A California Balloon Unsecured Promissory Note is a legal document that outlines a loan agreement between two parties. It is specifically relevant for individuals or businesses in California who are looking to borrow money or lend money without providing any collateral. This type of promissory note is commonly used when the borrower is unable or unwilling to pledge any assets as security for the loan. Key elements included in a California Balloon Unsecured Promissory Note typically consist of details such as the names and addresses of the borrower and the lender, the loan amount, the interest rate or method of calculation, the repayment terms, and the due date of the final balloon payment. It serves as evidence of the debt and specifies the rights and obligations of both parties. Some types of California Balloon Unsecured Promissory Notes include: 1. Personal Unsecured Promissory Note: This type of promissory note is commonly used between individuals for personal loans. It does not require collateral, making it suitable for situations where trust and a good credit history are the main factors in granting a loan. 2. Business Unsecured Promissory Note: This promissory note is used when a business seeks financing without offering any specific assets as collateral. It is often employed for startup businesses or small companies lacking substantial assets. 3. Vendor Unsecured Promissory Note: Sometimes, a vendor may offer financing to a customer to facilitate the purchase of goods or services. In such cases, a vendor unsecured promissory note can be used, ensuring the repayment terms are clearly stated. 4. Bridge Unsecured Promissory Note: Bridge loans serve as a temporary solution to bridge the gap between the borrower's immediate financial needs and a future anticipated inflow of funds. Balloon unsecured promissory notes can be utilized in this context to provide a short-term financing option. 5. Convertible Unsecured Promissory Note: This type of promissory note includes an option for the lender to convert the outstanding debt into equity in the borrower's company. It is typically utilized in startup or early-stage businesses seeking funding from angel investors or venture capitalists. A California Balloon Unsecured Promissory Note is an important legal document that protects both parties involved in a loan transaction. It clearly outlines the loan terms, repayment schedule, and consequences of default. Seek the guidance of a legal professional when creating or signing such a promissory note to ensure compliance with California laws and to protect your interests.

California Balloon Unsecured Promissory Note

Description

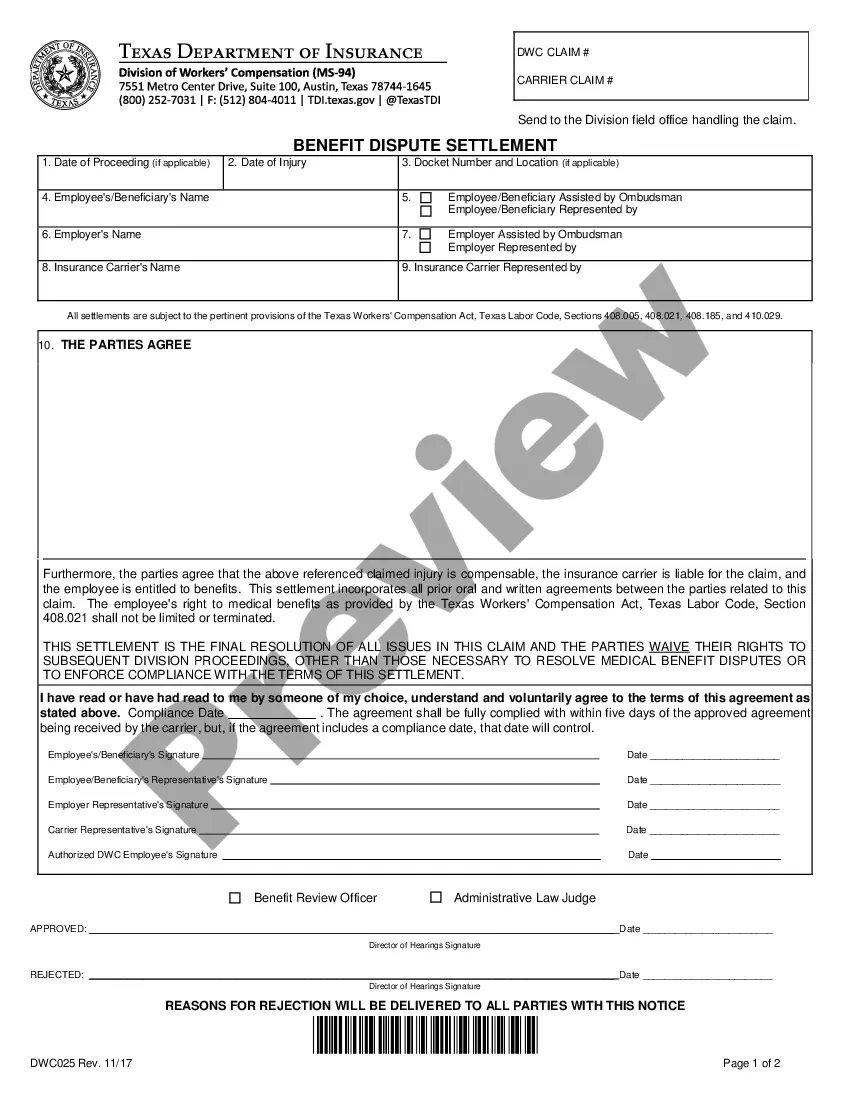

How to fill out California Balloon Unsecured Promissory Note?

