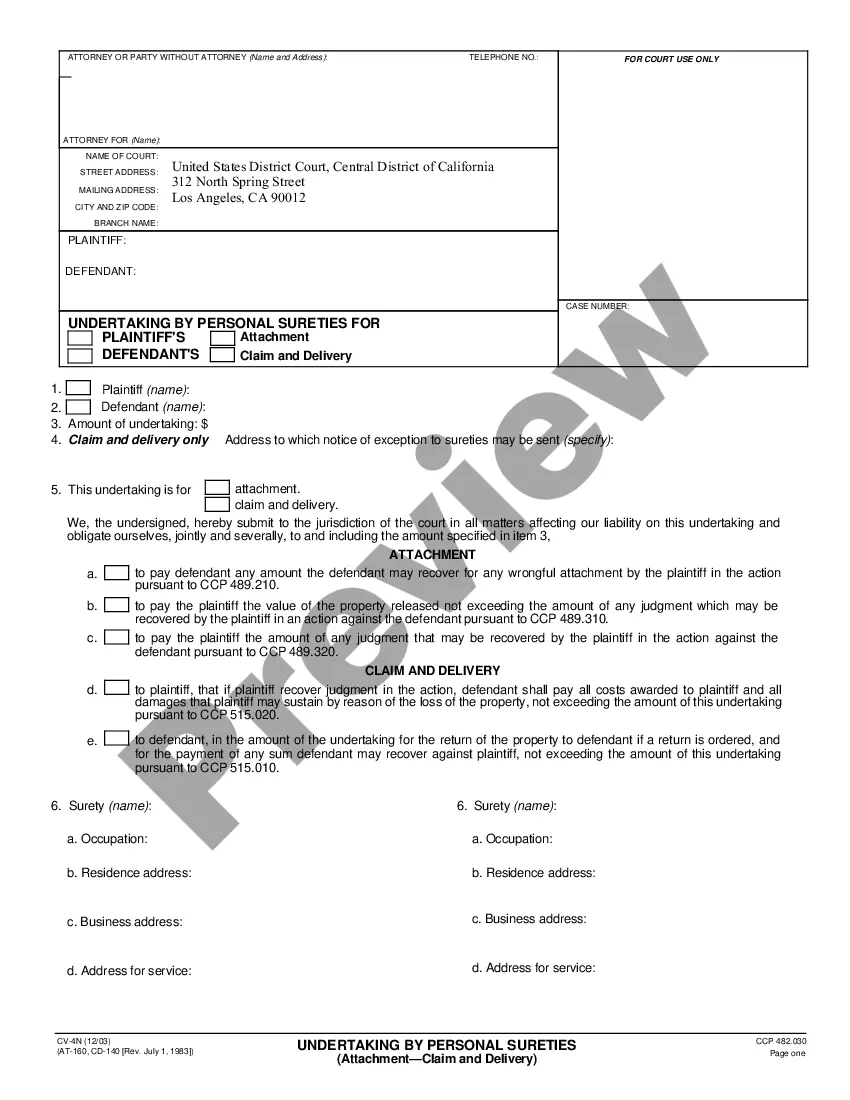

California Undertaking By Personal Sureties (Attachment-Claim And Delivery) is an agreement between a creditor and a debtor that allows a creditor to attach a debtor’s property to secure payment of a debt. The debtor agrees to give the creditor a lien on the property in exchange for a promise by the creditor to release the lien if the debt is paid. The security interest in the debtor's property is held by the surety, who is usually a third party such as a bank, trust company, or other financial institution. The surety agrees to pay the creditor if the debtor fails to pay the debt. This type of arrangement is commonly used when a debtor is unable to obtain financing from a traditional lender. There are two types of California Undertaking By Personal Sureties (Attachment-Claim and Delivery): 1. Attachment: This type of undertaking allows the creditor to attach the debtor’s property in order to secure payment of the debt. The attachment must be done by a court order and the creditor must file a claim and demand for delivery of the property. 2. Claim and Delivery: This type of undertaking allows the creditor to make a claim against the debtor’s property and demand delivery of the property. The creditor must file a claim in order to make a demand for delivery. The court will order the debtor to deliver the property to the creditor, or it can order the debtor to pay the debt.

