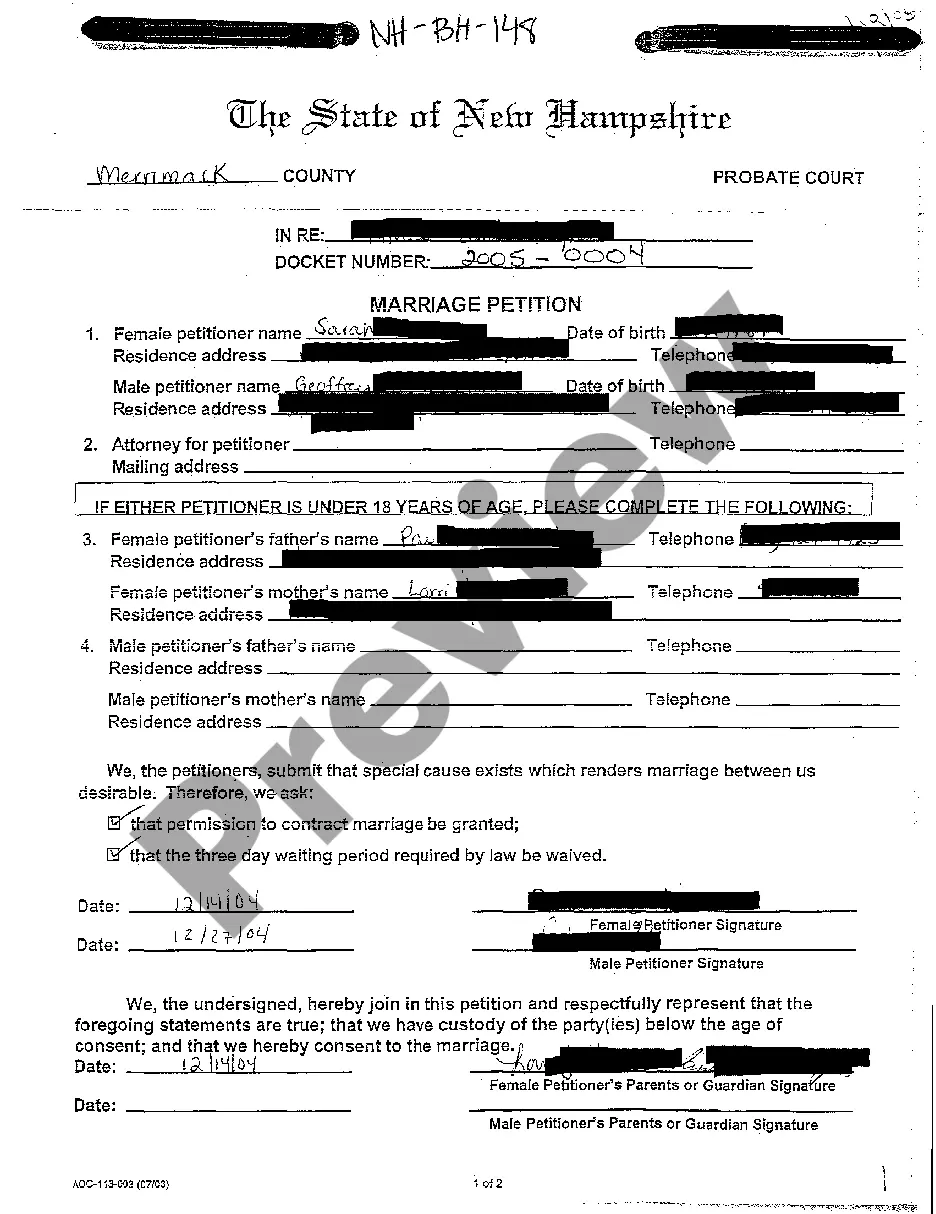

The California Information Bulletin Surety Bond, also known as the RIBS Bond, is a type of surety bond required by the State of California for businesses who sell goods or services to the state. This bond guarantees the company’s performance and payment in accordance with the contract terms and conditions. It serves as a financial guarantee to the state that the company will comply with the terms and requirements of the contract, and if not, the state can make a claim against the bond for damages. The bond is issued by an insurance company or surety on behalf of the business. There are two types of California Information Bulletin Surety Bonds: the RIBS Performance Bond and the RIBS Payment Bond. The RIBS Performance Bond guarantees the performance of the contract, meaning the business will provide the goods or services as stated in the agreement. The RIBS Payment Bond guarantees the payment of the contract, meaning the business will pay the state for the goods or services they provided.

