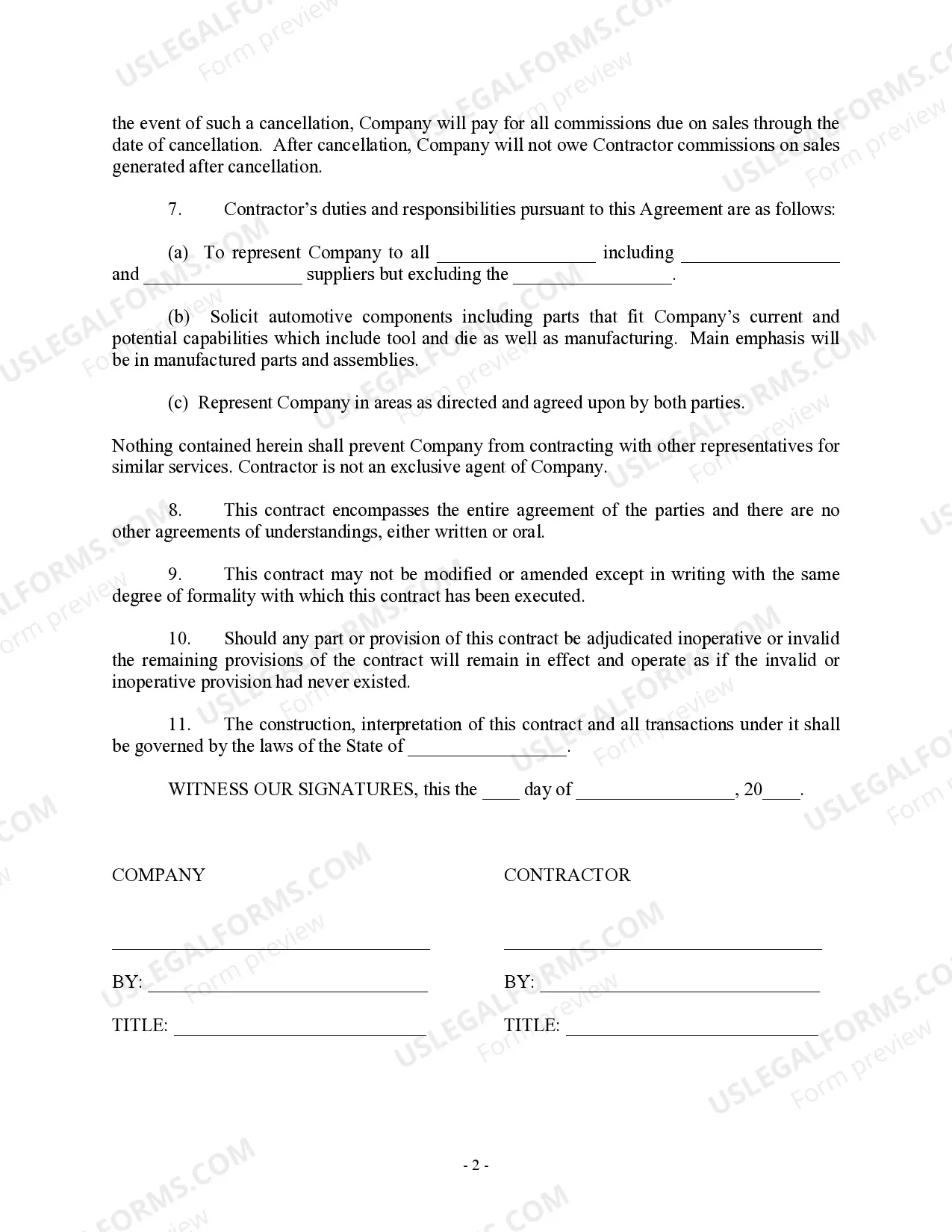

The California Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legal document that outlines the terms and conditions of a working relationship between an employer and a self-employed independent contractor in the state of California. This employment agreement type is specifically designed for individuals who work on a commission or percentage of sales basis. It is commonly used in industries such as real estate, sales, insurance, and marketing, where individuals are compensated based on the revenue generated from their own efforts. The agreement typically includes details such as the parties involved, the job description, the commission structure, and any additional terms and conditions agreed upon by both parties. It sets forth the expectations and rights of the contractor, as well as the obligations of the employer. Under this agreement, the self-employed independent contractor has the freedom to manage their own business and work schedule. They are responsible for generating their own leads, closing sales, and meeting performance targets. In return, they receive a percentage of the sales or revenue they generate, as outlined in the agreement. This employment agreement is often used as an alternative to traditional salaried or hourly employment, providing individuals with more flexibility and potentially higher earning potential. It allows both parties to capitalize on the contractor’s ability to generate and close sales, while also mitigating the employer's financial risk by compensating based on performance. Different types of the California Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor may vary based on the specific industry and job requirements. For example: 1. Real Estate Agent Agreement — Percentage of Sales: This agreement is tailored for real estate agents who earn a commission based on the sale of properties. It outlines the commission structure, responsibilities, and any additional terms unique to the real estate industry. 2. Insurance Sales Agent Agreement — Percentage of Premiums: This agreement is specifically designed for insurance agents who earn a percentage of the premiums collected from policies they sell. It defines the commission structure, product lines, and any additional terms related to insurance sales. 3. Freelance Sales Representative Agreement — Percentage of Total Sales: This type of agreement is suitable for individuals who work as freelance sales representatives for various companies. It lays out the commission structure, product lines, and sales targets, while allowing the contractor to represent multiple brands simultaneously. In conclusion, the California Employment Agreement — Percentage of Sales — Self-Employed Independent Contractor is a legal document that establishes the working relationship between an employer and a commission-based independent contractor. It is customizable based on the industry and job requirements, ensuring that both parties have a clear understanding of the expectations and compensation structure.

