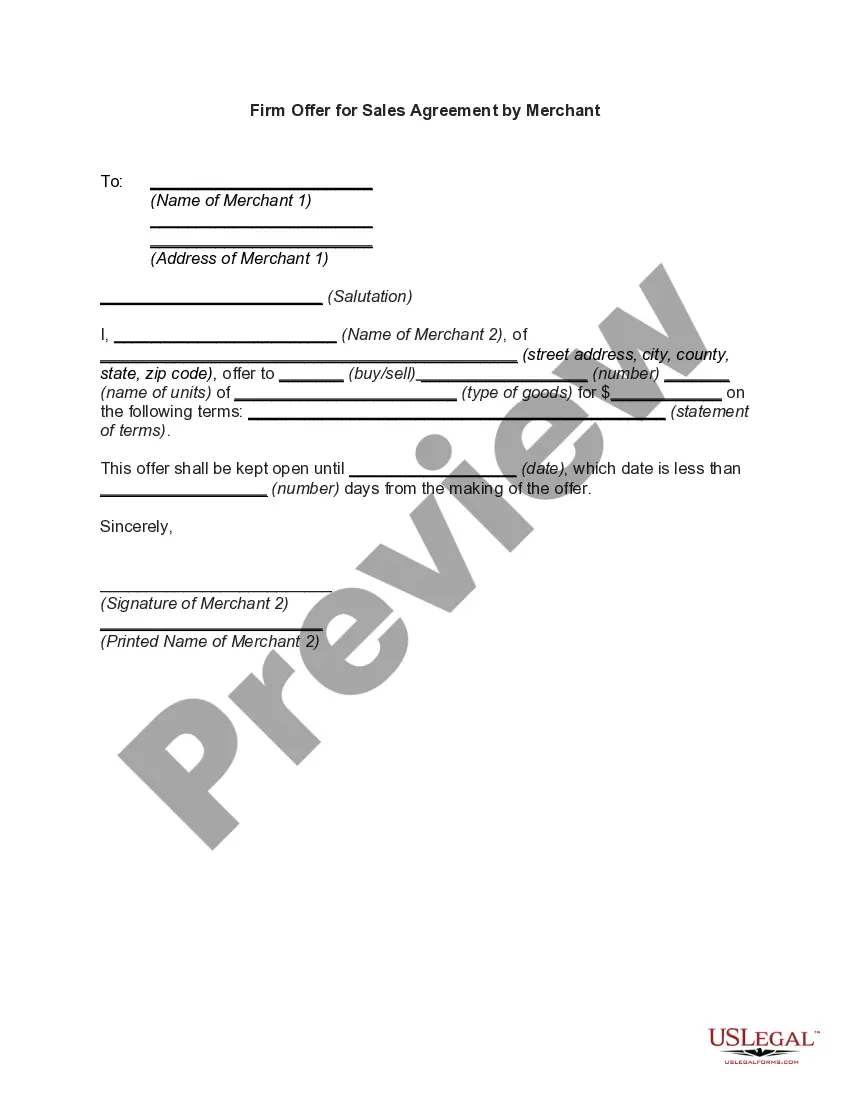

This form is a sample letter in Word format covering the subject matter of the title of the form.

California Sample Letter for Payoff of Loan held by Mortgage Company is a written document used by borrowers to inform their mortgage company of their intention to pay off their loan. This letter typically includes specific details about the loan and the borrower's account. Keywords: California, Sample Letter, Payoff of Loan, Mortgage Company There are several types of California Sample Letters for Payoff of Loan held by Mortgage Company, including: 1. Basic Payoff Letter: This type of letter includes the borrower's contact information, loan account number, and the date by which the borrower intends to pay off the loan. It may also request a payoff statement from the mortgage company. 2. Demand Payoff Letter: In situations where the borrower needs an immediate response or wants to expedite the loan payoff process, a demand payoff letter may be used. This letter usually includes a specific deadline for the mortgage company to provide a payoff amount and instructions for finalizing the payoff. 3. Final Payoff Letter: Once the borrower has successfully paid off the loan, they can send a final payoff letter to the mortgage company. This letter confirms the completion of the loan repayment and requests a satisfaction of mortgage or release of lien document. 4. Partial Payoff Letter: If the borrower wants to pay off only a portion of the loan, a partial payoff letter is used. This letter outlines the amount being paid and confirms that the borrower intends to continue making regular payments for the remaining balance. When writing a California Sample Letter for Payoff of Loan held by Mortgage Company, it is crucial to include relevant information such as: — Borrower's full name, address, and contact information — Mortgage company's name, address, and contact information — Loan account number or reference number — Date of thletterte— - Specific request for a payoff statement, if needed — Payment method for the loan payoff (e.g., certified check, wire transfer) — The amount intended to be paid of— - Request for a final payoff statement or satisfaction of mortgage document, if applicable — A clear deadline for the mortgage company to respond or provide necessary information — Any additional instructions or requirements for the mortgage company to process the payoff Remember to always adapt the content to suit your specific circumstances and consult a professional for legal or financial advice.California Sample Letter for Payoff of Loan held by Mortgage Company is a written document used by borrowers to inform their mortgage company of their intention to pay off their loan. This letter typically includes specific details about the loan and the borrower's account. Keywords: California, Sample Letter, Payoff of Loan, Mortgage Company There are several types of California Sample Letters for Payoff of Loan held by Mortgage Company, including: 1. Basic Payoff Letter: This type of letter includes the borrower's contact information, loan account number, and the date by which the borrower intends to pay off the loan. It may also request a payoff statement from the mortgage company. 2. Demand Payoff Letter: In situations where the borrower needs an immediate response or wants to expedite the loan payoff process, a demand payoff letter may be used. This letter usually includes a specific deadline for the mortgage company to provide a payoff amount and instructions for finalizing the payoff. 3. Final Payoff Letter: Once the borrower has successfully paid off the loan, they can send a final payoff letter to the mortgage company. This letter confirms the completion of the loan repayment and requests a satisfaction of mortgage or release of lien document. 4. Partial Payoff Letter: If the borrower wants to pay off only a portion of the loan, a partial payoff letter is used. This letter outlines the amount being paid and confirms that the borrower intends to continue making regular payments for the remaining balance. When writing a California Sample Letter for Payoff of Loan held by Mortgage Company, it is crucial to include relevant information such as: — Borrower's full name, address, and contact information — Mortgage company's name, address, and contact information — Loan account number or reference number — Date of thletterte— - Specific request for a payoff statement, if needed — Payment method for the loan payoff (e.g., certified check, wire transfer) — The amount intended to be paid of— - Request for a final payoff statement or satisfaction of mortgage document, if applicable — A clear deadline for the mortgage company to respond or provide necessary information — Any additional instructions or requirements for the mortgage company to process the payoff Remember to always adapt the content to suit your specific circumstances and consult a professional for legal or financial advice.