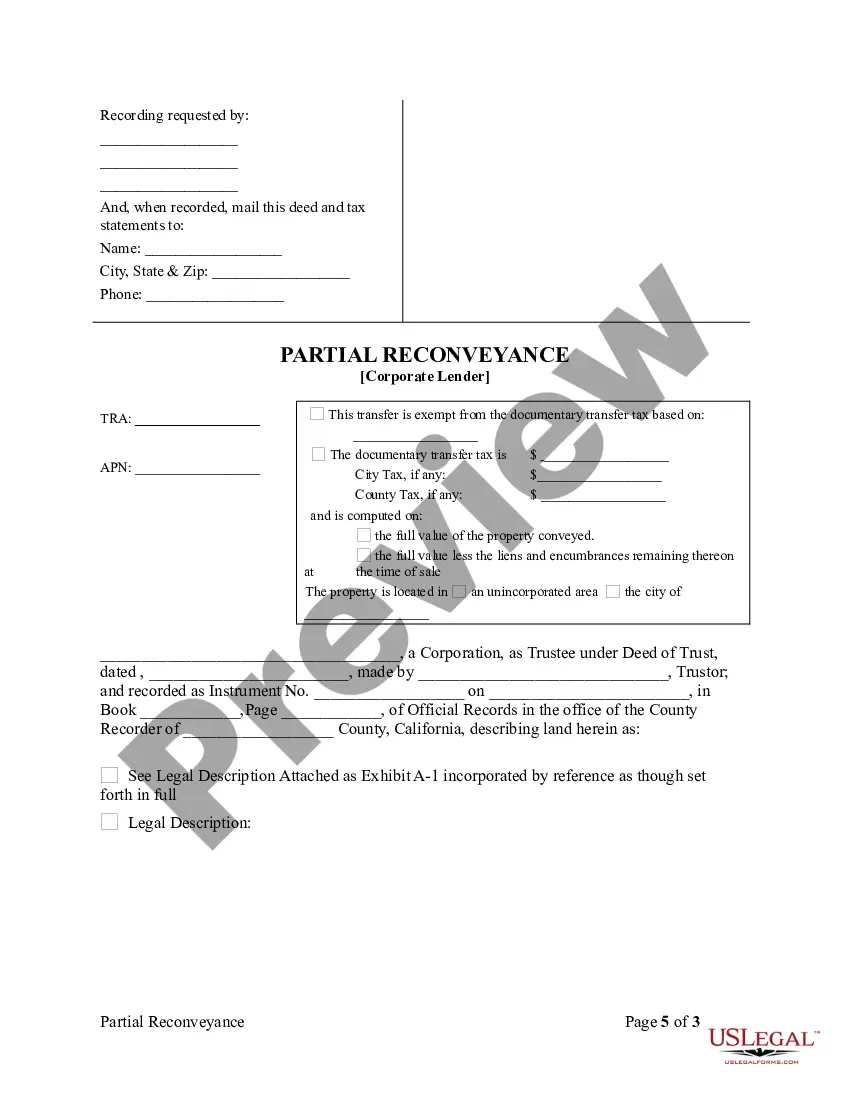

California Partial Release of Property From Deed of Trust for Corporation

Description California Property Deed

How to fill out California Release Deed Trust Form?

If you are in search of precise California Partial Release of Property From Deed of Trust for Corporation samples, US Legal Forms is what you require; access documents crafted and reviewed by state-certified legal experts.

Utilizing US Legal Forms not only protects you from complications related to legal paperwork; you also save time and effort, as well as money! Downloading, printing, and filling out a professional template is definitely more affordable than hiring an attorney to do it for you.

And there you have it. With just a few easy clicks, you obtain an editable California Partial Release of Property From Deed of Trust for Corporation. Once you create your account, all subsequent orders will be processed even more smoothly. After obtaining a US Legal Forms subscription, simply Log In/">Log In to your profile and click the Download button found on the form's page. Then, when you need to use this template again, you’ll always be able to find it in the My documents section. Don't waste your time and energy searching multiple sites for forms. Acquire accurate documents from just one secure platform!

- To start, complete your registration process by providing your email and setting a password.

- Follow the directions below to set up your account and acquire the California Partial Release of Property From Deed of Trust for Corporation template to meet your needs.

- Utilize the Preview feature or review the document details (if available) to ensure that the template is the one you require.

- Verify its legitimacy in your state.

- Click on Buy Now to place an order.

- Select your preferred payment plan.

- Set up your account and pay using your credit card or PayPal.

- Choose a convenient format and save the document.

