California Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a legal document that outlines the terms and conditions for the sale and purchase of assets in a business transaction while retaining specific employees. This agreement aims to ensure a smooth transfer of assets and maintain continuity in the workforce. In California, there are several types of Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transactions, such as: 1. Standard Asset Purchase Transaction: This type of agreement involves the sale and purchase of assets of a business, where certain employees are retained by the buyer. The agreement specifies the assets being sold, the price, and the terms for retaining employees. 2. Asset Purchase Transaction with Exclusive Retention: In this type of agreement, the buyer exclusively retains certain key employees from the seller's business. The agreement lays down the conditions for the retention of these employees, including their roles, salaries, and benefits. 3. Asset Purchase Transaction with Optional Retention: This agreement allows the buyer to choose whether to retain certain employees or not. The terms and conditions of employee retention are negotiated separately and included in the agreement. 4. Partial Asset Purchase Transaction: In some cases, a buyer may only acquire a portion of the seller's assets. This type of agreement details the specific assets being sold and the retained employees associated with those assets. California Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction typically covers key elements, including: a) Identification of the buyer and seller: The agreement clearly identifies the parties involved in the transaction, including their legal names and addresses. b) Asset details: The agreement states the assets being sold, such as tangible property, equipment, inventory, intellectual property rights, customer lists, etc. c) Purchase price and payment terms: The agreement specifies the total purchase price, the payment schedule, and any contingencies for adjustments in price, such as inventory valuation. d) Employee retention provisions: This section defines the employees to be retained, their positions, compensation, benefits, and any conditions for the retention, like satisfactory performance or background checks. e) Seller's representations and warranties: The seller provides assurances regarding the accuracy of information, authority to sell assets, absence of liens or claims, and compliance with laws. f) Indemnification and liability: The agreement addresses the allocation of liabilities, indemnification provisions, and any limitations on the buyer's responsibility for the seller's liabilities. g) Confidentiality and non-compete: The agreement may include provisions regarding the protection of confidential information and non-competition restrictions on the seller. h) Governing law and dispute resolution: This section specifies that the agreement will be governed by California law and outlines the process for resolving any disputes that may arise. It is important to note that the specific terms and conditions of a California Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction may vary depending on the parties involved, the nature of the business being sold, and the negotiations between the buyer and seller. It is advisable to consult with legal professionals for guidance in customizing and executing such agreements to ensure compliance with California state laws and protect the interests of all parties involved.

