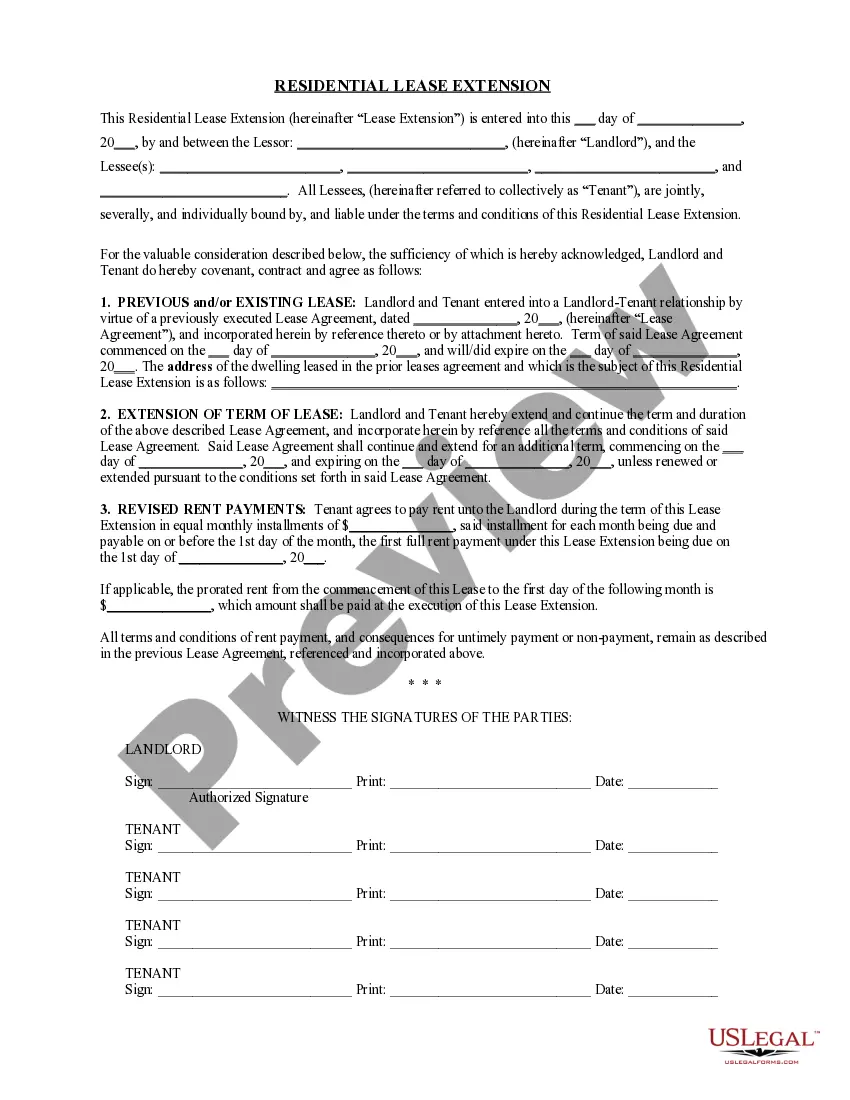

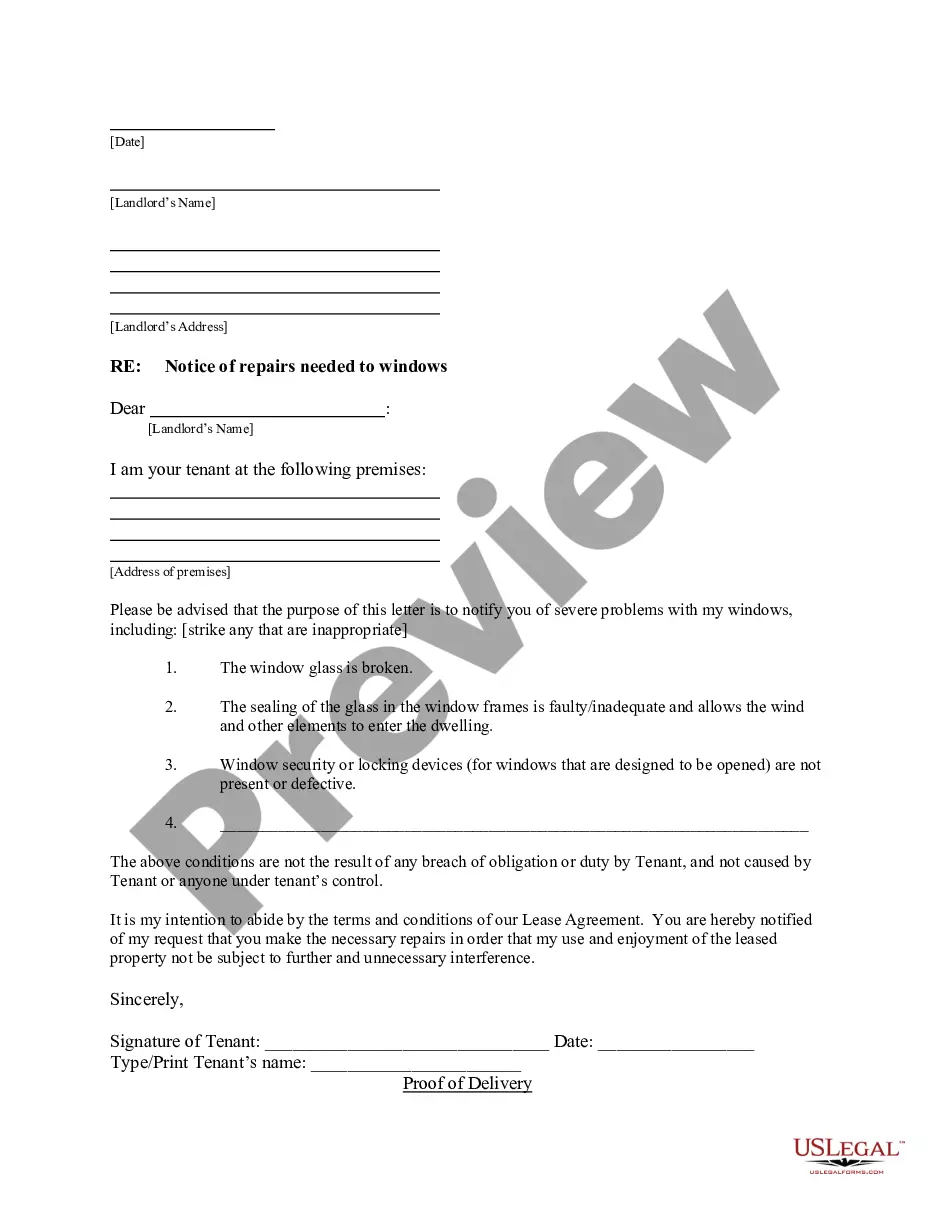

The California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal contract that outlines the terms and conditions of the sale of a retail store by a sole proprietorship in California. This agreement is specifically designed for cases where the goods and fixtures included in the sale will be priced at the invoice cost, plus an additional percentage. There are various types of California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, which include: 1. Standard Agreement: This type of agreement is the most common and covers all the essential elements required for the sale of a retail store by a sole proprietorship. It includes clauses related to the purchase price, payment terms, inventory valuation, transfer of assets, non-compete agreements, and warranties. 2. Detailed Inventory Agreement: Some sales may require a more detailed inventory list specifying the goods and fixtures being sold. This agreement type includes an exhaustive inventory list, including descriptions, quantities, and values for all items being transferred as part of the sale. 3. Percentage Negotiation Agreement: In certain cases, the percentage added to the invoice cost for pricing goods and fixtures may require negotiation between the buyer and seller. This type of agreement specifically addresses the negotiation process and allows for flexibility in determining the final percentage. 4. Lease Assignment Agreement: If the retail store being sold is leased rather than owned by the sole proprietorship, an additional lease assignment agreement may be required. This agreement transfers the lease rights and responsibilities from the seller to the buyer, ensuring a smooth transition in the business operations. Key terms and concepts related to the California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage include: — Purchase Price: This is the total amount agreed upon by the buyer and seller for the retail store, goods, and fixtures. It includes the invoice cost of the goods plus the additional percentage determined. — Payment Terms: The agreement should include the payment schedule and methods, including any provisions for down payments, installments, or financing arrangements. — Inventory Valuation: This clause outlines how the inventory value is determined, typically based on the invoice cost provided by the seller's suppliers. — Transfer of Assets: This section covers the transfer of all assets related to the retail store, including ownership of goods, fixtures, licenses, permits, and intellectual property rights. — Non-Compete Agreement: A non-compete clause may be included to prevent the seller from opening a similar business in the same geographic area for a specified period