California Loan Agreement - Long Form

Description

How to fill out Loan Agreement - Long Form?

US Legal Forms - among the largest collections of legal templates in the United States - offers a broad selection of legal document formats that you can download or create.

By utilizing the website, you will have access to thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the California Loan Agreement - Long Form in just minutes.

If you have a monthly membership, Log In to download the California Loan Agreement - Long Form from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded California Loan Agreement - Long Form. Every template you add to your account has no expiration date and is yours indefinitely. Thus, to download or print another copy, simply go to the My documents section and click on the form you need. Access the California Loan Agreement - Long Form with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast number of professional and state-specific templates that fulfill your business or personal needs and requirements.

- To use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have chosen the correct form for the city/state. Click the Review button to examine the form's content.

- Read the form description to ensure you have selected the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

A loan extension agreement is a mutual agreement between a lender and borrower that extends the maturity date on a borrower's loan. Most commonly used when a borrower falls behind on payments, a loan extension agreement can restructure the loan payment schedule to get the borrower back on track.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

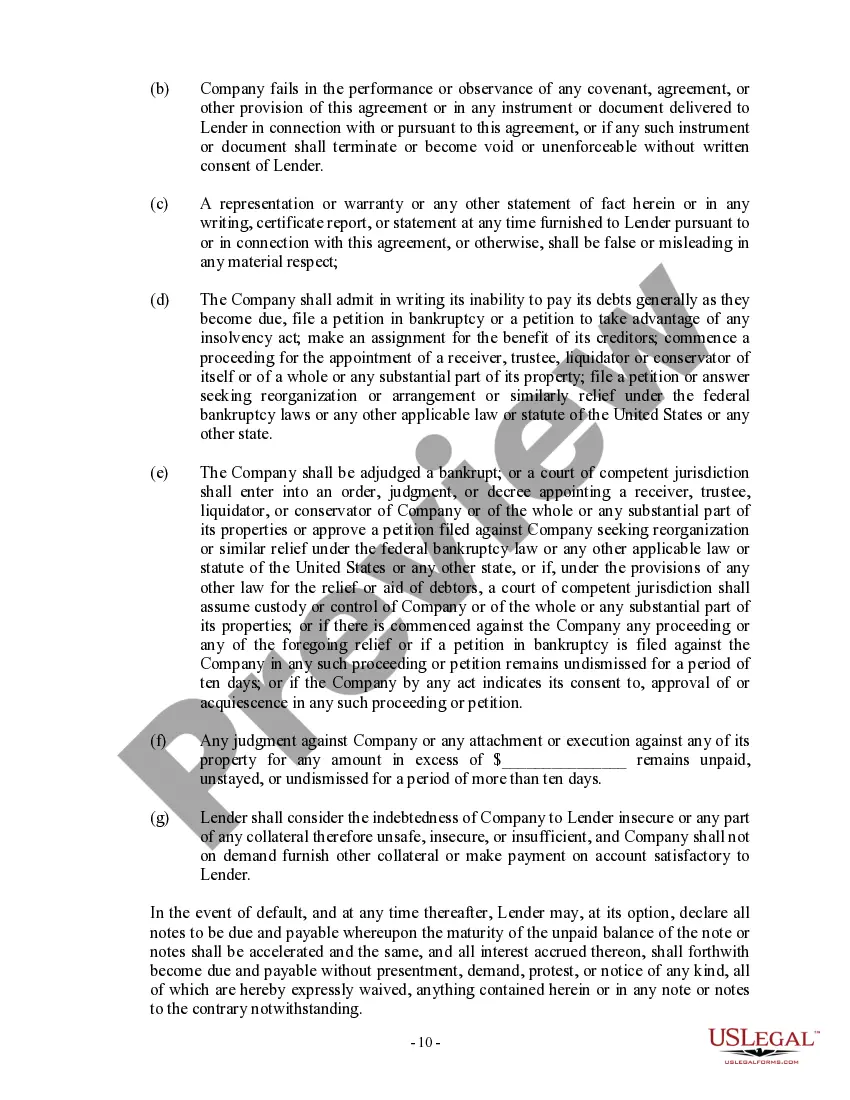

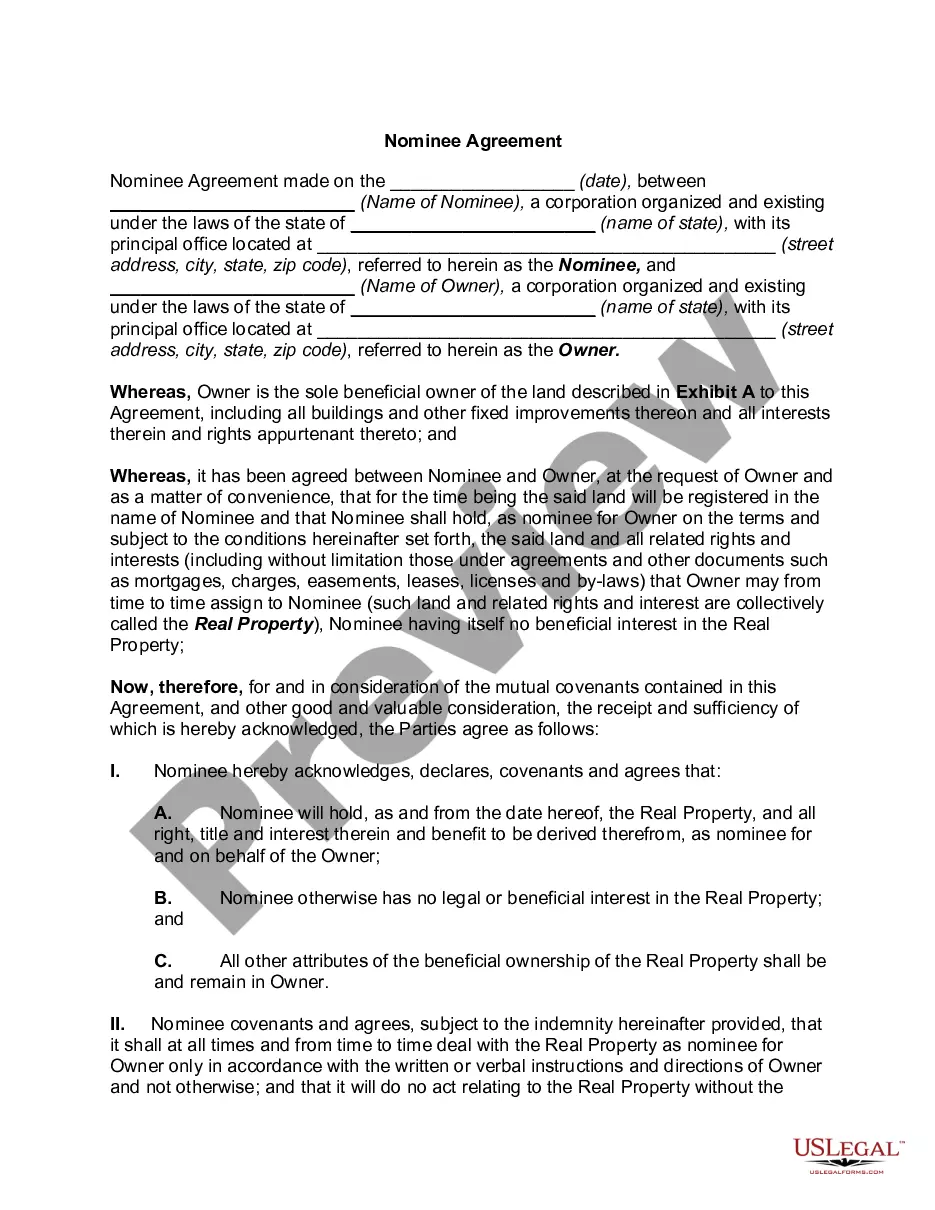

All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered, must be clearly outlined.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.