California Identity Theft Contact Table is a comprehensive resource that provides contact information for various organizations, agencies, and institutions related to identity theft in the state of California. This table serves as a valuable tool for individuals looking for assistance, guidance, or reporting instances of identity theft within the state. The California Identity Theft Contact Table comprises several types of contacts, which include: 1. Law Enforcement Agencies: This category includes contact information for local police departments, county sheriff's offices, and other law enforcement agencies that handle identity theft cases in California. These contacts are crucial for reporting identity theft incidents and initiating investigations. 2. Consumer Protection Agencies: This section lists agencies dedicated to protecting consumers' interests in California. These organizations offer assistance in resolving identity theft-related issues, provide guidance on fraud prevention, and educate the public about scams and fraudulent activities. 3. Credit Reporting Agencies: California Identity Theft Contact Table provides contact information for the major credit reporting agencies, such as Experian, Equifax, and TransUnion. These agencies are crucial in placing fraud alerts, freezing credit reports, and resolving disputes arising from identity theft. 4. Government Offices: This category includes contact information for government offices in California involved in combating identity theft. It may comprise the Attorney General's office, the Department of Justice, or other relevant departments responsible for enacting and enforcing identity theft laws. 5. Non-profit Organizations: The table may include contacts for non-profit organizations offering identity theft support, education, and advocacy services. These organizations can offer guidance, resources, and support to victims of identity theft. 6. Financial Institutions: Contact details for major banks, credit unions, and other financial institutions operating in California can be included in this section. Victims of identity theft can reach out to these institutions to report fraudulent charges, close compromised accounts, and mitigate the damage caused by identity theft. 7. Legal Aid Services: This section may contain contacts for legal aid organizations and services that provide free or low-cost legal advice and representation to victims of identity theft in California. These resources can assist victims in dealing with legal matters related to identity theft, such as disputing fraudulent debts or restoring their credit. The California Identity Theft Contact Table acts as a centralized reference point, offering an extensive list of relevant contacts to help individuals navigate the complex process of reporting identity theft, seeking assistance, and taking necessary steps to recover from such incidents.

