Title: California Sample Letter for Requesting Tax Clearance Letter — A Comprehensive Guide Introduction: In California, a tax clearance letter is a document issued by the Franchise Tax Board (FT) upon the request of an individual or organization to certify that all tax liabilities, returns, and obligations have been fulfilled. This letter proves that the taxpayer's account is in good standing and serves various purposes, such as during business transactions, property transfers, or when applying for certain licenses. This article will provide a detailed description of what a California sample letter for requesting a tax clearance letter entails, including relevant keywords. 1. Purpose of the Tax Clearance Letter: The tax clearance letter verifies that an individual or entity has met all tax obligations, including filing returns, paying taxes owed, and resolving any outstanding issues. This document gives confidence to third parties that the taxpayer is in good standing and poses no risk in terms of unpaid taxes. 2. Components of a California Sample Letter for Requesting Tax Clearance: A typical California sample letter for requesting a tax clearance letter should contain the following components: a. Header: Include your personal or business information, such as name, address, phone number, and email address. b. Recipient Information: Address the letter to the appropriate California Franchise Tax Board representative. Include their name, title, division, and mailing address. c. Salutation: Start with a formal salutation, such as "Dear [Recipient's Last Name]". d. Introduction: Briefly introduce yourself or your organization and state the purpose of your letter, which is to request a tax clearance letter. e. Description of Current Status: Provide a detailed overview of your current tax situation, mentioning that all tax obligations have been met, outstanding debts resolved if applicable, and any tax liens released. f. Supporting Documentation: Include any supporting documents that can reinforce your claim of being tax compliant, such as tax returns filed, records of payments made, or lien release documents. g. Contact Information: Reiterate your contact information and request that the recipient contacts you if any further information or documents are required. h. Closing: Use a professional closing, such as "Sincerely" or "Yours faithfully". Sign your name, print it below, and include any relevant titles or positions. 3. Types of California Sample Letters for Requesting Tax Clearance: While the general structure remains the same, there might be variations in the content and purpose of requesting a tax clearance letter, depending on the specific circumstances. Some common types of California sample letters for requesting tax clearance letters include: a. Individual Tax Clearance Letter Request: This is typically used by individuals to obtain a tax clearance letter for personal reasons, such as property transfers, immigration purposes, or before applying for a professional license. b. Business Tax Clearance Letter Request: Businesses may require a tax clearance letter for various situations, such as mergers, acquisitions, sale of assets, or transferring ownership. This letter ensures that the business has fulfilled all its tax obligations. c. Non-Profit Organization Tax Clearance Letter Request: Non-profit organizations often need a tax clearance letter to prove their compliance with tax regulations before applying for grants, contracts, or when involved in fundraisers. Conclusion: Obtaining a tax clearance letter is crucial for individuals and businesses in California to demonstrate tax compliance and resolve any potential issues related to outstanding tax obligations. By following the appropriate format and providing the necessary supporting documents, individuals and organizations can request a tax clearance letter confidently. Remember to tailor the content of your letter based on your specific situation to ensure clarity and accuracy. Keywords: California, sample letter, request, tax clearance, Franchise Tax Board (FT), tax obligations, tax liabilities, tax compliance, tax returns, outstanding debts, tax lien, individual, business, non-profit organization.

California Sample Letter for Request for Tax Clearance Letter

Description

How to fill out California Sample Letter For Request For Tax Clearance Letter?

It is possible to spend hrs online trying to find the legal file design that suits the federal and state specifications you require. US Legal Forms provides a large number of legal kinds that happen to be examined by professionals. You can easily acquire or print out the California Sample Letter for Request for Tax Clearance Letter from the services.

If you have a US Legal Forms bank account, you may log in and click the Down load key. Following that, you may complete, revise, print out, or signal the California Sample Letter for Request for Tax Clearance Letter. Every legal file design you buy is your own forever. To get one more duplicate for any bought kind, go to the My Forms tab and click the related key.

