The California Statement of Economic Interests in Auditors Claims Managers-Adjusters is a form required by the California Fair Political Practices Commission (FNPC) that must be completed annually by certain public officials and employees, as well as by members of the Board of Administration of the California Public Employees' Retirement System. This form is the same for all individuals required to file, and includes questions about investments, income, and gifts in order to ensure compliance with California conflict of interest regulations. The California Statement of Economic Interests in Auditors Claims Managers-Adjusters consists of two parts: Part I and Part II. Part I requires Auditors Claims Managers-Adjusters to list all investments made in the past year that exceed $2,000, as well as any income sources over $500. This section also requires Auditors Claims Managers-Adjusters to list any gifts received from certain sources, such as lobbyists, subcontractors, and government entities. Part II requires Auditors Claims Managers-Adjusters to disclose any business interests they have, including partnerships, directorships, and other affiliations. In addition, this section requires information regarding any independent contractor activities, outside employers, or other sources of income. The California Statement of Economic Interests in Auditors Claims Managers-Adjusters must be filed annually by the April 1st deadline. Failure to file this form may result in civil and criminal penalties.

California Statement Of Economic Interests For Auditors Claims Managers-Adjusters

Description

How to fill out California Statement Of Economic Interests For Auditors Claims Managers-Adjusters?

How much duration and resources do you typically dedicate to creating official documentation.

There’s a superior alternative to obtaining such forms than enlisting legal professionals or squandering hours searching online for a suitable template. US Legal Forms is the premier online repository that offers expertly crafted and validated state-specific legal documents for any objective, including the California Statement Of Economic Interests For Auditors Claims Managers-Adjusters.

Another benefit of our library is that you can retrieve previously obtained documents that you securely store in your profile in the My documents tab. Access them anytime and re-fill your paperwork as often as necessary.

Conserve time and energy managing formal documentation with US Legal Forms, one of the most reputable online services. Register with us today!

