California Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Business Case)

Description

How to fill out California Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Business Case)?

Managing official paperwork necessitates focus, accuracy, and utilizing correctly-prepared templates. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your California Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Business Case) template from our collection, you can be confident it adheres to federal and state regulations.

Engaging with our service is straightforward and quick. To obtain the necessary documents, all you will need is an account with an active subscription. Here’s a brief guide for you to acquire your California Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Business Case) within moments.

All documents are prepared for multiple uses, like the California Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Business Case) available on this page. If you require them in the future, you can complete them without additional payment - just access the My documents tab in your profile and finalize your document whenever you need it. Experience US Legal Forms and streamline your business and personal documentation swiftly and in full legal adherence!

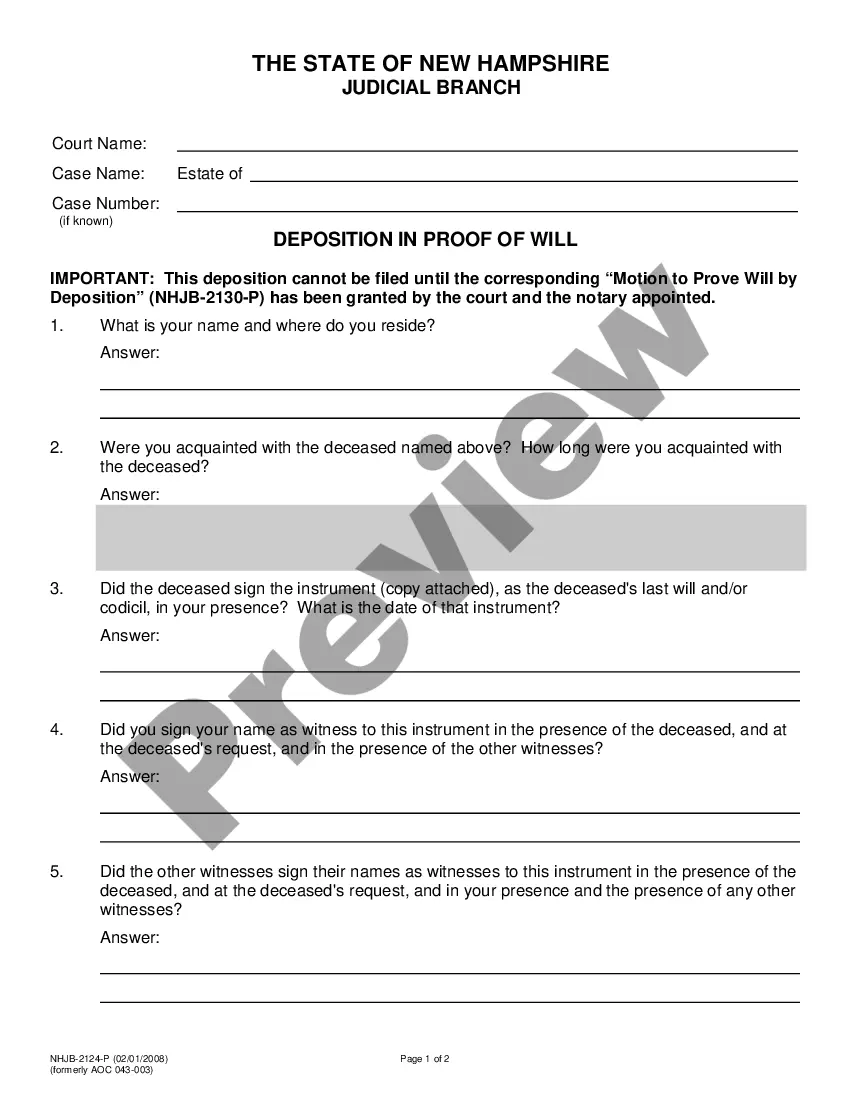

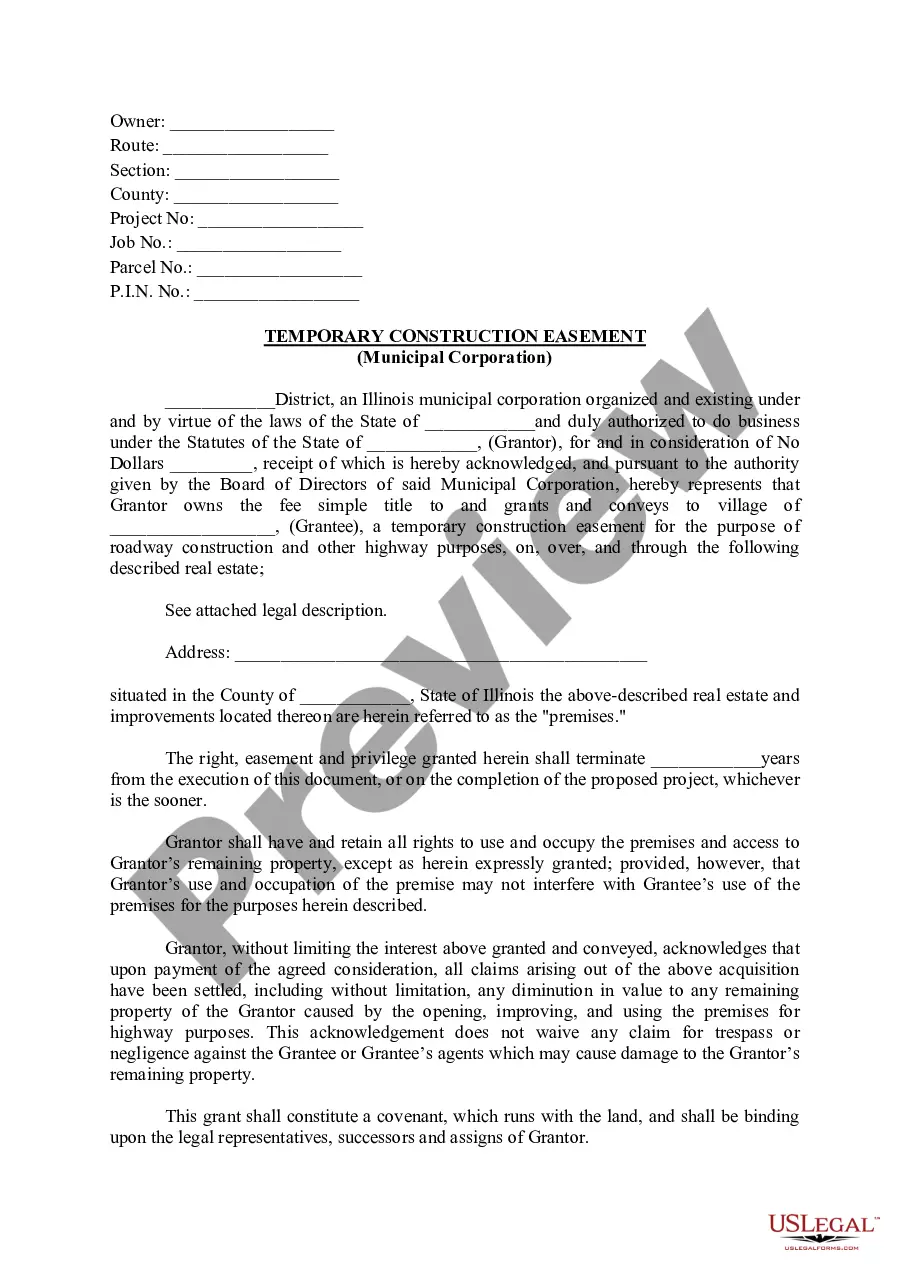

- Ensure to carefully review the form content and its alignment with general and legal standards by previewing it or reading its outline.

- Seek an alternative official template if the one you initially opened is not suitable for your situation or state rules (the tab for that is located at the top page corner).

- Log In to your account and download the California Rights And Responsibilities Of Chapter 13 Debtors And Their Attorneys (Business Case) in your desired format. If this is your first experience with our service, click Buy now to proceed.

- Register for an account, select your subscription package, and pay using your credit card or PayPal account.

- Choose the format in which you wish to receive your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

Form popularity

FAQ

Yes, Chapter 13 allows individuals to retain possession of their assets during the bankruptcy process. This feature is particularly beneficial for those who want to keep their homes and vehicles while possibly reducing their overall debt burden. Through the framework provided by the California Rights and Responsibilities of Chapter 13 Debtors and Their Attorneys (Business Case), you can develop a plan that prioritizes asset retention while managing your financial responsibilities.