Should you use the US Legal Forms website the first time, stick to the easy guidelines below:

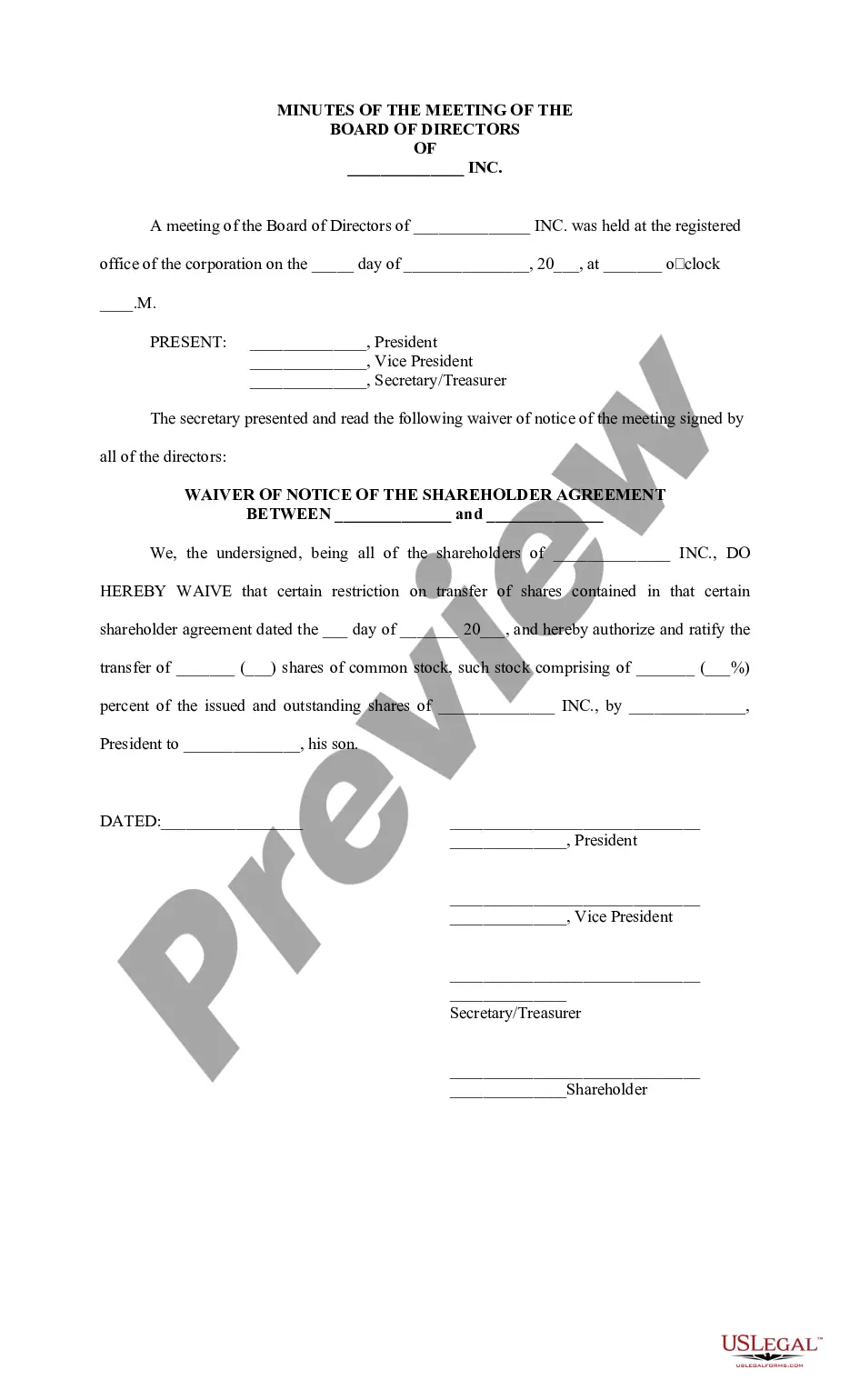

- Initial, ensure that you have selected the correct file design to the state/town that you pick. See the kind description to make sure you have selected the appropriate kind. If readily available, use the Review key to search with the file design too.

- If you wish to get one more model in the kind, use the Lookup industry to get the design that suits you and specifications.

- Once you have discovered the design you want, simply click Get now to continue.

- Pick the costs strategy you want, type your qualifications, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the legal kind.

- Pick the formatting in the file and acquire it for your gadget.

- Make adjustments for your file if needed. It is possible to complete, revise and signal and print out California Sample Letter for Request for Tax Clearance Letter.

Down load and print out a large number of file themes making use of the US Legal Forms website, that offers the most important variety of legal kinds. Use expert and state-certain themes to take on your small business or person requires.