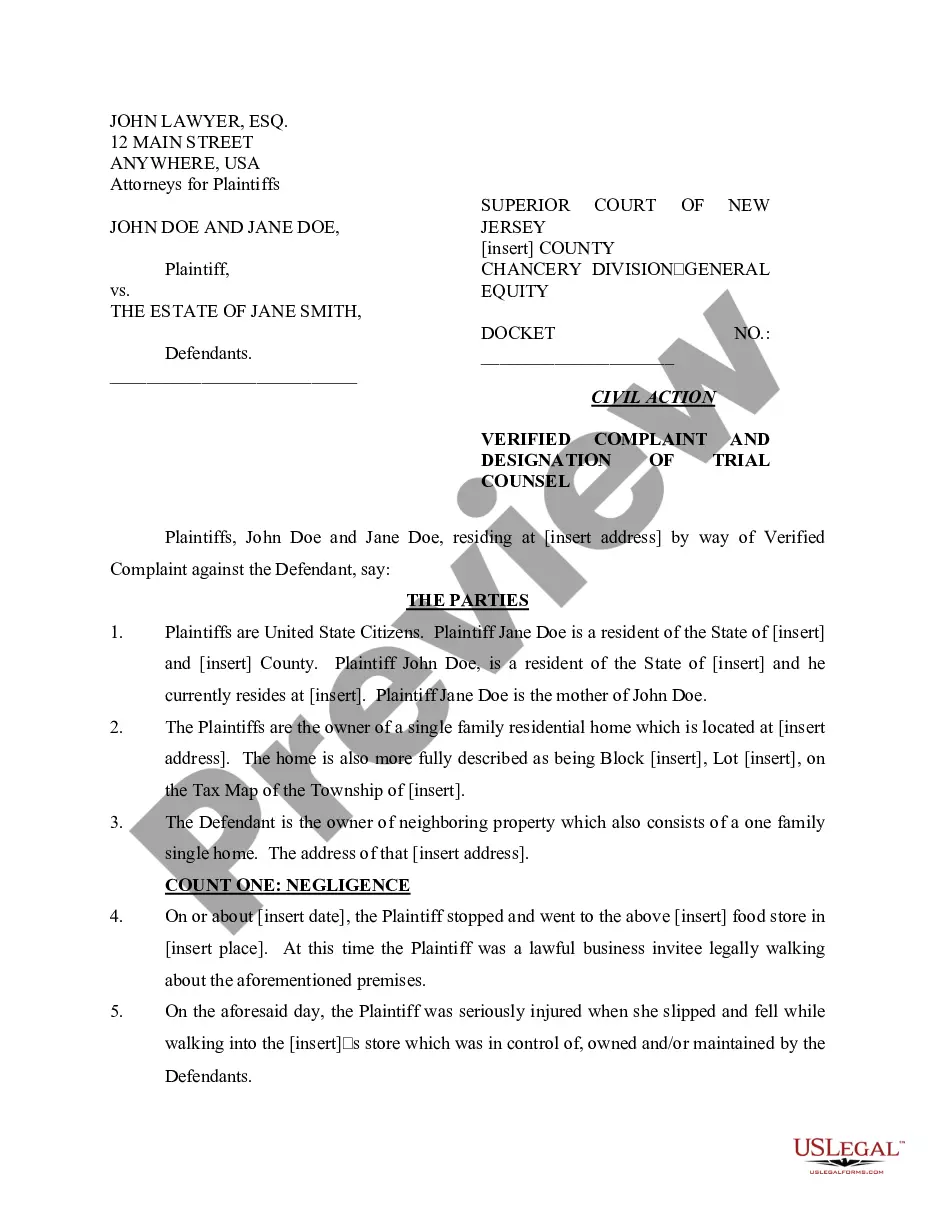

The California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) is a program that allows homeowners to transfer their residential real property to a grandchild without reappraisal or reassessment. This program is available to all counties in California but is especially beneficial to Alameda County homeowners. The program allows homeowners to transfer a primary residence to a grandchild without the reassessment of the property taxes associated with the property. The property must be used as the grandchild’s primary residence for a minimum of three years after the transfer of ownership. The exclusion is limited to $1 million of the full cash value of the property. To qualify, the transfer of ownership must occur between the grandchild and the grandparent, with no other person having an ownership interest in the property. The grandparent must have owned and occupied the property as their primary residence for at least one year prior to the transfer of the ownership. The California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) is a great way to help transfer real property without the burden of reassessment and higher property taxes.

