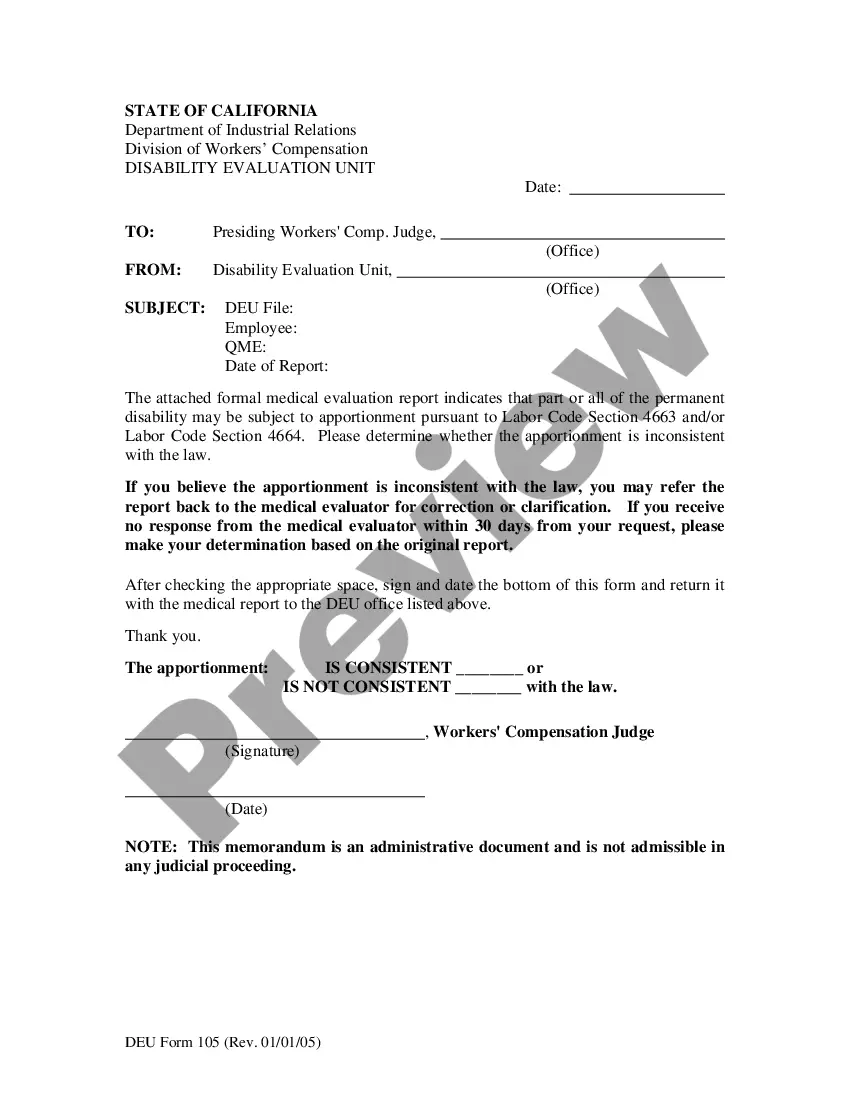

California Apportionment is the process of dividing the state of California into different political districts. This process is done in order to ensure that each district is represented fairly in the state government. In California, the apportionment process is completed every ten years based on updated census data. The California Constitution, and the federal Voting Rights Act, require the state to divide itself into districts that are equal in population, compact, and geographically contiguous. The California Apportionment process consists of two steps: the creation of a Citizens Redistricting Commission (CRC) and the creation of the new district maps. The CRC is a 14-member commission responsible for creating the new district maps. The commission is made up of five Democrats, five Republicans, and four members of neither party. The commission is responsible for creating district maps that adhere to the federal and state requirements, while also considering the communities of interest in the state. After the commission has created the new maps, they are submitted to the California State Legislature for approval. There are several types of California Apportionment, including Congressional Apportionment, which is the process of determining the number of congressional seats each state is allocated, State Senate Apportionment, which is the process of dividing the state into 40 Senate districts, and Assembly Apportionment, which is the process of dividing the state into 80 Assembly districts.

California Apportionment

Description

How to fill out California Apportionment?

Managing official paperwork demands focus, accuracy, and utilizing well-prepared templates.

US Legal Forms has been assisting individuals nationwide in doing precisely that for a quarter of a century, ensuring that when you select your California Apportionment template from our repository, it adheres to federal and state laws.

All the documents are created for versatile use, including the California Apportionment displayed on this page. If you require them again, you can complete them without additional payment - simply access the My documents tab in your profile and finalize your document as needed. Utilize US Legal Forms and complete your business and personal documentation swiftly and in full legal conformity!

- Ensure to diligently verify the content of the form and its alignment with general and legal standards by reviewing it or perusing its description.

- Seek an alternative formal template if the one you have opened does not fit your circumstances or state laws (the tab for that is located in the upper page corner).

- Log In to your account and save the California Apportionment in your preferred format. If it’s your initial experience with our service, click Buy now to proceed.

- Set up an account, select your subscription option, and pay using your credit card or PayPal account.

- Indicate the format in which you wish to receive your document and click Download.

