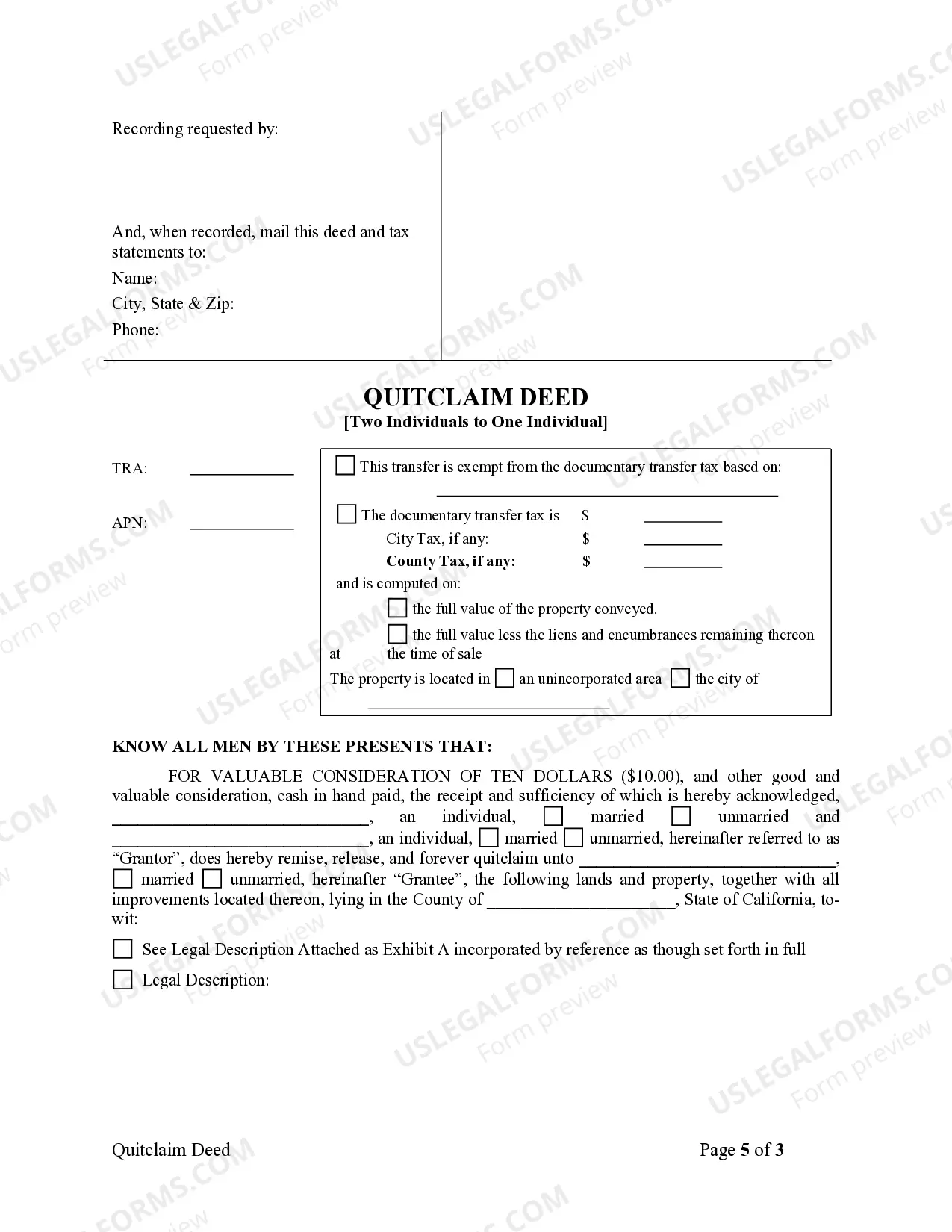

This form is a Quitclaim Deed where the grantors are two individuals and the grantee is one individual.

California Quitclaim Deed from two Individuals to One Individual

Description

How to fill out California Quitclaim Deed From Two Individuals To One Individual?

