A California contract between a General Agent of an Insurance Company and an Independent Agent serves as an agreement that outlines the terms and conditions under which an independent agent represents the insurance company in selling insurance policies and managing client accounts. This contract establishes a working relationship between the two parties and specifies their responsibilities, obligations, and compensation structure. Here are the different types of California contracts that can exist between a General Agent of an Insurance Company and an Independent Agent: 1. Exclusive Agency: In this type of contract, the Independent Agent exclusively represents a specific insurance company. The agent is restricted from selling policies from other insurance companies and must prioritize the products and services of the general agent's company. 2. Non-Exclusive Agency: Here, the Independent Agent represents multiple insurance companies simultaneously. The agent has the flexibility to offer policies from different insurance companies to clients, providing more options and tailoring coverage to their specific needs. 3. General Agency: In a General Agency agreement, the General Agent acts as an intermediary between the insurance company and various Independent Agents. The General Agent recruits, trains, and supervises Independent Agents, and assists them in the sales and service processes. 4. Sub-General Agency: This type of contract is similar to a General Agency, but the Sub-General Agent operates below the General Agent in the hierarchy. They may have a smaller territory or focus on specific products within the insurance company's portfolio. 5. Managing General Agency: A Managing General Agent (MGA) is granted broader authority by the insurance company. The MGA operates almost independently, having greater control and decision-making power over underwriting, pricing, and managing policyholders. Key elements covered in a California contract between a General Agent of an Insurance Company and an Independent Agent may include: 1. Roles and Responsibilities: Clearly defining the duties and obligations of each party, such as sales quotas, servicing policies, providing customer support, and compliance with applicable laws and regulations. 2. Compensation: Detailing the commission structure, bonuses, incentives, or other forms of remuneration for the Independent Agent based on sales performance, renewals, or other agreed-upon metrics. 3. Licensing and Certifications: Specifying that the Independent Agent holds all necessary licenses, certifications, and complies with legal requirements to sell insurance products within California. 4. Territory and Product Coverage: Outlining the geographical area(s) and types of insurance products the Independent Agent can market and sell on behalf of the insurance company. 5. Termination and Renewal: Describing the conditions under which either party can terminate the contract, as well as provisions for renewal processes and terms. 6. Confidentiality and Non-Compete: Including clauses that protect the insurance company's proprietary information, trade secrets, and policies, as well as prohibiting the Independent Agent from soliciting or selling policies of competing insurance companies during or after the contract period. 7. Legal Disputes and Governing Law: Specifying the jurisdiction and applicable laws to resolve any disputes that may arise during the course of the contract. Remember, it is essential for both parties involved in a California Contract between a General Agent of an Insurance Company and Independent Agent to carefully review and understand the terms before signing. It is advisable to seek legal counsel to ensure compliance with California's insurance laws and regulations.

California Contract between General Agent of Insurance Company and Independent Agent