Release Deed Trust Form popularity

Partial Release Deed Other Form Names

Release Of Interest In Property Form FAQ

In California, a deed of trust does not show ownership; rather, it serves as a security interest in the property. The actual ownership is reflected on the property title. Understanding how the California Partial Release of Property From Deed of Trust for Corporation works can clear up any confusion about ownership versus the lender's interest. This distinction is critical for those dealing with property transactions.

To remove someone from a deed without refinancing, you can use a quitclaim deed. This legal document allows the current owner to transfer their interest without affecting existing loans. The California Partial Release of Property From Deed of Trust for Corporation can facilitate this process for corporate properties. It is also best to consult with a legal professional to ensure everything is executed correctly.

In California, to remove a co-owner from your house title, you will need their consent to sign a quitclaim deed. This deed transfers their interest to you, effectively updating the title. The California Partial Release of Property From Deed of Trust for Corporation is beneficial in navigating property matters involving corporations. Legal advice can also help you avoid potential complications during this process.

To remove a co-owner from a property title, you need to execute a deed that relinquishes their interest. This typically involves using a quitclaim deed to transfer ownership. If you are managing corporate property, the California Partial Release of Property From Deed of Trust for Corporation can guide you in ensuring compliance with relevant regulations. Consulting with a real estate attorney is advisable for a seamless transition.

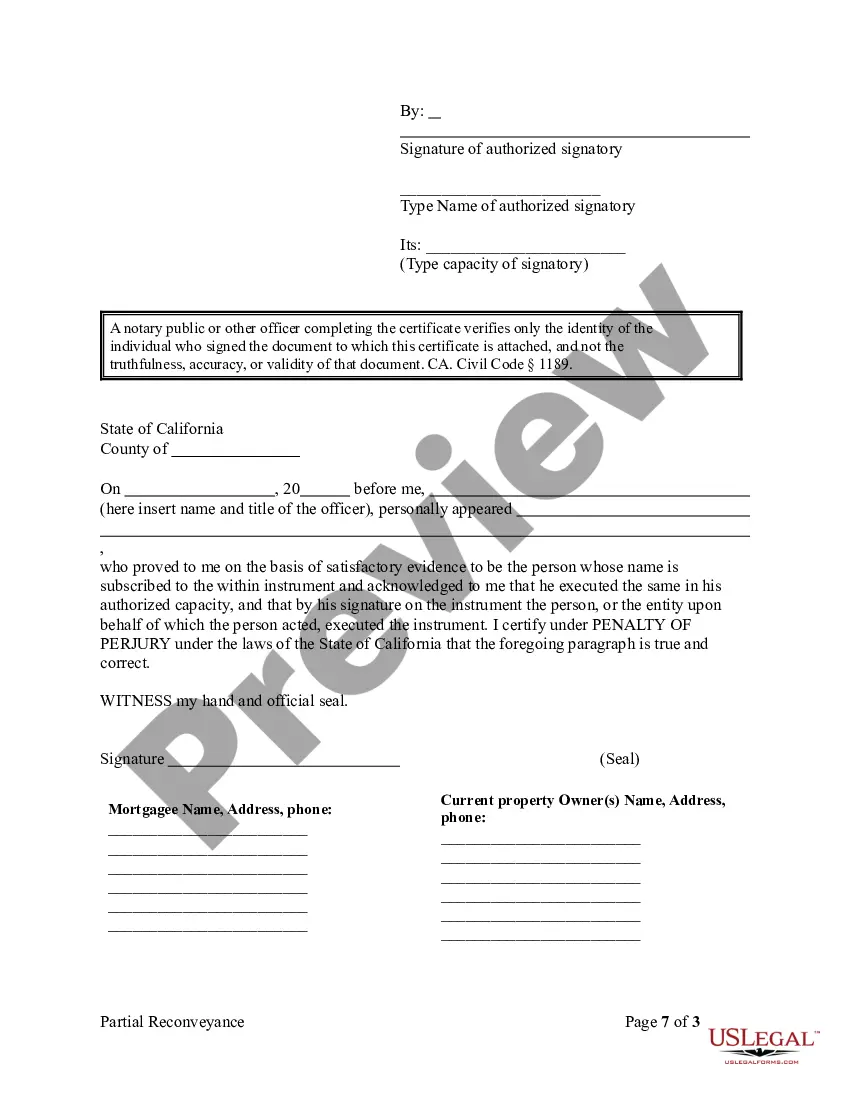

Filling out a California grant deed involves several steps. First, ensure you have the necessary information, like the parties’ names and the property description. You can leverage the California Partial Release of Property From Deed of Trust for Corporation to understand what details need to be included for corporate properties. After you fill out the deed, don’t forget to notarize it and file it with your county's recorder's office.

