California Sale of Business — Promissory Not— - Asset Purchase Transaction refers to a legal document that outlines the terms and conditions of the sale of a business in California, where the buyer agrees to make payments to the seller over a specified period. This type of transaction typically involves the transfer of assets, such as inventory, equipment, trademarks, and customer lists, from the seller to the buyer. Keywords: California Sale of Business, Promissory Note, Asset Purchase Transaction, legal document, terms and conditions, buyer, seller, payments, transfer of assets, inventory, equipment, trademarks, customer lists. There are several types of California Sale of Business — Promissory Not— - Asset Purchase Transactions, including: 1. Full Asset Purchase Transaction: This type of transaction involves the complete transfer of all assets owned by the seller to the buyer. The buyer assumes control of all aspects of the business, including its liabilities, contracts, and other obligations. 2. Partial Asset Purchase Transaction: In this scenario, only specific assets of the business are transferred to the buyer. The buyer may choose to acquire certain assets, such as equipment, inventory, or intellectual property, while leaving other assets with the seller. 3. Stock Purchase Transaction: Instead of directly purchasing the assets of the business, the buyer acquires the majority or all of the seller's stock. This allows the buyer to gain control of the business entity itself, including all of its assets and liabilities. 4. Installment Sale Transaction: This type of transaction involves the buyer making a series of payments to the seller over a specified period. The purchase price is typically financed through a promissory note, which outlines the details of the payment schedule, interest rate, and any other terms agreed upon by the parties. 5. Seller Financing Transaction: In this type of transaction, the seller provides financing to the buyer by accepting a promissory note from the buyer as partial or full payment for the sale. This arrangement allows the buyer to make payments directly to the seller, often with an agreed-upon interest rate and repayment schedule. California Sale of Business — Promissory Not— - Asset Purchase Transaction is a legal and binding agreement that protects the rights and interests of both the buyer and the seller during the sale of a business in California. It ensures that both parties are clear on the terms of the sale and provides a framework for payment and asset transfer.

California Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Promissory Note - Asset Purchase Transaction?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legitimate document templates accessible online, but finding reliable ones isn't easy.

US Legal Forms offers an extensive collection of template documents, including the California Sale of Business - Promissory Note - Asset Purchase Transaction, which are designed to comply with state and federal guidelines.

Once you locate the correct template, click Get now.

Choose the pricing plan you want, complete the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Sale of Business - Promissory Note - Asset Purchase Transaction template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/region.

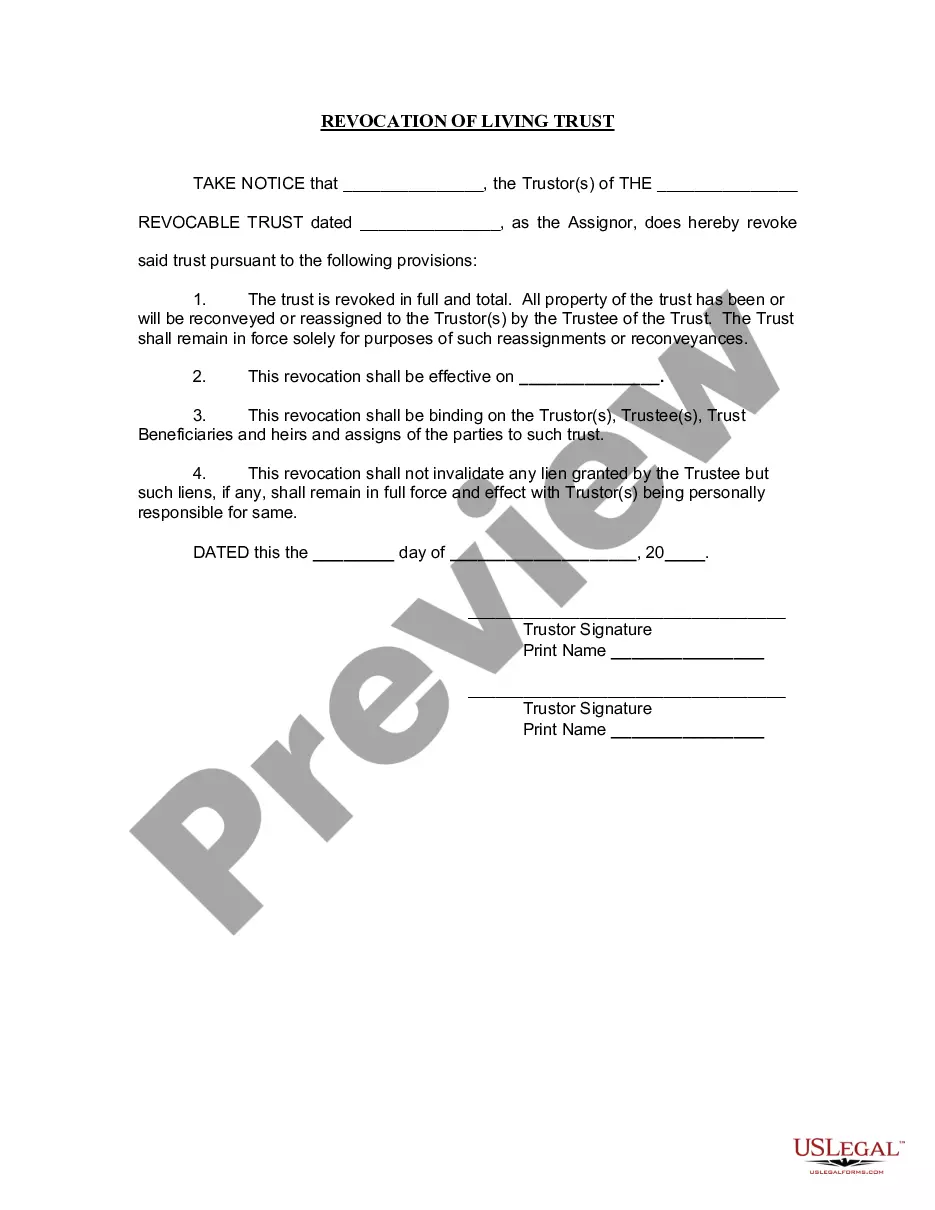

- Use the Review button to examine the form.

- Read the description to confirm that you've selected the correct template.

- If the template isn’t what you’re looking for, utilize the Search field to find a template that suits your needs and criteria.

Form popularity

FAQ

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.) along with the rights and obligations of the parties.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

An asset sale transaction involves the sale of some or all of the assets used in a business from a selling company to a buyer.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

Interesting Questions

More info

Apply for Note Sell Note Our company is unique. We offer the most experienced and best pricing for your business and all notes in an easy-to-use website! We're always working with the best people to build business, so your next meeting is sure to be better than the last. Furthermore, we offer a fast and friendly service that allows you to view and compare notes from several lenders. You'll be able to get a wide range of mortgage notes ranging from a few thousand to thousands of dollars. Our goal is to help you get your business loan quickly. Our fast and responsive staff is available 24/7 to answer all your questions. Our main goal is to provide the best quality service and price to our customers. When we say best of the business, we mean it. We offer the best mortgage loans, the best prices, and the most options available. Our website provides a searchable index of current offers so that you can quickly compare multiple mortgages and find the best deal for your business or home.