Description

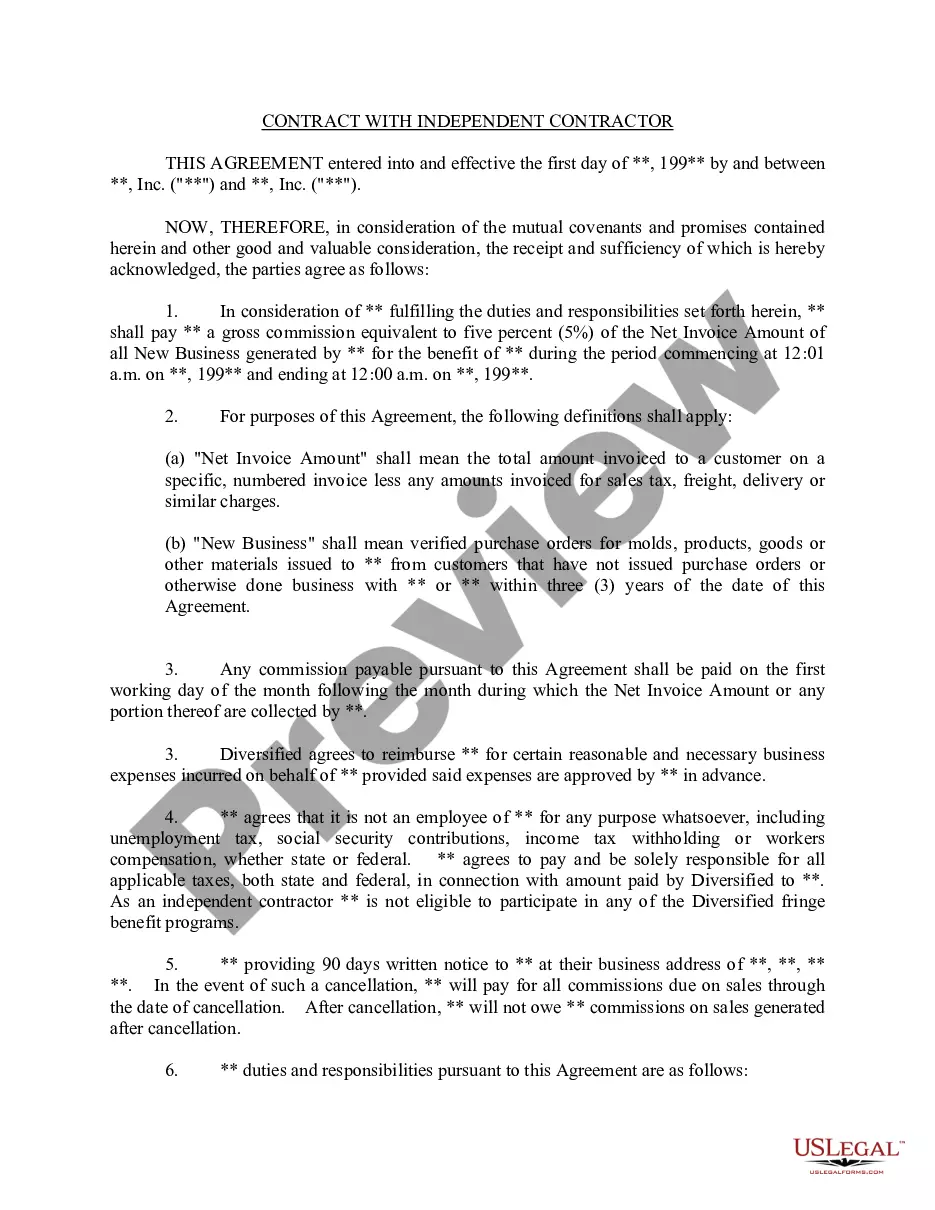

How to fill out California Contract Between General Agent Of Insurance Company And Independent Agent?

If you want to comprehensive, down load, or printing legitimate papers templates, use US Legal Forms, the biggest selection of legitimate forms, that can be found on-line. Use the site`s simple and easy hassle-free lookup to find the files you will need. Different templates for company and person reasons are sorted by types and suggests, or keywords. Use US Legal Forms to find the California Contract between General Agent of Insurance Company and Independent Agent within a few click throughs.

In case you are currently a US Legal Forms buyer, log in to your profile and then click the Down load button to get the California Contract between General Agent of Insurance Company and Independent Agent. You can also access forms you in the past downloaded within the My Forms tab of your profile.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the appropriate area/region.

- Step 2. Utilize the Review solution to look over the form`s content material. Do not neglect to see the outline.

- Step 3. In case you are not satisfied with the type, use the Research discipline near the top of the screen to get other types of the legitimate type template.

- Step 4. Upon having discovered the shape you will need, click on the Acquire now button. Opt for the rates strategy you choose and add your accreditations to register on an profile.

- Step 5. Process the deal. You can utilize your Мisa or Ьastercard or PayPal profile to complete the deal.

- Step 6. Pick the file format of the legitimate type and down load it in your gadget.

- Step 7. Full, edit and printing or sign the California Contract between General Agent of Insurance Company and Independent Agent.

Each and every legitimate papers template you acquire is your own property eternally. You may have acces to every type you downloaded in your acccount. Click the My Forms portion and decide on a type to printing or down load again.

Remain competitive and down load, and printing the California Contract between General Agent of Insurance Company and Independent Agent with US Legal Forms. There are thousands of skilled and express-distinct forms you can utilize for the company or person needs.