California Substitution Of Trustee And Full Reconveyance (Los Angeles)

Description Full Reconveyance

How to fill out California Substitution Of Trustee And Full Reconveyance (Los Angeles)?

US Legal Forms represents the simplest and most economical method to find appropriate legal templates.

It boasts the largest online collection of commercial and personal legal documents prepared and reviewed by legal experts.

Here, you can discover printable and fillable templates that align with federal and state laws - just like your California Substitution Of Trustee And Full Reconveyance (Los Angeles).

Review the form description or preview the document to ensure you’ve identified the one that meets your needs, or find another using the search feature above.

Press Buy now when you’re confident about its suitability with all the requirements and choose your preferred subscription plan.

- Acquiring your template involves just a few easy steps.

- Users who already possess an account with an active subscription merely need to Log In to the platform and download the document onto their device.

- Subsequently, they can locate it in their profile in the My documents section.

- For first-time users of US Legal Forms, here’s the process to obtain a correctly drafted California Substitution Of Trustee And Full Reconveyance (Los Angeles).

Form popularity

FAQ

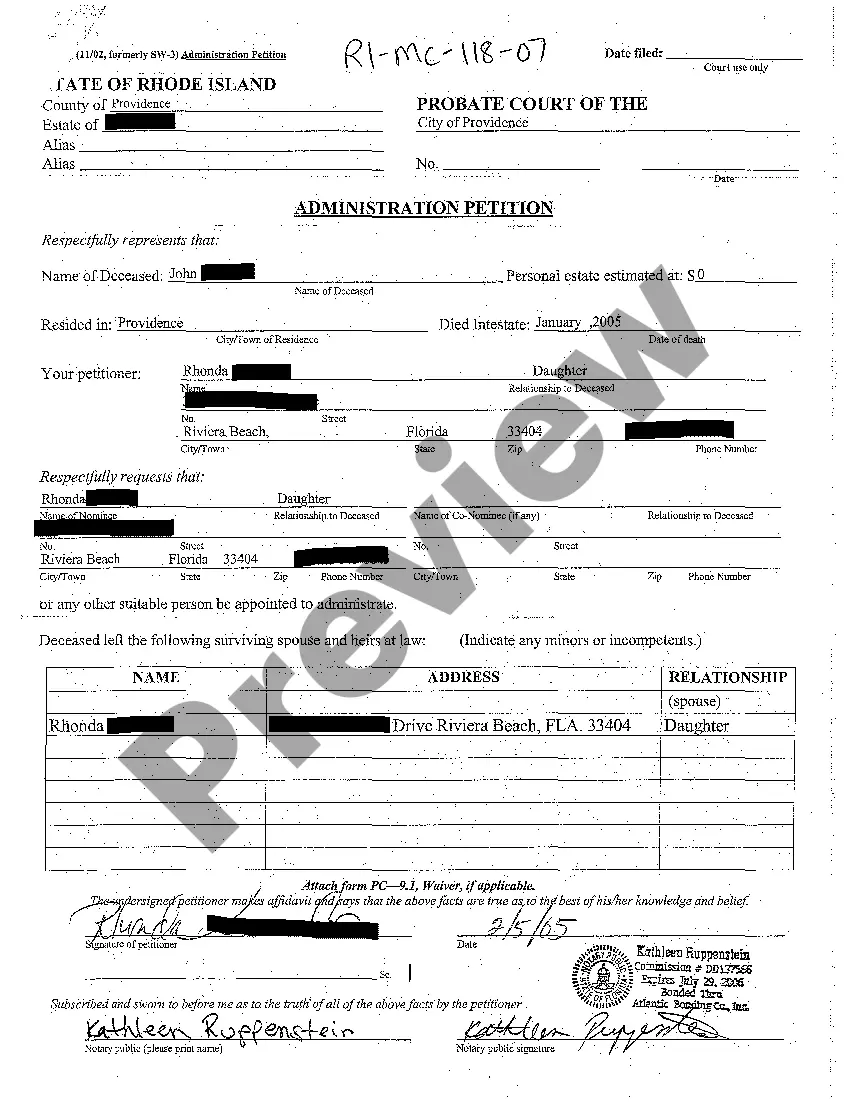

Once you receive a deed of reconveyance, it is important to keep it in a safe place. You should record this deed with the county recorder to ensure the information is publicly available. Additionally, you might need to provide a copy to your title company or potential buyers in the future. Utilizing US Legal Forms can simplify this process by providing templates and guidance for the California Substitution Of Trustee And Full Reconveyance (Los Angeles) process.