If you aim to finalize, retrieve, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site's straightforward and user-friendly search to discover the documents you need.

A range of templates for business and personal applications are organized by categories and suggestions, or keywords.

Step 4. Once you have identified the form you need, select the Purchase now button. Choose the payment plan you prefer and enter your information to create an account.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the California Balloon Unsecured Promissory Note in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to access the California Balloon Unsecured Promissory Note.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are a first-time user of US Legal Forms, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review feature to examine the form's content. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to locate other versions in the legal document template.

Form popularity

FAQ

Yes, a promissory note is a legally binding document in California, provided it meets certain criteria. It must include the amount owed, the interest rate, repayment terms, and the signatures of all parties involved. When you create a California Balloon Unsecured Promissory Note, ensure it is clear and comprehensive to protect both the lender and the borrower. Consider using US Legal Forms to craft a solid, enforceable agreement.

In California, the interest on a promissory note varies, depending on the agreement between the parties. Generally, the maximum legal interest rate is 10% per year unless there is a specific agreement stating otherwise. When considering a California Balloon Unsecured Promissory Note, it is essential to outline the interest rate clearly in the terms to avoid disputes. Likewise, using US Legal Forms to draft your agreement ensures compliance with state laws.

An unsecured form of promissory note does not require the borrower to put up any collateral. This means the lender takes on more risk but can also potentially earn higher interest. Specifically, in the case of a California Balloon Unsecured Promissory Note, this flexibility can be appealing, but both parties should understand the implications.

To fill out a promissory note, you need to include essential details such as the borrower and lender’s names, principal amount, interest rate, and repayment schedule. It’s crucial to clearly outline any terms specific to a California Balloon Unsecured Promissory Note, including the due date and payment details. For assistance, platforms like uslegalforms can guide you through the process.

Yes, a promissory note can hold up in court if it meets certain legal requirements. For a California Balloon Unsecured Promissory Note to be enforceable, it should include clear terms, signatures, and an agreement on repayment. In the event of a dispute, such documentation serves as a critical piece of evidence.

Companies might issue unsecured promissory notes to gain quick access to funds without tying up assets. This can enhance their financial flexibility, allowing them to invest in growth or cover unexpected costs. In the case of a California Balloon Unsecured Promissory Note, the terms can often be tailored to meet specific business needs.

Investors, including individuals and companies, often look to buy unsecured promissory notes as a way to earn returns. They might be attracted to these notes for their potential interest rates, even without collateral backing. In the field of California Balloon Unsecured Promissory Notes, buyers see opportunities in financing options that may not require strict security.

In California, a promissory note does not need to be notarized to be legally binding. However, having it notarized can provide an additional layer of security and proof of authenticity. Using a California Balloon Unsecured Promissory Note can enhance trust between parties, but it is not a strict requirement.

Yes, balloon payments are legal in California, provided they comply with state laws. These payments can appear in various types of loans, including a California Balloon Unsecured Promissory Note. It’s crucial to understand how these payments will affect your overall repayment strategy.

A promissory note can be deemed invalid in California if it lacks essential components. Key elements such as the absence of a specified repayment amount, failure to include signatures, or unclear terms can render a California Balloon Unsecured Promissory Note unenforceable. Always ensure your note meets these legal requirements.

Interesting Questions

More info

It enables easy, instant funding of anything via token transfers between anyone in the world, instantly. It does not require a third party intermediary. The entire process is completely transparent and peer-to-peer. Bangor does not take a cut of token transfer fees, either. How Bangor works In just under a minute, anyone can set up a smart token on the Bangor Exchange and send their tokens to anyone else in the world, without sending their tokens to, or receiving tokens from, a central party. This results in instantaneous money transfers between anyone with a Bangor token and anyone without. Bangor uses an algorithm to determine the most suitable matching of token holders to a smart token. This algorithm constantly balances tokens from multiple smart token buyers and sellers in order to arrive at a fair match by matching all token holders equally with a given smart token as close to the first matching round as possible.