California Application For Earnings Witholding Order For Taxes test

Description

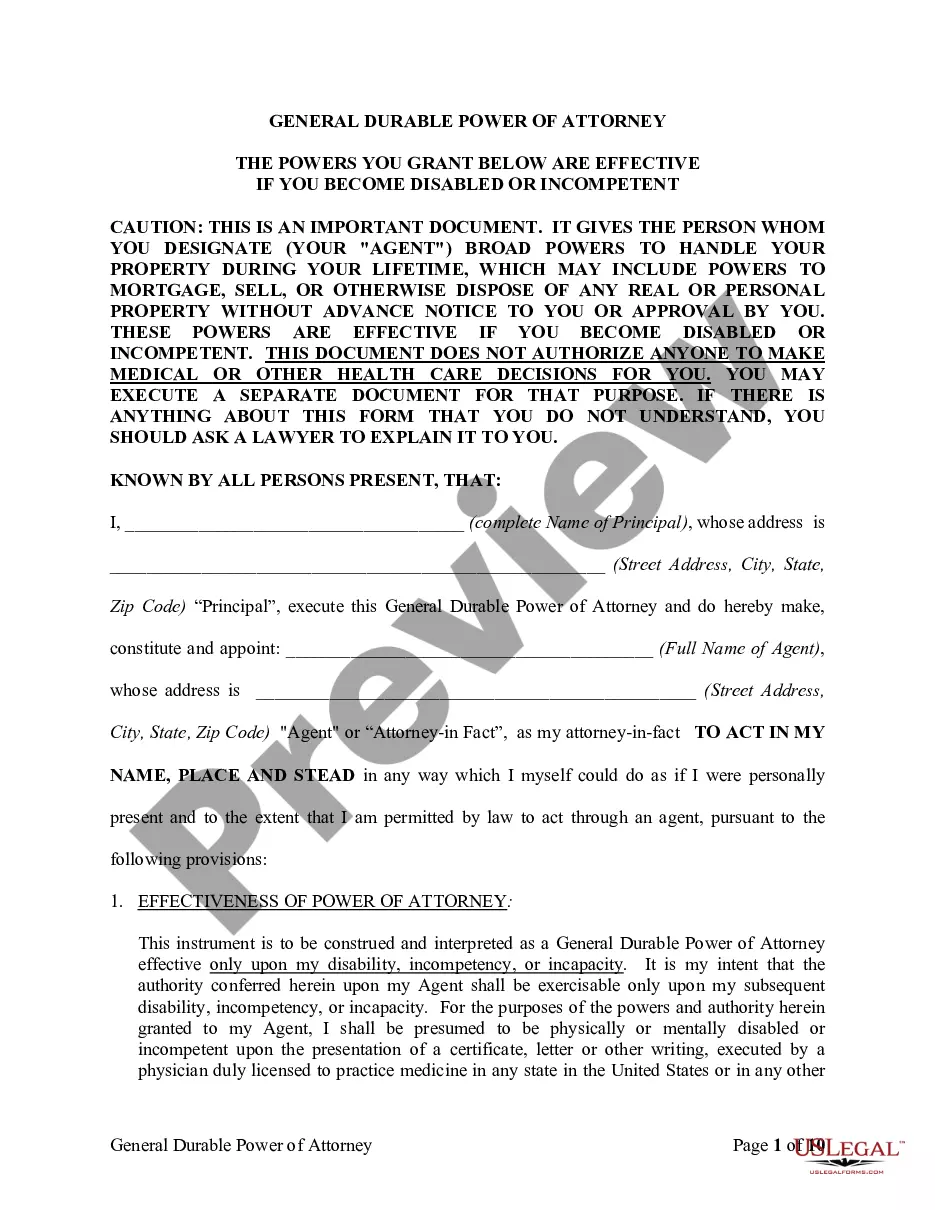

How to fill out California Application For Earnings Witholding Order For Taxes Test?

Drafting legitimate documents can be quite a hassle unless you have accessible fillable templates ready to use. With the US Legal Forms virtual collection of official paperwork, you can trust the blanks you discover, as all of them align with federal and state laws and have been validated by our experts.

