California Attachment To Schedule Of Property (For Principal Residence Only)

Description

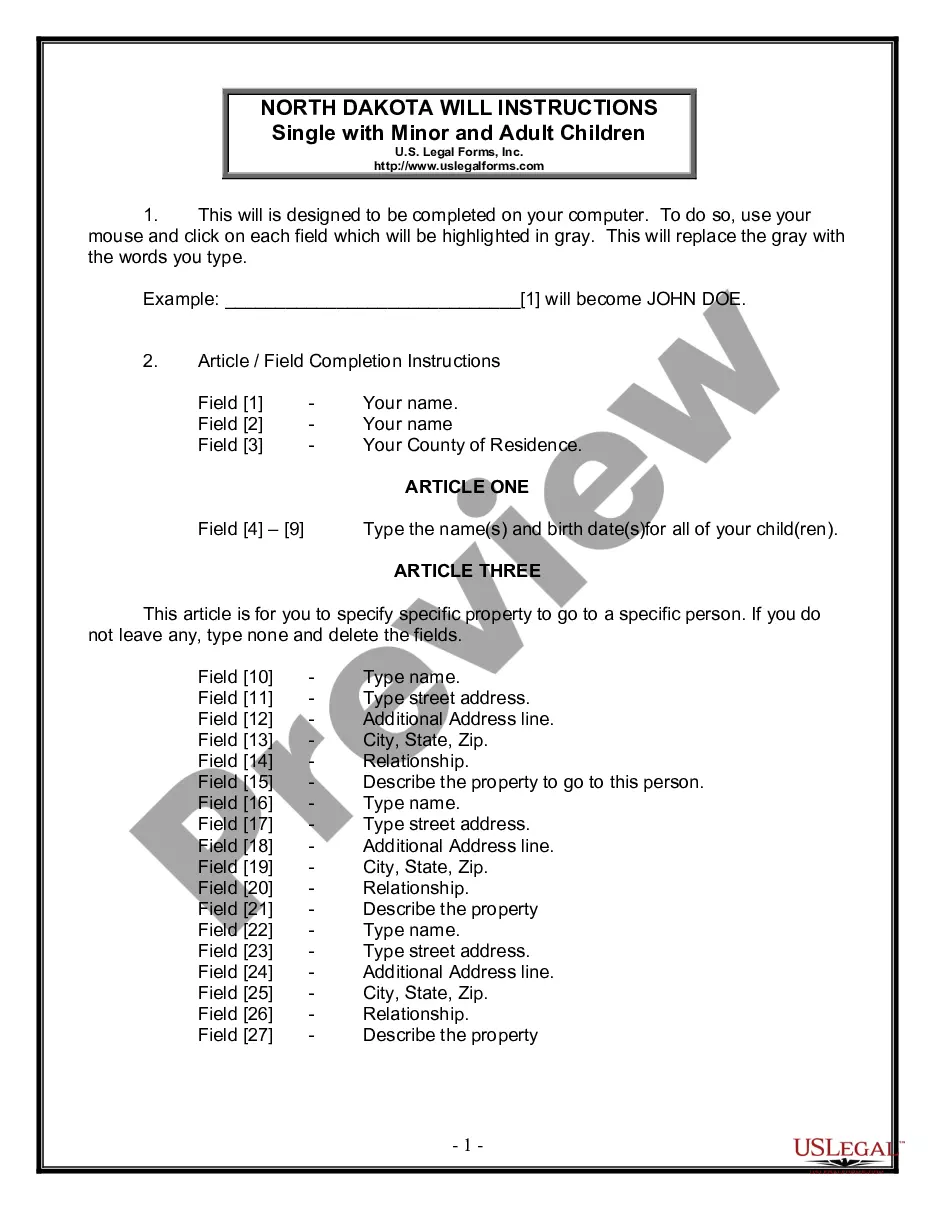

How to fill out California Attachment To Schedule Of Property (For Principal Residence Only)?

What is the usual duration and effort you devote to creating formal documents.

