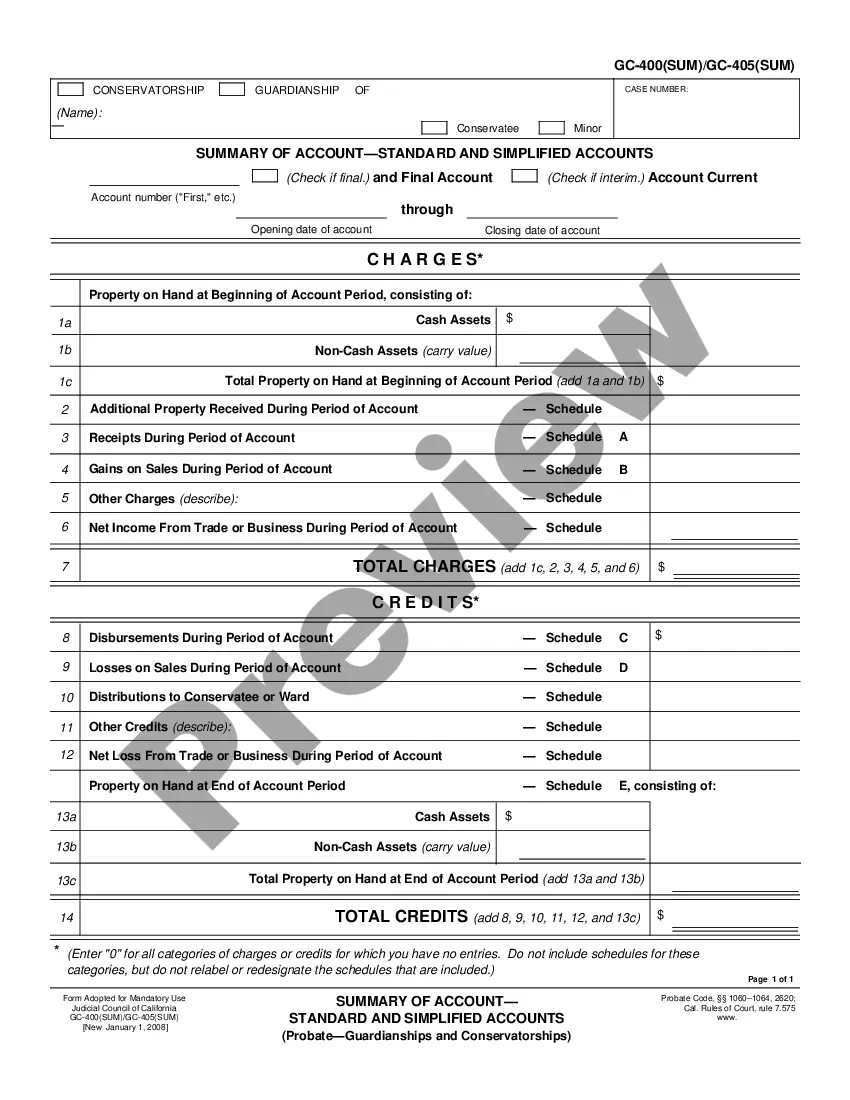

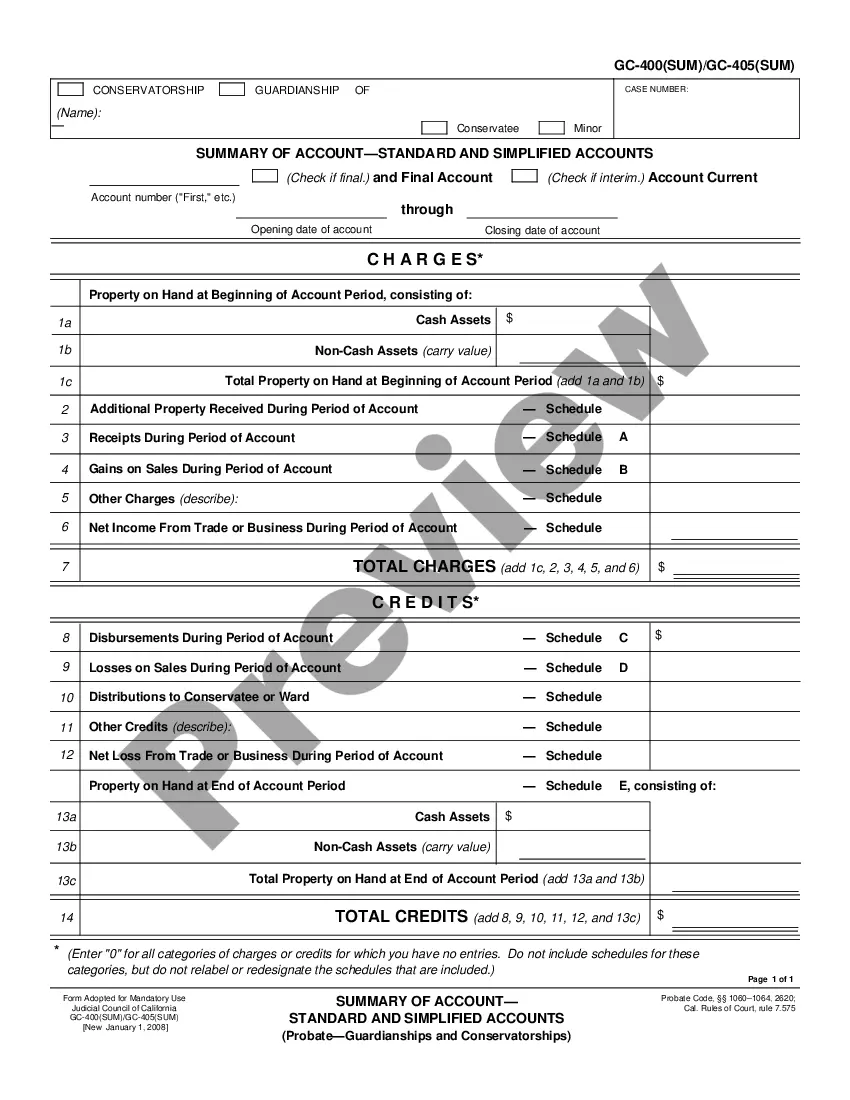

California Summary Of Account-Standard And Simplified Accounts (SOA) provide a high-level summary of an individual's financial status. The SOA is an important tool for understanding a person's financial situation, and it is used by lenders, credit card companies, and other financial institutions. The SOA is divided into two categories: Standard and Simplified. Standard SOA: The Standard SOA includes information such as total assets, total liabilities, net worth, and overall credit rating. It also includes details about the individual's income, expenses, and debt. Simplified SOA: The Simplified SOA includes only the most basic information such as total assets, total liabilities, and net worth. It does not include any details about the individual's income, expenses, or debt. Both Standard and Simplified Sons are used by lenders and other financial institutions to assess an individual's financial status. They are also used by individuals to understand their financial situation and to plan for their financial future.

California Summary Of Account-Standard And Simplified Accounts

Description

How to fill out California Summary Of Account-Standard And Simplified Accounts?

If you're looking for a method to correctly finalize the California Summary Of Account-Standard And Simplified Accounts without employing an attorney, then you have landed on the perfect site.

US Legal Forms has established itself as the largest and most esteemed collection of official templates for every individual and business scenario.

An additional fantastic aspect of US Legal Forms is that you never misplace the documents you've obtained - you can access any of your downloaded forms in the My documents tab of your profile whenever you require it.

- Ensure the document displayed on the page aligns with your legal circumstances and state laws by reviewing its text description or browsing through the Preview mode.

- Type the form title in the Search tab at the top of the page and select your state from the list to find an alternative template in case of any discrepancies.

- Revisit the content check and click Buy now when you feel assured of the document's adherence to all requirements.

- Log In to your account and select Download. Create an account with the service and choose a subscription plan if you haven't done so yet.

- Utilize your credit card or the PayPal option to purchase your US Legal Forms subscription. The form will be ready for download immediately afterward.

- Choose the format in which you wish to receive your California Summary Of Account-Standard And Simplified Accounts and download it by clicking the appropriate button.

- Incorporate your template into an online editor for quick completion and signing, or print it out to prepare your physical copy manually.

Form popularity

FAQ

Probate code compliant accounting in California refers to an accounting that meets statutory requirements set forth in the Probate Code. This includes providing accurate records of all estate assets, liabilities, receipts, and disbursements. Executors must prepare these accounts to ensure transparency and protect beneficiaries' interests. Using tools that explain the California Summary Of Account-Standard And Simplified Accounts can help executors stay compliant and organized.

To begin the conservatorship process in California, you must file a petition with the court outlining the need for a conservator. You'll also need to provide evidence regarding the individual's inability to care for themselves or manage their finances. The court will review your application and appoint a hearing date. Familiarizing yourself with the California Summary Of Account-Standard And Simplified Accounts can prepare you for the potential financial management responsibilities involved.

