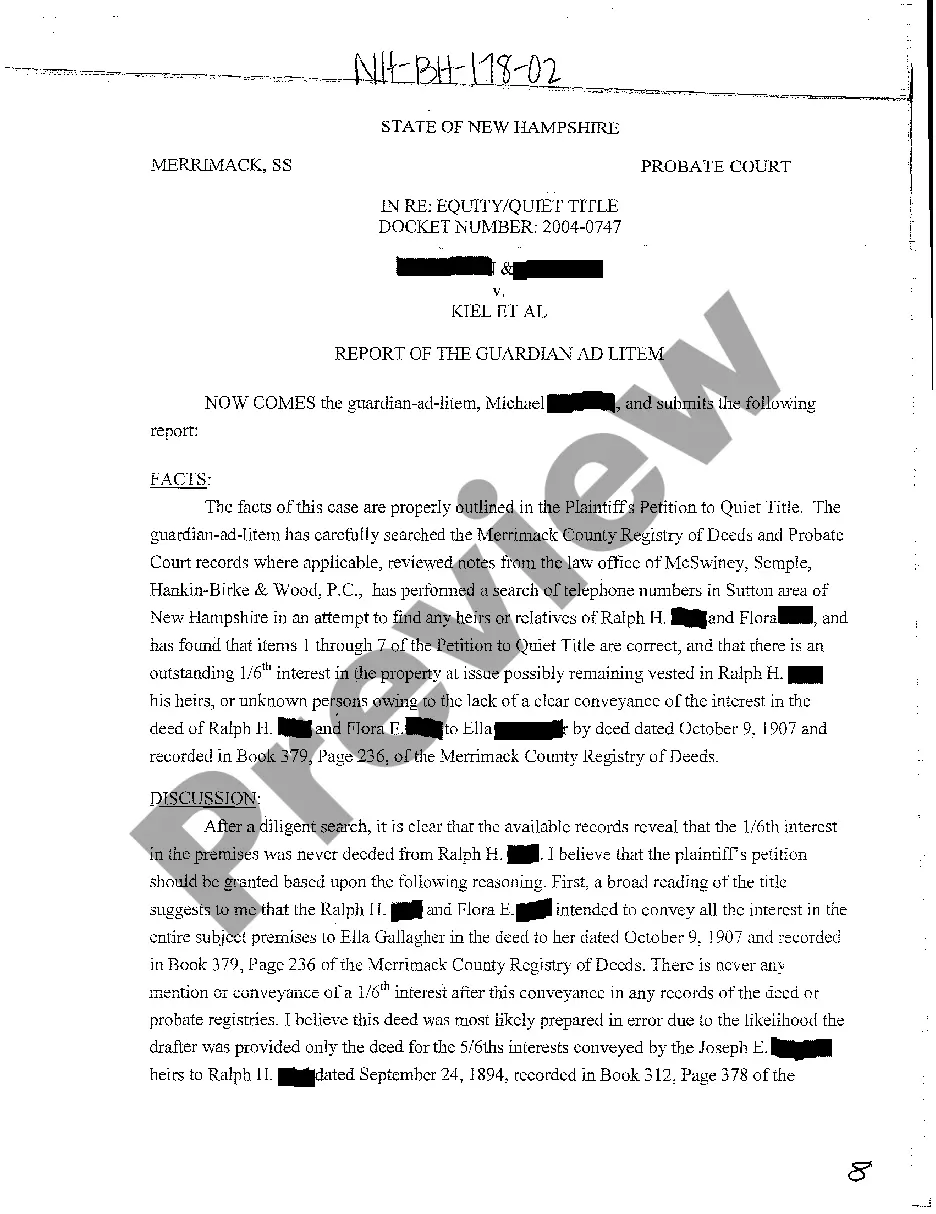

The California Declaration of Self Employment Income (San Francisco Division) is a document used to report self-employment income to the State of California. The form collects information on income, expenses, and other business details from individuals who are self-employed in San Francisco. It is used to determine the amount of taxes owed by the self-employed individual. There are two types of California Declaration of Self Employment Income (San Francisco Division): Form 590-P and Form 590-V. Form 590-P is used to report income from a sole proprietorship or single-member LLC. Form 590-V is used to report income from a partnership, LLC, or S-corporation.