Among numerous paid and complimentary templates available online, it's difficult to ascertain their precision and dependability.

For instance, it's unclear who authored them or if they possess the expertise to manage what you require these for.

Stay composed and utilize US Legal Forms!

Review the document by reading the description using the Preview function. Click Buy Now to initiate the ordering process or search for another template using the Search field located in the header. Choose a pricing plan, register for an account, and complete the payment with your credit/debit card or PayPal. Download the form in the desired file format. Once you've registered and paid for your subscription, you may use your California Quitclaim Deed from two Individuals to One Individual as many times as necessary or for as long as it remains active in your state. Edit it with your preferred online or offline editor, fill it out, sign it, and create a hard copy. Achieve more for less with US Legal Forms!

- Obtain California Quitclaim Deed forms from two Individuals to One Individual created by experienced attorneys.

- Steer clear of the expensive and time-consuming task of searching for a lawyer and then compensating them to draft a document for you that you can readily find yourself.

- If you hold a subscription, Log In to your account and locate the Download button next to the document you're searching for.

- You will also have access to all previously obtained templates in the My documents section.

- If you are using our website for the first time, adhere to the instructions below to quickly acquire your California Quitclaim Deed from two Individuals to One Individual.

- Ensure that the document you find is legitimate in your state.

Form popularity

FAQ

Many people consider the California Quitclaim Deed from two Individuals to One Individual risky because it provides no warranty of title. Essentially, this means that the new owner inherits the property with all existing issues. If prior claims or liens exist, the new owner may have to deal with those problems. It's essential to understand these risks, which is why platforms like US Legal Forms can offer insights and guidance when using a quitclaim deed.

If you're on the deed but not the mortgage, you own the property but may not be responsible for mortgage payments. However, the lender may still have a claim to the property if the mortgage defaults. With a California Quitclaim Deed from two Individuals to One Individual, it's crucial to understand how these distinctions affect ownership and liabilities. Consulting a legal professional can provide clarity on your specific circumstances.

When two people are listed on a deed, it is typically referred to as joint ownership. This could involve a California Quitclaim Deed from two Individuals to One Individual, where two individuals share ownership. This type of arrangement ensures that both parties have a legal claim to the property. It is essential to clarify the type of joint ownership, as it affects how the property is managed and transferred in the future.

If your name appears on a deed, you hold ownership rights to the property associated with that deed, including a California Quitclaim Deed from two Individuals to One Individual. This means you can sell, transfer, or use the property as collateral. Additionally, you share responsibilities with co-owners for property taxes, maintenance, and other obligations. Understanding these rights can help you fully leverage your ownership.

Yes, adding someone to a deed can impact taxes related to property ownership. Generally, when you transfer ownership through a California Quitclaim Deed from two Individuals to One Individual, it may trigger reassessment of property taxes. This means that the county may reassess the property's value, resulting in a potential increase in property taxes. It's wise to consult a tax professional to understand the specific implications for your situation.

Yes, you can add someone to your house deed in California by using a California Quitclaim Deed from two Individuals to One Individual. This type of deed allows you to transfer interest in the property to another person legally. Be sure to follow the necessary procedures, like notarizing the document and recording it with the county, to complete the process.

