The California Application For Wholesaler License Limited Liability Company Owner is an application to obtain a wholesaler license from the State of California in order to sell goods in the state. This license is specifically for limited liability companies (LCS). The types of California Application For Wholesaler License Limited Liability Company Owner include: — New Wholesaler's License Limited Liability Company Owner: This is for LCS that are not currently licensed but would like to obtain a wholesaler’s license— - Renewal Wholesaler's License Limited Liability Company Owner: This is for LCS that are already licensed and would like to renew their license. — Transfer Wholesaler's License Limited Liability Company Owner: This is for LCS that are transferring their wholesaler’s license from one entity to another. The application requires the applicant to provide personal information such as name, address, and contact information. The applicant must also provide the LLC’s name, Federal Employer Identification Number (VEIN), and the type of business. The applicant must also provide the name and address of the proposed location, and the types of goods to be sold. The application must be accompanied by the required fees and documentation. Upon receipt of the application, the State of California will review the application and notify the applicant of the decision.

California Application For Wholesaler License Limited Liability Company Owner

Description

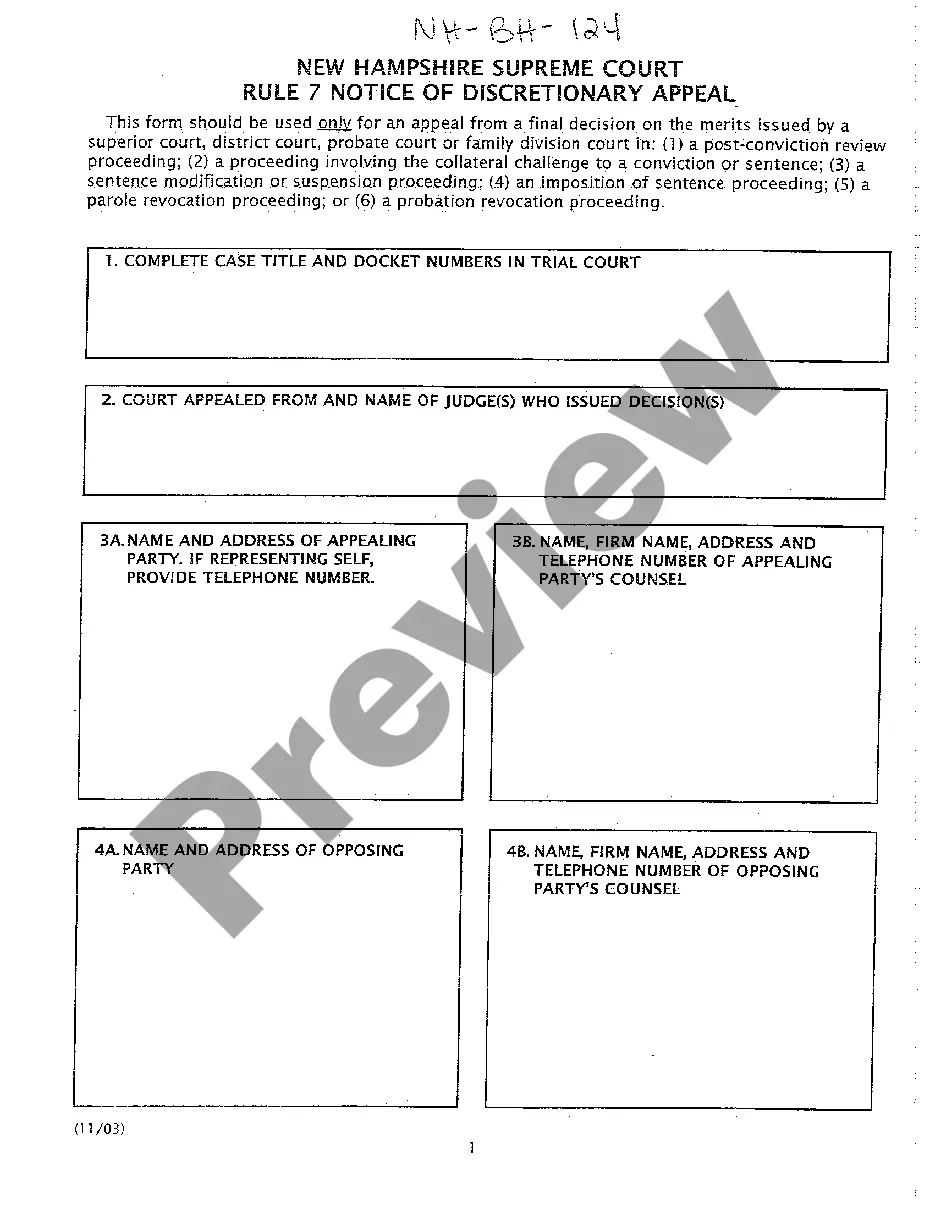

How to fill out California Application For Wholesaler License Limited Liability Company Owner?

