California Chapter 13 Plan

Description

How to fill out California Chapter 13 Plan?

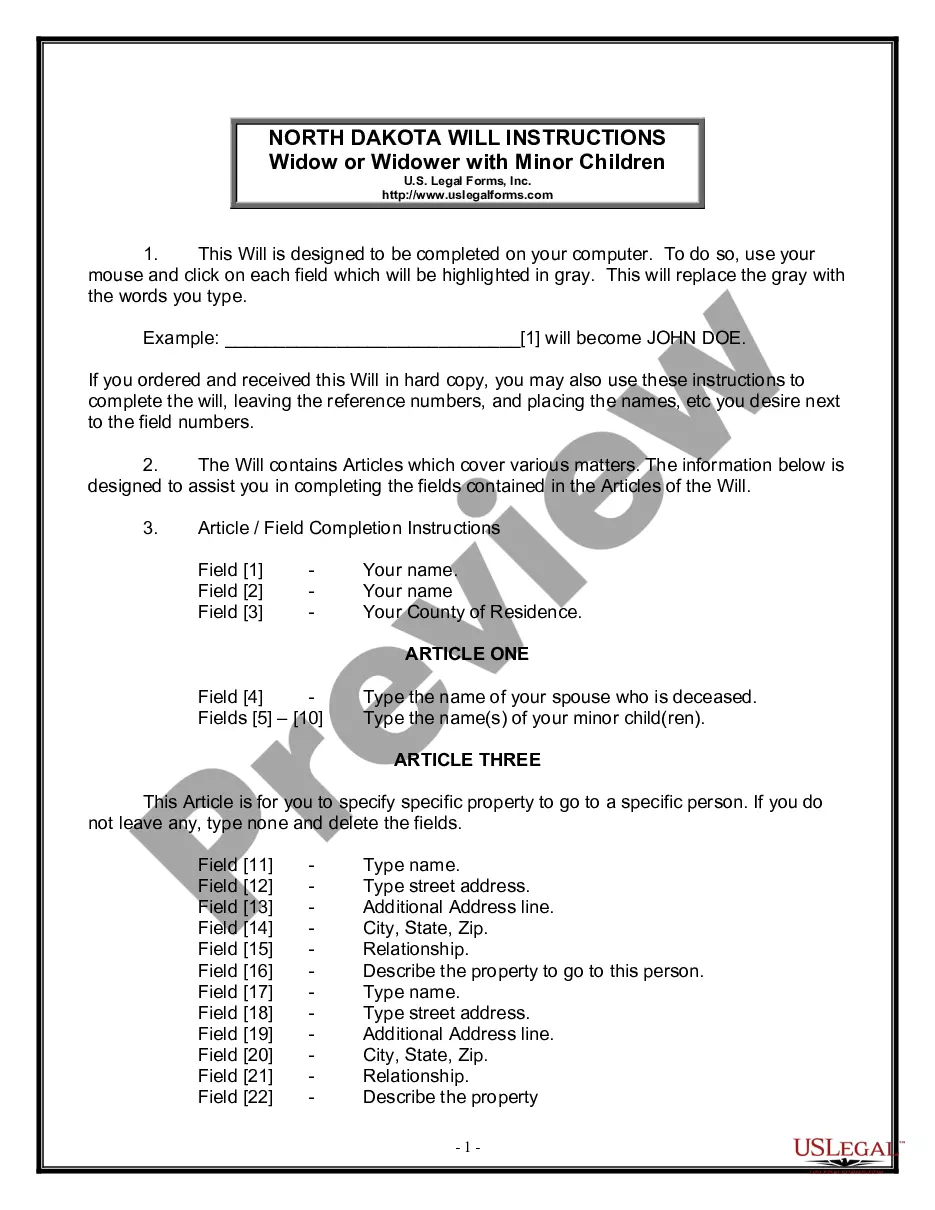

Managing official documentation demands focus, accuracy, and utilizing well-crafted templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your California Chapter 13 Plan template from our collection, you can be confident it adheres to federal and state regulations.

