California Corporate Resolution Authorizing a Charitable Contribution

Description

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

Are you currently in a location where you need paperwork for either business or personal purposes almost every day.

There are numerous authentic document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a wide range of form templates, such as the California Corporate Resolution Authorizing a Charitable Contribution, designed to comply with state and federal regulations.

Once you locate the correct form, click on Get now.

Choose the pricing plan you prefer, fill in the requested information to create your account, and make payment using your PayPal or Credit Card. Select a suitable file format and download your document. You can access all the document templates you have purchased in the My documents section. You may also obtain an additional copy of the California Corporate Resolution Authorizing a Charitable Contribution at any time if needed. Just select the appropriate form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the California Corporate Resolution Authorizing a Charitable Contribution template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and ensure it corresponds to the correct city/state.

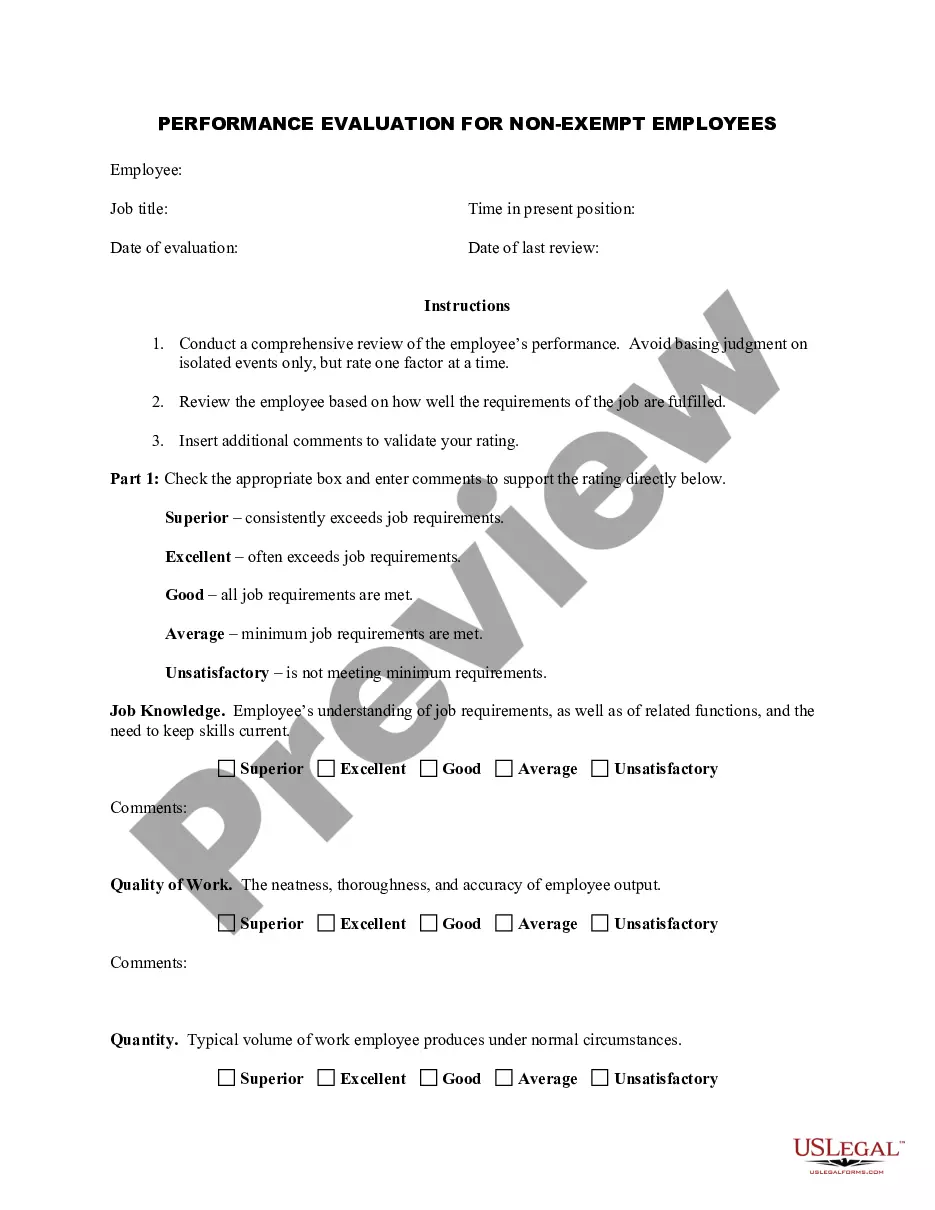

- Utilize the Review button to inspect the form.

- Examine the description to confirm you have chosen the correct form.

- If the form isn’t what you’re looking for, utilize the Search box to find the form that suits your needs and requirements.

Form popularity

FAQ

The charitable solicitation law in California regulates how organizations ask for donations from the public. This law requires many charities to register with the state and adhere to specific guidelines for fundraising. Understanding this law is essential if you are preparing a California Corporate Resolution Authorizing a Charitable Contribution, as compliance ensures that your organization operates within legal boundaries while supporting charitable causes.

The purpose of a corporate resolution is to officially document important decisions made by a corporation's board or managers. It serves as a record that ensures compliance, provides clarity, and protects the organization when entering into agreements. When it comes to a California Corporate Resolution Authorizing a Charitable Contribution, it helps confirm that the decision to contribute has been made correctly and is in line with the company's objectives.

A corporate resolution for authorized signers identifies specific individuals permitted to sign documents on behalf of the company. This resolution ensures that there is a clear record of who holds authority in financial and legal matters, promoting accountability. For your needs regarding a California Corporate Resolution Authorizing a Charitable Contribution, ensuring the right individuals are authorized can simplify charitable transactions.

