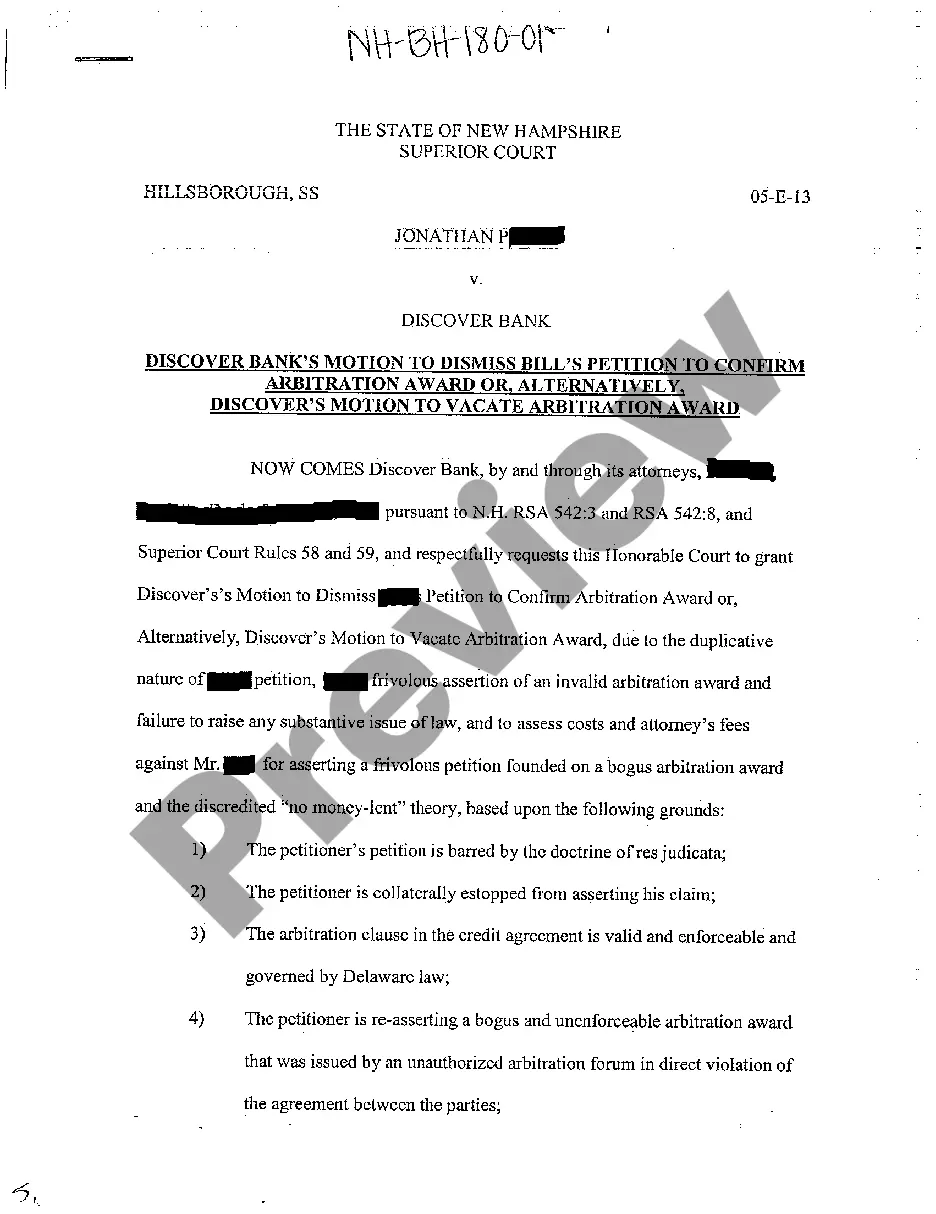

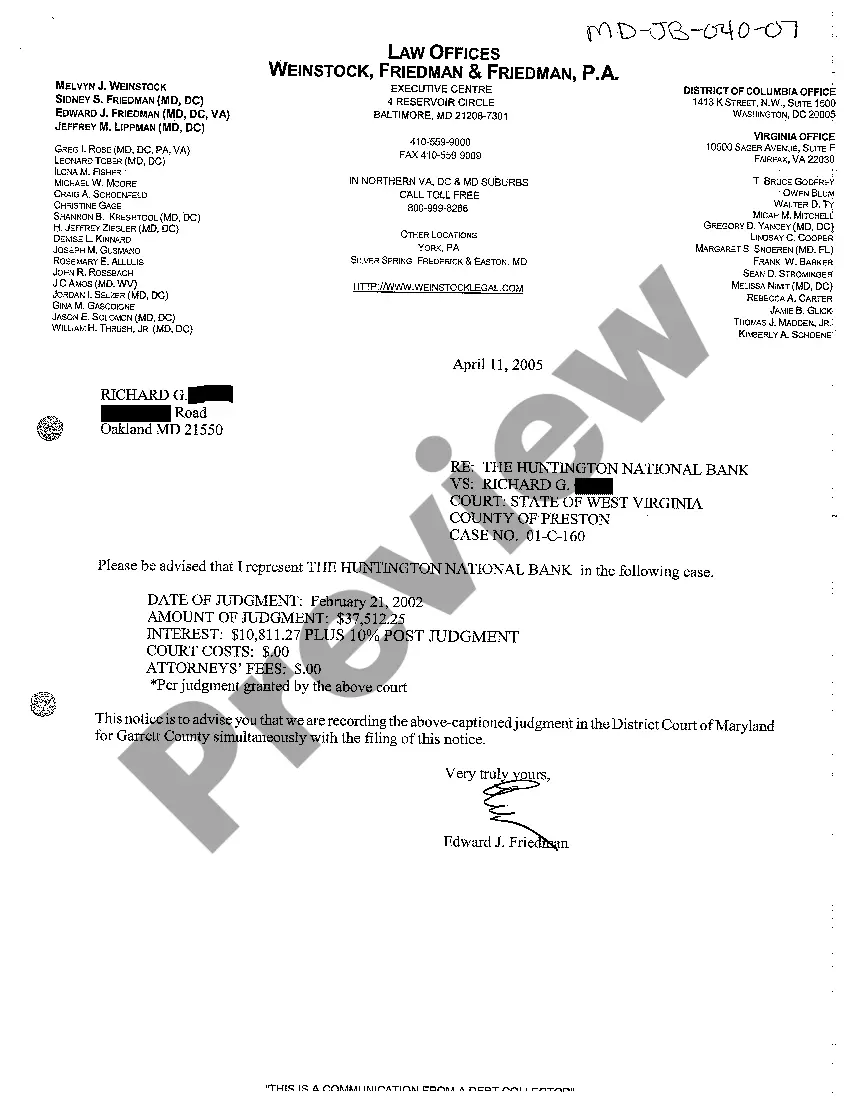

A California Final Report Of Mortgage Modification Mediation Program Mediator is a licensed and trained professional who assists homeowners and lenders in resolving mortgage modification disputes. The Mediator will conduct an informal mediation session with both parties to facilitate a mutually beneficial resolution. The Mediator will review documents, discuss options, and create a Final Report outlining the agreement reached. The Final Report must be signed by both parties to be legally binding. There are two types of California Final Report Of Mortgage Modification Mediation Program Mediators: Court-Appointed Mediators and Private Mediators. Court-Appointed Mediators are appointed by the court to serve as a neutral third party in a dispute. Private Mediators are typically hired by a homeowner or lender to facilitate a resolution outside of court proceedings.

California Final Report Of Mortgage Modification Mediation Program Mediator

Description

How to fill out California Final Report Of Mortgage Modification Mediation Program Mediator?

If you’re seeking a method to effectively finalize the California Final Report Of Mortgage Modification Mediation Program Mediator without employing an attorney, then you’ve arrived at the ideal location.

US Legal Forms has demonstrated itself as the most comprehensive and respected repository of formal templates for every personal and business circumstance. Each document you encounter on our website is crafted in accordance with federal and state regulations, ensuring that your paperwork is in order.