Utilizing our service is simple and efficient. To access the necessary documents, all you need is an account with an active subscription. Here’s a quick guide for you to acquire your California Chapter 13 Plan in minutes.

All documents are designed for versatile use, like the California Chapter 13 Plan you see on this page. If you require them later, you can complete them without additional payment - simply navigate to the My documents tab in your profile and finalize your document whenever needed. Experience US Legal Forms and prepare your business and personal documents swiftly and in full legal compliance!

- Ensure to thoroughly review the form contents and its alignment with general and legal standards by previewing it or reading its summary.

- Seek another official template if the one you opened is not suitable for your circumstances or state laws (the tab for that is at the top page corner).

- Log In/">Log In to your account and download the California Chapter 13 Plan in your preferred format. If this is your first time using our service, click Buy now to proceed.

- Create an account, select your subscription option, and pay using your credit card or PayPal account.

- Choose the format in which you want to save your form and click Download. Print the document or import it into a professional PDF editor for electronic preparation.

Form popularity

FAQ

A Chapter 13 case can be dismissed for various reasons, including failure to make timely payments to creditors. Additionally, not submitting necessary documents or not meeting the repayment plan requirements can lead to dismissal. It's crucial to stay updated with all court requests and comply with scheduling deadlines to avoid complications. Utilizing platforms like US Legal Forms can provide resources and guidance to help you navigate this process successfully.

Several factors can make you ineligible for a California Chapter 13 Plan. If your income is too high and does not meet the requirement for a repayment plan, you may not qualify. Furthermore, ongoing obligations like child support or alimony that are not addressed properly might prevent you from meeting eligibility criteria. Consulting with a legal expert can help clarify your specific circumstances.

Yes, some individuals do not qualify for a California Chapter 13 Plan. Primarily, if your secured and unsecured debts exceed certain limits set by the law, you may be ineligible. Additionally, if you have filed for bankruptcy multiple times in a short period, this could impact your ability to qualify. It's essential to assess your financial situation carefully to determine your eligibility.

In California, you can file for Chapter 13 if your unsecured debts are less than $465,275 and secured debts are under $1,395,875. These limits may change over time, so it's wise to check current figures before proceeding. A structured California Chapter 13 Plan allows you to reorganize your debts and establish a manageable repayment schedule. For exact figures tailored to your circumstances, consider consulting with a financial advisor or using resources like US Legal Forms for assistance.

To initiate your California Chapter 13 Plan, you first need to gather your financial documents, including your income statements and debt records. After that, you should complete the required Chapter 13 bankruptcy forms. It’s advisable to consult a legal expert or utilize a platform like US Legal Forms to ensure you fill out everything correctly. Once your paperwork is ready, file it with your local bankruptcy court and schedule a meeting with your creditors.

year plan under California Chapter 13 typically requires you to repay a portion of your debt over 36 months. This plan can be based on your disposable income and is designed to allow debtors to maintain their assets. It is crucial to keep up with your payments, as completion can lead to a significant reduction in overall debt. Consider using platforms like uslegalforms to guide you through the process.

After a California Chapter 13 plan is confirmed, you begin making consistent payments as directed by the order. The bankruptcy trustee oversees the distribution of these payments to your creditors. You must also complete any required financial education courses. Maintaining compliance is essential for achieving the ultimate goal of debt discharge.

In California, Chapter 13 allows individuals to reorganize their debts while maintaining their assets. You propose a repayment plan based on your income and expenses, which the court must approve. Once confirmed, you make monthly payments to a bankruptcy trustee who distributes these funds to your creditors. This process not only provides relief but can also prevent foreclosure on your home.

After your confirmation hearing in a California Chapter 13 case, the bankruptcy court will issue an order confirming or denying your repayment plan. If confirmed, you start making payments according to the plan. You also receive information on how to handle your obligations during the repayment period. It's a vital moment that helps you focus on fulfilling your financial commitments.

Once your California Chapter 13 plan is confirmed, you must begin making payments as outlined in the plan. You will continue to make these payments for the duration of the plan, usually three to five years. During this time, the court monitors payments to ensure compliance. Successfully completing the plan can lead to debt discharge, providing a fresh financial start.