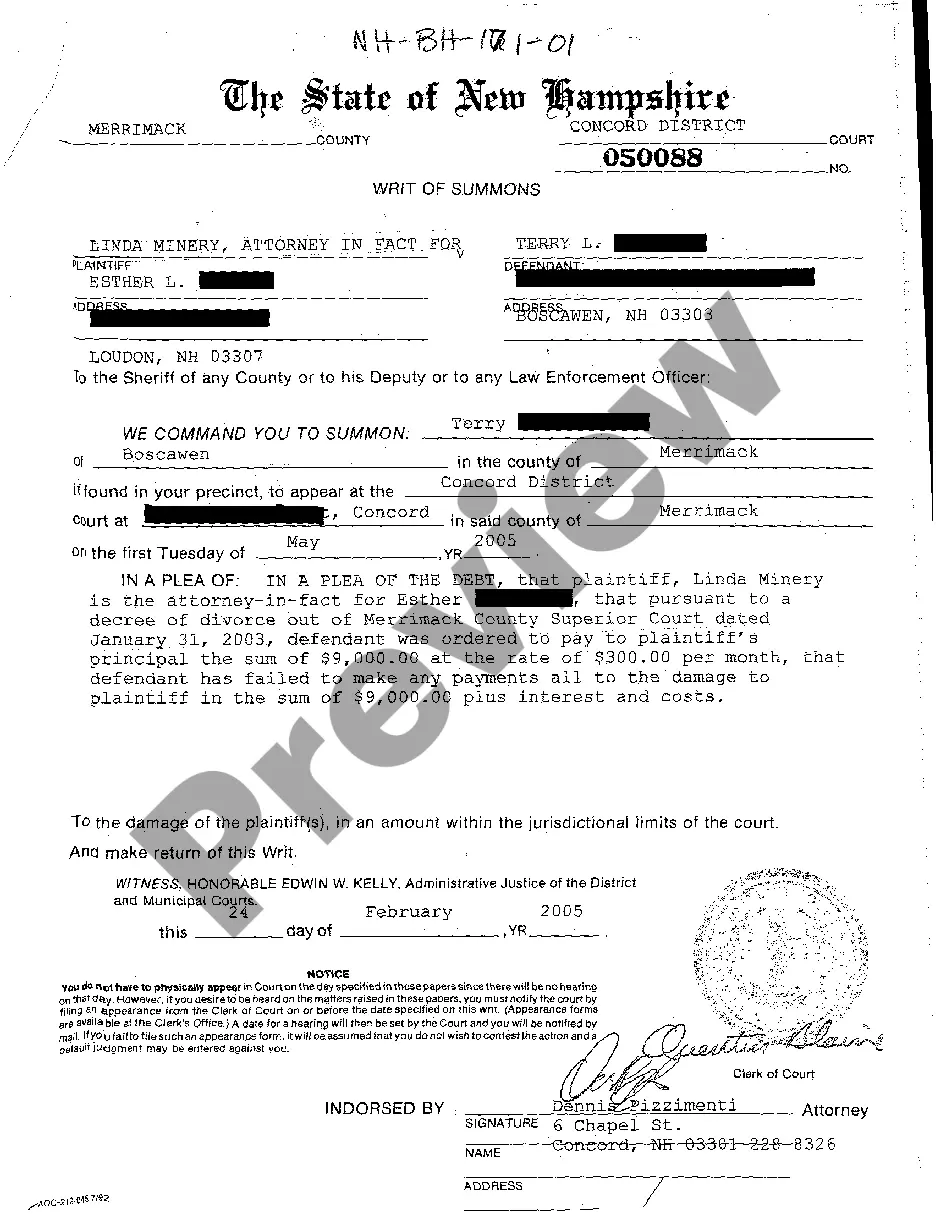

- Review the form details to ensure it complies with your state regulations. To do this, examine the form summary or utilize the Preview option.

- If your legal template doesn't suit your requirements, search for another one using the search bar located at the top of the page.

- If you already possess an account with us, Log In and download the California Statement Of Economic Interests For Auditors Claims Managers-Adjusters. If not, continue to the following instructions.

- Click Buy now after you find the appropriate document. Choose the subscription plan that fits your needs best to access the complete services of our library.

- Establish an account and complete the payment for your subscription. You can perform the transaction using your credit card or via PayPal - our service is entirely secure for that.

- Download your California Statement Of Economic Interests For Auditors Claims Managers-Adjusters onto your device and complete it either on a printed hard copy or digitally.

Form popularity

FAQ

Form 700 must be filled out by designated public officials and employees who handle financial matters in California. This includes individuals in roles such as government executives, board members, and certain commission members. By completing this form, these officials help uphold public trust and ensure transparency regarding the California Statement Of Economic Interests For Auditors Claims Managers-Adjusters. If you’re unsure about your obligations, consider consulting platforms like USLegalForms.

Not all public officials are required to file a Form 700 statement of economic interests. However, individuals in specific positions, like those overseeing public resources or finances, typically must disclose their financial interests. This requirement plays a crucial role in maintaining transparency and accountability in public service. For further clarification on requirements, using resources like USLegalForms can be beneficial.

Yes, you can request an extension on filing Form 700 in certain situations. It’s important to submit your extension request before the original filing deadline. Keep in mind that receiving an extension does not waive your responsibility to file the California Statement Of Economic Interests For Auditors Claims Managers-Adjusters at a later date. For more guidance on extensions, consider resources available on USLegalForms.

Filing Form 700 electronically involves accessing the California Fair Political Practices Commission's (FPPC) website, where you can complete your form online. You will need to create an account, fill in the required fields, and electronically submit your statement. Utilizing online platforms simplifies the process, making it easier for individuals handling the California Statement Of Economic Interests For Auditors Claims Managers-Adjusters.

To file Form 7200 electronically, you need to visit the official IRS website or use an authorized e-file provider. The online process is straightforward, guiding you through each step of the filing. This method is efficient and ensures accuracy in your submission. For detailed instructions, consider checking platforms like USLegalForms for helpful resources related to the California Statement Of Economic Interests For Auditors Claims Managers-Adjusters.

To fill out Form 700 Schedule C, begin by listing all investments and financial interests held in businesses or organizations. Include the type of investment and its value, ensuring accuracy in your disclosures. This step is vital for Auditors and Claims Managers-Adjusters to comply with the California Statement Of Economic Interests, facilitating a clear understanding of your economic ties.

The primary purpose of a statement of economic interest is to disclose potential conflicts of interest, thus promoting transparency and accountability. This is particularly important in roles such as Auditors and Claims Managers-Adjusters, where decisions can significantly impact public trust. By understanding their financial landscape, these professionals uphold integrity in their roles.

Form 700 is often required for elected officials, candidates, and certain employees in California who hold decision-making authority. Those involved in regulatory roles, including Auditors and Claims Managers-Adjusters, must accurately complete this form. By filing, they contribute to a transparent environment, aligning with the California Statement Of Economic Interests for ethical governance.

A statement of economic interest in California is a required document for certain public officials and employees to declare their financial interests. This ensures accountability and transparency in government operations. Specifically, for Auditors and Claims Managers-Adjusters, it helps avoid conflicts of interest and promotes ethical decision-making.

An economic interest in a Limited Liability Company (LLC) refers to a member's share in the LLC's assets and profits. This interest does not necessarily include management rights but allows for financial benefits. It's important for individuals to recognize their economic interest when completing the California Statement Of Economic Interests For Auditors Claims Managers-Adjusters.