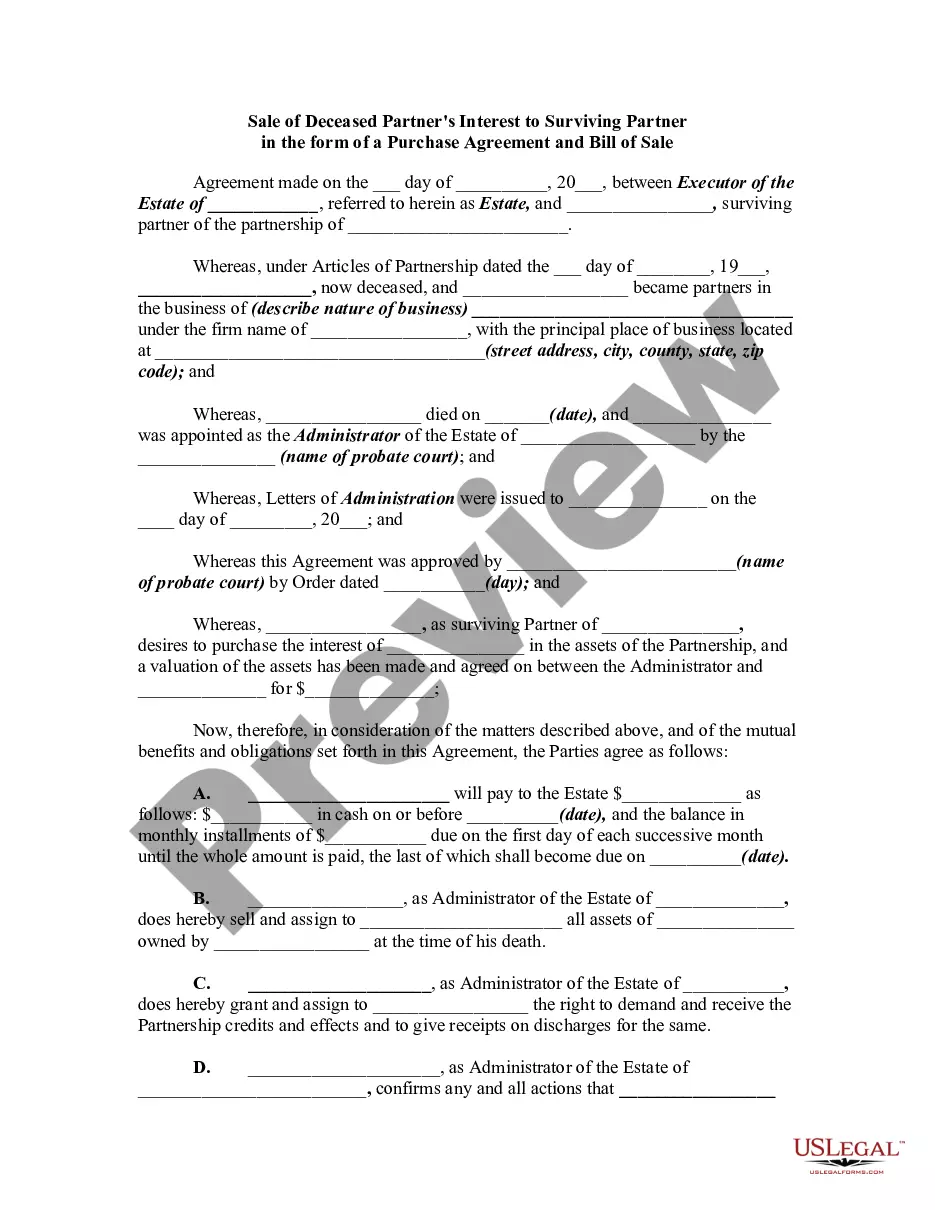

When a partner in a business passes away in California, it becomes necessary for the remaining partner to acquire the deceased partner's interest. This transaction typically takes the form of a Purchase Agreement and Bill of Sale, which outlines the terms and conditions of the sale. In California, there are two types of sales of a deceased partner's interest to a surviving partner: sale by agreement and sale by executor. Sale by Agreement: A sale by agreement occurs when the surviving partner and the deceased partner had previously agreed upon the terms of the sale. This agreement is usually documented in a partnership agreement or a separate buy-sell agreement. However, even if there is no explicit agreement, the Uniform Partnership Act, which governs partnerships in California, allows for the surviving partner to purchase the deceased partner's interest at a fair price. The Purchase Agreement: The Purchase Agreement is a legally binding contract that outlines the terms and conditions of the sale. It includes crucial details such as the purchase price, payment terms, and any provisions related to the transfer of assets or liabilities. The agreement may also highlight any restrictions or limitations on the surviving partner's use of the business name or intellectual property. The Bill of Sale: The Bill of Sale is a legal document that provides evidence of the transfer of the deceased partner's interest to the surviving partner. It includes a detailed description of the assets being transferred, such as shares, ownership percentage, and any other relevant business interests. This document ensures a smooth transfer of ownership and clear title to the surviving partner. Sale by Executor: In cases where the deceased partner did not previously agree upon a sale with the surviving partner, the sale becomes the responsibility of the deceased partner's executor or personal representative. The executor has the authority to sell the deceased partner's interest in the business and distribute the proceeds to the partner's estate or beneficiaries. Roles of the Executor: The executor, who is typically named in the deceased partner's will or appointed by the court, is responsible for ensuring a fair and transparent sale. They must act in the best interest of the estate and follow the guidelines provided by the probate court. The surviving partner should cooperate with the executor to facilitate the sale process. Purchase Agreement and Bill of Sale: In a sale by executor, the Purchase Agreement and Bill of Sale still play a vital role. These documents ensure that the terms and conditions of the sale, including the purchase price and other relevant provisions, are properly documented and legally binding. The sale must adhere to California probate laws and the instructions provided in the deceased partner's will. Conclusion: In California, the sale of a deceased partner's interest to a surviving partner can occur through a pre-agreed sale or by the executor of the deceased partner's estate. Regardless of the method, a Purchase Agreement and Bill of Sale are essential for documenting the transaction and ensuring a smooth transfer of ownership. These legal documents protect the rights and interests of both parties involved and provide clarity and legality to the sale process.

California Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

How to fill out California Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

Are you currently within a situation in which you need paperwork for both enterprise or person reasons nearly every day time? There are a lot of legitimate document themes available on the Internet, but getting versions you can rely isn`t straightforward. US Legal Forms provides 1000s of develop themes, much like the California Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale, which are composed to fulfill state and federal specifications.

