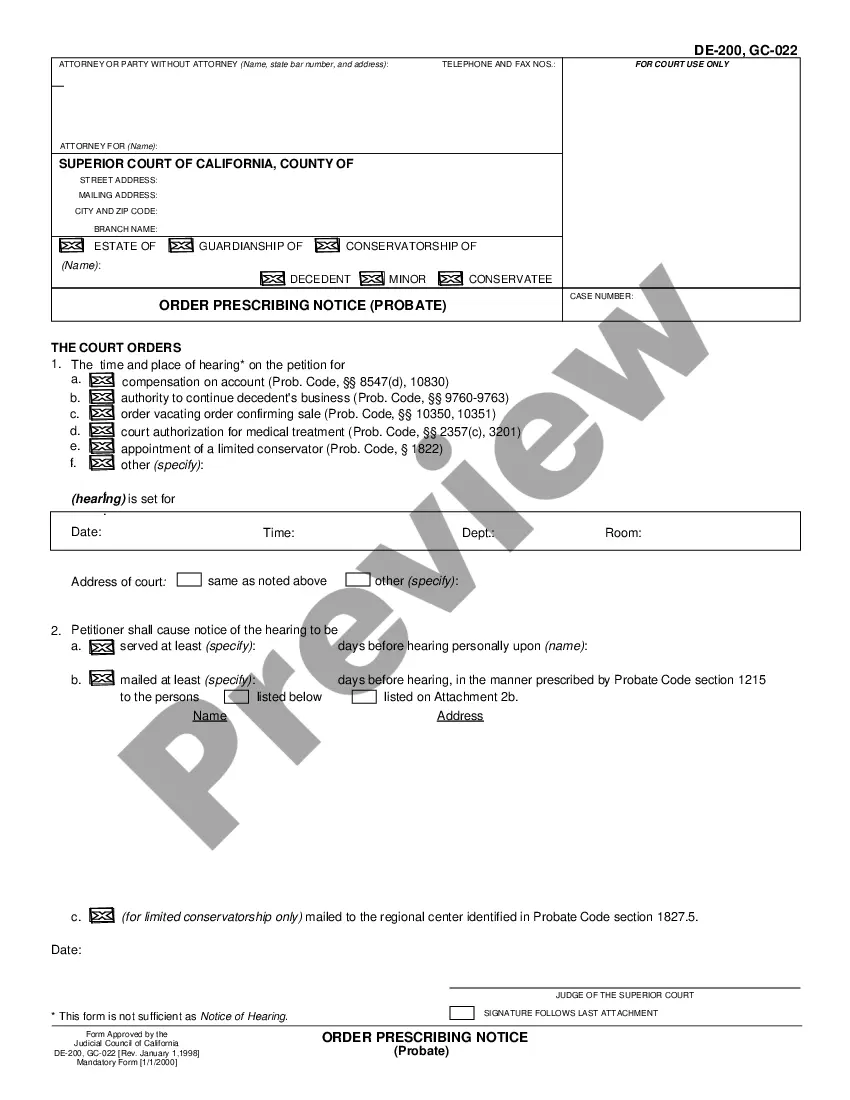

The following form seeks to give such assurance.

California Privacy and Confidentiality of Credit Card Purchases: A Detailed Description California is a state in the United States that has implemented stringent laws and regulations regarding the privacy and confidentiality of credit card purchases. These laws aim to protect consumers and their personal information from unauthorized access, misuse, and fraudulent activities. By understanding the California privacy and confidentiality laws, consumers can ensure the security of their credit card transactions and maintain control over their personal data. The California Privacy and Confidentiality of Credit Card Purchases laws apply to both online and offline transactions and encompass various aspects related to consumer protection. Here are some key components and types of privacy and confidentiality measures regulating credit card purchases in California: 1. Personal Information Protection: California mandates the protection of personal information collected during credit card transactions. This includes the customer's full name, credit card number, expiration date, CVV code, billing address, and any other piece of personally identifiable information (PIN). Merchants are required to implement robust security measures to safeguard this data, such as using encryption techniques, secure payment gateways, and secure servers. 2. Unauthorized Access Prevention: California privacy laws emphasize the prevention of unauthorized access to credit card information. Merchants are obliged to implement safeguards that restrict access to customer data only to authorized personnel. This involves implementing secure authentication methods, firewalls, and restricting physical access to data storage areas. 3. Data Breach Notification: In the event of a data breach or unauthorized access to credit card information, California law requires merchants to promptly notify affected customers. This notification should include details about the breach, the type of information compromised, and relevant contact information for further assistance. This allows customers to take preventive measures, such as freezing their credit and monitoring for any suspicious activity. 4. Privacy Policy Compliance: California law necessitates that businesses collecting credit card information must have a comprehensive privacy policy. The privacy policy should outline how the collected data will be used, secured, and shared, giving customers clear insights into how their personal information is managed. This allows customers to make informed decisions about sharing their credit card details. 5. Payment Card Industry Data Security Standard (PCI DSS) Compliance: This is an industry-wide security standard mandated by California and various credit card networks. It requires merchants to implement a set of security protocols and measures to ensure the safe handling of credit card information. Compliance involves regular security assessments, network vulnerability scans, and maintenance of secure systems. By adhering to these California privacy and confidentiality laws, businesses can build trust with their customers and establish a secure environment for credit card transactions. Customers can confidently engage in online and offline purchases, knowing that their personal information is safeguarded. In conclusion, the California Privacy and Confidentiality of Credit Card Purchases laws aim to protect consumers' personal information during credit card transactions. By implementing security measures, promptly notifying customers in the event of a data breach, and complying with privacy policies and industry standards, businesses can ensure the privacy and confidentiality of credit card purchases in California.