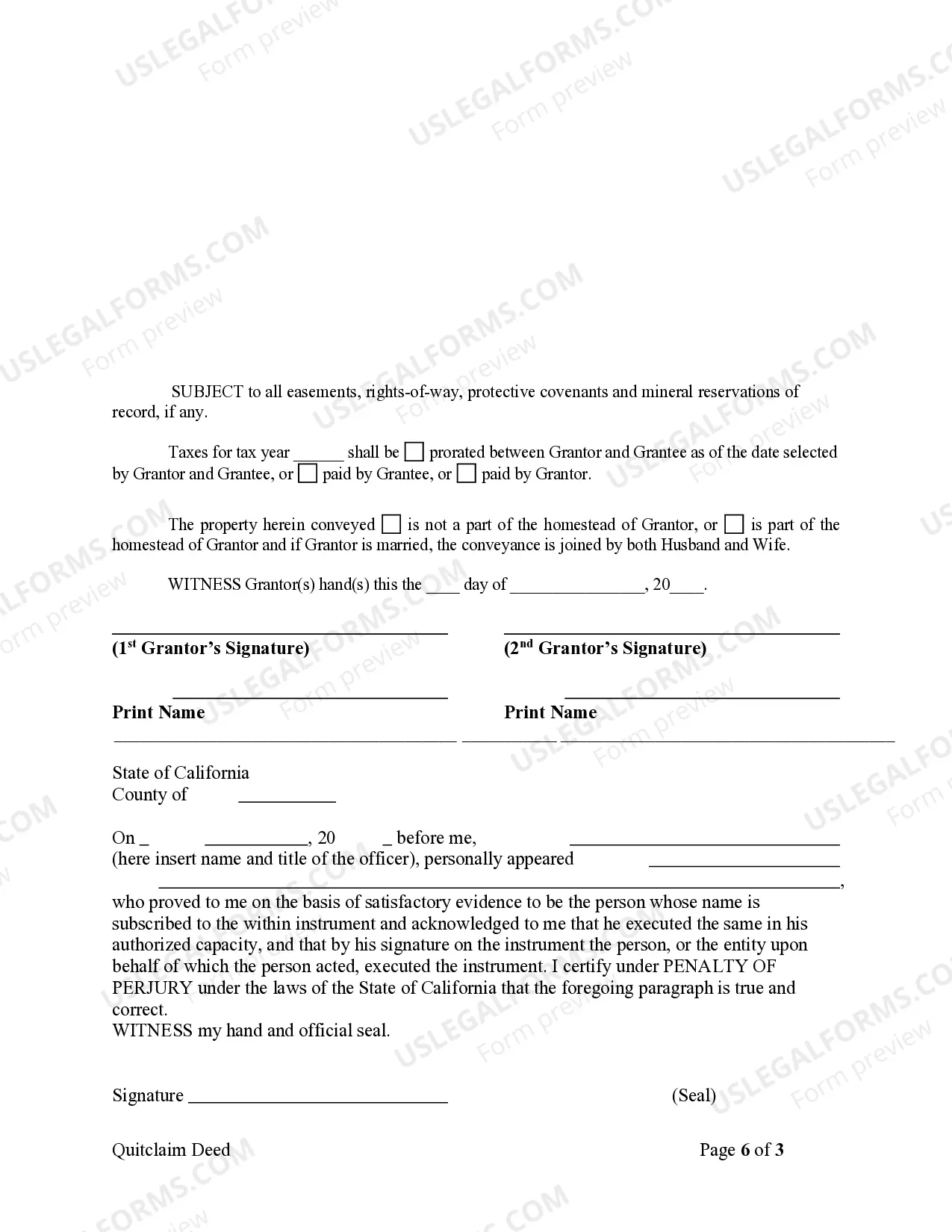

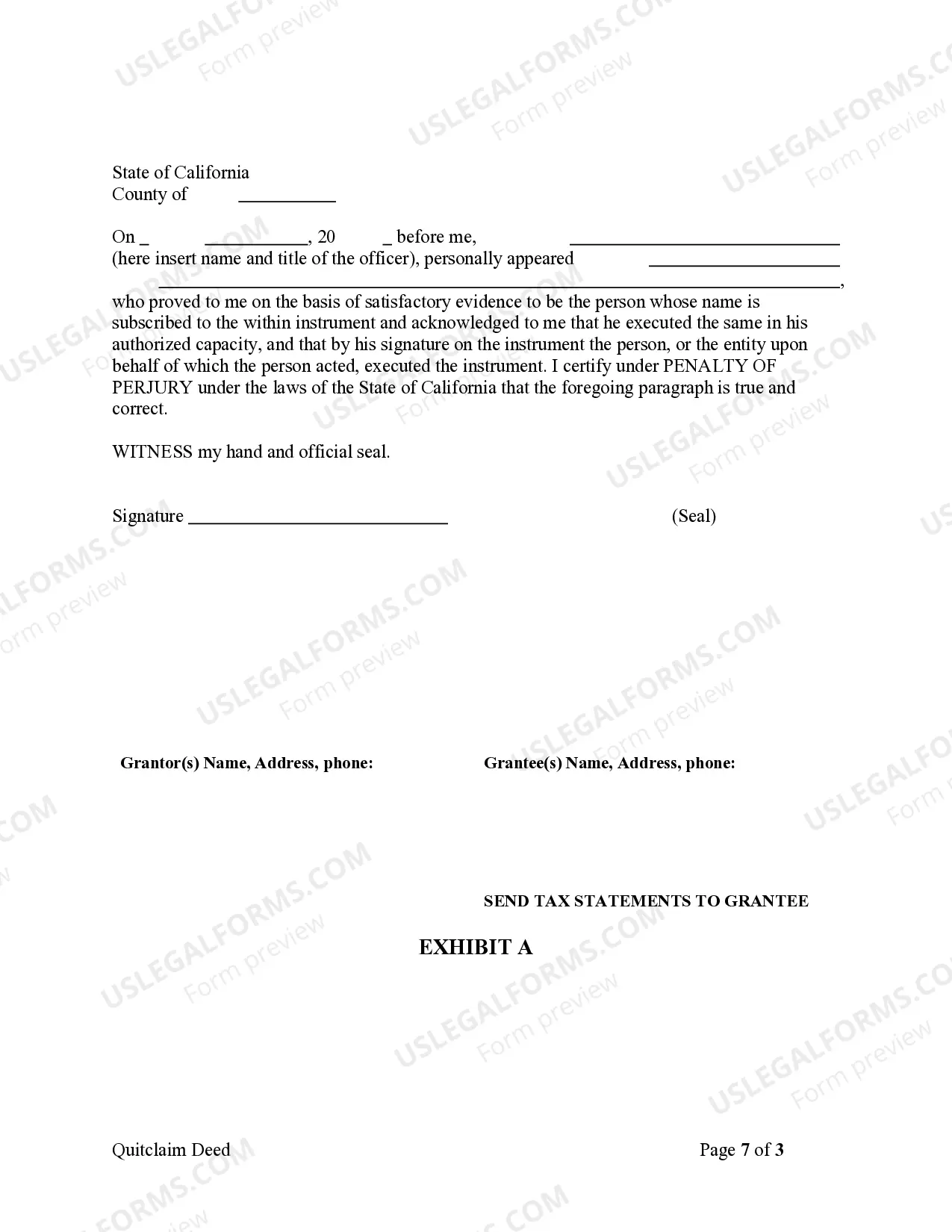

Filling out a quit claim deed correctly is essential for a smooth transfer of property ownership. You should start by including the names of the grantors and grantees, along with the property description and any relevant legal details. It is advisable to use a comprehensive resource like UsLegalForms to guide you through each step and ensure that your California Quitclaim Deed from two Individuals to One Individual meets all requirements for your area.

To add an owner to a deed, you would create a California Quitclaim Deed from two Individuals to One Individual. This deed outlines the property details and names the current owners as well as the new owner. It's crucial to ensure the deed is accurately filled out and signed by all parties involved, after which it should be recorded with the local county recorder's office to formalize the ownership transfer.

Adding someone to a deed in California can have various tax implications, which generally depend on the relationship between the parties involved. If the individuals are family members, there may be exemptions from certain taxes. However, it’s essential to review your specific case or consult a tax professional to understand how a California Quitclaim Deed from two Individuals to One Individual might impact property taxes and potential reassessment.

To add a person to a deed in California, you typically need to create a new California Quitclaim Deed from two Individuals to One Individual. This process involves completing the deed form with the appropriate information about the new owner and the property. Once completed, you must have it signed by the current owners and notarized, then record it with the county recorder's office to make the change official.