Yes, you can remove someone's name from a property deed. This process generally involves drafting and signing a quitclaim deed or grant deed. Using the California Partial Release of Property From Deed of Trust for Corporation can also simplify this process, especially for corporations. It is wise to consult with a legal expert to ensure the removal aligns with California laws.

A partial release is often included in situations where a corporation needs to sell or refinance part of a property while retaining the overall ownership structure. Common scenarios might involve development projects or sales of interest in a commercial property. This allows companies to strategically manage real estate assets while dealing with financial obligations. Exploring the California Partial Release of Property From Deed of Trust for Corporation can help streamline this process.

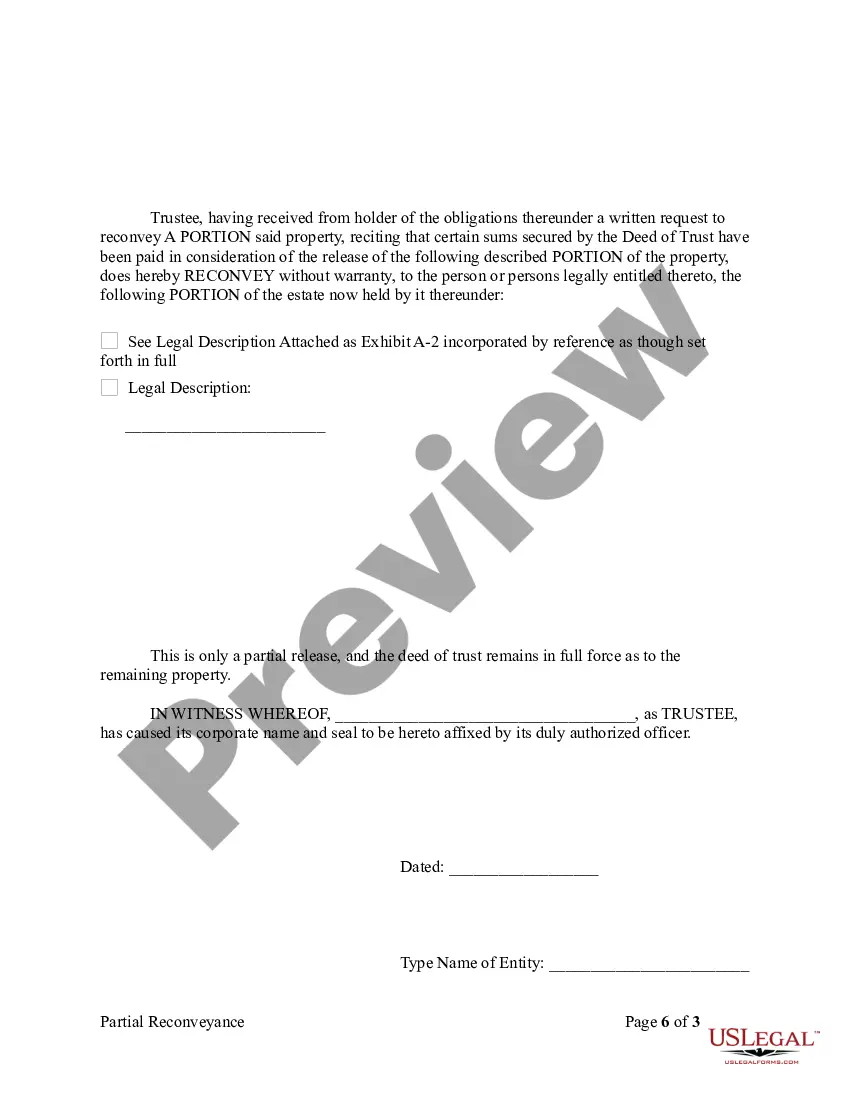

Partial reconveyance occurs when a lender releases a portion of the property from the deed of trust while retaining rights to the remaining part. This process is common in California and allows for greater flexibility in property management for corporate entities. It empowers corporations to reassign portions of their real estate holdings without complete liquidation. Utilizing partial reconveyances can improve financial maneuverability.

A partial deed release is a document that removes a portion of property from the lien of a deed of trust, allowing the owner to sell or refinance that specific section. This process is especially beneficial for corporations that might want to liquidate certain assets without disturbing the entire property. By leveraging the California Partial Release of Property From Deed of Trust for Corporation, businesses can optimize their asset management strategies. Proper documentation and recording are keys to ensuring valid partial releases.

A partial release allows specific assets or portions of a property to be freed from the deed of trust, while a full release discharges all claims and obligations related to the property. Corporations often choose partial releases to manage real estate more flexibly, strategically keeping some obligations while clearing others. This distinction can significantly impact financial planning and ownership structures. It's vital to assess the implications of each type for effective property management.