There’s a superior alternative to obtaining such forms rather than engaging legal experts or wasting hours searching the internet for an appropriate template. US Legal Forms is the premier online repository that provides expertly drafted and verified state-specific legal documents for any reason, such as the California Attachment To Schedule Of Property (For Principal Residence Only).

Another advantage of our library is that you can retrieve previously downloaded documents that you securely maintain in your profile under the My documents tab. Access them anytime and revise your paperwork as often as you need.

Conserve time and energy preparing official documents with US Legal Forms, one of the most reliable web solutions. Join us today!

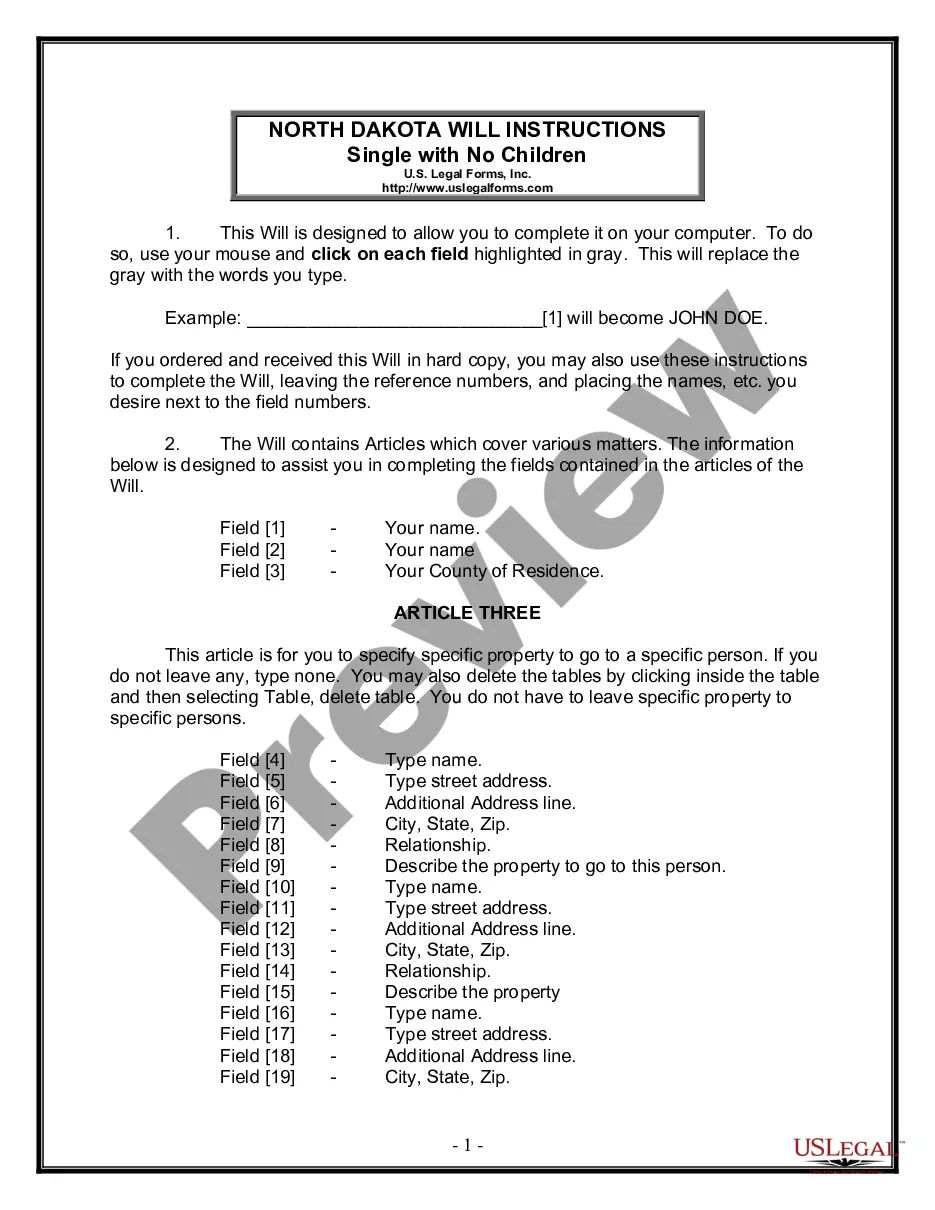

- Review the form content to ensure it meets your state’s standards. For this, examine the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, seek a different one using the search feature at the top of the webpage.