A board resolution for authorized signatory is a written document from a company's board of directors. It indicates who is designated to act on behalf of the corporation for signing legal documents. This is particularly important when addressing contributions or investments, such as a California Corporate Resolution Authorizing a Charitable Contribution, confirming that designated signers can proceed with charitable actions.

Writing a corporate resolution involves clearly stating the decision in a structured format. You begin by naming the company, the date, and the specific resolution being adopted. Then, you include a clause that forwards the authority to certain individuals. For those drafting a California Corporate Resolution Authorizing a Charitable Contribution, it’s crucial to specify the charitable organization and the amount to be donated.

A corporate resolution to authorize a signature is a formal document that grants specific individuals the power to make decisions on behalf of the company. This resolution outlines who has the authority to sign documents, contracts, or checks, ensuring clarity and compliance within the organization. If you are considering a California Corporate Resolution Authorizing a Charitable Contribution, having a clear authority established can streamline your charitable giving process.

Yes, California mandates that nonprofits establish bylaws as part of their organizational structure. Bylaws provide the rules for operation and governance, ensuring smooth functioning. When drafting these bylaws, it may be beneficial to include provisions for a California Corporate Resolution Authorizing a Charitable Contribution, as it underscores the nonprofit's commitment to charitable giving.

Yes, many charities in the United States qualify for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This designation allows them to receive tax-deductible contributions, supporting their philanthropic missions. If your organization seeks such status, a California Corporate Resolution Authorizing a Charitable Contribution may play a significant role in demonstrating your commitment to charitable activities.

Various organizations, including certain nonprofits, are exempt from California sales tax when it comes to their purchases for charitable purposes. This exemption helps nonprofits direct more resources to their missions. If you are considering making such purchases, having a California Corporate Resolution Authorizing a Charitable Contribution can be an essential document to support your tax-exempt status.

Nonprofits in California can be recognized as tax-exempt organizations if they meet specific criteria set by the Internal Revenue Service and the state. This status allows them to operate without paying certain taxes, which can help further their charitable efforts. When creating a nonprofit, consider drafting a California Corporate Resolution Authorizing a Charitable Contribution to clarify intended charitable activities.