California Undertaking By Personal Sureties (Attachment-Claim And Delivery)

Description

How to fill out California Undertaking By Personal Sureties (Attachment-Claim And Delivery)?

Engaging with legal paperwork demands focus, precision, and the utilization of well-structured templates. US Legal Forms has been assisting individuals nationwide for 25 years. Thus, when you select your California Undertaking By Personal Sureties (Attachment-Claim And Delivery) template from our platform, you can rest assured it adheres to both federal and state laws.

Utilizing our platform is straightforward and efficient. To obtain the necessary documentation, all you require is an account with a valid subscription. Here’s a brief guide to locate your California Undertaking By Personal Sureties (Attachment-Claim And Delivery) in mere minutes.

All documents are designed for multiple uses, such as the California Undertaking By Personal Sureties (Attachment-Claim And Delivery) displayed on this page. If you need them again, you can fill them out without additional payment - just navigate to the My documents section in your profile and complete your document whenever necessary. Experience US Legal Forms and efficiently prepare your business and personal paperwork in full legal compliance!

- Ensure you thoroughly scrutinize the form content and its alignment with general and legal standards by previewing it or reviewing its description.

- Look for an alternative formal template if the initially opened one does not meet your requirements or state laws (the link is located at the top corner of the page).

- Log In to your account and download the California Undertaking By Personal Sureties (Attachment-Claim And Delivery) in your desired format. If this is your first visit to our website, click Buy now to continue.

- Create an account, select your subscription plan, and make payment using your credit card or PayPal account.

- Determine the format in which you wish to receive your form and click Download. Print the blank or upload it to a professional PDF editor for paper-free submission.

Form popularity

FAQ

To fill out a surety bond form for the California Undertaking By Personal Sureties (Attachment-Claim And Delivery), start by gathering the necessary information, such as the names of the parties involved, the amount of the bond, and relevant dates. Clearly fill in each section of the form without any errors to avoid delays. Make sure to review the instructions carefully, as they provide additional guidelines specific to California requirements. If you need assistance, consider using USLegalForms, which offers easy-to-follow templates and resources designed to simplify the process.