Form popularity

FAQ

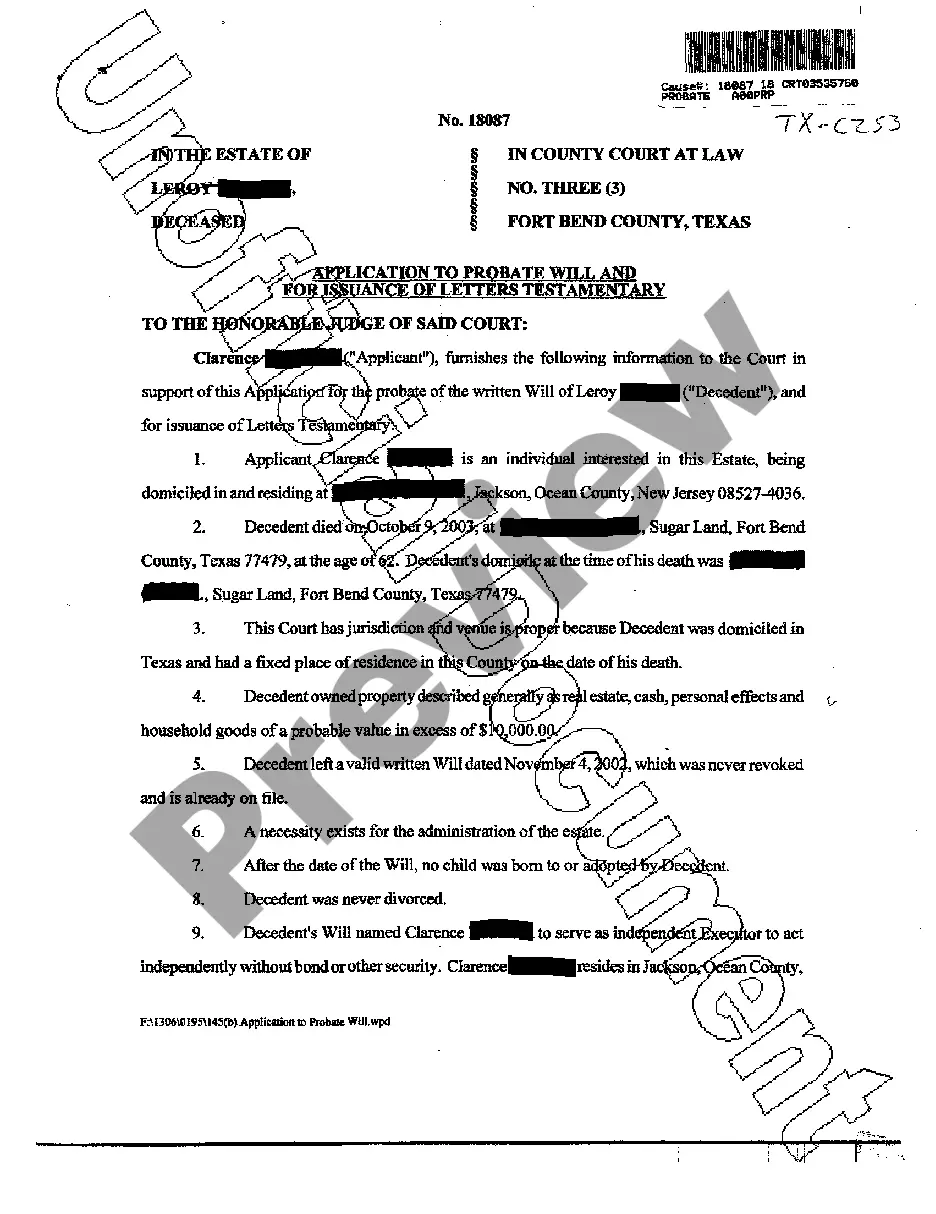

Schedule R must be filed by corporations and LLCs that earn income in multiple states, including California. This form helps determine how much of your income is subject to California apportionment. By filing it correctly, you ensure compliance with state tax regulations. Failure to do so can result in financial penalties and a complicated tax situation.

Any individual or business entity earning income in California must file a California state tax return. This includes residents, non-residents, and part-year residents with California source income. Understanding your tax filing requirements in relation to California apportionment can simplify your tax season. It’s essential to be proactive and informed to avoid penalties.

To avoid the $800 LLC fees in California, ensure your business operates outside the state or is structured in a way that limits exposure to California apportionment. Consider forming the LLC in a different state that has lower fees. Additionally, utilizing resources like US Legal Forms can guide you through structuring your entity correctly. By understanding your obligations, you can mitigate unnecessary fees.

Entities that operate both inside and outside California qualify to file Schedule R. This includes corporations and LLCs that need to determine their income apportioned to California. By filing this schedule, you can fairly assess your tax liabilities. It’s an important step for any business navigating California apportionment rules.

Typically, corporations and LLCs doing business in California must file California Schedule R. This requirement applies to entities that have income from sources both inside and outside California. Proper filing is crucial for accurately determining your California apportionment. Failing to file Schedule R can lead to penalties and misunderstandings regarding your tax obligations.

If you are a corporation or a limited liability company (LLC) engaged in business in California, you need to file California Schedule R. This form is essential for calculating your income attributable to California apportionment. It's vital for ensuring compliance with state tax laws. By filing Schedule R, you accurately represent your business presence in California.

To calculate the apportionment ratio, businesses typically use a three-factor formula that considers property, payroll, and sales. Each factor represents a proportion of the total activity within California compared to the overall business operations. Accurate calculation is crucial for complying with California apportionment regulations and ensuring correct tax payments.

A California apportioned license plate allows commercial vehicles to operate in multiple jurisdictions while paying an appropriate portion of fees based on the weight of the vehicle and distance traveled in each state. This system simplifies the registration process for businesses that operate across state lines. Understanding this concept is essential for companies looking to navigate the regulations related to California apportionment.

Property apportionment accounts for the physical assets a business has in various states, including real estate, machinery, and equipment. In California, businesses must consider these assets when determining their overall apportionment ratio. This aspect of California apportionment helps ensure that tax burdens reflect where business activities actually occur.

When a tax is apportioned, it means that it is distributed among different jurisdictions based on a predetermined formula. California apportionment is particularly important for businesses that operate both within and outside the state, as it influences how much tax is due. This method of allocation ensures fairness and compliance with state tax laws.