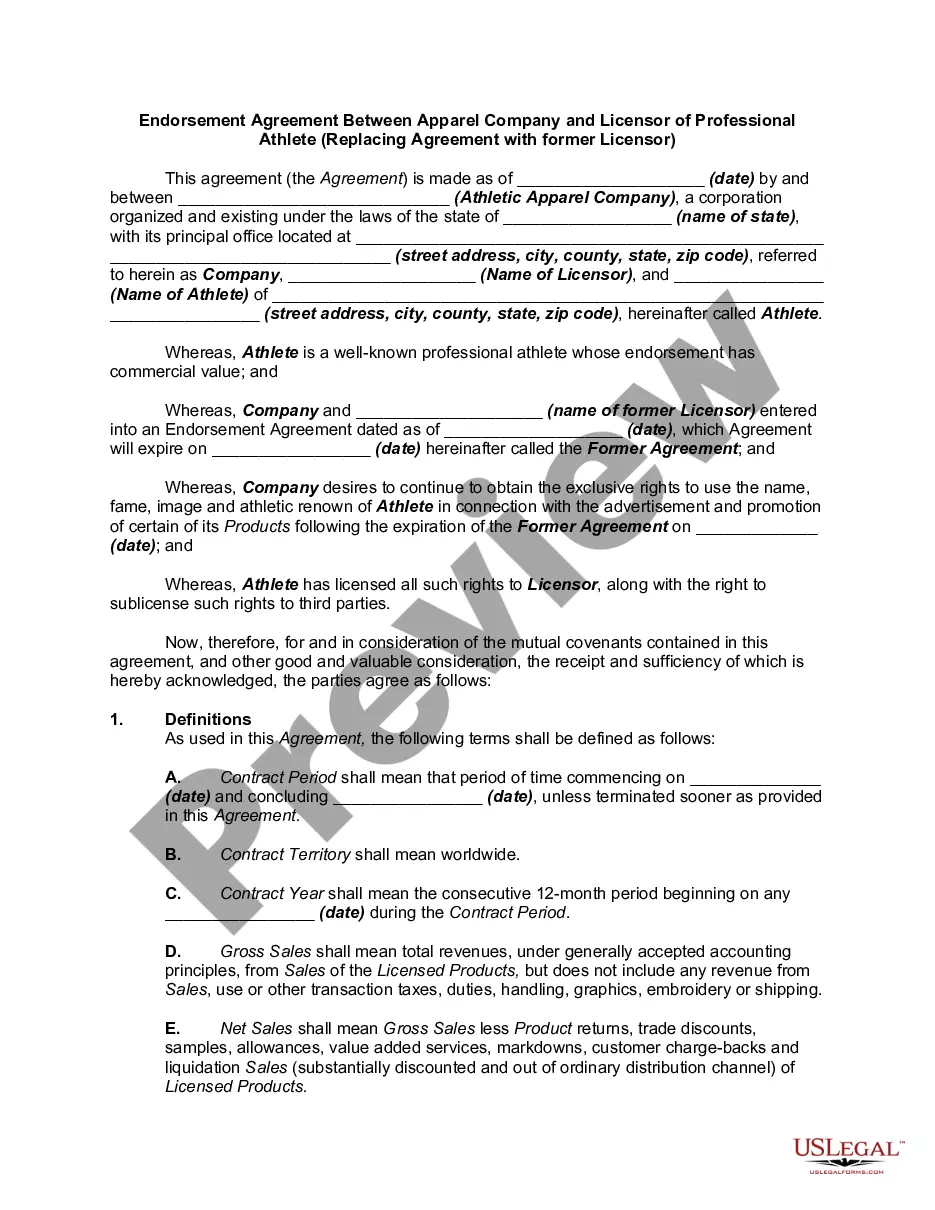

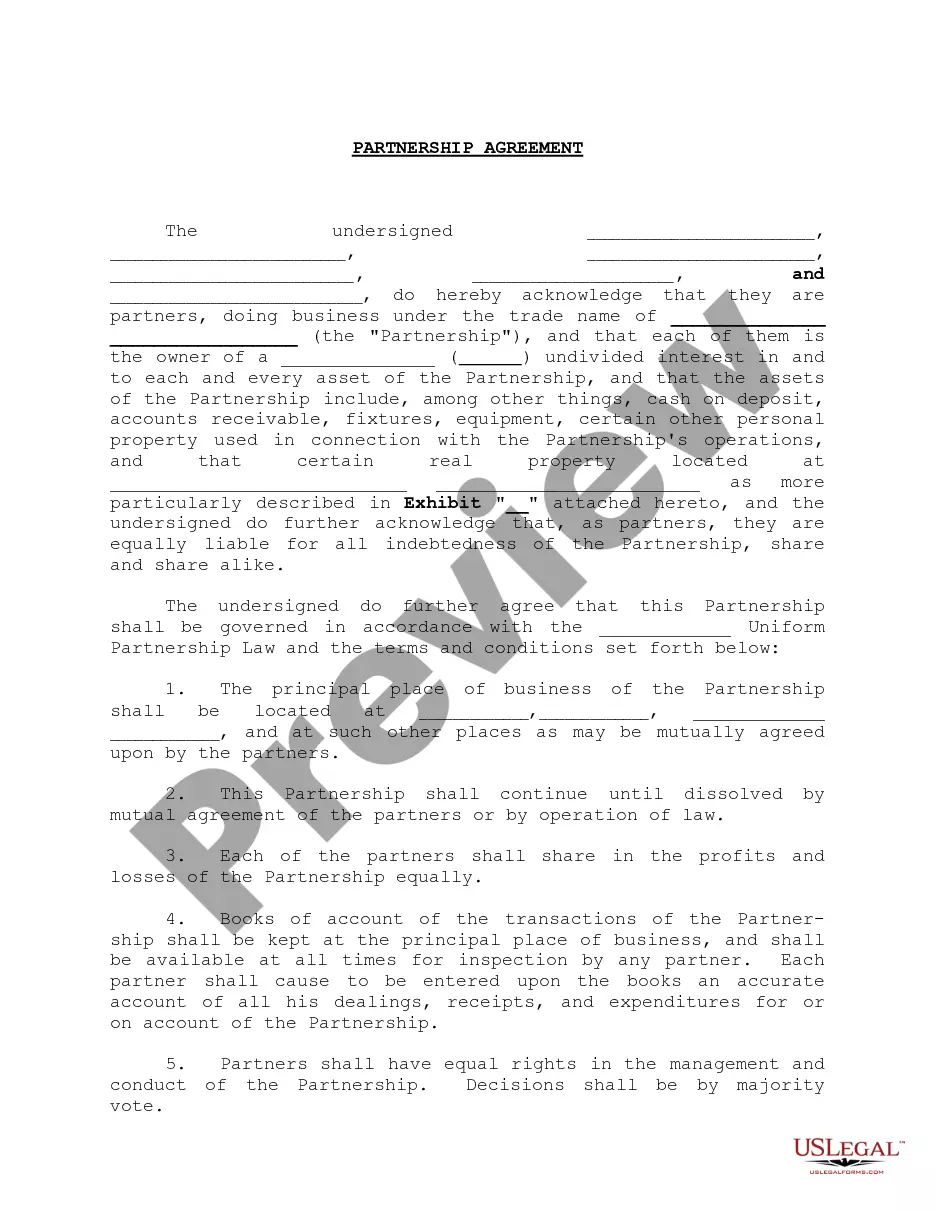

A California Asset Purchase Agreement — Business Sale is a legally binding contract that defines the terms and conditions surrounding the sale of a business. It typically involves the transfer of assets, excluding liabilities, from the seller to the buyer. This agreement is specific to the state of California and is governed by the laws of the state. It is designed to protect the interests of both parties involved in the transaction and ensure a smooth transfer of the business. The agreement contains various provisions that cover essential aspects of the sale, including the purchase price, payment terms, and specifics about the assets being transferred. It outlines the rights, responsibilities, and obligations of the buyer and seller, ensuring that both parties are aware of their duties. The purchase price is a key component of the agreement and typically includes the valuation of the business, as well as the payment terms. It specifies whether the payment will be made in a lump sum or if it will be structured over a period of time. Additionally, the agreement may outline any representations or warranties made by the seller regarding the assets being sold, ensuring that the buyer is informed about the condition and value of the assets. California Asset Purchase Agreements — Business Sale can vary depending on the specific type of business being sold. Some types of business sales that may have different agreements include: 1. Stock Purchase Agreement: This agreement involves the sale of a company's shares to the buyer. It differs from an asset purchase agreement because the buyer acquires the company's entire assets and liabilities. 2. Intellectual Property Assignment Agreement: This agreement pertains to the transfer of patent, trademarks, copyrights, or other intellectual property rights from the seller to the buyer. It ensures that all rights related to the intellectual property are properly transferred. 