Yes, in California, executors generally must provide an accounting to beneficiaries unless they have a waiver. Beneficiaries have a right to know how the estate is being managed and how funds are being disbursed. This requirement promotes trust and transparency within the probate process. Resources on California Summary Of Account-Standard And Simplified Accounts offer useful insights for executors on their obligations.

Probate accounting involves documenting all financial transactions related to the estate during the probate process. Executors need to outline incoming and outgoing funds, including asset valuations and expenses. This process is crucial for transparency and accountability to the beneficiaries. Utilizing guidance on California Summary Of Account-Standard And Simplified Accounts can simplify preparing these financial statements.

In California, a waiver of accounting occurs when beneficiaries agree to forgo a formal accounting by the executor or administrator. This means the executor can manage the estate without providing detailed financial reports. Essentially, it streamlines the process and allows for quicker distribution. Understanding the California Summary Of Account-Standard And Simplified Accounts can help beneficiaries make informed decisions about waiving this accounting.

The final accounts for an estate consist of all financial records that reflect how the estate was administered. This typically includes inventories of assets, details on liabilities, and records of distributions to beneficiaries. Using the California Summary Of Account-Standard And Simplified Accounts can help streamline the documentation process, ensuring everything is organized and easily understood by all involved parties.

The final accounting form for probate is a legal document that provides a detailed summary of the estate's financial status prior to its closure. This form should comply with California probate law and typically includes income, expenses, and distributions made during the probate process. A resource like the California Summary Of Account-Standard And Simplified Accounts can guide you through filling out this form accurately.

Objections to the final accounting can arise from various parties interested in the estate, often due to perceived inaccuracies or omissions. Common objections include disputes over expenses, mismanagement of funds, or disagreements on asset valuations. Addressing these objections early in the process, ideally using the California Summary Of Account-Standard And Simplified Accounts, can facilitate smoother resolutions.

Probate accounting in California requires a detailed and accurate representation of the estate's financial transactions. Necessary components include records of assets, debts, income, and expenditures. By utilizing the California Summary Of Account-Standard And Simplified Accounts, you can ensure that all required elements are included and presented correctly, reducing the chances for disputes.

The final accounting of probate is a comprehensive report that summarizes all financial activities related to the estate. This document details all income, expenses, distributions, and any other transactions that occurred during the probate process. Utilizing the California Summary Of Account-Standard And Simplified Accounts can simplify the preparation of this final accounting and enhance clarity for all interested parties.