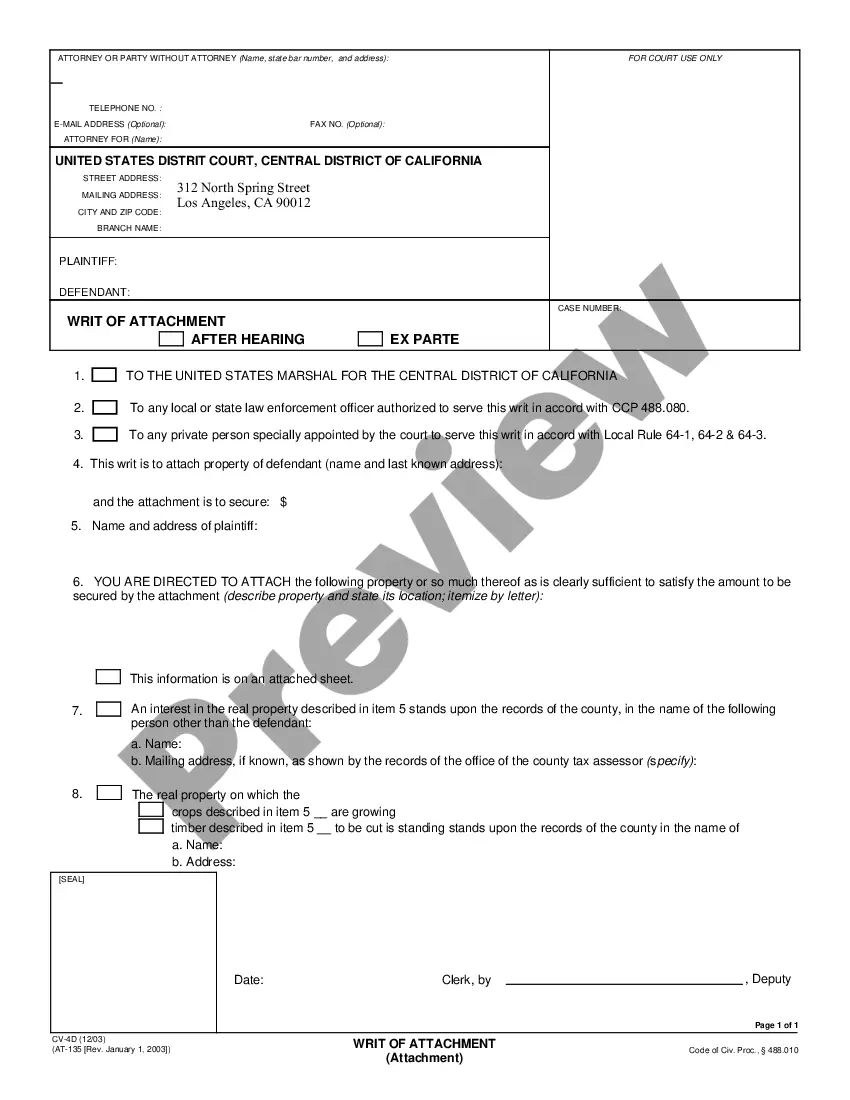

An attachment bond is a legal bond that a plaintiff must post to attach a defendant's property before a final judgment. This bond protects the defendant's interests by ensuring they can recover damages if the attachment is unjustified. It plays a critical role in balancing the interests of both the plaintiff and the defendant during litigation. The California Undertaking By Personal Sureties (Attachment-Claim And Delivery) can help you navigate the complexities of securing an attachment bond.

A bond for a writ is an assurance provided to the court that any financial liabilities arising from the writ will be met. This bond is crucial for maintaining the integrity of the judicial process by protecting the rights of all parties involved. The bond serves as a safety net for debtors, assuring that they will be compensated if the court ultimately rules in their favor. The California Undertaking By Personal Sureties (Attachment-Claim And Delivery) effectively facilitates this bond acquisition.

A bond for writ of attachment in California protects the interests of debtors during the attachment process. This bond ensures that if the attachment is later found to be wrongful, the debtor can receive compensation for any losses. It acts as a safeguard that promotes fairness in legal proceedings. Utilizing the California Undertaking By Personal Sureties (Attachment-Claim And Delivery) can help streamline obtaining this bond.

A writ of possession undertaking in California is a legal mechanism that allows a party to take possession of property that is in dispute. This undertaking is important when a creditor seeks to reclaim property without delay. By securing an undertaking, the creditor demonstrates their commitment to meet any financial obligations associated with the possession. The California Undertaking By Personal Sureties (Attachment-Claim And Delivery) is essential for ensuring this process runs smoothly.

In California, a writ of attachment typically remains valid for a specific period, often up to three years. After this time, you may need to renew the writ to continue its enforcement. It is essential to keep track of these timelines to ensure you can act quickly if necessary. The California Undertaking By Personal Sureties (Attachment-Claim And Delivery) provides a solid understanding of these timeframes and legal obligations.

A writ of attachment allows a creditor to seize a debtor's property before a court judgment. Once the court issues the writ, it authorizes the creditor to take possession of specified assets. This process ensures that the debtor cannot hide or waste the property during the litigation process. Understanding the California Undertaking By Personal Sureties (Attachment-Claim And Delivery) is vital, as it outlines the obligations you will need to fulfill.

You can request a writ of attachment by submitting a formal petition to the court. This petition should include details about your claim and the reasons for needing the writ. It's crucial to gather supporting evidence to enhance your chances of approval. Consider using the UsLegalForms platform to prepare your petition accurately and efficiently.

To obtain a writ of attachment in California, you must file an application in court. This process involves providing information about your claim and demonstrating that the debtor poses a risk of moving or hiding their assets. Seeking assistance from a legal professional can streamline your efforts. The California Undertaking By Personal Sureties (Attachment-Claim And Delivery) can be a useful resource during this process.