California Identity Theft Contact Table

Description

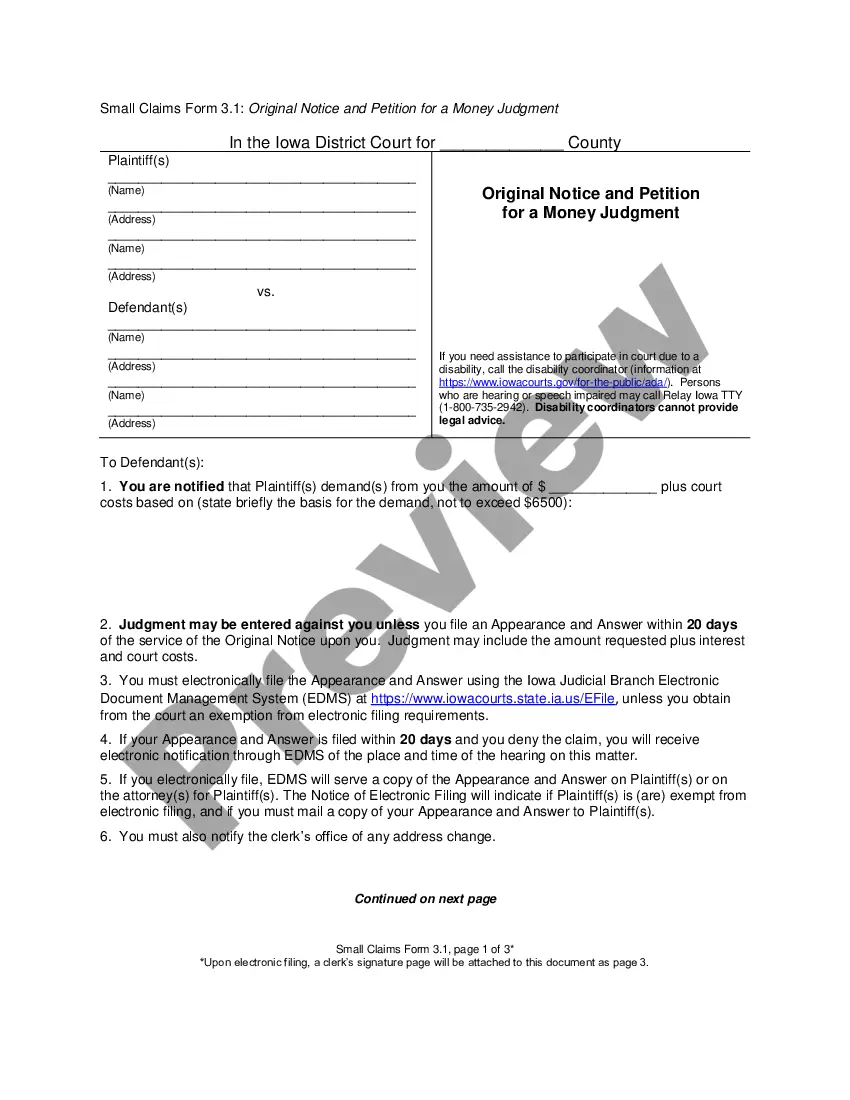

How to fill out California Identity Theft Contact Table?

Discovering the right legitimate record format might be a have difficulties. Needless to say, there are a variety of layouts available on the net, but how do you find the legitimate type you want? Make use of the US Legal Forms website. The assistance offers a huge number of layouts, like the California Identity Theft Contact Table, which you can use for organization and personal needs. All the kinds are checked by pros and meet up with federal and state requirements.

In case you are currently signed up, log in for your account and click the Acquire option to get the California Identity Theft Contact Table. Use your account to look from the legitimate kinds you have ordered formerly. Go to the My Forms tab of your own account and acquire yet another duplicate from the record you want.

In case you are a whole new user of US Legal Forms, listed below are simple recommendations that you should stick to:

- Initially, ensure you have selected the appropriate type for your town/state. You can examine the shape utilizing the Preview option and look at the shape outline to make sure this is the right one for you.

- When the type is not going to meet up with your requirements, utilize the Seach field to find the right type.

- Once you are positive that the shape is suitable, select the Purchase now option to get the type.

- Pick the costs plan you desire and enter the necessary info. Build your account and pay for the order with your PayPal account or credit card.

- Opt for the submit structure and acquire the legitimate record format for your device.

- Comprehensive, change and print out and signal the attained California Identity Theft Contact Table.

US Legal Forms is definitely the greatest library of legitimate kinds where you will find different record layouts. Make use of the company to acquire professionally-manufactured files that stick to condition requirements.

Form popularity

FAQ

California Penal Code Section 530.5(a) PC - Unauthorized use of another person's personal identifying information. California Penal Code Section 530.5(c) PC - Fraudulent possession of another person's personal identifying information.

Section 1798.93 - Action or cross-complaint to establish that person victim of identity theft (a) A person may bring an action against a claimant to establish that the person is a victim of identity theft in connection with the claimant's claim against that person.

A copy of your FTC Identity Theft Report. A government-issued ID with a photo. Proof of your address (mortgage statement, rental agreement, or utilities bill) Any other proof you have of the theft?bills, Internal Revenue Service (IRS) notices, etc.

Inform your bank, building society and credit card company of any unusual transactions on your statement. Request a copy of your credit file to check for any suspicious credit applications. Report the theft of personal documents and suspicious credit applications to the police and ask for a crime reference number.

Under California law, debt collectors must do the following: Start a review of the disputed debt within 10 business days of receiving your statement and a police report. Notify the credit reporting agencies that certain accounts are under dispute.

?Any info you provide to scammers could be used to steal your identity.? Sophisticated scammers have also been stealing personal data from tax preparers and businesses. Preparers and business owners who may have been targeted should contact FTB at (916) 845-7088 and select option 1.

It is the unlawful violation of an individual's right to the protection of his/her privacy. This illegitimate acquisition of your information can be performed in a variety of ways. Most commonly, identity theft includes stealing, misrepresenting or hijacking the identity of another person or business.

A person convicted of misdemeanor identity theft faces up to one year in county jail, a fine of up to $1,000, or both. A person convicted of felony identity theft faces up to three years in California state prison, a fine of up to $10,000, or both. Federal law prohibits identity theft more severely than California law.