A California Sale and Leaseback Agreement for a commercial building is a legal arrangement in which the owner of a commercial property in California sells the property to a buyer and simultaneously leases it back from the buyer, becoming a tenant in their former property. The agreement typically includes specific terms and conditions regarding the sale, leaseback period, rent payments, and other relevant details. This type of agreement offers several benefits for both the property owner and the buyer. For the property owner, it provides an opportunity to free up capital tied to the property while maintaining operational control and use of the building. It allows them to use the funds from the sale for various purposes such as expansion, debt reduction, or further investments, without having to vacate the premises. For the buyer, a sale and leaseback agreement presents an attractive investment opportunity by acquiring a fully leased property with a reliable tenant already in place. They can secure a steady income stream from the lease payments and potentially benefit from any appreciation in the property's value over time. There are different types of Sale and Leaseback Agreements for Commercial Buildings in California. The most common ones include: 1. Finance Lease: This type of agreement involves a long-term lease arrangement where the property owner (now a tenant) retains some responsibilities for property maintenance, insurance, and property taxes. The tenant pays fixed periodic rent to the buyer (now the landlord) and has the option to purchase the property at the end of the lease term. 2. Operating Lease: In this type of agreement, the property owner (tenant) leases the property for a shorter period. The buyer (landlord) assumes most of the responsibilities for property maintenance, insurance, and taxes. The lease payments may be structured as fixed or variable depending on the terms agreed upon. 3. Synthetic Lease: A synthetic lease is a combination of a loan and a lease arrangement. It allows the property owner (tenant) to retain the tax benefits of ownership while transferring most of the risks and rewards of owning the property to the buyer (landlord). The tenant records the lease as an operating expense rather than a liability. 4. Net Lease: Under this type of agreement, the property owner (tenant) agrees to pay not only the rent but also property taxes, insurance, and maintenance costs associated with the property. The buyer (landlord) receives a net rental income as they are not responsible for these additional expenses. In conclusion, a California Sale and Leaseback Agreement for a commercial building involves the sale of a property by its owner to a buyer who then leases it back to the seller. The agreement offers financial and operational advantages to both parties involved. The different types of these agreements include finance lease, operating lease, synthetic lease, and net lease, each with its own variations and benefits.

California Sale and Leaseback Agreement for Commercial Building

Description

How to fill out California Sale And Leaseback Agreement For Commercial Building?

Are you currently in a situation where you require documents for either professional or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of templates, including the California Sale and Leaseback Agreement for Commercial Property, designed to comply with both federal and state regulations.

Once you find the appropriate document, click Purchase now.

Choose the payment plan you prefer, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Sale and Leaseback Agreement for Commercial Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct region/county.