When you are previously knowledgeable about US Legal Forms site and get a merchant account, simply log in. Following that, you can obtain the California Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale format.

If you do not provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Discover the develop you require and make sure it is for that proper metropolis/region.

- Use the Preview switch to review the shape.

- Browse the outline to ensure that you have chosen the proper develop.

- In the event the develop isn`t what you`re searching for, use the Look for industry to discover the develop that fits your needs and specifications.

- Once you find the proper develop, simply click Acquire now.

- Opt for the costs strategy you need, complete the specified info to produce your account, and pay for the transaction making use of your PayPal or charge card.

- Decide on a handy paper format and obtain your version.

Discover every one of the document themes you may have bought in the My Forms menus. You can obtain a more version of California Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale any time, if necessary. Just go through the required develop to obtain or print out the document format.

Use US Legal Forms, probably the most comprehensive variety of legitimate types, in order to save time as well as steer clear of mistakes. The service provides appropriately made legitimate document themes which you can use for an array of reasons. Produce a merchant account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

Business partnership agreement. A properly arranged and funded agreement is a legally binding contract that spells out exactly what is to happen if one of the business's owners dies. It generally calls for the survivors to buy the deceased owner's share in the business from his or her heirs.

up in basis resets the cost basis of an inherited asset to its market value on the decedent's date of death. If the asset is later sold, the higher new cost basis would be subtracted from the sale price to calculate the capital gains tax liability, if any.

If the partner dies, the partner's estate will typically succeed to that decedent's interest in the partnership.

If the property is held in a partnership the assets in the partnership do not automatically receive a step-up in basis like those held in a disregarded LLC. It is possible to get a step-up in basis for the assets, but there must be an election under Section 754 of the Internal Revenue Code.

However, while the assets within an S or C corporation do not receive a step-up in basis, the stock does receive a step-up. In conclusion, a step-up in basis at the death of an individual can have a significant impact on the capital gains taxes paid by the heirs of a deceased person.

If the heir will be the new owner, submit the following to a DMV office: The California Certificate of Title. ... Affidavit for Transfer without Probate (REG 5), completed and signed by the heir. An original or certified copy of the death certificate of all deceased owners.

754 provides an election to adjust the inside bases of partnership assets pursuant to Sec. 743(b) upon the transfer of a partnership interest caused by a partner's death. A Sec. 754 election can also be made when a member's interest is sold or upon certain distributions of partnership assets.

If the value of the property owned by the person who died had decreased since that person acquired it, the basis will be decreased. For example, if Alex owned stock that he purchased for $100,000, but the stock was only worth $50,000 on the date of his death, the new stepped down basis is $50,000.