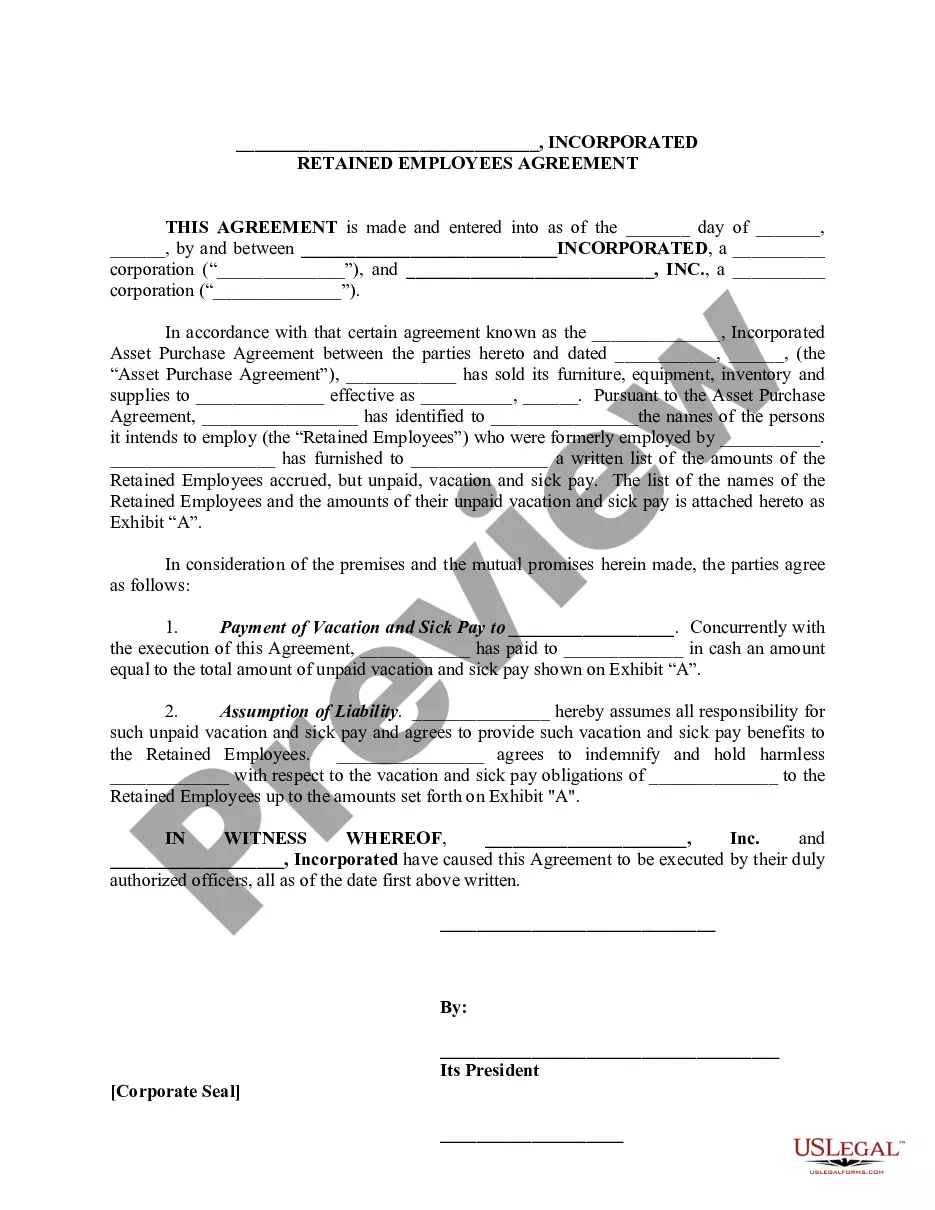

California Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out California Sale Of Business - Retained Employees Agreement - Asset Purchase Transaction?

Have you been in the situation that you require papers for possibly organization or personal uses nearly every working day? There are a variety of legitimate record layouts available online, but getting types you can rely on is not effortless. US Legal Forms gives a large number of develop layouts, just like the California Sale of Business - Retained Employees Agreement - Asset Purchase Transaction, which can be composed in order to meet state and federal requirements.

If you are presently familiar with US Legal Forms site and get a merchant account, merely log in. Following that, it is possible to obtain the California Sale of Business - Retained Employees Agreement - Asset Purchase Transaction format.

Should you not have an account and would like to begin to use US Legal Forms, adopt these measures:

- Discover the develop you want and ensure it is for your proper area/region.

- Take advantage of the Preview switch to analyze the form.

- Browse the description to ensure that you have selected the correct develop.

- If the develop is not what you`re trying to find, take advantage of the Look for area to discover the develop that suits you and requirements.

- Once you find the proper develop, click on Buy now.

- Opt for the pricing plan you would like, submit the specified info to produce your bank account, and purchase an order utilizing your PayPal or bank card.

- Select a practical document format and obtain your backup.

Find all the record layouts you might have purchased in the My Forms menus. You may get a additional backup of California Sale of Business - Retained Employees Agreement - Asset Purchase Transaction anytime, if required. Just go through the essential develop to obtain or printing the record format.

Use US Legal Forms, by far the most substantial assortment of legitimate types, in order to save some time and stay away from errors. The service gives professionally made legitimate record layouts that you can use for a range of uses. Create a merchant account on US Legal Forms and start making your lifestyle a little easier.