A California Corporate Resolution for Single Member LLC is a legally binding document that outlines the decisions made by the sole owner of a Limited Liability Company (LLC). It serves as a written record of the LLC owner's actions, providing evidence of important resolutions and decisions. This document is crucial for maintaining proper corporate governance and protecting the owner's liability protection. There are several types of California Corporate Resolutions for Single Member LLC, including: 1. Appointment of an Authorized Signatory: This type of resolution designates an individual, usually the LLC owner or a trusted employee, as the authorized signatory for the company. The authorized signatory is granted the authority to sign contracts, agreements, and other legal documents on behalf of the LLC. 2. Bank Account Establishment: This resolution is used when the LLC owner decides to open a bank account solely for the company's use. It specifies the name of the bank, the type of account, and any additional requirements or restrictions for the account. Furthermore, this resolution authorizes the designated signatory to deposit and withdraw funds on behalf of the LLC. 3. Business Transactions: This type of resolution covers important business decisions made by the LLC owner regarding day-to-day operations. It could include authorizing the purchase or sale of assets, entering into contracts, hiring employees, or terminating contracts. 4. Tax Matters: This resolution addresses tax-related decisions made by the LLC owner, such as filing tax returns, appointing a tax professional, or applying for tax identification numbers. 5. Dissolution of LLC: In the event that the LLC owner decides to dissolve the company, a resolution is necessary to document this decision. It outlines the steps to be taken for winding down the business, notifying creditors, and distributing assets. Each type of resolution includes essential details such as the date of the resolution, the name and contact information of the LLC owner, and a clear and concise description of the decision being made. Signatures of the LLC owner, witnesses, and any appropriate parties involved may also be required to ensure the resolution's validity. Additionally, it is advisable to keep a copy of the resolution in the company's records for future reference and compliance with regulatory requirements.

Limited Liability Company

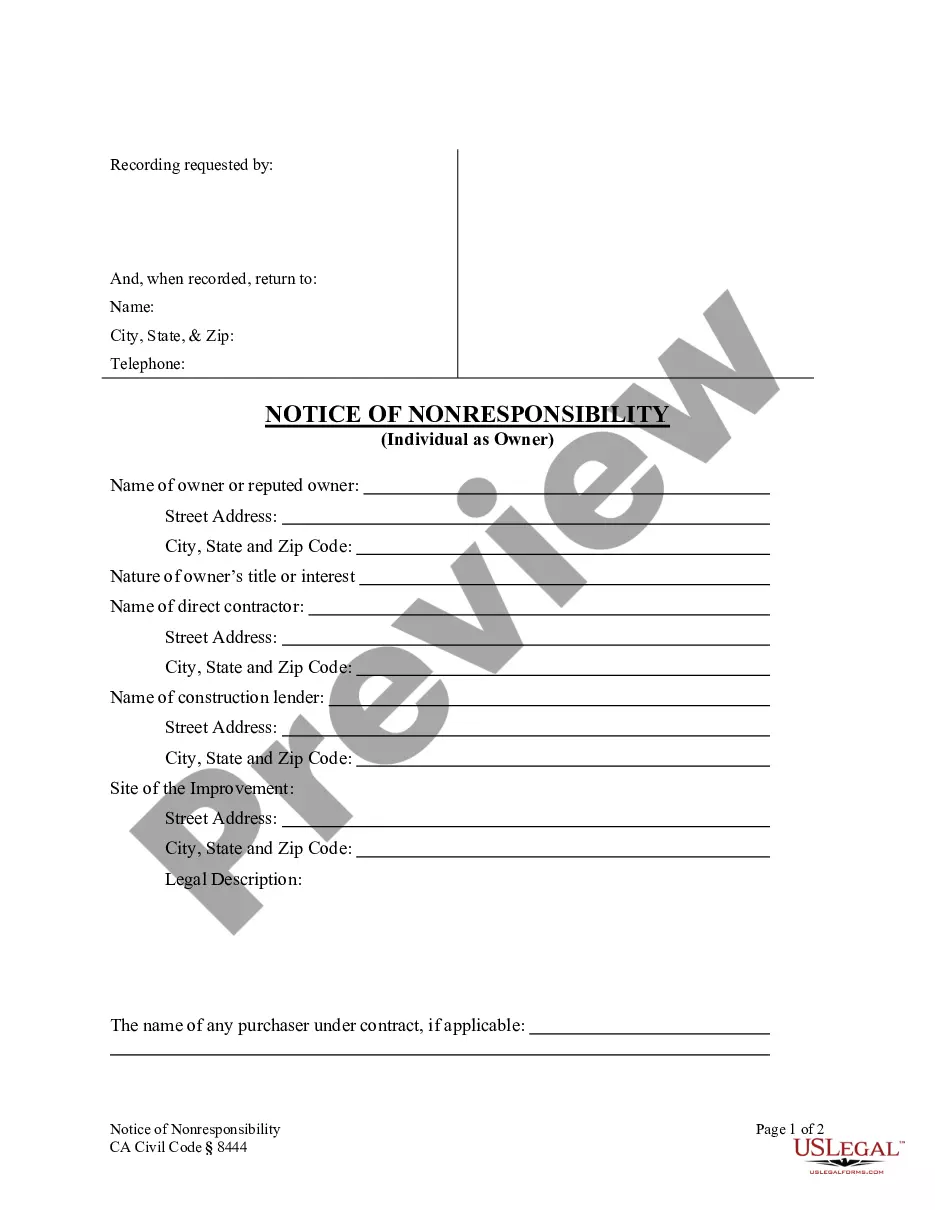

Description corporate resolution form california

How to fill out California Corporate Resolution For Single Member LLC?

If you're looking to acquire, download, or print authentic document templates, utilize US Legal Forms, the largest collection of official forms available online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you need.

A variety of templates for business and personal reasons are categorized by types and states, or keywords.

Each legal document template you purchase belongs to you permanently. You can access every form you've downloaded within your account. Click on the My documents section to select a form for printing or downloading again.

Be proactive and download, and print the California Corporate Resolution for Single Member LLC with US Legal Forms. There are millions of professional and state-specific forms available for your personal or business needs.

- Utilize US Legal Forms to find the California Corporate Resolution for Single Member LLC with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and then click the Acquire button to access the California Corporate Resolution for Single Member LLC.

- You can also retrieve forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form appropriate for the intended city/state.

- Step 2. Utilize the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you find the form unsatisfactory, employ the Lookup box at the top of the screen to search for alternative versions of the document template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account for the transaction.

- Step 6. Select the format of the official form and download it to your device.

- Step 7. Complete, review, and print or sign the California Corporate Resolution for Single Member LLC.

Form popularity

FAQ

A corporate resolution is a legal document that outlines actions a board of directors will take on behalf of a corporation. by Staff.

Your SMLLC should have its own bank account. Payments your business receives for its goods and services should be deposited in that account, and money in the account should be used only for business purposes.

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution.

During the first meeting of the members (LLC) or Board of Directors (Corporation), it is common for a business to establish a board resolution top open a bank account. A banking resolution is often one of the most necessary, as a business cannot generally create a bank account without one.

Updated October 30, 2020: An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.

What Is an LLC Banking Resolution? An LLC Banking Resolution is a formal document needed for an LLC to establish a bank relationship. It defines the representatives who are authorized to manage the company's bank account, including their roles and privileges.

Interesting Questions

More info

Legal business Legal Services.