California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out California Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

Locating the appropriate legal document template can be challenging.

Clearly, there is an abundance of templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to confirm that it is indeed the right one for you.

- The service offers a vast selection of templates, including the California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, which you can utilize for both business and personal purposes.

- All of the forms are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

- Use your account to search for the legal forms you have previously ordered.

- Visit the My documents tab in your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

A 1099 employee, often referred to as an independent contractor, is subject to different labor laws than traditional employees. They are not entitled to benefits such as minimum wage, overtime, or unemployment insurance typically granted to employees under the California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor framework. It is vital to be aware of these differences to maintain compliance with California labor laws.

The Fair Labor Standards Act (FLSA) generally does not apply to independent contractors, as it primarily protects employees. However, the classification of a worker as an independent contractor or employee affects their rights under the FLSA. Understanding this distinction is crucial when drafting a California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, ensuring adherence to applicable laws and regulations.

California law governs independent contractors through Assembly Bill 5 (AB5), which establishes a strict criterion for determining whether a worker is an independent contractor or an employee. To qualify as a self-employed independent contractor under the California Employment Agreement - Percentage of Sales model, individuals must meet the three-pronged test. It’s essential to properly categorize your work relationships, as misclassification can lead to significant legal implications.

The three controls for independent contractors include the control over the work schedule, the ability to decide how the work will be performed, and the option to accept or reject jobs. This flexibility is key for self-employed individuals, especially those using a California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor. By understanding these controls, you can better define your role and ensure compliance with California's labor laws.

The ABC rule is a standard used in California to determine whether a worker is an independent contractor or an employee. It outlines three criteria that must be met for a worker to qualify as an independent contractor. Essentially, it protects workers by ensuring they have rights and benefits associated with employment. Understanding the ABC rule is crucial for creating a California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

The new law for independent contractors in California significantly affects how companies classify workers. Under Assembly Bill 5 (AB5), the distinction between employees and independent contractors has become stricter, requiring companies to meet specific criteria. This legislation has a direct impact on the California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor. Understanding these changes is essential for anyone considering this type of agreement to ensure compliance and protection.

The percentage an independent contractor should make can vary based on the industry and the specific agreement made between the parties involved. Generally, many contracts include compensation structures that range from 10% to 50% of the sales generated by the work performed. A well-drafted California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor should clearly outline these terms to ensure both parties understand their financial expectations. Utilizing the services of US Legal Forms can help you create a compliant and tailored agreement that reflects your unique needs.

The new law in California, known as AB 5, affects how independent contractors are classified. It establishes stricter criteria for recognizing workers as independent contractors rather than employees. This legislation aims to ensure that workers receive important benefits and protections. Consequently, a California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor needs to reflect this classification to avoid legal complications.

Yes, independent contractor agreements are highly recommended in California. While not always legally required, having a detailed California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor provides clarity and protection for both parties. The agreement should outline payment terms, responsibilities, and the project's scope. Using a formal agreement helps mitigate risks and ensures compliance with state laws.

The 2 year contractor rule in California refers to a guideline that helps determine the classification of independent contractors. If you consistently engage a contractor over two years without a valid written California Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, they may be regarded as an employee. This classification has significant implications for taxes and insurance. Being proactive in managing contracts will assist in avoiding misunderstandings.

Interesting Questions

More info

Agreement Loan Agreement Promissory Note Free Employment Contract Templates The term is to be agreed upon in writing between the parties, and the agreement must be in writing, signed and dated. The term for which the hire is to take place will continue for an undetermined period of time and the employee must be offered for the full term with all conditions to be agreed upon being satisfied. The person/people making the offer for the employment of this Employee shall be the employer of record in the relevant Employment Document. If this Employee is not the employer of record then the person making the offer shall be the employer of record. The employment contract will last for the term determined in the Employment Agreement and will be for the full term and for the duration of the employment, inclusive of any extended leave of absence, and will continue on its terms and conditions throughout time.