3. Real Estate Purchase Agreement: In some cases, the sale of a business may also involve the transfer of real estate. In such cases, a separate agreement may be needed to cover the sale of the property, including details about the purchase price, contingencies, and closing procedures. Overall, a California Asset Purchase Agreement — Business Sale serves as a comprehensive document that governs the sale of a business. It protects the rights and interests of both the buyer and seller, ensuring a fair and efficient transaction.

California Asset Purchase Agreement - Business Sale

Description

How to fill out California Asset Purchase Agreement - Business Sale?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document templates that you can download or create.

By using the website, you can access thousands of templates for business and personal use, categorized by types, states, or keywords. You can obtain the latest versions of documents like the California Asset Purchase Agreement - Business Sale in moments.

If you already possess a subscription, Log In and download the California Asset Purchase Agreement - Business Sale from the US Legal Forms repository. The Download button will be visible on every template you view. You have access to all previously saved documents in the My documents section of your account.

Select the format and download the document to your device.

Make modifications. Complete, modify, print, and sign the saved California Asset Purchase Agreement - Business Sale. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or create another version, simply visit the My documents section and click on the template you need.

- If you wish to use US Legal Forms for the first time, below are straightforward steps to get started.

- Ensure you have selected the appropriate template for your city/region. Click the Preview button to review the document's content.

- Examine the document summary to make sure you have chosen the correct template.

- If the template does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your selection by clicking the Buy now button. Then, choose the pricing plan you want and provide your details to register for an account.

- Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

When a person liable for sales and use taxes sells his or her business or stock of goods, the Buyer must withhold a specific portion of the purchase price to pay any sales or use taxes owed by the Seller to the California State Board of Equalization ("SBE") (RTC Section 6811).

In an asset sale, sellers are subject to potentially higher taxes than in a stock sale. While intangible assets, such as goodwill, are taxed at capital gains rates, other hard assets may be taxed at higher ordinary income tax rates. Currently, federal capital gains rates are around 20%, while state rates vary.

An asset sale involves the purchase of some or all of the assets owned by a company. Examples of common assets which are sold include; plant and equipment, land, buildings, machinery, stock, goodwill, contracts, records and intellectual property (including domain names and trademarks).

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

The result reflects whether your company made a profit or took a loss on the sale of the property.Step 1: Debit the Cash Account.Step 2: Debit the Accumulated Depreciation Account.Step 3: Credit the Property's Asset Account.Step 4: Determine the Property's Book Value.Step 5: Credit or Debit the Disposal Account.

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices.

In an asset purchase, Buyer and Seller allocate the purchase price to the different assets, first to tangible assets, based on fair market value, then to intangibles other than goodwill, and finally to goodwill. The Buyer takes the assets with a tax basis equal to the portion of the purchase price allocated to them.

As of October 2016, only five states in the U.S. do not impose a state sales tax. The rest have a state sales tax with California charging the most. As a retailer, it is your responsibility to file and pay the sales taxes on products you sell within the state although most retailers simply charge it to the customer.

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.