Yes, a Chapter 13 debtor is considered a debtor in possession. This means you retain control over your property while adhering to the repayment plan approved by the court. As per the California Rights and Responsibilities of Chapter 13 Debtors and Their Attorneys (Business Case), you have the responsibility to manage your assets and maintain your financial affairs during the bankruptcy process.

Yes, you can keep your assets when you file for Chapter 13 bankruptcy in California. This process allows you to reorganize your debts while making manageable payments over three to five years. Under the California Rights and Responsibilities of Chapter 13 Debtors and Their Attorneys (Business Case), you can retain your property, including your home and car, as long as you stay current on your payment plan.

Collect Your California Bankruptcy Documents.Take a Credit Counseling Course.Complete the Bankruptcy Forms.Get Your Filing Fee.Print Your Bankruptcy Forms.File Your Forms With the California Bankruptcy Court.Mail Documents to Your Trustee.Take a Debtor Education Course.

If a creditor objects to your repayment plan, you will have an opportunity to respond to the objection. If you are able to overcome the objection, then your repayment plan will be approved, and you can proceed with your bankruptcy case.

In Chapter 13 bankruptcy, you must devote all of your "disposable income" to the repayment of your debts over the life of your Chapter 13 plan. Your disposable income first goes to your secured and priority creditors. Your unsecured creditors share any remaining amount.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

In Chapter 13 bankruptcy, you're able to keep expensive property like a house or a luxury car so long as you make monthly payments under a three-to-five year repayment plan. But unlike Chapter 7 which results in a discharge of debts in 96% of cases, only about 40% of Chapter 13 cases end in discharge.

You don't have to pay unsecured debts in full. Instead, you pay all your disposable income toward the debt during your three-year or five-year repayment plan. The unsecured creditors must receive as much as they would have if you'd filed Chapter 7.

A Chapter 13 bankruptcy can remain on your credit report for up to 10 years, and you will lose all your credit cards. Bankruptcy also makes it nearly impossible to get a mortgage if you don't already have one.