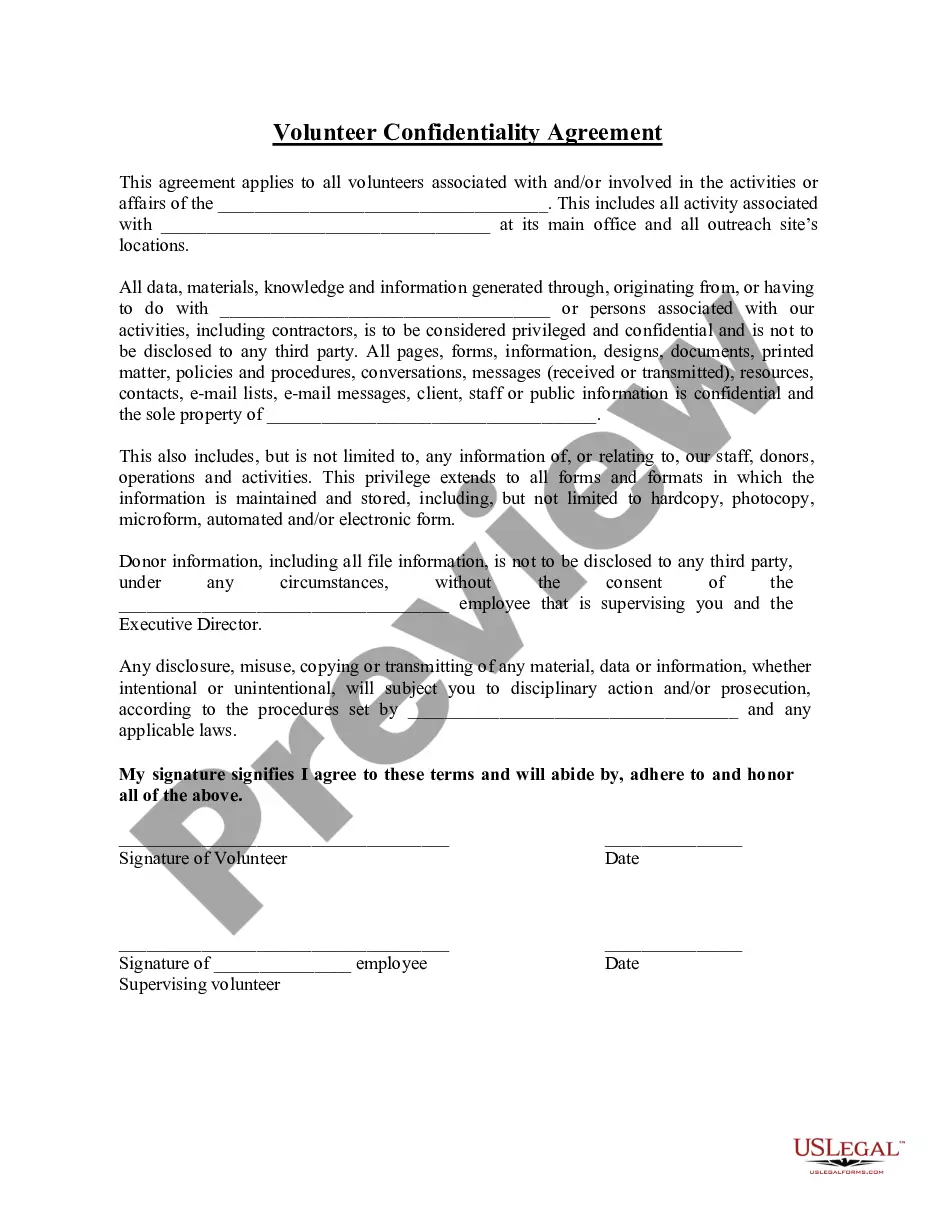

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [City Clerk's Name] [City Clerk's Office] [City Hall Address] [City, State, ZIP Code] Subject: Request for Ad Valor em Tax Exemption for Property [Property Address] Dear [City Clerk's Name], I hope this letter finds you well. I am writing to request an Ad Valor em Tax Exemption for my property located at [Property Address]. As a responsible property owner, I believe that my property should be eligible for this benefit based on the criteria outlined in the California Revenue and Taxation Code. To provide a comprehensive background on my request, let me first explain the relevance and significance of an Ad Valor em Tax Exemption. Ad Valor em taxes are levied based on the assessed value of the property and can often be a significant financial burden for property owners. The California Revenue and Taxation Code provides certain exemptions for qualifying properties, which reliefs homeowners from paying a portion or the entirety of their property taxes. Based on my research and circumstances, I believe my property meets the necessary requirements for an Ad Valor em Tax Exemption. The specific criteria that I believe make my property eligible for this exemption include: 1. Owner-Occupancy: I legally reside on the property as my primary residence and have continuously done so for the past [number of years]. This establishes my property as a homestead and fulfills the occupancy criteria for exemption eligibility. 2. Age or Disability Exemption: I am [age]/have been classified as legally disabled by the state of California. My age or disability qualifies me for additional exemptions based on the California Revenue and Taxation Code [specific sections or codes if applicable]. 3. Income Eligibility: My income falls within the range specified in the California Revenue and Taxation Code [specific sections or codes if applicable] for eligibility of property tax exemptions. I have attached my recent tax returns and income statements for your reference. 4. [Additional Criteria]: If there are any other specific characteristics or qualifiers relevant to your particular Ad Valor em Tax Exemption request, mention them here. In light of the above, I kindly request you to review my request for an Ad Valor em Tax Exemption for my property [Property Address]. Enclosed with this letter, please find all the necessary supporting documentation, including my proof of residency, age or disability verification, and income declarations. I understand that the City Clerk's office might require additional information or documentation to process my request. Please let me know if there is anything further needed from my end to facilitate the verification process. Thank you for your attention to this matter, and I appreciate your prompt consideration of my request. I trust that your office will take the appropriate measures to evaluate my eligibility for property tax exemption in accordance with the applicable laws and regulations. I eagerly await your response. If you require any additional information or have any questions regarding this request, please feel free to contact me at [Phone Number] or [Email Address]. Sincerely, [Your Name]

California Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

How to fill out California Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

US Legal Forms - one of many greatest libraries of legal varieties in the United States - provides an array of legal file web templates it is possible to down load or produce. Utilizing the web site, you can get a huge number of varieties for enterprise and person purposes, categorized by categories, states, or key phrases.You can find the newest types of varieties much like the California Sample Letter to City Clerk regarding Ad Valorem Tax Exemption within minutes.

If you have a membership, log in and down load California Sample Letter to City Clerk regarding Ad Valorem Tax Exemption from the US Legal Forms catalogue. The Acquire button can look on every type you perspective. You have accessibility to all formerly acquired varieties from the My Forms tab of the bank account.

If you want to use US Legal Forms initially, listed here are easy recommendations to get you started:

- Make sure you have selected the correct type to your town/area. Go through the Review button to check the form`s content. Look at the type explanation to ensure that you have selected the right type.

- In case the type does not satisfy your demands, utilize the Lookup industry on top of the display screen to discover the one which does.

- In case you are pleased with the shape, verify your option by clicking on the Get now button. Then, select the pricing prepare you prefer and supply your accreditations to register for an bank account.

- Process the purchase. Make use of Visa or Mastercard or PayPal bank account to finish the purchase.

- Find the formatting and down load the shape on your system.

- Make modifications. Complete, revise and produce and indicator the acquired California Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

Each and every web template you included in your account does not have an expiration date and is also yours eternally. So, if you wish to down load or produce yet another copy, just go to the My Forms section and click on about the type you want.

Gain access to the California Sample Letter to City Clerk regarding Ad Valorem Tax Exemption with US Legal Forms, by far the most comprehensive catalogue of legal file web templates. Use a huge number of professional and state-distinct web templates that meet your company or person requirements and demands.