This form is a Grant Deed where the grantor is a living trust and the grantee is a living trust.

California Grant Deed - Living Trust to Living Trust

Description Grant Trust Form

How to fill out Deed Of Trust Vs Grant Deed?

Among a variety of complimentary and premium templates available online, you cannot be assured of their precision and trustworthiness.

For instance, who created them or if they possess adequate qualifications to address your requirements.

Stay calm and utilize US Legal Forms! Uncover California Grant Deed - Living Trust to Living Trust examples formulated by skilled attorneys and avoid the expensive and tedious process of searching for a lawyer and subsequently compensating them to draft a document for you that you can readily find on your own.

Select a pricing plan, sign up for an account, complete the payment for the subscription with your credit/debit card or PayPal, and download the document in the desired format. After registering and purchasing your subscription, you can use your California Grant Deed - Living Trust to Living Trust as many times as you wish or as long as it remains active in your state. Modify it with your preferred editor, fill it out, sign it, and print it. Accomplish more for less with US Legal Forms!

- If you have a membership, Log In to your account and locate the Download button adjacent to the form you need.

- You will also have access to your previously acquired templates in the My documents section.

- If you are utilizing our website for the first time, adhere to the instructions below to acquire your California Grant Deed - Living Trust to Living Trust promptly.

- Ensure that the document you find is valid in the state where you reside.

- Examine the template by reviewing the description using the Preview feature.

- Hit Buy Now to commence the purchasing process or search for another sample using the Search box located in the header.