after the sale. — Warranties: The agreement may include warranties or guarantees by the seller regarding the accuracy of financial statements, absence of liens or encumbrances on the assets, and other representations about the business's condition. In conclusion, the California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a comprehensive legal document that protects the rights and interests of both the buyer and seller in the sale of a retail store. Its various types and specific clauses ensure clarity and fairness throughout the transaction process.

California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides an array of legal form templates that you can download or print.

By using the site, you can access thousands of forms for commercial and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage within moments.

If you already have a monthly membership, Log In and download the California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously stored forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the stored California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage. Each template you add to your account does not have an expiration date and is yours indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of expert and state-specific templates that satisfy your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are simple steps to assist you.

- Ensure you have selected the correct form for your city/region. Click the Preview button to review the form's content.

- Read the form description to confirm you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find a more suitable one.

- If you are satisfied with the form, confirm your choice by clicking on the Purchase now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

Interesting Questions

More info

PO business number Accounts Apply for your business number applications Business Number application Registering with your province and territory For more information about register with, please visit the pages at Nova Scotia and Canada: Register Business Number — Nova Scotia. Register Business Number — Canada. Register Business Number — Provinces and Territories. Business Number applications for your location, contact and to register for your business. Register your business with government Do you have a registered business? If you live in the Philippines, you can register your business with the Philippine government. If you are operating a business in the Netherlands or you are operating a business without a business number in a country or territories, you can still register your business with the government. If you are operating business in the Netherlands, make sure to register with your province before registering your business with the government.