A full reconveyance in California is a legal document issued by the lender to release a borrower from the mortgage obligation after full payment. This reconveyance signifies the removal of the lien on the property, granting the borrower clear ownership. Understanding this concept is vital in real estate transactions, and US Legal Forms can provide you with templates to simplify this process.

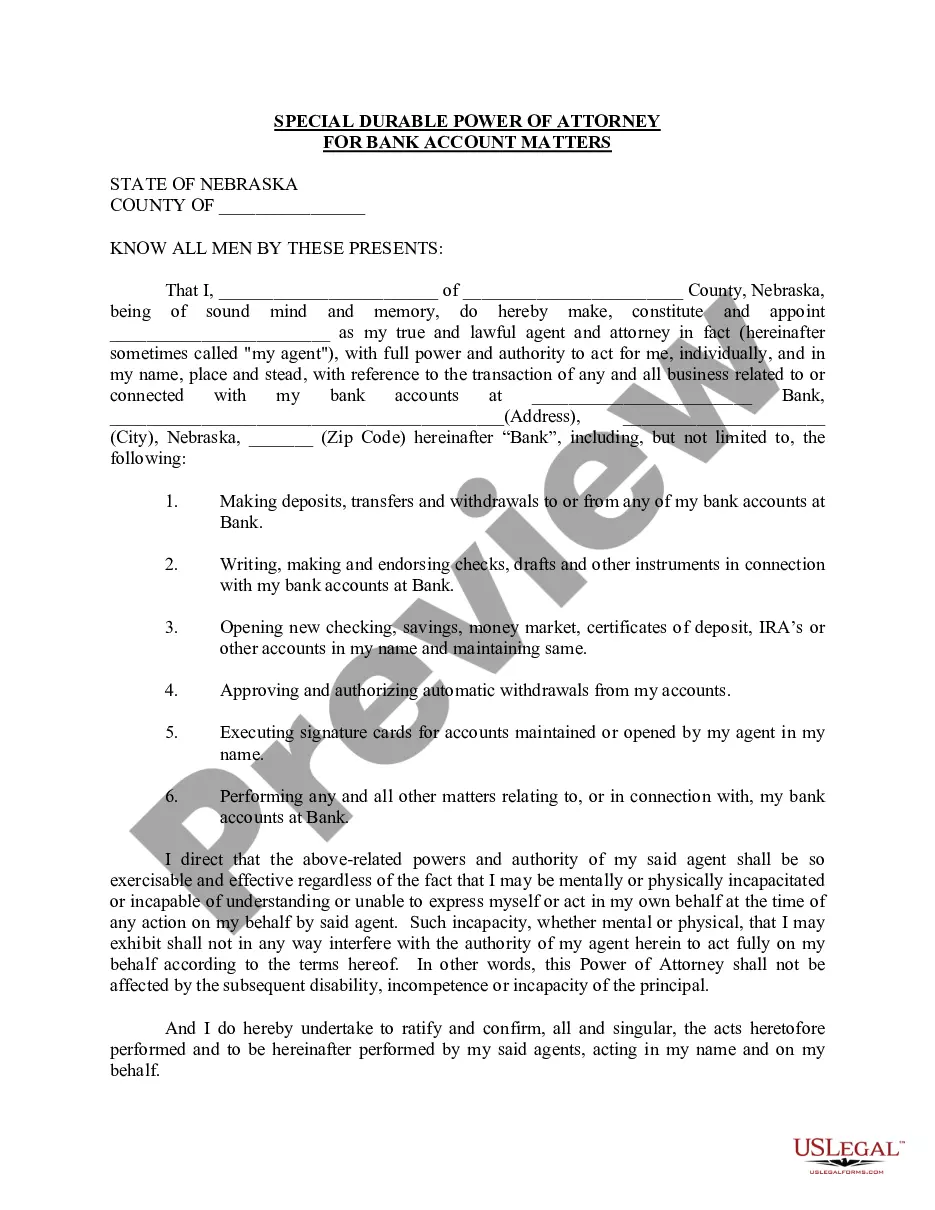

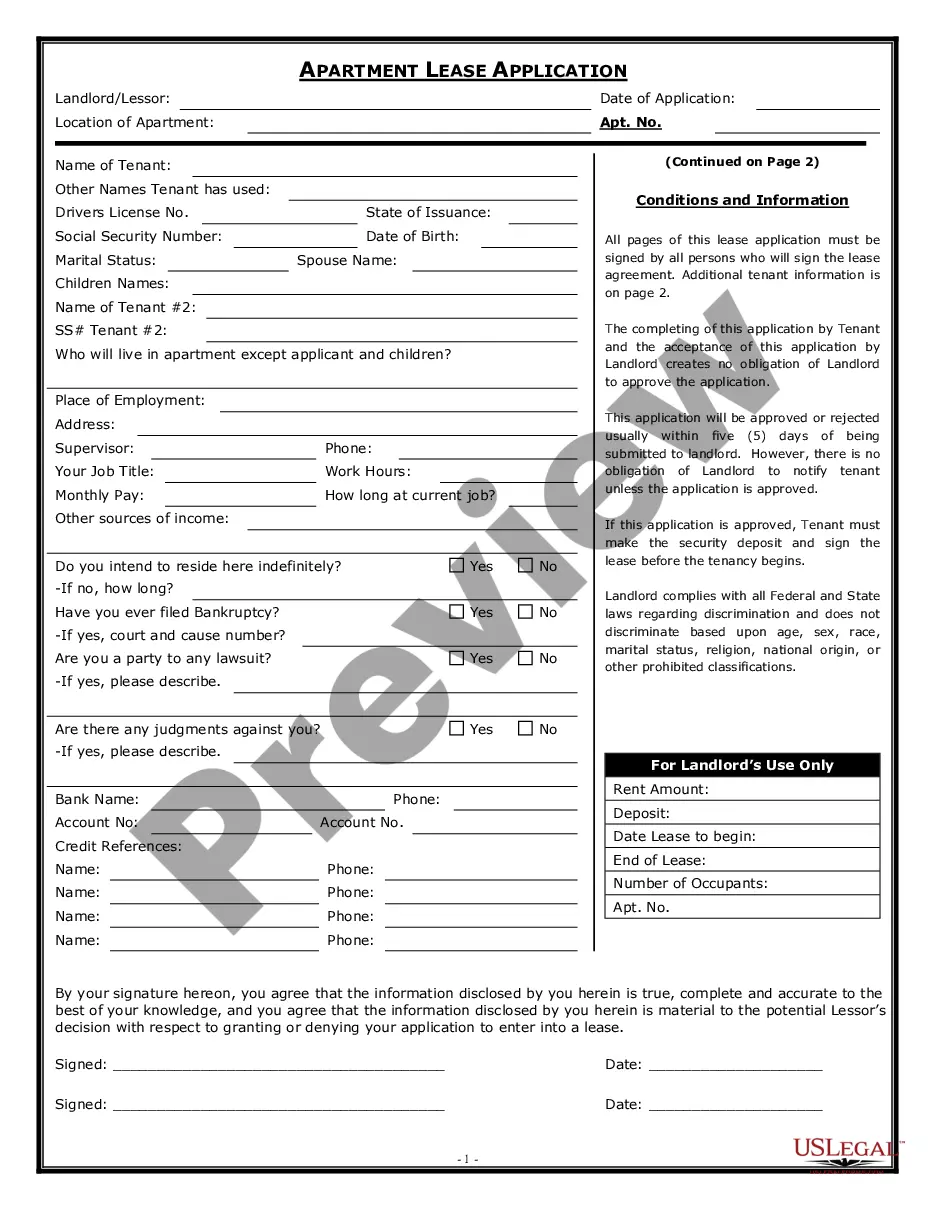

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

The trustee holds the property in trust (for the benefit of the beneficiary-lender) until a recorded ?Full Reconveyance? (sometimes referred to as a deed of re- conveyance) reconveys the bare legal title back to the person(s) entitled to said title.

Once the loan amount has been paid in full, California requires lenders to execute a deed of reconveyance within seventy-five days after the debt has been paid.