Grant Deed Example Form popularity

Ca Living Trust Other Form Names

California Grant Deed Example FAQ

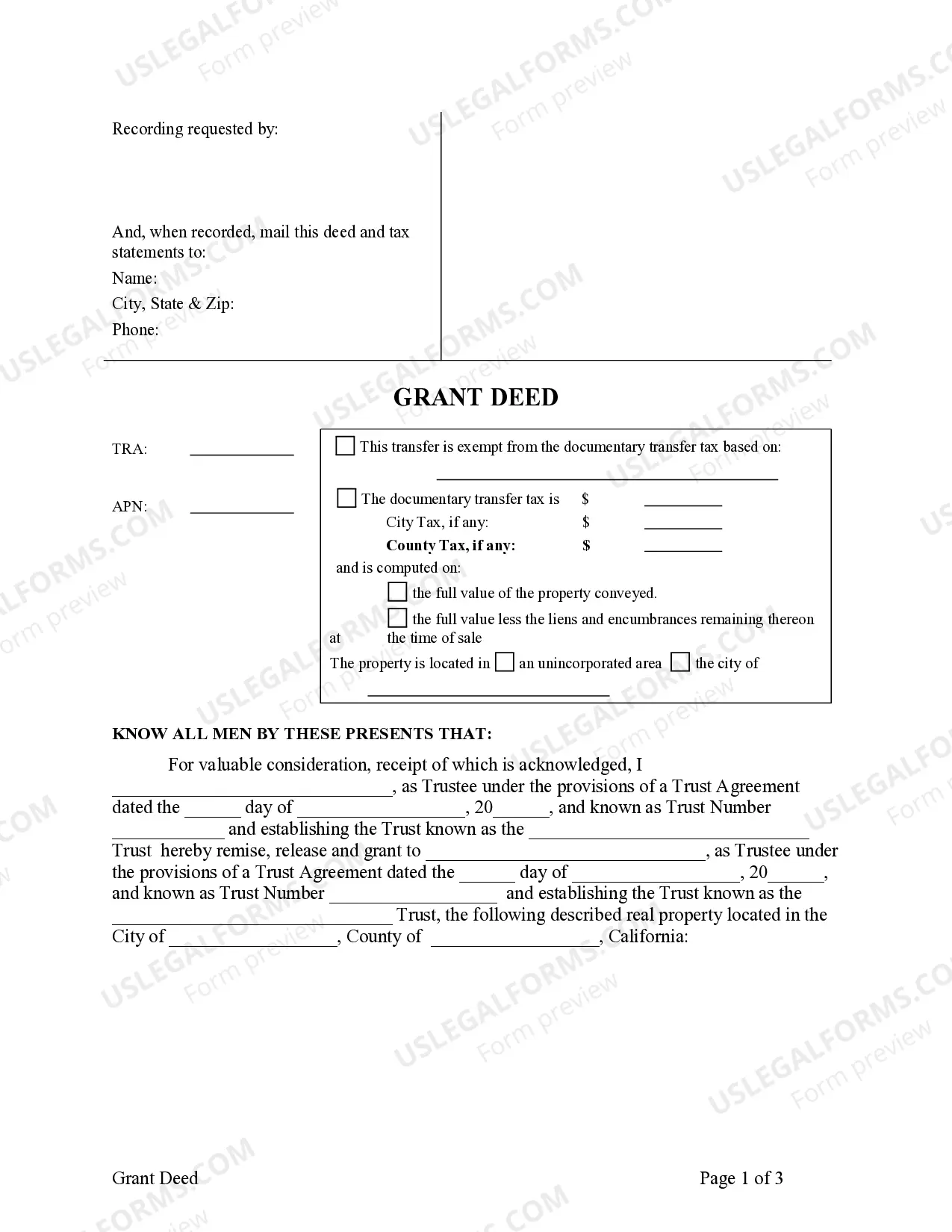

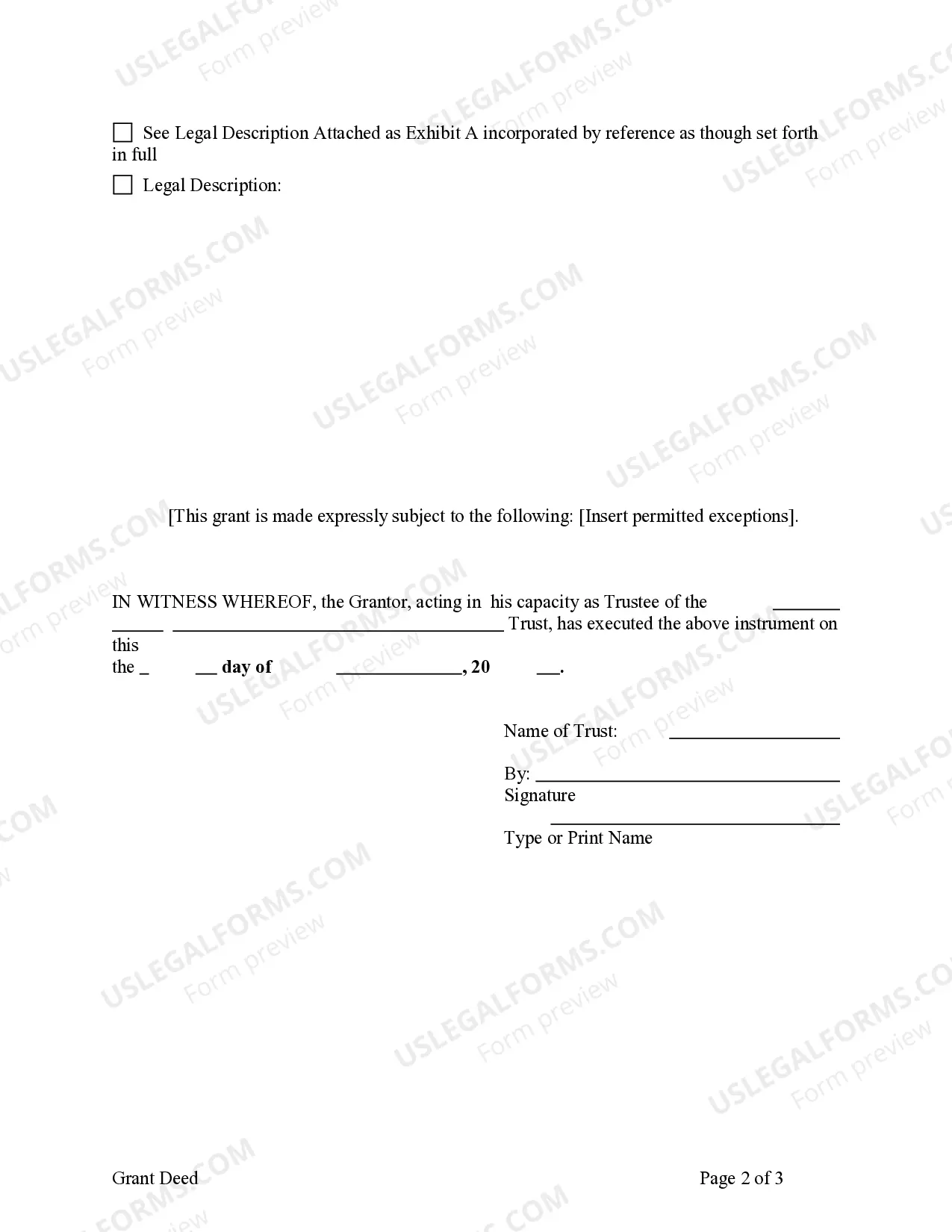

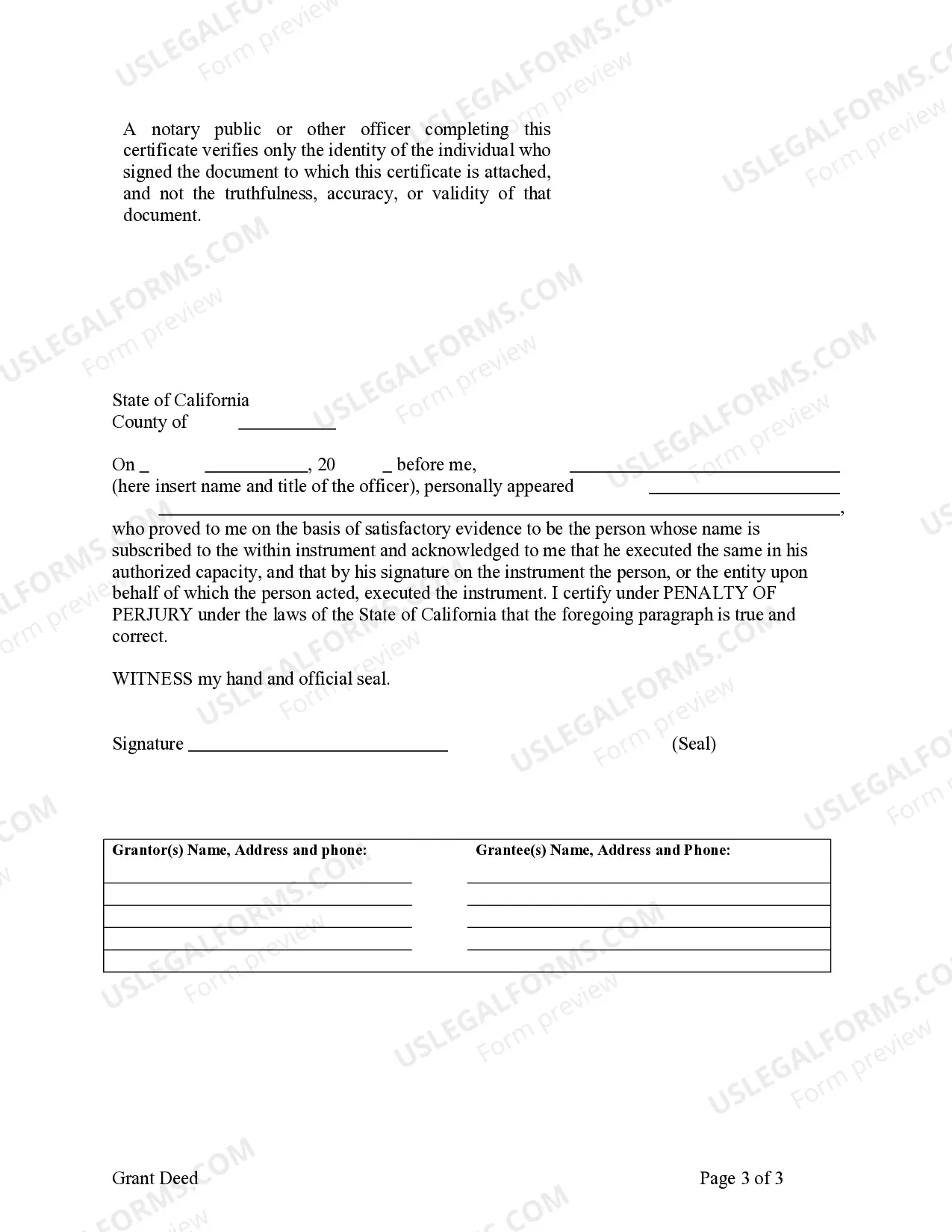

In California, the grant deed must be signed by the grantor, who is the current owner of the property. If the property is part of a living trust, the trustee typically signs on behalf of the trust. This ensures that the California Grant Deed - Living Trust to Living Trust reflects the correct legal ownership, protecting all parties involved.

To fill out a grant deed in California, you should start by accurately entering the names of the grantor and the grantee. Include a detailed property description to prevent confusion in the future. If you are completing a California Grant Deed - Living Trust to Living Trust, make sure to state the trust's name clearly to ensure that the transfer of ownership is valid and recognized.

Yes, in California, recording a grant deed is essential to provide public notice of the property transfer. This recording protects the rights of the grantee and helps prevent future disputes over property ownership. For a California Grant Deed - Living Trust to Living Trust, this step is particularly crucial as it highlights the legal transfer of assets within the trust framework.