Acquiring your California Application For Earnings Withholding Order For Taxes document from our collection is as simple as 1-2-3. Previously registered users with an active subscription just need to Log In and press the Download button after finding the appropriate template. Later on, if required, users can retrieve the same blank from the My documents section of their profile.

Have you not tried US Legal Forms yet? Sign up for our service today to access any official document swiftly and effortlessly whenever you require it, and maintain your paperwork organized!

- Document compliance review. You should carefully examine the content of the form you wish to ensure it meets your needs and adheres to your state laws. Previewing your document and reading its general overview will assist you in this process.

- Alternative search (optional). If you discover any discrepancies, navigate the library using the Search tab on the top of the page until you locate a suitable blank, and click Buy Now when you identify the one you require.

- Account setup and form acquisition. Establish an account with US Legal Forms. After account authentication, Log In and choose your best-suited subscription plan. Complete your payment to proceed (options for PayPal and credit cards are available).

- Template download and subsequent use. Select the file format for your California Application For Earnings Withholding Order For Taxes document and click Download to save it to your device. Print it for manual completion of your documents, or utilize a multi-featured online editor to create an electronic version more quickly and effectively.

Form popularity

FAQ

In California, the maximum amount that can be withheld for child support is generally 50% of disposable earnings for an employee who is supporting another spouse or child. If the individual is not supporting anyone else, this percentage may increase to 60%. Understanding these limits is crucial when utilizing the California Application For Earnings Withholding Order For Taxes test to ensure legal compliance.

The time it takes for an income withholding order to take effect can vary, but it usually occurs within a few weeks once the employer receives the order. Employers are required to implement the order in a timely manner, but delays may arise from paperwork or internal processes. Utilize the California Application For Earnings Withholding Order For Taxes test for guidance on managing timelines effectively.

To calculate disposable earnings for garnishment in California, first determine the employee's gross earnings, then subtract mandatory deductions like taxes and Social Security. The remaining amount represents disposable earnings, which can be subject to garnishment. This process is crucial when using the California Application For Earnings Withholding Order For Taxes test to ensure compliance with state rules.

An earnings withholding order for taxes is a legal directive that instructs an employer to deduct a specified amount from an employee's paycheck to satisfy tax obligations. This type of order ensures that outstanding tax debts are collected systematically. Understanding the California Application For Earnings Withholding Order For Taxes test can provide insights on how these orders are implemented and managed.

If an employer fails to withhold child support in Pennsylvania, the employee may face legal repercussions, including wage garnishments and possible fines. In addition, the custodial parent may file a complaint with the court to enforce the support order. Utilizing the California Application For Earnings Withholding Order For Taxes test can help clarify the obligations and processes involved in ensuring proper withholding.

Filling out California tax withholding involves completing the state’s tax forms accurately to reflect your financial situation. You will need to input your personal details, dependents, and any additional amounts you wish to withhold. The California Application For Earnings Withholding Order For Taxes test provides guidance on this process, ensuring you properly manage your tax obligations. For assistance, consider using resources from US Legal Forms to simplify the form-filling process.

An earnings withholding order is a legal directive that instructs an employer to deduct a specified amount from an employee’s wages for tax obligations or debt. Understanding this process is key for anyone looking to manage their taxes effectively. To learn more about the process, explore our information on the California Application For Earnings Withholding Order For Taxes test available on our platform.

To stop garnishment from the California Franchise Tax Board, you need to address your tax liability and possibly negotiate a payment arrangement. Filing the appropriate forms, such as the California Application For Earnings Withholding Order For Taxes test, can be necessary for resolving these issues. Our platform provides tools that can help you manage the situation more effectively.

Yes, California does have state income tax forms that individuals must complete for filing their taxes. These forms vary based on income level and filing status, and correctly filling them out is crucial for compliance. For clarity on these forms, look into the resources for the California Application For Earnings Withholding Order For Taxes test we offer.

The form for tax withholding in California is typically the DE-4 form, which allows employees to indicate their withholding preferences. Ensuring you fill out this form accurately can help prevent issues with tax deductions. To find more useful forms and information, consider checking the California Application For Earnings Withholding Order For Taxes test on our site.