California Information Bulletin Surety Bond

Description

How to fill out California Information Bulletin Surety Bond?

If you’re looking for a method to effectively finalize the California Information Bulletin Surety Bond without enlisting the help of a legal expert, then you’ve found the ideal location.

US Legal Forms has established itself as the most comprehensive and esteemed repository of official templates for every personal and commercial scenario. Every document you discover on our website is crafted in alignment with federal and state laws, ensuring that your paperwork is accurate.

Another great feature of US Legal Forms is that you will never lose the documents you purchased - any of your downloaded forms can be found in the My documents tab of your profile whenever you require them.

- Confirm that the document displayed on the page aligns with your legal needs and state laws by reviewing its text description or examining the Preview mode.

- Type the form name into the Search tab located at the top of the page and choose your state from the dropdown menu to find an alternative template if there are any discrepancies.

- Repeat the content verification process and click Buy now when you are certain the paperwork satisfies all requirements.

- Log In to your account and click Download. If you do not already have an account, create one with the service and select a subscription plan.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be ready for download immediately after.

- Select the format in which you want to save your California Information Bulletin Surety Bond and download it by clicking the appropriate button.

- Upload your template to an online editor for quick completion and signing, or print it out for manual preparation of your hard copy.

Form popularity

FAQ

Surety bonds are typically provided by insurance companies or other financial institutions specializing in surety. These entities evaluate your qualifications and the nature of the bond you need. The California Information Bulletin Surety Bond outlines various providers, making it easy to find a suitable option for your bonding needs.

The process of getting a surety bond released includes submitting a formal request to the surety company. Make sure to provide any necessary supporting documents that prove you've fulfilled your contract obligations. Referencing the California Information Bulletin Surety Bond can help simplify the process and ensure compliance.

To get a surety bond released, you need to fulfill the terms outlined in your bond agreement. This often means ensuring that all obligations have been met. If you have questions, the California Information Bulletin Surety Bond can provide clarity on the process and requirements for release.

Finding your surety bond involves checking your records or contacting the issuer directly. You may also want to look through your financial documents or online accounts related to the bond. Use the California Information Bulletin Surety Bond to guide you in locating the necessary information efficiently.

To redeem a surety bond, you typically submit a request to the issuer. It's important that you provide the necessary documentation, such as the original bond and any related paperwork. The California Information Bulletin Surety Bond process is designed to be straightforward, ensuring you can retrieve your funds efficiently.

A surety acknowledgement is a formal document that confirms the understanding and acceptance of the terms laid out in a surety bond, such as the California Information Bulletin Surety Bond. It serves as evidence that all parties involved agree to the bond's conditions and obligations. Having a signed acknowledgement can be crucial in any claims process, as it strengthens your case and clarifies the roles of the parties involved.

You should file a bond claim in California when you believe a violation of the terms of the California Information Bulletin Surety Bond has occurred. Common reasons to file include non-payment for services, failure to complete a project, or any misconduct that harms you as a claimant. Acting quickly is important, as delays may affect your ability to recover your losses.

In California, the deadline to file a bond claim typically ranges from six months to one year from the date of the violation. It's crucial to review the terms specified in your California Information Bulletin Surety Bond, as the exact deadline may vary based on the type of bond. To ensure timely filing, keep track of important dates and gather your documentation promptly.

If you suspect a bond violation, you should report it to the surety company that issued the California Information Bulletin Surety Bond. They are responsible for addressing issues related to the bond. Additionally, you may contact the relevant California regulatory agency for assistance in resolving any disputes or to seek further guidance on how to proceed.

To file a bond claim in California, begin by gathering all necessary documentation related to the claim. You will need to prepare a written notice that includes details about the bond, the specifics of the violation, and any supporting evidence. Submit your claim to the surety company that issued the California Information Bulletin Surety Bond. Make sure to send your claim within the time limits set by the surety.