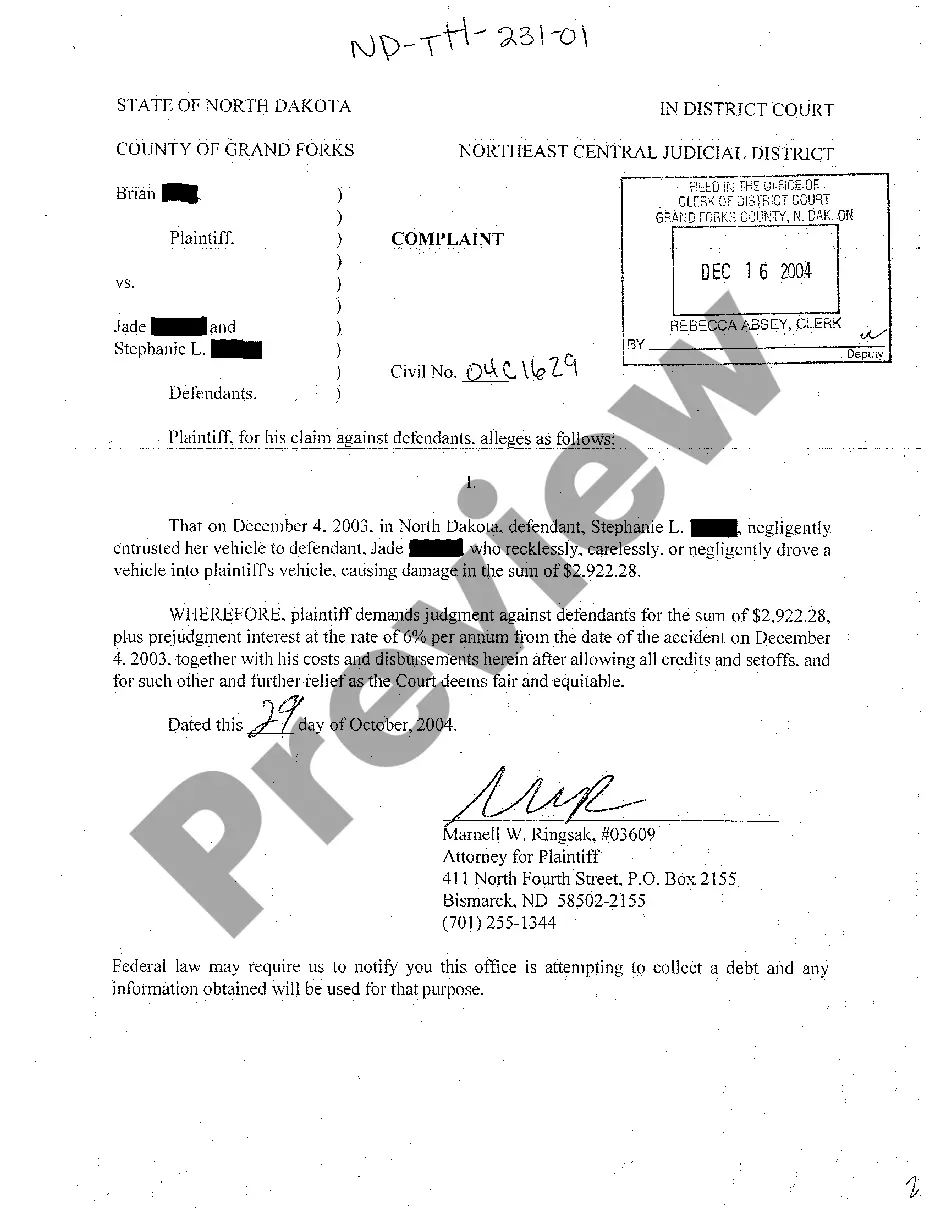

The California Notice Of Levy (Enforcement Of Judgment) is a legal document used by the court to collect a judgment obtained against a debtor. It is an order from the court to a third party, such as an employer or bank, to pay all or a portion of the debtor's wages or bank accounts to the court or creditor. The Notice Of Levy is served on the third party, who is then responsible for paying the funds to the court or creditor. There are two types of California Notice Of Levy (Enforcement Of Judgment): Wage Garnishment and Bank Levy. Wage Garnishment requires an employer to withhold and pay a portion of the debtor's wages to the court or creditor. Bank Levy requires a financial institution to pay the court or creditor a portion of the debtors funds up to the full amount of the debt.

California Notice Of Levy (Enforcement Of Judgment)

Description

How to fill out California Notice Of Levy (Enforcement Of Judgment)?