Drafting legal documents can be quite a challenge if you lack accessible fillable templates. With the US Legal Forms online library of official paperwork, you can trust the information you find, as all documents conform to federal and state laws and are verified by our specialists.

Obtaining your California Application For Wholesaler License Limited Liability Company Owner from our collection is as simple as 1-2-3. Existing users with a valid membership just need to Log In and click the Download button after locating the appropriate template. If necessary, users can also retrieve the same document from the My documents section of their profile. However, even if you're a newcomer to our service, setting up a valid subscription will only take a short time. Here’s a quick guide for you.

Haven't you tried US Legal Forms yet? Subscribe to our service today to obtain any official document swiftly and effortlessly whenever you need to, and maintain your paperwork in order!

- Document compliance assessment: You should diligently review the form content you are interested in and verify whether it meets your requirements and adheres to your state legislation. Previewing your document and checking its overall description will assist you in this process.

- Alternative search (optional): If you encounter any discrepancies, search through the library using the Search tab above until you find an appropriate template, and click Buy Now once you identify the one you require.

- Account setup and document acquisition: Create an account with US Legal Forms. After verifying your account, Log In and select your desired subscription plan. Proceed with payment to continue (PayPal and credit card options are provided).

- Template download and further utilization: Select the file format for your California Application For Wholesaler License Limited Liability Company Owner and click Download to store it on your device. Print it to complete your paperwork by hand, or utilize a feature-rich online editor to prepare an electronic version more efficiently.

Form popularity

FAQ

One significant disadvantage of a California LLC is the $800 minimum franchise tax that exists even if your LLC does not generate income. Additionally, California's regulatory environment can be complex, which may lead to potential liability or operational hurdles. When considering your options, it's helpful to complete the California Application For Wholesaler License Limited Liability Company Owner, as it can provide insight into regulatory requirements. Overall, understanding these challenges will allow you to make informed decisions.

Yes, you can establish an LLC without actively conducting business, allowing you to set the groundwork for future endeavors. This is often done to protect personal assets or to prepare for a specific business venture. However, once you complete the California Application For Wholesaler License Limited Liability Company Owner, it may still be wise to stay aware of any state or local fees that could apply, even if you are not operating yet.

To avoid the $800 annual minimum franchise tax for your California LLC, you can consider setting up your business in a different state if feasible. Another option is to ensure your LLC is not considered 'doing business' in California by keeping your activities minimal within the state. However, this might require you to complete the California Application For Wholesaler License Limited Liability Company Owner and remain compliant with the local laws. Consulting with a tax professional could provide tailored strategies based on your specific situation.

Indeed, obtaining a business license is essential for an LLC in California. When you complete the California Application For Wholesaler License Limited Liability Company Owner, you're also required to secure a business license to comply with state regulations. This license legitimizes your operations and helps avoid potential fines. Each jurisdiction may have different rules, so ensure you understand the local requirements.

Yes, even if you have a Limited Liability Company (LLC) in California, you typically need a business license. The California Application For Wholesaler License Limited Liability Company Owner process requires not only the formation of the LLC but also obtaining the necessary licenses to operate legally. Depending on your business activities, local regulations may impose additional licensing requirements. It's important to check your city or county for specific requirements.

To apply for a wholesale license in California, you need to complete the application process through the appropriate state agency. If you are a Limited Liability Company Owner, you'll specifically need to submit the California Application For Wholesaler License Limited Liability Company Owner. Using platforms like USLegalForms can simplify this process and help you gather all required documents efficiently.

An EIN and a seller's permit are different documents. An EIN is a tax ID used for reporting purposes, while a seller's permit allows you to collect sales tax from customers. If you plan to buy wholesale in California, ensure that you also apply for the California Application For Wholesaler License Limited Liability Company Owner alongside a seller's permit to conduct your business smoothly.

An EIN is not the same as a vendor's license. While an EIN is used for tax identification, a vendor's license allows you to sell goods or services to consumers. For those looking to wholesale in California, acquiring the California Application For Wholesaler License Limited Liability Company Owner will help you meet the licensing requirements in your business endeavor.

It is not legal to wholesale in California without a proper license. Engaging in wholesale activities without a license can lead to penalties and legal issues. To avoid complications, it is advisable to navigate the application process for the California Application For Wholesaler License Limited Liability Company Owner to ensure compliance.

You do not necessarily need an LLC to buy wholesale. However, having a Limited Liability Company can offer advantages such as liability protection and potential tax benefits. Additionally, to legally operate as a wholesaler in California, you must apply for the California Application For Wholesaler License Limited Liability Company Owner, regardless of your business structure.