California Asset Purchase Agreement - More Complex

Description

How to fill out Asset Purchase Agreement - More Complex?

US Legal Forms - among the greatest libraries of lawful types in America - gives an array of lawful papers web templates you may obtain or printing. While using site, you can find a large number of types for business and individual uses, sorted by classes, suggests, or keywords.You will find the most up-to-date types of types such as the California Asset Purchase Agreement - More Complex in seconds.

If you have a monthly subscription, log in and obtain California Asset Purchase Agreement - More Complex through the US Legal Forms collection. The Obtain option can look on every kind you see. You have accessibility to all previously acquired types from the My Forms tab of the accounts.

In order to use US Legal Forms the very first time, allow me to share basic recommendations to help you get began:

- Be sure you have chosen the right kind for your area/county. Select the Preview option to analyze the form`s articles. Read the kind information to ensure that you have selected the right kind.

- When the kind does not match your requirements, take advantage of the Search area on top of the monitor to find the one who does.

- If you are satisfied with the form, confirm your choice by clicking on the Purchase now option. Then, select the prices plan you want and supply your qualifications to register to have an accounts.

- Procedure the purchase. Make use of Visa or Mastercard or PayPal accounts to finish the purchase.

- Choose the structure and obtain the form on your own gadget.

- Make modifications. Fill up, modify and printing and sign the acquired California Asset Purchase Agreement - More Complex.

Every single template you put into your money does not have an expiration time which is your own permanently. So, if you want to obtain or printing another duplicate, just check out the My Forms segment and then click in the kind you will need.

Obtain access to the California Asset Purchase Agreement - More Complex with US Legal Forms, by far the most considerable collection of lawful papers web templates. Use a large number of skilled and express-distinct web templates that satisfy your small business or individual requires and requirements.

Form popularity

FAQ

Here are the key components of a real estate purchase agreement: The address and description of the property being purchased. The name, address, and contact information of the buyer and seller of the property. The agreed purchase price.

When you make a purchase offer on a home, make sure you fully understand all of the conditions specified in your contract. Some important contingency clauses should include financing, home inspections, closing costs, and the closing date, among others.

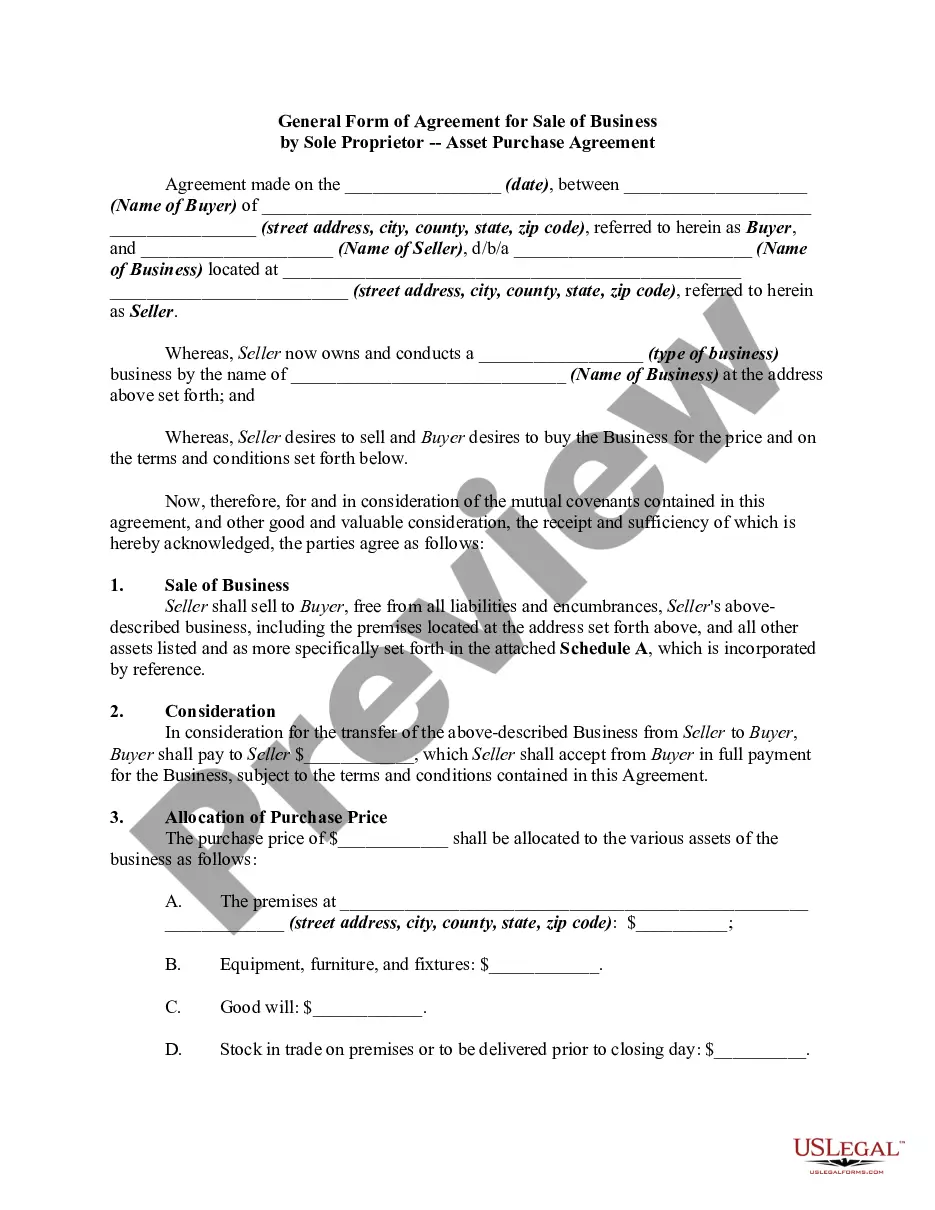

An Asset Purchase Agreement (APA) is a contract that spells out the terms of the sale in precise detail. It is a legally binding agreement that formalizes the price, deal structure, terms, and other aspects of the transaction. All in all, it is one of the most important legal documents during the acquisition process.

There are two core methods to buy or sell a business: an asset purchase or a share purchase. An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

The asset purchase agreement is typically prepared by the buyer's lawyer. However, it is important to have the agreement reviewed by a business lawyer to ensure that all assets are properly transferred and that the purchase price is fair.

First and foremost, a purchase agreement must outline the property at stake. It should include the exact address of the property and a clear legal description. Additionally, the contract should include the identity of the seller and the buyer or buyers.

The Mortgage. By far, the main reason why deals fall through is that buyers fail to get mortgage approval.

A purchase and sale agreement is used to document the parties' intentions and the terms they have agreed will govern the transaction. You can include specific terms like the product or property, the price of the product or property, conditions for the delivery of the product, and the date of product delivery.