Compiling official documents can be quite a challenge if you lack accessible fillable templates. With the US Legal Forms online repository of formal paperwork, you can trust the entries you locate, as all of them align with federal and state laws and are verified by our professionals.

Acquiring your California Notice Of Levy (Enforcement Of Judgment) from our platform is as effortless as pie. Previously registered users with an active subscription simply need to sign in and click the Download button after locating the correct template. Subsequently, if necessary, users can retrieve the same document from the My documents section of their profile. However, even if you are a newcomer to our platform, signing up for a valid subscription will only take a few moments. Here’s a quick guide for you.

Haven’t you explored US Legal Forms yet? Enroll in our service today to obtain any official document rapidly and effortlessly each time you require it, and maintain your paperwork in good order!

- Document compliance confirmation. You should carefully review the content of the form you wish to ensure it meets your needs and adheres to your state law stipulations. Previewing your document and checking its overall description will assist you in doing just that.

- Alternative search (optional). If there are any discrepancies, search the library using the Search tab at the top of the page until you find an appropriate template, and click Buy Now once you identify the one you require.

- Account setup and form acquisition. Create an account with US Legal Forms. After account verification, Log In and select your most fitting subscription plan. Complete the payment to continue (PayPal and credit card options are available).

- Template download and subsequent use. Choose the file format for your California Notice Of Levy (Enforcement Of Judgment) and click Download to save it on your device. Print it to complete your paperwork manually, or utilize a feature-rich online editor to prepare an electronic version more swiftly and effectively.

Form popularity

FAQ

You should file the EJ-130 form when you want to levy on a debtor's wages or bank accounts after obtaining a judgment. Ideally, this should happen soon after your judgment is secured, maximizing your chances of collection. Timely action in relation to your California Notice Of Levy (Enforcement Of Judgment) can significantly affect your recovery efforts.

Enforcing a judgment in California involves a series of steps, from securing a writ of execution to potentially placing a levy on the debtor's property. You can initiate this process by filing necessary documents, like the EJ-130 form, with the court. Remember, utilizing the California Notice Of Levy (Enforcement Of Judgment) helps you understand the enforcement avenues available to ensure you collect what is rightfully yours.

To file a judgment lien in California, you must first obtain a certified copy of your judgment. Then, you will need to complete the required forms and file them with the county recorder's office where the debtor's property is located. Filing this lien is critical in leveraging a California Notice Of Levy (Enforcement Of Judgment), as it secures your claim against the debtor's property.

A writ of execution in California allows a winning party to collect on a judgment without requiring additional court action. This legal order enables the sheriff to seize assets or wages to satisfy a debt. Utilizing a California Notice Of Levy (Enforcement Of Judgment) can enhance your ability to successfully execute a writ and recover the funds you're owed.

In California, you typically have 90 days to file a writ of mandate after the event you wish to challenge occurs. This deadline is crucial, especially if you pursue actions related to a California Notice Of Levy (Enforcement Of Judgment). Make sure you gather all necessary documents and prepare your case in a timely manner to avoid missing this window.

To find out if there is a judgment against you in California, you can search the public court records through online databases or contact your local courthouse directly. Additionally, credit reports may provide information regarding any outstanding judgments. It’s essential to stay informed about your financial standing to take appropriate actions. For more detailed guidance, US Legal Forms is an excellent resource to navigate judgment inquiries.

A California Notice Of Levy (Enforcement Of Judgment) is a legal tool that allows a creditor to seize your property or wages to satisfy an unpaid judgment. This notice is typically issued after a court judgment has been rendered, allowing the creditor to enforce their rights. Understanding this process is crucial for anyone facing a levy, as it can lead to significant financial consequences. US Legal Forms offers solutions and information on how to effectively deal with such notices.

In California, a judgment can generally be enforced for a period of 10 years from the date it was entered. After this period, you may need to renew the judgment to continue enforcement. This timeline emphasizes the importance of acting promptly, especially in response to a California Notice Of Levy (Enforcement Of Judgment). Consider utilizing services from US Legal Forms to learn more about judgment renewals and enforcement options.

A notice of levy from the Employment Development Department (EDD) is a legal document issued in California that allows the state to collect unpaid debts related to employment taxes. This notice specifies the amount owed and the assets subject to seizure. It is crucial to take this notice seriously and act quickly to address the debt. You may want to consult US Legal Forms for resources that can help you understand your rights and obligations.

To respond to a California Notice Of Levy (Enforcement Of Judgment), review the document carefully to understand the details. Take immediate action by considering whether you wish to contest the levy or comply. You can file a claim of exemption if you believe the property should not be subject to levy. For further assistance, platforms like US Legal Forms can provide you with necessary forms and guidance.