- If you currently have an account with us, Log In/">Log In and download the California Attachment To Schedule Of Property (For Principal Residence Only). If not, proceed to the subsequent steps.

- Click Buy now once you locate the appropriate blank. Select the subscription plan that best fits your needs to gain access to the entire array of our library's offerings.

- Create an account and pay for your subscription. You can complete a transaction using your credit card or PayPal - our service is entirely trustworthy in this regard.

- Download your California Attachment To Schedule Of Property (For Principal Residence Only) onto your device and complete it on a printed hard copy or digitally.

Form popularity

FAQ

California Schedule R is required for claiming the Property Tax Postponement Program. If you are seeking to delay property tax payments due to financial hardship, you must include this schedule. It can be beneficial to complete your California Attachment To Schedule Of Property (For Principal Residence Only) as well, ensuring you fully understand the options available for relief.

The principal residence exemption in California allows homeowners to avoid a portion of property taxes on their primary residence. This exemption helps reduce the overall financial burden of property ownership. By filling out the California Attachment To Schedule Of Property (For Principal Residence Only), you can apply this exemption to ensure you are benefiting from all available tax relief.

Schedule 540 is the California personal income tax form used to report income, deductions, and credits. This form helps residents calculate their tax liabilities accurately, including any property-related taxes. When you complete your California Attachment To Schedule Of Property (For Principal Residence Only), it is vital to ensure that you have the correct information to complete Schedule 540 effectively.

The $7,000 property tax exemption in California reduces the taxable value of eligible properties, effectively lowering property taxes for homeowners. This exemption applies primarily to principal residences, making it essential for homeowners to explore this benefit. To take full advantage of this, include it in your California Attachment To Schedule Of Property (For Principal Residence Only).

California Form 593 is used for reporting real estate withholding. If you sell property in California, this form helps you report the amount withheld from the sale to cover tax liabilities. It is crucial to include this form when you fill out your California Attachment To Schedule Of Property (For Principal Residence Only) to ensure compliance and avoid penalties.

You must file Schedule R if you meet the eligibility criteria related to age, income, or disability. This includes individuals aged 65 or older or those caring for someone who fits these categories. If you're utilizing the California Attachment To Schedule Of Property (For Principal Residence Only), filing Schedule R may lower your tax bills and ensure you take advantage of potential deductions.

Schedule R is designed for senior citizens and individuals who are disabled or providing care for someone disabled. To qualify, you must meet certain age and income requirements outlined by California tax regulations. Including the California Attachment To Schedule Of Property (For Principal Residence Only) may help you in maximizing benefits that come with this schedule and ensure you comply with tax guidelines.

If you are a California resident filing your income tax return, you typically need to attach Schedule CA 540. This schedule helps you adjust your income to reflect it correctly for California tax purposes. Additionally, if you have deductions or credits like those covered by the California Attachment To Schedule Of Property (For Principal Residence Only), including Schedule CA 540 will ensure you receive the benefits you deserve.

In California, anyone who earns income above a certain threshold must file a state tax return. This applies to residents, part-year residents, and even non-residents with California source income. To determine whether you need to file, consider your total income, filing status, and age. Utilizing the California Attachment To Schedule Of Property (For Principal Residence Only) may help clarify your tax obligations.

California withholding applies to various transactions, mainly involving the sale of real estate, when the seller is either a non-resident or an entity. This includes individuals and businesses that may have property sales in California. Knowing how to navigate these requirements, including the California Attachment To Schedule Of Property (For Principal Residence Only), will help ensure compliance during your property transactions.