California Declaration Of Self Employment Income (San Francisco Division)

Description

How to fill out California Declaration Of Self Employment Income (San Francisco Division)?

Handling official paperwork necessitates focus, precision, and utilizing well-structured templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your California Declaration Of Self Employment Income (San Francisco Division) template from our platform, you can trust it adheres to federal and state regulations.

Interacting with our platform is simple and quick. To obtain the required documents, all you need is an account with an active subscription. Here’s a concise guideline for you to acquire your California Declaration Of Self Employment Income (San Francisco Division) in minutes.

All documents are designed for multiple uses, like the California Declaration Of Self Employment Income (San Francisco Division) available on this page. If you require them again, you can fill them out without additional payment - just access the My documents tab in your profile and finalize your document whenever you need it. Try US Legal Forms and handle your business and personal documentation swiftly and in complete legal compliance!

- Ensure to carefully review the form content and its alignment with general and legal standards by previewing it or checking its description.

- Look for an alternative official template if the one opened previously does not fit your situation or state requirements (the option for that is located in the upper corner of the page).

- Log In to your account and save the California Declaration Of Self Employment Income (San Francisco Division) in the desired format. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, choose your subscription plan, and complete the payment with your credit card or PayPal account.

- Select the format in which you wish to receive your document and click Download. Print the template or incorporate it into a professional PDF editor to prepare it digitally.

Form popularity

FAQ

An income and expense report typically includes all sources of income and all costs related to your business. For the California Declaration Of Self Employment Income (San Francisco Division), you should include detailed records of sales, services rendered, and any operational expenses. Accurate reporting ensures transparency and assists in effective financial planning.

Yes, if you earn income through self-employment, you need to register with the California Secretary of State. Doing this ensures compliance with regulations while supporting your California Declaration Of Self Employment Income (San Francisco Division). Proper registration also aids in establishing credibility with clients and stakeholders.

To report your self-employment income in California, you must complete the appropriate tax forms, such as the Schedule C. You will detail your earnings and expenses, thus aligning with the California Declaration Of Self Employment Income (San Francisco Division). Using platforms like uslegalforms can simplify this process, helping you fill out forms correctly and efficiently.

You typically show income and expenses through detailed records, like receipts and bank statements. In the context of the California Declaration Of Self Employment Income (San Francisco Division), maintaining organized records will simplify your financial reporting. This clarity helps in accurately calculating your tax obligations.

Yes, California imposes a self-employment tax that applies to individuals earning income through self-employment. This tax is part of the California Declaration Of Self Employment Income (San Francisco Division). It is essential to understand this obligation to ensure compliance and avoid penalties.

An income declaration is a statement that reports your total earnings from all sources. This declaration plays a crucial role in the California Declaration Of Self Employment Income (San Francisco Division). It helps authorities assess your financial capacity, especially when applying for loans or benefits.

An income and expense declaration outlines your earnings and costs over a specific period. This document is vital for those involved in the California Declaration Of Self Employment Income (San Francisco Division). It provides a clear picture of your financial situation, essential for tax reporting and eligibility for various benefits.

To fill out self-employment income, start by gathering all your income statements, such as 1099 forms or invoices. Next, visit the California Declaration Of Self Employment Income (San Francisco Division) to complete the required forms accurately. Ensure you include all sources of income and relevant business expenses to get an accurate picture of your net income. For further assistance, consider using the solutions provided by uslegalforms to navigate this process seamlessly.

The self-employment form for proof of income is a document that self-employed individuals use to report their earnings. It serves as a formal declaration to provide clear evidence of income when applying for loans, mortgages, or other financial assistance. Specifically, the California Declaration Of Self Employment Income (San Francisco Division) helps streamline this process for residents in this area. By using this form, you can present your income details accurately and efficiently, making it easier for lenders to evaluate your financial situation.