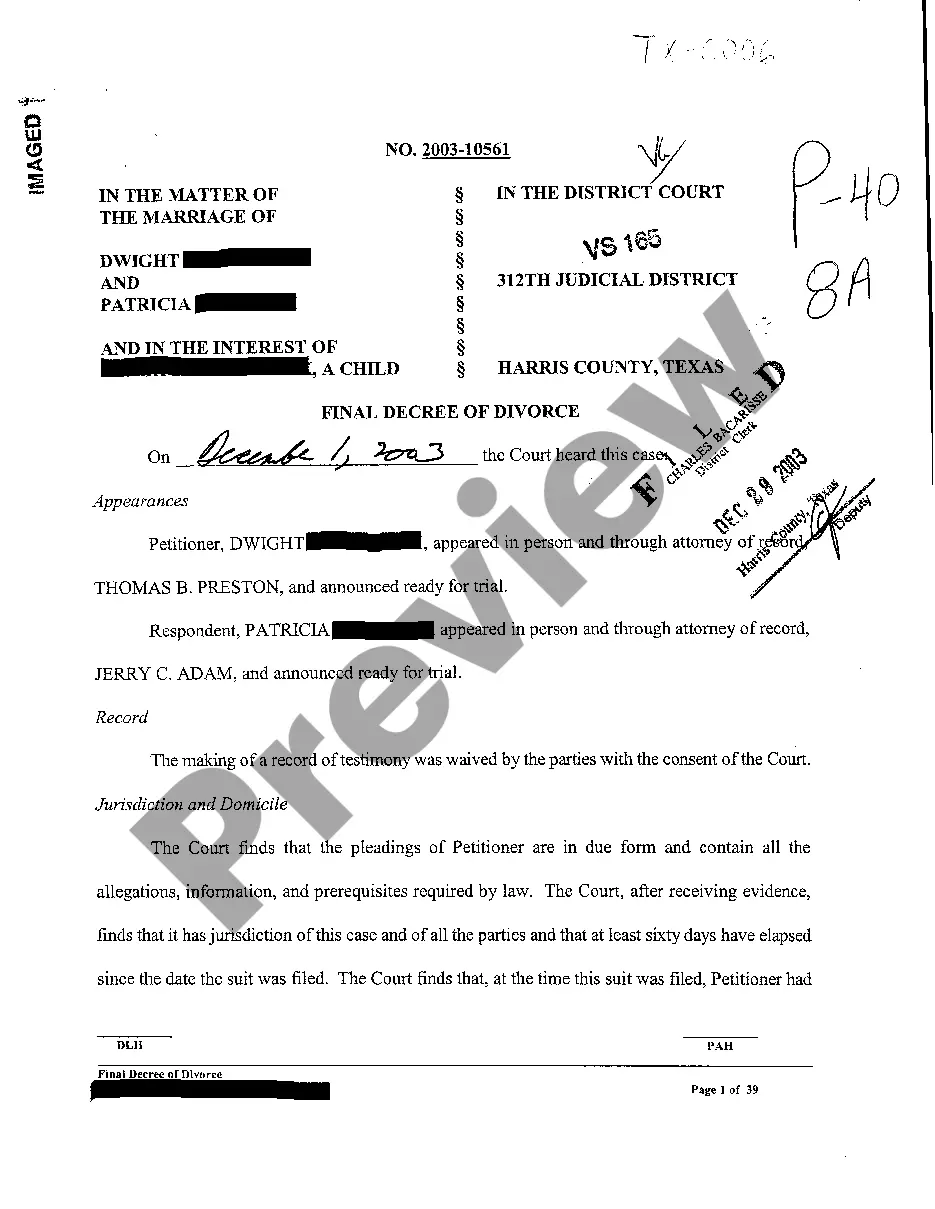

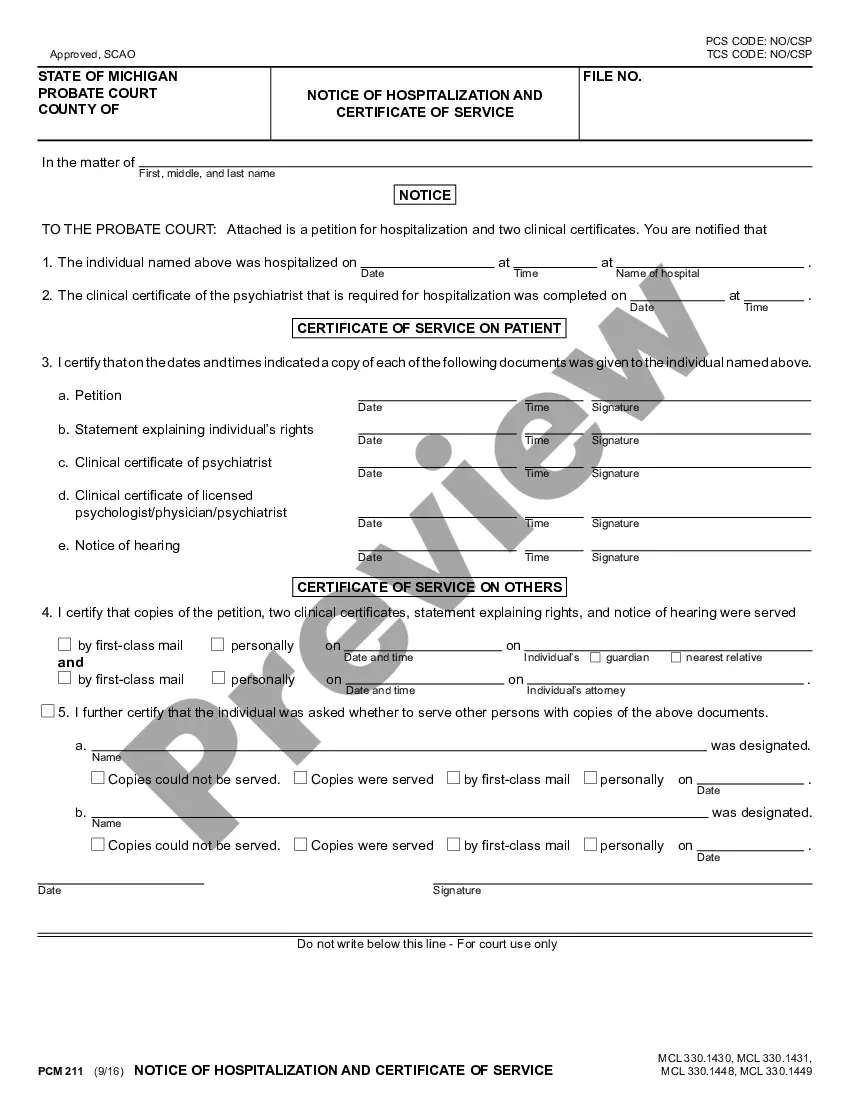

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.

Legal Definition: The Trustee or Substitute Trustee is the authorized individual, acting as an agent of the court, who oversees the sale process and makes certain the property is sold in a fair and equitable manner.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.