California Chapter 13 (Recommended Form)

Description

How to fill out California Chapter 13 (Recommended Form)?

If you’re seeking a method to adequately prepare the California Chapter 13 (Recommended Form) without enlisting a legal professional, then you’re exactly in the correct spot.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of formal templates for every individual and business scenario. Every document you find on our online service is crafted in line with federal and state laws, so you can be assured that your paperwork is in order.

Another great feature of US Legal Forms is that you will never misplace the documents you bought - you can access any of your downloaded forms in the My documents tab of your profile whenever you require it.

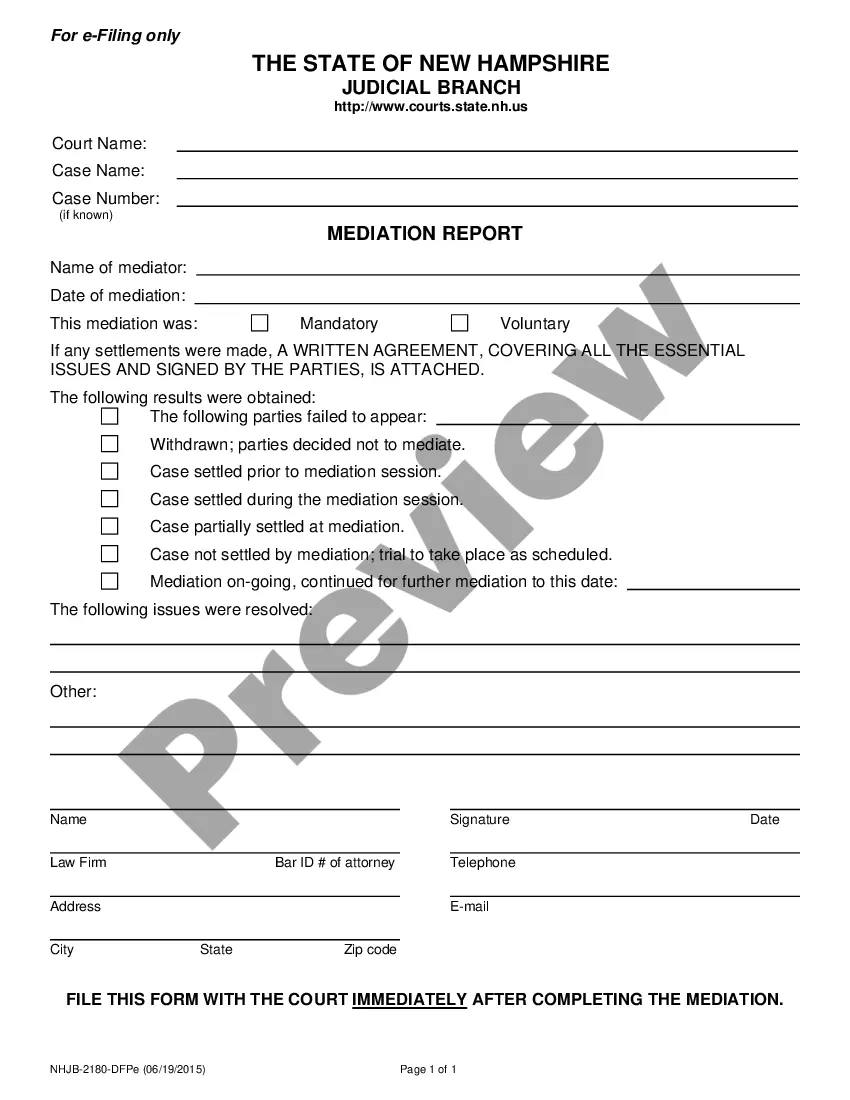

- Ensure the document visible on the page aligns with your legal circumstances and state laws by reviewing its text description or browsing through the Preview mode.

- Type the form name in the Search tab at the top of the page and choose your state from the dropdown to find another template if there are any discrepancies.

- Repeat the content review and click Buy now when you are certain that the paperwork meets all the requirements.

- Log In/">Log In to your account and click Download. Register for the service and select a subscription plan if you don’t already have one.

- Utilize your credit card or the PayPal option to complete your US Legal Forms subscription purchase. The blank will be available for download immediately afterward.

- Select the format in which you wish to receive your California Chapter 13 (Recommended Form) and download it by clicking the corresponding button.

- Upload your template to an online editor for quick completion and signing, or print it out to prepare a physical copy manually.

Form popularity

FAQ

Several factors can disqualify you from filing for California Chapter 13 (Recommended Form). If you have previously filed for Chapter 13 and did not complete the repayment plan, you may be ineligible. Additionally, exceeding certain debt limits or failing to provide required documentation can also prevent you from qualifying. For more details and assistance, the US Legal Forms platform can provide further clarity on your eligibility.

The average California Chapter 13 monthly payment varies based on your income, debts, and repayment plan. Generally, payments range from a few hundred to over a thousand dollars each month. To determine your expected payment, review your financial situation thoroughly, and you may also find insights on this topic through the US Legal Forms platform to help you make informed decisions.

To fill out the California Chapter 13 (Recommended Form), start by gathering all necessary financial documents, including income, expenses, debts, and assets. Next, follow the instructions in the form closely, ensuring you accurately input your financial data. If you're unsure about specifics, consider using the resources available on the US Legal Forms platform, which can guide you through each step of the process.

To file for California Chapter 13 (Recommended Form), there is no set minimum amount of debt required, but your debts must fall below a certain threshold. As of the latest guidelines, unsecured debts should be less than $419,275 and secured debts under $1,257,850. This structure allows you to qualify for a repayment plan that suits your financial situation. Understanding these limits is essential for effective planning, and using USLegalForms can help you determine your eligibility.

You can file for California Chapter 13 (Recommended Form) on your own, but it's often complicated. The process involves intricate paperwork and legal requirements that can be challenging to navigate alone. Using a service like USLegalForms can simplify this process, providing the necessary guidance and resources. This support can help ensure you complete all forms correctly and meet deadlines.

Filing for California Chapter 13 (Recommended Form) can provide significant benefits. This option allows you to reorganize your debts while keeping your valuable assets. It may offer you a manageable payment plan over three to five years, making your financial obligations less overwhelming. Choosing this path can lead to a fresh start and improved financial stability.

Yes, there are circumstances where you might be denied Chapter 13 in California. Common reasons include failing to meet the eligibility requirements, such as having excessive debt or not having a stable income. It is essential to understand these factors before filing. Utilizing the California Chapter 13 (Recommended Form) from US Legal Forms can help you prepare your case thoroughly and increase your chances of approval.