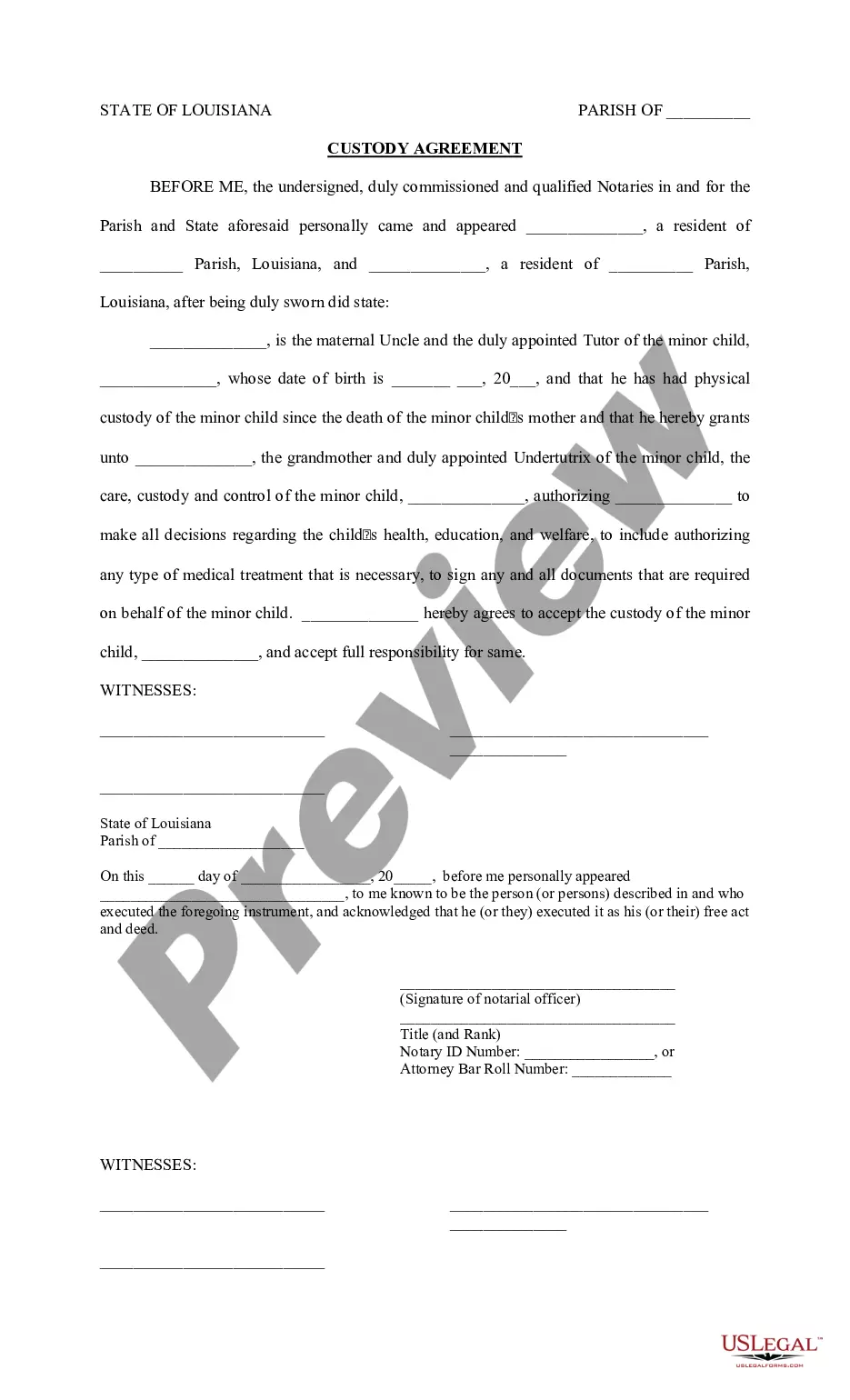

- Use the Review button to scrutinize the document.

- Read the description to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search field to find the document that meets your needs and requirements.

Form popularity

FAQ

The obligations of a landlord in California encompass ensuring the property is in good repair, respecting tenant rights, and fulfilling any agreements made in the lease. They are also required to comply with health and safety regulations, which are essential for tenant satisfaction. By clarifying these obligations upfront in a California Sale and Leaseback Agreement for Commercial Building, landlords can set the stage for productive tenant relationships and long-term success.

Landlords in California have a range of responsibilities in a commercial lease, including maintaining the property, adhering to safety standards, and ensuring tenant rights are respected. They must also manage leases appropriately and keep the lines of communication open with tenants. Understanding these responsibilities is vital when engaging in a California Sale and Leaseback Agreement for Commercial Building, as both parties need clear terms to avoid disputes.

In California, the responsibility for repairs in a commercial lease typically depends on the terms outlined in the lease agreement. Generally, landlords are responsible for major structural repairs, whereas tenants may handle routine maintenance and minor repairs. This division of responsibilities is crucial for clarity in a California Sale and Leaseback Agreement for Commercial Building, as it ensures that both parties understand their obligations.

The primary responsibility of a landlord is to provide a safe and habitable environment for tenants. This includes addressing issues such as plumbing, heating, and electrical systems. A landlord must also respond promptly to tenant requests and maintain necessary standards of living. This commitment plays a critical role in fostering positive relationships, especially during agreements like the California Sale and Leaseback Agreement for Commercial Building.

In California, commercial landlords have several responsibilities related to the maintenance and operation of their properties. They must ensure that the building complies with local, state, and federal regulations. Additionally, landlords are often tasked with maintaining common areas, ensuring safety protocols, and addressing tenant concerns. This attention to duty is essential for a successful California Sale and Leaseback Agreement for Commercial Building.

The disadvantages of a sale and leaseback include potential loss of property ownership, possible higher lease costs, and less control over property use. These factors can impact your financial strategy significantly. To navigate these challenges effectively, consider consulting our platform at UsLegalForms, which provides tailored solutions for California Sale and Leaseback Agreements for Commercial Buildings.

In California, a lease usually covers a longer term, typically one year, while a rental agreement often operates on a month-to-month basis. Both documents outline tenant obligations and landlord rights but differ in duration and renewal processes. Understanding this difference is crucial when engaging in a California Sale and Leaseback Agreement for Commercial Building.

The new renters law in California for 2024 focuses on enhancing tenant protections. It limits rent increases and strengthens eviction protections. If you are considering a California Sale and Leaseback Agreement for Commercial Building, be aware of how these laws could impact your investment and lease structure.

For a lease to be valid in California, it must include essential elements such as mutual consent, a lawful object, and consideration. Additionally, both parties must be competent to contract. A well-structured California Sale and Leaseback Agreement for Commercial Building reinforces these elements, protecting the interests of both the seller and the buyer.

The California rental agreement 2025 establishes the terms and conditions of renting a property in California. It outlines responsibilities and expectations for both landlords and tenants. If you're considering a California Sale and Leaseback Agreement for a Commercial Building, understanding these agreements helps ensure compliance with state laws.

Interesting Questions

More info

Lease Agreement FIRST AMENDMENT Lease Agreement Lease Rental Agreement Hold back Agreement Assignment Amendments Waiver Contract Complete Hold Back Agreements Sublease Agreement Supplemental Lease Agreement Parent Clauses Misc. INCORPORATION REFERENCE Lease Sale Sale Sale Sales Escrow Purchase Purchaser Purchase Escrow Deposit Open Split View Download Cite Sample (2) The Seller's Information The information contained within this document is for reference only. The Seller, their agents and their representatives and assigns hereby expressly disclaim any legal responsibility or liability for errors or omissions. The Seller, their agents and their representatives hereby waive any duty of confidentiality with respect to this document that may arise by reason of its content, and authorize your use of this document. The Seller reserves the right, in its sole discretion, to change, modify, or delete any representation, warranty, or other statement contained in this document at any time.