Another excellent feature of US Legal Forms is that you'll never misplace the documents you've obtained - you can always find any of your downloaded templates in the My documents section of your profile whenever you need it.

- Verify that the document displayed on the page aligns with your legal circumstances and state legislation by reviewing its text description or browsing through the Preview mode.

- Input the form title in the Search tab at the top of the page and select your state from the dropdown to locate an alternate template if there are any discrepancies.

- Repeat the content verification process and click Buy now when you are sure about the document's adherence to all requirements.

- Log In to your account and click Download. Register for the service and choose a subscription plan if you do not have one yet.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be accessible for download immediately afterward.

- Choose the format in which you wish to receive your California Final Report Of Mortgage Modification Mediation Program Mediator and download it by selecting the appropriate button.

- Incorporate your template into an online editor to complete and sign it swiftly or print it out to prepare your physical copy manually.

Form popularity

FAQ

Mediation generally serves as a beneficial tool for resolving mortgage disputes. It allows both parties to engage in a constructive discussion without the pressures of a courtroom setting. By involving a California Final Report Of Mortgage Modification Mediation Program Mediator, you gain guidance to help find workable solutions. Ultimately, mediation fosters collaboration, increasing the chances of reaching an agreement that suits both you and your lender.

The average settlement offer during mediation can vary widely based on the specific circumstances of your case. Typically, settlement offers are influenced by factors like the lender's policies, your financial situation, and the property value. While some homeowners may receive favorable terms, others may face less advantageous proposals. Engaging a California Final Report Of Mortgage Modification Mediation Program Mediator helps clarify these offers, ensuring that you understand your options and can negotiate effectively.

It's important to maintain a constructive tone during mediation. Avoid making inflammatory statements or personal attacks, as they can hinder progress. Additionally, refrain from making promises you cannot keep or using language that may be perceived as confrontational. Instead, focus on your needs and the facts of your situation to create a productive dialogue with the California Final Report Of Mortgage Modification Mediation Program Mediator.

Once a mediation agreement is signed, it generally becomes legally binding. However, there may be grounds for rescinding or modifying the agreement under certain circumstances, such as mutual consent or major misrepresentation. It is advisable to consult the California Final Report Of Mortgage Modification Mediation Program Mediator to understand your options before making any final decisions.

Mediation agreements can be quite enforceable, particularly if they meet certain legal criteria. Under the guidance of the California Final Report Of Mortgage Modification Mediation Program Mediator, you can create a solid agreement that will hold up in court if necessary. Enforceability increases when both parties are clear about terms and conditions.

Mortgage mediation is a process where a neutral third party helps homeowners and lenders negotiate mortgage modification terms. The California Final Report Of Mortgage Modification Mediation Program Mediator facilitates this dialogue, helping to bridge communication gaps and work toward a mutually beneficial solution. This approach can alleviate the stress involved in navigating mortgage issues.

Yes, mediation agreements can hold up in court, provided they are properly executed. When you use the California Final Report Of Mortgage Modification Mediation Program Mediator, you have the additional support of legal expertise, which can lead to well-structured agreements. Consequently, these agreements can be favorable if disputes arise later.

Mediation in California is primarily a voluntary process, which means it is not inherently binding. If you negotiate a resolution through the California Final Report Of Mortgage Modification Mediation Program Mediator, you can create a binding agreement upon signing. Therefore, it’s crucial to ensure all parties understand the outcomes and agree to the terms.

In California, mediation itself is not legally binding. However, if both parties reach a mutual agreement during the process, that agreement can become enforceable if documented properly. Utilizing the California Final Report Of Mortgage Modification Mediation Program Mediator can help you achieve binding agreements that are effective and durable.

One downside of mediation is that it relies on both parties to agree to the terms, which might not always happen. If parties fail to reach a resolution, they may have to pursue litigation instead. Furthermore, the California Final Report Of Mortgage Modification Mediation Program Mediator may not guarantee the same level of protection or enforceability as a legal decision. However, mediation often fosters better communication and can lead to mutually beneficial solutions.