Filling out a California grant deed requires accurate information about the property and the parties involved. Begin with the grantor's full name, followed by the grantee's details. Be sure to include a clear property description, as this is essential for a California Grant Deed - Living Trust to Living Trust to avoid any disputes in the future.

Transferring property to a living trust in California involves executing a grant deed that clearly identifies the trust as the new owner. You'll need to fill out the grant deed correctly and ensure it's recorded with the local county recorder's office. Utilizing a California Grant Deed - Living Trust to Living Trust can streamline this process, making your intentions clear and legally binding.

A grant deed is valid in California when it meets specific legal requirements. It must include the grantor's signature, a description of the property, and the names of both the grantor and grantee. Importantly, a California Grant Deed - Living Trust to Living Trust also requires that the deed be notarized to ensure the grantor's intent is legitimate.

Making a living trust without a lawyer in California is possible, and you can utilize online services to help you. By creating a California Grant Deed - Living Trust to Living Trust, you can designate how your assets will be managed and distributed. Select trustworthy online platforms that offer templates and tools for DIY estate planning. With proper guidance, you can successfully establish your living trust and ensure your wishes are honored.

Yes, you can create a living trust by yourself in California. To establish a California Grant Deed - Living Trust to Living Trust, you need to gather relevant information about your assets and beneficiaries. You can find templates and resources online, which guide you through the process. However, consider consulting an expert if your situation is complex.

To petition for a modification of a trust in California, you will typically need to file a petition with the court, detailing your reasons for the modification. While a judge may grant your petition based on valid reasons such as changes in circumstances, involving legal expertise is often beneficial. If you are considering modifications related to a California Grant Deed - Living Trust to Living Trust, using USLegalForms can provide essential guidance throughout this legal process.

Transferring property from one trust to another in California involves executing a new grant deed that reflects the change in ownership. You'll want to ensure that the trust being transferred to is properly established and recognized under state law. When it comes to a California Grant Deed - Living Trust to Living Trust, it's crucial to maintain accurate documentation throughout this process. USLegalForms can provide templates to facilitate these transfers.