California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County)

Description

How to fill out California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County)?

US Legal Forms is the most uncomplicated and cost-effective method to find suitable legal templates.

It’s the largest online collection of commercial and individual legal documents drafted and verified by lawyers.

Here, you can discover printable and fillable forms that adhere to federal and local regulations - just like your California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County).

Review the form details or preview the document to confirm you’ve selected the one that fits your needs, or search for an alternative using the search feature above.

Click Buy now when you’re confident of its suitability with all the specifications, and select your preferred subscription plan.

- Acquiring your template requires just a few easy steps.

- Users who already possess an account with an active subscription only need to Log In to the online service and download the file onto their device.

- They can subsequently find it in their profile under the My documents tab.

- And here’s how you can secure a professionally crafted California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) if you are using US Legal Forms for the first time.

Form popularity

FAQ

The Prop 19 exclusion in California refers to the property tax relief available when eligible homeowners transfer their properties under certain conditions. This exclusion allows properties to be passed to children or grandchildren without triggering a reassessment of the property's tax value. It creates financial advantages for families looking to keep property within the lineage. For detailed guidance on filing a California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County), our platform offers valuable resources.

Yes, Proposition 19 does apply to grandchildren, allowing them to potentially take advantage of property tax benefits. Under this legislation, grandchildren can inherit property from grandparents without reassessment if specific conditions are met. This exemption aims to facilitate smoother real estate transfers within families. To understand how Prop 19 impacts your situation, consider exploring the California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) through our services.

The grandparent to grandchild exclusion allows for property to be transferred from a grandparent to a grandchild without triggering property tax reassessment. This provision benefits families by preserving property tax savings when passing down family homes. If you qualify for this exclusion, it can significantly reduce your property tax liabilities. You can learn more about making a California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) on our platform.

Yes, a parent can deny a grandparent visitation in California, as parents have the primary authority over their children's upbringing. However, grandparents may still seek visitation rights through the court if they believe it is in the child's best interest. The court will consider various factors, including the relationship between the grandparent and grandchild. Understanding your rights and options regarding the California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) can also help in these situations.

Reassessments in California occur when property changes ownership or undergoes improvements exceeding a certain value. Other factors like new construction also trigger reassessments. To effectively manage property transitions, understanding the California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) provides insights on avoiding sudden tax increases during ownership changes.

Proposition 58 allows property owners to transfer real estate between parents and children without triggering reassessment. This exclusion benefits families by maintaining lower property tax rates on inherited properties. Families interested in transferring property can explore the California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) to enhance their tax situation.

Avoiding property tax reassessment in California involves understanding available exclusions, like those for inheriting from grandparents. Engaging with knowledgeable resources can clarify eligibility requirements. The California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) acts as a crucial tool to help families preserve tax advantages during transfers.

To avoid property tax reassessment in California, you can transfer property under specific exclusions like Proposition 58. By utilizing the California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County), property owners can transfer family homes without increasing taxes. Consulting legal resources can simplify navigating these rules.

The grandparent-grandchild exclusion allows property transfers between grandparents and their grandchildren without reassessment, provided certain conditions are met. This exemption can significantly reduce property tax burdens for families. Utilizing the California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) helps ensure families maximize these benefits during property transfers.

In California, seniors may qualify for property tax postponement at age 62, allowing them to defer payments on their property taxes. However, they do not automatically stop paying taxes at a certain age. Instead, seniors can explore options like the California Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild (Alameda County) for financial relief and assistance.